How do I file for unemployment benefits in Kentucky?

- Collect your information

- Create an account. With an online Kentucky unemployment insurance account, you’ll be able to file your claim, submit weekly claims, and keep track of general benefit account information.

- File a claim. Once you’ve created your account, you’re ready to file your claim. ...

- Complete your eligibility review. Your Kentucky unemployment eligibility is based on a variety of factors. ...

- Set up your payment options. Through the online system, you’ll also decide how you want to receive your Kentucky unemployment compensation payments.

- Unemployed, and.

- Worked in Kentucky during the past 12 months (this period may be longer in some cases), and.

- Earned a minimum amount of wages determined by Kentucky guidelines, and.

- Actively seeking work each week you are collecting benefits.

What are the qualifications for unemployment benefits in Kentucky?

- You must be able to work throughout the benefit period. ...

- You must be available to work at all times. ...

- You must be looking actively for employment opportunities throughout the benefit period

- You must not reject any job opportunities offered to you at any point during the benefit period

How much does unemployment pay in KY?

Effective July 1, 2020 the minimum rate is $39 and the maximum rate is $569 per week regardless of how high the wages are. There must be at least $1500 in one of the 4 quarters or the claim will be invalid. The total wages outside of the highest quarter must be at least $1,500.

How do you sign up for unemployment in Kentucky?

- Your Social Security number

- Your alien registration number and work permit type, in addition to any other documentation that authorizes your employment in the United States if you are not a U.S Citizen

- The name, mailing address and phone number of your last employer and the location where you reportedly worked.

How to find out the status of unemployment in Kentucky?

Kentucky Unemployment Insurance - Employer Guide. SIDES State Information Data Exchange Submitting Electronic Claim Protests SIDES is a free electronic system that uses a nationally standardized format to easily respond to UI information requests, attach documentation when needed, and receive a date-stamped confirmation of receipt.

How do I apply for unemployment benefits in Kentucky?

Unemployment Insurance ServicesFile or access your unemployment insurance claim.Request your bi-weekly benefits onlineRequest your bi-weekly benefits by calling the voice response unit at 877-369-5984. ... Direct deposit - set up or make changes

How much does unemployment pay in Kentucky?

If you are eligible to receive unemployment, your weekly benefit rate in Kentucky will be 1.1923% of your total wages during the base period. You will receive a maximum of $522 each week; the minimum amount is $39 (in 2021). You may receive benefits for a maximum of 26 weeks.

Will I qualify for unemployment ky?

To be eligible for this benefit program, you must a resident of Kentucky and meet all of the following: Unemployed, and. Worked in Kentucky during the past 12 months (this period may be longer in some cases), and. Earned a minimum amount of wages determined by Kentucky guidelines, and.

Is ky still paying Covid unemployment?

Traditional unemployment benefits will continue to be paid to eligible claimants after Sept. 4, 2021, although pandemic unemployment programs expire on Sept. 4.

How long does it take to get approved for unemployment in KY?

The waiting week will always be your first payable week on your initial claim. You will request benefits for two weeks. If you are otherwise eligible, the amount of your first benefit payment will be for one week. Your maximum benefit amount will not change.

What are the requirements for unemployment?

When applying for unemployment benefits, you must:Have earned enough wages during the base period.Be totally or partially unemployed.Be unemployed through no fault of your own.Be physically able to work.Be available for work.Be ready and willing to accept work immediately.

How long does unemployment take to get approved?

It takes at least three weeks to process a claim for unemployment benefits and issue payment to most eligible workers.

How long does it take to get back pay from unemployment in KY?

Benefits are claimed every two weeks. Your first benefit request will be 13 days after the date you file the claim. You cannot request sooner than 13 days.

How long is unemployment on Covid?

Under the CARES Act states are permitted to extend unemployment benefits by up to 13 weeks under the new Pandemic Emergency Unemployment Compensation (PEUC) program.

Is Kentucky extending the unemployment?

March 28, 2022 Kentucky Governor Andy Beshear (D) signed House Bill 144 into law on March 24, freezing the state's unemployment insurance tax rate at 2020 pre-pandemic levels for 2022.

Do you have to pay back unemployment during Covid 19?

