You can also apply:

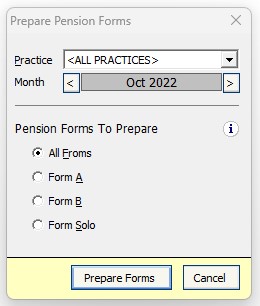

- By mail. Fill out an Application for Pension (VA Form 21P-527EZ).

- In person. Bring your application to a VA regional office near you.

- With the help of a trained professional. You can work with a trained professional called an accredited representative to get help applying for VA pension benefits.

- Use our online service, My Pension Benefit Access (MyPBA) to apply. OR.

- Call PBGC's Customer Contact Center to request an application for pension benefits. Call at 1-800-400-7242. TTY/ASCII users may call 711.

How do I file an intent to file a pension claim?

You can submit your intent to file by phone or by written form. Call 800-827-1000, Monday through Friday, 8:00 a.m. to 9:00 p.m. ET. Download, fill out, and submit an Intent to File a Claim for Compensation and/or Pension, or Survivors Pension and/or DIC (VA Form 21-0966). Mail it to the pension management center (PMC) for your state.

What information do I need to fill out my pension application?

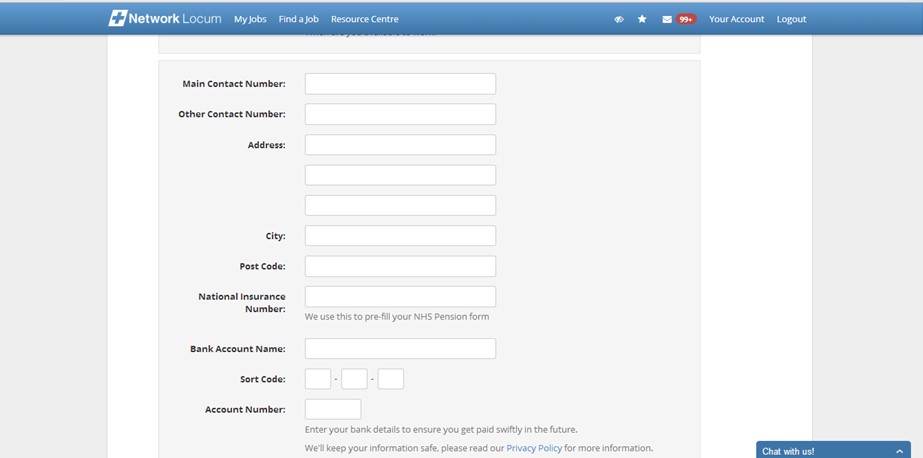

Gather the information listed below that you’ll need to fill out your pension application. Your financial information and the financial information of your dependents (required)

How do I file a pension claim for a deceased person?

Call 800-827-1000, Monday through Friday, 8:00 a.m. to 9:00 p.m. ET. Download, fill out, and submit an Intent to File a Claim for Compensation and/or Pension, or Survivors Pension and/or DIC (VA Form 21-0966). Mail it to the pension management center (PMC) for your state.

When can I apply for a pension?

You can apply for a pension if: you are now eligible or will be eligible within the next 180 days to receive benefits from PBGC, under the provisions of your pension plan; and. you would like to begin receiving your retirement benefit within the next 180 days.

How long does it take to get retirement benefits?

What to do if you are not a beneficiary on SPD?

What is a summary plan description?

How to check SPD?

How long does it take to decide on SPD?

How long does it take to appeal a health insurance plan?

How long does it take to get a decision from a denied claim?

See more

About this website

How do I claim my pension fund?

To claim your benefit, you must get hold of a withdrawal notification form from your HR department, complete this and return with required supporting documents (proof of banking and ID) to your HR department. They will then counter-sign and forward it to the fund administrator for processing.

Who is eligible for pension benefits?

To be eligible for service retirement, you must have at least five years of CalPERS-credited service and be at least age 50, 52, or 55 depending on your retirement formula . If you have a combination of classic and PEPRA service, you may be eligible to retire at age 50 .

How long does it take to process pension benefits?

It normally takes about three months to process your application. Benefit payments cannot start until your application is processed and approved. If your application is approved after your pension effective date, you receive benefit payments retroactive to your pension effective date.

