.jpg)

- Adjust all earnings for inflation

- Calculate your Average Indexed Monthly Earnings (AIME)

- Apply your AIME to the benefit formula to determine primary insurance amount (PIA)

- Adjust PIA for filing age

Full Answer

How retirement benefits are calculated by Social Security?

Social Security calculators provided by other companies or non ... So failing to file tax returns could adversely affect a person's Social Security retirement or disability benefit rate. Furthermore, if and when a person claims Social Security benefits ...

How do you calculate Social Security retirement?

You must wait until your full retirement age (FRA ... If you're not sure when it makes sense for each person to sign up, create "my Social Security" accounts and use the calculator there to help you figure out how much each of you can get from the program ...

What is the maximum Social Security retirement benefit payable?

- $2,364 at age 62.

- $3,345 at age 66 and 4 months.

- $4,194 at age 70.

How to estimate Social Security retirement benefits?

- Currently receiving benefits on your own Social Security record.

- Waiting for a decision about your application for benefits or Medicare.

- Age 62 or older and receiving benefits on another Social Security record.

- Eligible for a Pension Based on Work Not Covered By Social Security.

What is the formula for calculating my Social Security benefits?

Average Indexed Monthly Earnings (AIME) Up to 35 years of earnings are needed to compute average indexed monthly earnings. After we determine the number of years, we choose those years with the highest indexed earnings, sum such indexed earnings, and divide the total amount by the total number of months in those years.

How do you find out how much SS you will get when you retire?

The quickest and easiest is to use AARP's Social Security Benefits Calculator or check your online My Social Security account. The latter draws on your earnings record on file with the Social Security Administration; for the AARP calculator, you'll need to provide your average annual income.

How much Social Security will I get if I make $75000 a year?

about $28,300 annuallyIf you earn $75,000 per year, you can expect to receive $2,358 per month -- or about $28,300 annually -- from Social Security.

How much Social Security will I get if I make $60000 a year?

That adds up to $2,096.48 as a monthly benefit if you retire at full retirement age. Put another way, Social Security will replace about 42% of your past $60,000 salary. That's a lot better than the roughly 26% figure for those making $120,000 per year.

Benefit Calculators

The best way to start planning for your future is by creating a my Social Security account online. With my Social Security, you can verify your earnings, get your Social Security Statement, and much more – all from the comfort of your home or office.

Online Benefits Calculator

These tools can be accurate but require access to your official earnings record in our database. The simplest way to do that is by creating or logging in to your my Social Security account. The other way is to answer a series of questions to prove your identity.