States tried clawing back overpayments from hundreds of thousands of people earlier in the pandemic. Labor Department officials issued initial rules in May 2021 that let states waive collection in some cases and asked states to refund any amounts already collected toward the overpayment.

Are they extending unemployment?

The American Rescue Plan Act, signed March 11, 2021, extended the Federal Pandemic Unemployment Compensation (FPUC) program, which provides an additional $300 to workers for weeks of unemployment ending on March 11, 2021 through September 4, 2021.

What are the requirements to file unemployment in Kentucky?

Kentucky residents must meet the following requirements to claim unemployment benefits: You've lost your income or had your hours drastically reduced through no fault of your own. You must be willing to work and actively seeking work (see note below). Your past earnings must meet certain standards.

How long does it take to get unemployment benefits?

No matter what, you will get at least 15 weeks of benefits, assuming you don't find new employment that makes you ineligible for unemployment. The CARES Act currently extends that by 13 weeks.

How much do you have to earn to qualify for unemployment in 2019?

Your wages during the base period must check all these boxes to qualify: You must have earned at least $1,500 in one quarter. You must have earned at least $1,500 total, across the other three quarters.

Should Kentucky workers apply for unemployment?

Image source: Getty Images. Kentucky workers should apply for unemployment if they cannot work due to COVID-19. Kentucky workers should apply for unemployment if they cannot work due to COVID-19. Kentucky businesses are doing their part to slow the spread of COVID-19 by shutting down until the crisis has passed, ...

Is Kentucky requiring work search?

Kentucky has waived the work-search requirement due to the COVID-19 pandemic. It has also taken the unprecedented step of opening unemployment benefits to independent contractors and self-employed workers, who are normally not eligible.

What is unemployment in Kentucky?

Unemployment Insurance (UI) is an employer-paid insurance program that provides you with benefits when you’re separated from a job at no fault of your own. UI benefits help cover the gap in lost wages while you are between jobs.

How long does unemployment last in Kentucky?

Kentucky unemployment benefits are paid for a maximum of 26 weeks, though a Kentucky unemployment extension may be put in place to increase this limit during times of high unemployment.

What is the Kentucky Department of Workforce Investment?

The Kentucky Department of Workforce Investment’s Office of Employment and Training (OET) oversees unemployment insurance benefits for the state . In addition to upholding Kentucky unemployment laws, the mission of the office is to provide quality jobs for people and quality people for jobs.

How long is the base period for unemployment in Kentucky?

Every state looks at a one-year “base period” of wages when determining unemployment insurance eligibility. In Kentucky, the base period is the first four out of the last five calendar quarters before your claim was made. To meet Kentucky unemployment requirements, you must meet the following requirements:

Is unemployment based on need in Kentucky?

As in other states , eligibility for State of Kentucky unemployment insurance benefits is not based on need. That being said, there are many other eligibility requirements that must be met in order to receive benefits: Be a Kentucky resident. Meet income requirements for work completed in Kentucky.

Can I get unemployment if I quit my job in Kentucky?

While every case is different, your Kentucky unemployment benefits eligibility is not likely if you were fired or quit your job. In these cases, you are welcome to apply for Kentucky unemployment benefits, but the claim is likely to be denied. In order to receive Kentucky UI, you must be out of work—or receiving significantly reduced hours—at no fault of your own. This type of employment generally occurs through lay off or company closure.

Can you collect unemployment if you quit?

While being fired for misconduct or quitting are not usually grounds for unemployment insurance benefit eligibility, there are certain circumstances where the reason for quitting is that you had no other choice than to do so. In these cases you may be able to collect unemployment benefits.

What are the eligibility requirements for unemployment in Kentucky?

You must meet the following three eligibility requirements to collect unemployment benefits: You must have earned at least a minimum amount in wages before you were unemployed.

When does the Kentucky unemployment benefit expire?

ARP increases the maximum duration of PEUC benefits from 24 to 53 weeks, with an expiry date of September 4, 2021. For up-to-date information on Kentucky's rules on unemployment eligibility and amounts during the COVID-19 pandemic, visit the state's Unemployment Insurance page.