How much does a person get for pension?

A typical multiplier is 2%. So, if you work 30 years, and your final average salary is $75,000, then your pension would be 30 x 2% x $75,000 = $45,000 a year. That $45,000 becomes your guaranteed lifetime income.

Can you collect a pension and Social Security at the same time?

Yes. There is nothing that precludes you from getting both a pension and Social Security benefits. But there are some types of pensions that can reduce Social Security payments.

How do I apply for early retirement?

Call 1-800-772-1213 (TTY 1-800-325-0778) from 8:00 a.m. to 7:00 p.m., Monday through Friday, to apply by phone.

Can you request your pension?

If you have a defined benefit pension, you can usually begin taking it from the age of 60 or 65. You might be able to start receiving an income from it at age 55. However, the income you get is likely to be reduced, as you're taking it earlier than the normal pension age of the scheme.

When can you claim your pension?

The current State Pension age is 66 for men and women, however it will increase to 67 by 2028. A new State Pension system came into effect on 6 April 2016, and how much you'll receive will depend on whether you reached State Pension age before or after this date.

Can you be denied your pension?

In order to deny your pension plan, the plan's provider must have valid legal grounds to do so. As it typically stands for pension plan denial cases, valid reasons to completely deny a pension plan are somewhat rare, such as the pension fund running out of money.

How much is the average pension per month?

The average Social Security income per month in 2021 is $1,543 after being adjusted for the cost of living at 1.3 percent. How To Maximize This Income: Delay receiving these benefits until full retirement age, or age 67.

What is the best age to retire?

The full Social Security retirement age for men and women born between 1943 and 1954 is 66. If you begin collecting at 62, your benefits will be reduced by 25%. If you hold out until you turn 65, you'll get 93.3% of your benefits.

Do I have to pay taxes on my pension?

Taxes on Pension Income You have to pay income tax on your pension and on withdrawals from any tax-deferred investments—such as traditional IRAs, 401(k)s, 403(b)s and similar retirement plans, and tax-deferred annuities—in the year you take the money. The taxes that are due reduce the amount you have left to spend.

How do I prepare before starting my application?

Find out if you’re eligible for VA pension benefits Gather the information listed that you’ll need to fill out your pension application. You’ll nee...

Should I submit an intent to file form?

You may want to submit an intent to file form before you apply for pension benefits. This can give you the time you need to gather your evidence wh...

How long does it take VA to make a decision?

It depends. We process claims in the order we receive them, unless a claim requires priority processing.

Filing a Claim for Your Retirement Benefits - DOL

the plan’s procedures for filing a claim. It also describes your rights as well as your responsibilities under ERISA and your plan. For some single employer collectively bargained plans, you should also

Apply for Retirement Benefits | SSA

Before you apply, take time to review the basics, understand the process, and gather the documents you’ll need to complete an application. We encourage you to create or sign in to your personal my Social Security account to verify your earnings. Your future benefits are based on the earnings we have on your earnings record.

FERS Information - OPM.gov

Welcome to opm.gov. Congress created the Federal Employees Retirement System (FERS) in 1986, and it became effective on January 1, 1987.

FREQUENTLY ASKED QUESTIONS Tax Guide for the Retiree

Estimated Tax Payment – If you have not paid enough federal tax through withholding or receive income that . is not subject to withholding, you should make estimated tax payments . Use the worksheet in Form 1040-ES, Estimated Taxes for Individuals to figure the amount of estimated taxes to pay to Internal Revenue Service (IRS).

You can still file a claim and apply for benefits during the coronavirus pandemic

Get the latest information about in-person services, claim exams, extensions, paperwork, decision reviews and appeals, and how best to contact us during this time. Go to our coronavirus FAQs

Should I submit an intent to file form?

You may want to submit an intent to file form before you apply for pension benefits. This can give you the time you need to gather your evidence while avoiding a later potential start date (also called an effective date).

How long does it take VA to make a decision?

It depends. We process claims in the order we receive them, unless a claim requires priority processing.

How long does it take to get retirement benefits?