Additional Online Tools

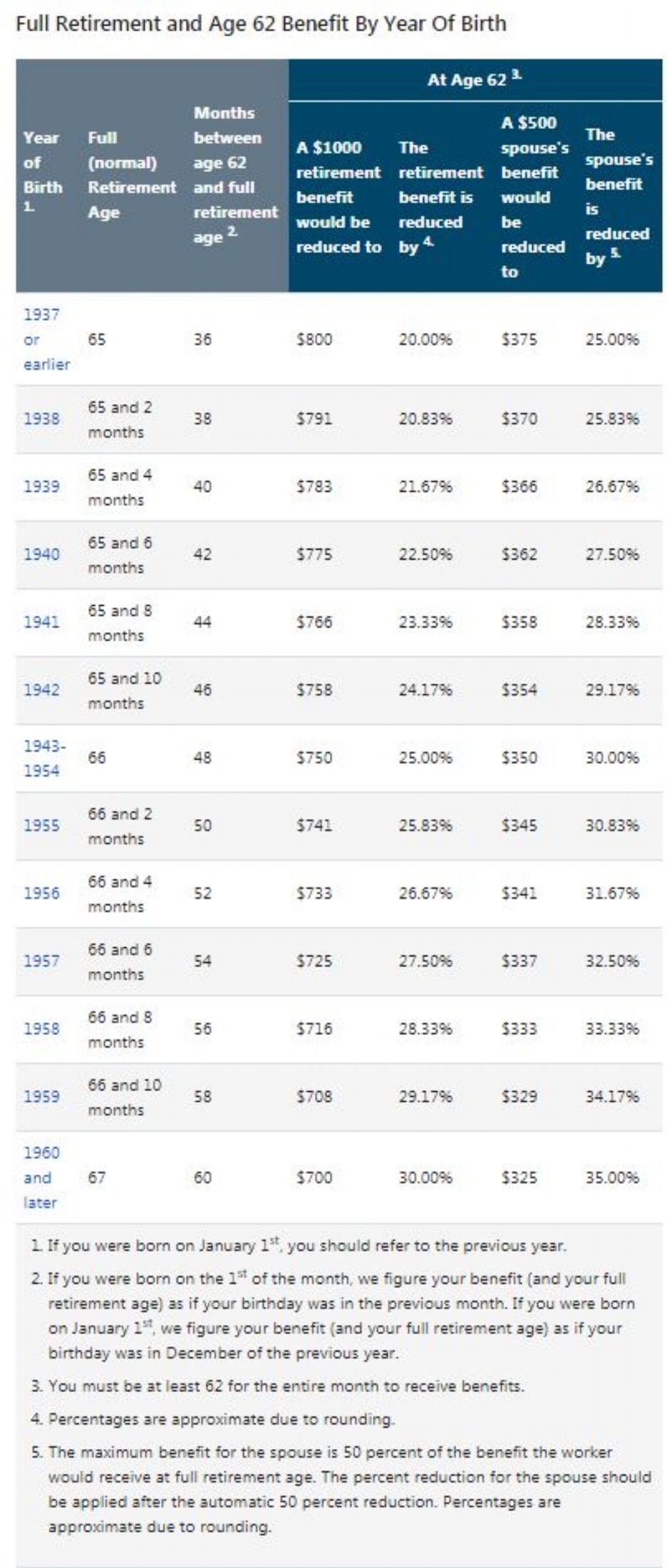

Find your full retirement age and learn how your monthly benefits may be reduced if you retire before your full retirement age.

What is the formula for Social Security benefits?

The Social Security benefits formula is designed to replace a higher proportion of income for low-income earners than for high-income earners. To do this, the formula has what are called “bend points." These bend points are adjusted for inflation each year.

How is Social Security decided?

Your Social Security benefit is decided based on your lifetime earnings and the age you retire and begin taking payments. Your lifetime earnings are converted to a monthly average based on the 35 years in which you earned the most, adjusted for inflation. Those earnings are converted to a monthly insurance payment based on your full retirement age.

What is wage indexing?

Social Security uses a process called wage indexing to determine how to adjust your earnings history for inflation. Each year, Social Security publishes the national average wages for the year. You can see this published list on the National Average Wage Index page. 3 .

What age do you get FRA?

This is the amount you will get if you start benefits at your Full Retirement Age (FRA). Your FRA can vary depending on the year you were born. For people born between 1943 and 1954, as in our example, the FRA is age 66. For people born on Jan. 1, the FRA is based on the year prior.

Is Social Security higher at age 70?

If you have already had most of your 35 years of earnings, and you are near 62 today, the age 70 benefit amount you see on your Social Security statement will likely be higher due to these cost of living adjustments .

Can you calculate inflation rate at 60?

Until you know the average wages for the year you turn 60, there is no way to do an exact calculation. However, you could attribute an assumed inflation rate to average wages to estimate the average wages going forward and use those to create an estimate.

How old do you have to be to file for Social Security?

You must be at least age 22 to use the form at right. Lack of a substantial earnings history will cause retirement benefit estimates to be unreliable. Enter your date of birth ( month / day / year format) / /. Enter earnings in the current year: $. Your annual earnings must be earnings covered by Social Security.

What is the benefit estimate?

Benefit estimates depend on your date of birth and on your earnings history. For security, the "Quick Calculator" does not access your earnings record; instead, it will estimate your earnings based on information you provide. So benefit estimates made by the Quick Calculator are rough. Although the "Quick Calculator" makes an initial assumption ...

How old do you have to be to use Quick Calculator?

You must be at least age 22 to use the form at right.

What happens if you don't give a retirement date?

If you do not give a retirement date and if you have not reached your normal (or full) retirement age, the Quick Calculator will give benefit estimates for three different retirement ages .

Primary Insurance Amount

The basic Social Security benefit is called the primary insurance amount (PIA). Typically the PIA is a function of average indexed monthly earnings (AIME). We determine the PIA by applying a PIA formula to AIME. The formula we use depends on the year of first eligibility (the year a person attains age 62 in retirement cases).

Benefit Based on PIA and Age

The amount of retirement benefits paid depends on a person's age when he or she begins receiving benefits. We reduce benefits taken before a person's normal (or full) retirement age and we increase benefits taken after normal retirement age.

Two Other Methods

Two other methods for computing a PIA have limited applicability. Relatively few new beneficiaries qualify for these two other methods.