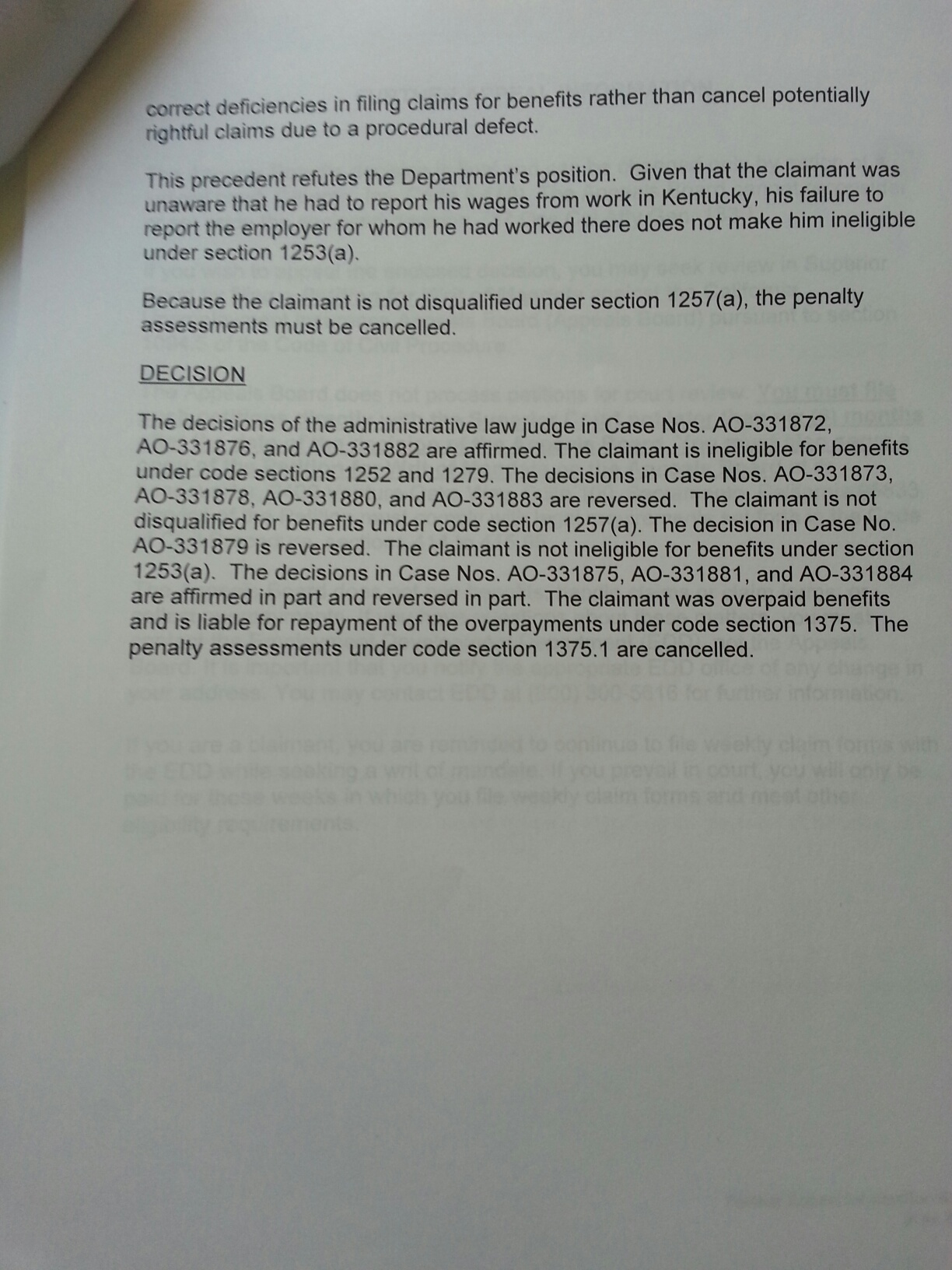

How long does it take to appeal unemployment in Kentucky?

How to Appeal a Denial of Unemployment Benefits in Kentucky. If your unemployment claim is denied, you have 15 days to appeal the decision to a referee. A hearing will be held on your appeal, typically by phone. If you are unhappy with the referee's decision, you may file an appeal with the Unemployment Insurance Commission within 15 days.

How much do you have to earn to qualify for unemployment in Kentucky?

To qualify for benefits in Kentucky, you must meet all four of the following requirements: You must have earned at least $750 in one quarter of the base period. You must have earned at least $750 outside of your highest paid quarter of the base period (that is, in the other three quarters).