Waiting Period. Your plan has 90 days in which to evaluate your claim and to tell you whether or not you will receive the retirement benefits. It may not take this long. If, because of special circumstances, your plan needs more time to decide your claim, it must tell you within the 90-day period that more time is needed, why it is needed, ...

What to do if you are not a beneficiary on SPD?

If it is not you, but an authorized representative or your beneficiary who is filing the claim, that person should refer to the SPD and follow your plans claims procedure. The procedure may require other documents when this type of claim is filed. When a claim is filed, be sure to keep a copy for your records.

What is a summary plan description?

The SPD provides a detailed overview of the plan – how it works, what benefits it provides, and the plan’s procedures for filing a claim. It also describes your rights as well as your responsibilities under ERISA and your plan.

How to check SPD?

Filing A Claim. An important first step is to check your SPD to make sure you meet your plans eligibility requirements to receive benefits. Your plan might say, for example, that you must have worked a certain number of years and/or be a certain age before you can start receiving benefits. Also, be aware of what your plan requires to file a claim. ...

How long does it take to decide on SPD?

Make a note of when you file your claim. Usually, claims are decided within the 90-day period (or 180 days if an extension applies). If you are entitled to benefits, check your SPD for how and when benefits are paid.

How long does it take to appeal a health insurance plan?

Reviewing your appeal can take up to 60 days, and up to an additional 60 days, if you have been notified of the need for an extension .

How long does it take to get a decision from a denied claim?

You have 60 days to request a full and fair review of your denied claim.

What is an appeal in PBGC?

An appeal must: be in writing; be clearly marked as an appeal; specifically state why you are appealing PBGC's determination and the result you are seeking; and. refer to the relevant information you believe is known by PBGC and include any additional information that the Appeals Board should consider.

What do you include in a letter to the Appeals Board?

To help the Appeals Board process your appeal or request for an extension of the filing deadline, you should include in your letter: your Social Security Number; the name of your pension plan; the PBGC case number assigned to your plan (this can be found at the top of your initial determination letter); your daytime telephone number (including the ...

How to file an appeal with PBGC?

How to File an Appeal. You must send your appeal to PBGC's Appeals Board. Your appeal must be postmarked by the U.S. Postal Service or received by the Appeals Board no later than 45 days after the date of PBGC's initial determination letter. An appeal must: be in writing; be clearly marked as an appeal; specifically state why you are appealing ...

What is the final step in the PBGC administrative review process?

Review by the Appeals Board is the final step in PBGC's administrative review process. If you do not appeal PBGC's initial determination to the Appeals Board, you may not be able to obtain review by a court of law.

When does PBGC take effect?

If you do not appeal, PBGC's initial benefit determination will take effect when the 45-day appeal period ends. If you do appeal, the determination will not take effect until the Appeals Board issues you a written decision. PBGC then will make any changes to your benefit ordered by the Appeals Board.

How to contact the appeals board?

If you have questions about how to file an appeal or a request for a filing extension, or would like information about your appeal, you may call the Appeals Board, toll-free, at 1-800-400-7242 or write to the Clerk of the Board at the above address. If you use a TTY/TDD, call toll-free 1-800-877-8339 ...

Can PBGC change my benefits?

After Your Benefit Determination Has Taken Effect. PBGC may change your benefit if it discovers an error, but only under certain circumstances. PBGC will always change your benefit if correcting the error will increase your monthly benefit by $1.00 or more.

What documents are required for a SSS?

If a representative will file for a retirement claim on behalf of a retiree-member, the SSS requires these additional documents: Authorized representative’s primary ID (SSS ID, UMID, PRC card, Seaman’s Book, or Alien Certificate of Registration) or two secondary IDs.

What is SSS retirement?

The SSS retirement benefit is a cash benefit paid to members of age 60 and above who can no longer work due to old age. SSS gives it either in a monthly pension or in a one-time lump sum cash. Applying for an SSS retirement pension without understanding everything about it can lead to a heartbreak.

What bank does SSS pay?

SSS will pay your monthly pension through an SSS-accredited bank (such as BPI, PNB, China Bank, or DBP) that you chose during your retirement benefit application. Or you may use your UMID card to withdraw your benefits from ATMs of participating banks such as PNB, UnionBank, Security Bank, and AUB.

