Don’t forget, Social Security benefits may be taxable

- To find out if their benefits are taxable, taxpayers should: Take one half of the Social Security money they collected during the year and add it to their other income.

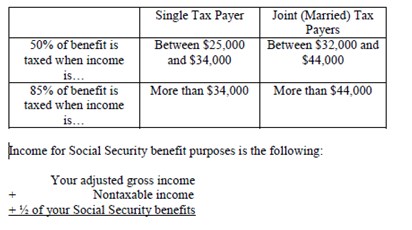

- Fifty percent of a taxpayer's benefits may be taxable if they are: Filing single, single, head of household or qualifying widow or widower with $25,000 to $34,000 income.

- Up to 85% of a taxpayer's benefits may be taxable if they are: Filing single, head of household or qualifying widow or widower with more than $34,000 income. ...

How do you calculate taxable social security?

you would calculate that your provisional income is $27,000 ($12,000 + $5,000 + $10,000). After provisional income, the second major factor in calculating taxable Social Security income is filing ...

How much of my social security benefit may be taxed?

If your income is above that but is below $34,000, up to half of your benefits may be taxable. For incomes of over $34,000, up to 85% of your retirement benefits may be taxed. For the purposes of taxation, your combined income is defined as the total of your adjusted gross income plus half of your Social Security benefits plus nontaxable interest.

How are Social Security benefits affected by your income?

Key Points

- Your marital status could affect Social Security benefits.

- Divorce can sometimes leave you with a reduced Social Security check.

- Eligibility for spousal benefits and survivor benefits can depend how long you were married.

How to calculate taxable Social Security income?

- Less than $25,000 single/$32,000 joint: 0% taxable.

- $25,000 to $34,000 single/$32,000 to $44,000 joint: up to 50% taxable.

- Greater than $34,000 single/$44,000 joint: up to 85% taxable.

What percentage of Social Security is taxable?

What is the highest portion of Social Security?

What is the maximum amount of Social Security benefits?

Is Social Security taxable?

Quick Rule: Is My Social Security Income Taxable?

According to the IRS, the quick way to see if you will pay taxes on your Social Social Security income is to take one half of your Social Security...

Calculating Your Social Security Income Tax

If your Social Security income is taxable, the amount you pay in tax will depend on your total combined retirement income. However, you will never...

How to File Social Security Income on Your Federal Taxes

Once you calculate the amount of your taxable Social Security income, you will need to enter that amount on your income tax form. Luckily, this par...

Simplifying Your Social Security Taxes

During your working years, your employer probably withheld payroll taxes from your paycheck. If you make enough in retirement that you need to pay...

State Taxes on Social Security Benefits

Everything we’ve discussed above is about your federal income taxes. Depending on where you live, you may also have to pay state income taxes. As y...

Tips For Saving on Taxes in Retirement

1. What you pay in taxes during your retirement will depend on how retirement friendly your state is. So if you want to decrease tax bite, consider...

How much of a person's income is taxable?

Fifty percent of a taxpayer's benefits may be taxable if they are: Filing single, single, head of household or qualifying widow or widower with $25,000 to $34,000 income. Married filing separately and lived apart from their spouse for all of 2019 with $25,000 to $34,000 income.

How much income do you need to be married to be eligible for a widow?

Filing single, head of household or qualifying widow or widower with more than $34,000 income. Married filing jointly with more than $44,000 income. Married filing separately and lived apart from their spouse for all of 2019 with more than $34,000 income.

When is the IRS filing 2020 taxes?

The tax filing deadline has been postponed to Wednesday, July 15, 2020. The IRS is processing tax returns, issuing refunds and accepting payments. Taxpayers who mailed a tax return will experience a longer wait. There is no need to mail a second tax return or call the IRS. Social Security Income.

Is Social Security taxable if you are single?

If they are single and that total comes to more than $25,000, then part of their Social Security benefits may be taxable.

Do you pay taxes on Social Security?

Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits. Social Security benefits include monthly retirement, survivor and disability benefits. They don't include supplemental security income payments, which aren't taxable. The portion of benefits that are taxable depends on ...

How much of your Social Security income is taxable?