Can you collect unemployment if you were fired?

If you were fired because you lacked the skills to perform the job or simply weren't a good fit, you won't necessarily be barred from receiving benefits. If, however, you were fired for good cause, you may be disqualified from receiving benefits.

Why is the Kentucky unemployment decision not final?

The decision is not yet final because the Commission has the right to seek review by the Kentucky Supreme Court. The Court’s decision, if it becomes final, will affect employers as it invalidates the state’s current statute allowing non-attorneys to represent an employer in administrative proceedings related to unemployment insurance claims.

When did the Kentucky court of appeals rule on unemployment?

On April 26, 2019, the Kentucky Court of Appeals issued a ruling pertaining to employer representation in administrative proceedings determining unemployment insurance eligibility. According to the Court’s ruling in the matter of Nichols v. Kentucky Unemployment Insurance Commission, employers would be required to have representation by an attorney ...

What is the meaning of 341.350 in Kentucky?

Under Section 341.350 of the Kentucky Unemployment Compensation Laws and Regulations, an individual shall be ineligible for benefits if he or she failed, without good cause, either to apply for available, suitable work or to accept suitable work when offered to him or her by the employment office or an employing unit.

Is Kentucky unemployment insurance going to be reviewed?

The Kentucky Unemployment Insurance Commission is taking the appropriate steps to seek the Kentucky Supreme Court’s review of the decision. In the meantime, there will be no changes to the current practice of allowing representation by non-attorneys in these administrative proceedings.

How to contact unemployment office?

If you suspect a claim has been filed in error, please promptly contact our office at (502) 564-2387.

Why is it important for employers to respond to unemployment claims?

Employers play a critical role in the early identification of attempts to defraud the unemployment insurance system. Your prompt response to notices of claims is necessary to ensure that payments are not disbursed in error, and that claimant information is protected.

What is OUI in Kentucky?

The Kentucky Office of Unemployment Insurance (OUI) collects personal information entered into electronic forms on this Internet site. For more information on your rights to request, review and correct information submitted on this electronic form, please see OUI's Privacy and Security Information.

What is the taxable wage base for Kentucky in 2021?

2021 Taxable Wage Base Base per worker will remain at $10,800 per worker. Kentucky employers are eligible to claim the full FUTA credit of 5.40% when filing your 2020 IRS 940 forms in January 2021. This will reduce your FUTA contribution rate to 0.60% (6.00% - 5.40%). The FUTA taxable wage base remains at $7,000 per worker.

When will Kentucky take the FUTA credit?

Kentucky employers are eligible to claim the full FUTA credit of 5.40% when filing your 2019 IRS 940 Forms in January 2020. This will reduce your FUTA contribution rate to 0.60% (6.00% - 5.40%).

When will nonprofits get 50% unemployment?

During the 2nd, 3rd, and 4th quarters of 2020, all eligible nonprofit reimbursing employers will only be billed for 50% of the unemployment benefits charged to their account, with the remaining 50% paid with federal funds from the Protecting Nonprofits Act signed by the President on August 3, 2020.

What is SCUF in KRS?

Per KRS 341.243, all contribution rates beginning with the 3rd quarter of 2018 shall be reduced by 0.075%, in order to implement SCUF. There is no increase or decrease in the total amount of tax you will pay. This reduction will divert 0.075% of the contributions that would have been applied to your employer reserve account, and apply to SCUF. In addition, you will not be able to claim SCUF payments on your Federal Unemployment Tax filings. Below is an example of how your 2018 reporting periods will change:

How to contact Kentucky unemployment?

You may also call toll-free 800-648-6057 for telecommunications relay service. IMPORTANT NOTE: Please be aware of fake unemployment filing websites designed to steal your personal information or charge you a fee. Make sure you are on a “.ky.gov” website when filing a Kentucky unemployment insurance claim. KCC services are free.

What time does the unemployment office open?

Website: Monday - Friday from 7 a.m. - 7 p.m., EST. Sunday from 10 a.m. - 9 p.m. EST. You may also call toll-free 800-648-6057 for telecommunications relay service. IMPORTANT NOTE: Please be aware of fake unemployment filing websites designed to steal your personal information or charge you a fee.