Is the SSS retirement process cumbersome?

Even the SSS retirement benefit application process may be too cumbersome for them to begin with.

Is SSS pension fair?

It’s perfectly understandable—you’ve worked 40 years of your life and paid your SSS contributions without fail. It’s only fair to receive a pension that’s commensurate with the money and years of labor you’ve invested.

Is SSS retirement an emotional retirement?

SSS Retirement Benefits: An Easy Guide to Claim Your Pension. The SSS retirement pension is always an emotional topic for retirees. It’s perfectly understandable—you’ve worked 40 years of your life and paid your SSS contributions without fail. It’s only fair to receive a pension that’s commensurate with the money and years of labor you’ve invested.

When is a 13 month pension payable?

The retiree is entitled to a 13th month pension payable every December. All retiree pensioners prior to the effectivity of RA 7875 on March 4, 1995 are automatically considered members of PhilHealth and, along with their legal dependents, are entitled to PhilHealth hospitalization benefits.

What is 18 months advance pension?

What is the 18 th months advance pension? A retiree has the option to receive in advance the first eighteen (18) months pension in lump sum, discounted of a preferential rate of interest to be determined by the SSS. Intent to receive the 18 month pension in advance should be declared during retirement claim application.

What is SSS retirement?

The SSS Retirement Benefit is a cash benefit paid either in monthly pension or as a lump sum to an SSS member who can no longer work due to old age.

How much is dependent allowance?

The legitimate, legitimated or legally adopted, and illegitimate children, conceived on or before the date of retirement of a retiree will each receive dependents’ allowance equivalent to 10 percent of the member’s monthly pension, or P250, whichever is higher. Only five minor children, beginning from the youngest, ...

How many months do you have to contribute to SSS?

The SSS member must have at least 120 months contribution upon prior to the semester of application to qualify in the monthly pension. Lump sum amount – is a one time payment granted to a retiree, if he/she hasn’t reached the required 120 monthly contributions.

When does dependent allowance stop?

The dependents’ allowance stops when the child reaches 21 years old, gets married, gets employed, or dies. However, the dependents’ allowance is granted for life for children who are over 21 years old, if they are incapacitated and incapable of self-support due to physical or mental defect that is congenital or acquired during minority.

What is the retirement age for underground mine workers?

However, for underground mine workers, optional retirement age is 55 and technical retirement age is 60. A member who is 60 years old and above, but not yet 65, with 120 contributions or more may continue paying as a Voluntary member up to 65 years old to avail of the higher amount of benefits. If a member has less than 120 monthly contributions ...

How long does it take to get retirement benefits?

Waiting Period. Your plan has 90 days in which to evaluate your claim and to tell you whether or not you will receive the retirement benefits. It may not take this long. If, because of special circumstances, your plan needs more time to decide your claim, it must tell you within the 90-day period that more time is needed, why it is needed, ...

What to do if you are not a beneficiary on SPD?

If it is not you, but an authorized representative or your beneficiary who is filing the claim, that person should refer to the SPD and follow your plans claims procedure. The procedure may require other documents when this type of claim is filed. When a claim is filed, be sure to keep a copy for your records.

What is a summary plan description?

The SPD provides a detailed overview of the plan – how it works, what benefits it provides, and the plan’s procedures for filing a claim. It also describes your rights as well as your responsibilities under ERISA and your plan.

How to check SPD?

Filing A Claim. An important first step is to check your SPD to make sure you meet your plans eligibility requirements to receive benefits. Your plan might say, for example, that you must have worked a certain number of years and/or be a certain age before you can start receiving benefits. Also, be aware of what your plan requires to file a claim. ...

How long does it take to decide on SPD?

Make a note of when you file your claim. Usually, claims are decided within the 90-day period (or 180 days if an extension applies). If you are entitled to benefits, check your SPD for how and when benefits are paid.

How long does it take to appeal a health insurance plan?

Reviewing your appeal can take up to 60 days, and up to an additional 60 days, if you have been notified of the need for an extension .

How long does it take to get a decision from a denied claim?

You have 60 days to request a full and fair review of your denied claim.