If your Social Security income is taxable, the amount you pay in tax will depend on your total combined retirement income. However, you will never pay taxes on more than 85% of your Social Security income. If you file as an individual with a total income that’s less than $25,000, you won’t have to pay taxes on your social security benefits in 2020, ...

How to find out if you will pay taxes on Social Security?

According to the IRS, the quick way to see if you will pay taxes on your Social Social Security income is to take one half of your Social Security benefits and add that amount to all your other income , including tax-exempt interest. This number is known as your combined income (combined income = adjusted gross income + nontaxable interest + half of your Social Security benefits).

How much to withhold from Social Security?

The only withholding options are 7%, 10%, 12% or 22% of your monthly benefit . After you fill out the form, mail it to your closest Social Security Administration (SSA) office or drop it off in person.

How to save on taxes in retirement?

You can also save on your taxes in retirement simply by having a plan. Help yourself get ready for retirement by working with a financial advisorto create a financial plan. It may seem daunting to wade through the options, but a matching tool like SmartAsset’scan help you find a person to work with to meet your needs. Just answer some questions about your financial situation and the tool will match you with up to three advisors in your area.

How much tax do you pay on your income if you live in one of the states?

So if you live in one of those four states then you will pay the state’s regular income tax rates on all of your taxable benefits (that is, up to 85% of your benefits). The other nine states also follow the federal rules but offer deductionsor exemptions based on your age or income.

How to file Social Security income on federal taxes?

Once you calculate the amount of your taxable Social Security income, you will need to enter that amount on your income tax form. Luckily, this part is easy. First, find the total amount of your benefits. This will be in box 3 of your Form SSA-1099.

What to do with a Roth IRA?

If you’re concerned about your income tax burden in retirement, consider saving in a Roth IRA. With a Roth IRA, you save after-tax dollars. Because you pay taxes on the money before contributing it to your Roth IRA, you will not pay any taxes when you withdraw your contributions. You also do not have to withdraw the funds on any specific schedule after you retire. This differs from traditional IRAs and 401 (k) plans, which require you to begin withdrawing money once you reach 72 years old (or 70.5 if you were born before July 1, 1949).

How much of your unemployment benefits are taxable?

more than $34,000, up to 85 percent of your benefits may be taxable. between $32,000 and $44,000, you may have to pay income tax on up to 50 percent of your benefits. more than $44,000, up to 85 percent of your benefits may be taxable.

How to get a replacement SSA-1099?

To get your replacement Form SSA-1099 or SSA-1042S, select the "Replacement Documents" tab to get the form.

Do you pay taxes on your benefits if you are married?

are married and file a separate tax return, you probably will pay taxes on your benefits.

Social Security taxable benefit calculator

Enter the total of any exclusion for U.S. savings bond interest, foreign-earned income, or housing.

The amount of Social Security benefits subject to federal income tax

For advisor use only. This calculator should not be used to provide tax or legal advice. For specific advice, please contact an experienced attorney or CPA.

What percentage of Social Security is taxable?

Moneytree Advise always assumes that 85% of the Social Security benefits is taxable to be most conservative (and straightforward). When running Aspire reports in Moneytree Plan, the advisor sets the taxable percentage between 0%, 50% or 85%. Prosper reports determine the taxable Social Security each year, thanks to the detailed tax analysis built into the projections. As a client’s provisional income changes, the amount of Social Security benefits subject to taxes can change too. The taxable amount determined by the projection displays on the Social Security Worksheet (report D16), then carried to the Taxable Income Analysis, column 6 (report D7).

What is the highest portion of Social Security?

The highest portion of social security benefits subject to taxes is 85%, while 0% is lowest, depending on provisional income. The provisional income is the adjusted gross income, plus tax-free interest, less Social Security benefits, plus one-half of Social Security benefits. The following ranges of provisional income determine the maximum taxable Social Security.

What is the maximum amount of Social Security benefits?

This one is easy – social security benefit times .85 is the maximum amount of taxable benefits.

Is Social Security taxable?

It is typical for Social Security benefits to be 85% taxable, especially for clients with higher income sources in retirement. But the benefit subject to taxation can be lower. Depending on income levels, taxable Social Security can be 0%, 50%, or 85% taxable.