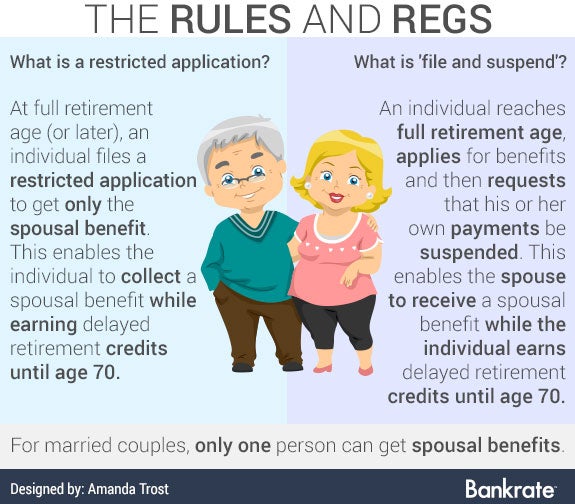

This makes you eligible to file a “restricted application,” which allows you to collect a spousal benefit while delaying benefits on your own earnings record. To do so, you should state in the remarks section of the application form that you wish to exclude your retirement benefit from the scope of your Social Security claim.

What are the benefits of SSA?

Social Security's Disability Insurance Benefits are federally funded and administered by the U.S. Social Security Administration (SSA). Social Security pays disability benefits to you and certain members of your family if you have worked long enough... Social Security and Retirement.

What is social security restricted application strategy?

- Your spouse, who may not have reached their full retirement age, may be subject to the annual earnings limitation, which is $17,640 for 2019

- If your spouse has suspended their own worker benefit, no spousal benefit is available

- You may be affected by the Government Pension Offset

What is a SSA check?

Social Security has long been a cornerstone of American democracy. However, it has also undergone some dramatic changes in the over 80 years since its passage. While the core program remains ...

Can spouse benefit from your SSDI benefits?

You can collect Social Security disability benefits as a spouse, based on your own earnings, or you can apply under your spouse’s Social Security benefits. If you choose the latter, you will receive 50 percent of the amount that is allocated to your spouse, based on calculations pertaining to their retirement age.

What does restricted application mean for Social Security?

What does restricted application mean?

What is reduced benefit situation?

What does it mean to file before FRA?

What is disability insurance?

What is a RIB benefit?

When can you restrict your child's benefits?

See more

About this website

Can you file and suspend and collect spousal benefits?

Your spouse or children cannot collect benefits on your work record while your own benefits are suspended. Under “deemed filing” rules, married people filing for Social Security at any age are automatically claiming both their retirement and their spousal benefit.

When can a spouse claim spousal Social Security benefits?

age 62You can claim spousal benefits as early as age 62, but you won't receive as much as if you wait until your own full retirement age. For example, if your full retirement age is 67 and you choose to claim spousal benefits at 62, you'd receive a benefit that's equal to 32.5% of your spouse's full benefit amount.

Can I collect spousal benefits and wait until I am 67 to collect my own Social Security?

You can only collect spousal benefits and wait until 70 to claim your retirement benefit if both of the following are true: You were born before Jan. 2, 1954. Your spouse is collecting his or her own Social Security retirement benefit.

Can I file for my Social Security at 62 and switch to ex spouse benefits later?

Only if your spouse is not yet receiving retirement benefits. In this case, you can claim your own Social Security beginning at 62 and make the switch to spousal benefits when your husband or wife files.

Can my wife claim spousal benefits before I retire?

No. You have to be receiving your Social Security retirement or disability benefit for your husband or wife to collect spousal benefits.

How are spousal Social Security benefits determined?

Spousal benefits are determined at the age you, as a spouse, file. The only relevance your spouse has is the amount of their Primary Insurance Amount (PIA). Spousal benefits are calculated using both your Primary Insurance Amounts and your spouse's Primary Insurance Amount.

Can I collect my husband's Social Security if he is still alive?

The earliest a widow or widower can start receiving Social Security survivors benefits based on age will remain at age 60. Widows or widowers benefits based on age can start any time between age 60 and full retirement age as a survivor.

Can I switch from spousal benefits to my own Social Security?

You will have to file an application to switch from survivor benefits on a late spouse's work record to retirement benefits on your own record. You should apply four months before you want your retirement benefit to start.

Can I collect my ex husband's Social Security then switch to mine?

Can I collect Social Security as a divorced spouse and wait to claim my own retirement benefit? In most circumstances, no. You can only file what Social Security calls a “restricted application” to claim ex-spousal benefits alone and postpone claiming your retirement benefits if: You were born before Jan.

At what age can I collect my ex husband's Social Security?

age 62 or olderBenefits For Your Divorced Spouse If you are divorced, your ex-spouse can receive benefits based on your record (even if you have remarried) if: Your marriage lasted 10 years or longer. Your ex-spouse is unmarried. Your ex-spouse is age 62 or older.

At what age can I collect half of my husband's Social Security?

A spouse can choose to retire as early as age 62, but doing so may result in a benefit as little as 32.5 percent of the worker's primary insurance amount. A spousal benefit is reduced 25/36 of one percent for each month before normal retirement age, up to 36 months.

Restricted Application Social Security Strategy Is on Its Way Out

To restrict an application to spousal benefits only, you must have been born before January 2, 1954. Anyone born on or after that date is out of luck when it comes to this particular strategy.

Can I apply only for spouse’s benefits and delay filing for my own ...

No, if you turn age 62 on or after January 2, 2016, you are required or “deemed” to file for both your own retirement and for any benefits you are due as a spouse, no matter what age you are.

Form SSA-2 | Information You Need to Apply for Spouse's or Divorced ...

You can apply: Online, if you are within 3 months of age 62 or older, or; By calling our national toll-free service at 1-800-772-1213 (TTY 1-800-325-0778) or visiting your local Social Security office. An appointment is not required, but if you call ahead and schedule one, it may reduce the time you spend waiting to apply.

Withdrawing Your Social Security Retirement Application | SSA

Unexpected life changes may occur after you apply for Social Security retirement benefits. If you change your mind about starting your benefits, you can cancel your application for up to 12 months after you became entitled to retirement benefits.

Documents you may need to provide

We may ask you to provide documents to show that you are eligible, such as:

What we will ask you

You should also have your checkbook or other papers that show your account number at a bank, credit union or other financial institution so you can sign up for Direct Deposit, and avoid worries about lost or stolen checks and mail delays.

What is restricted application?

What Is A Restricted Application? If you were born in 1953 or earlier, then you can file a “restricted application.”. This enables you to file for spousal benefits now and retirement benefits later.

When can I file for Social Security if I was born in 1954?

First, if one or both spouses were born in 1953 or earlier, then they may use this filing strategy. This also includes those born on January 1, 1954 because Social Security consider a person born on the first day of the month to be born in the previous month.

How long do you have to wait to file for spousal benefits?

If you are age 66 but your spouse is 60, you’ll need to wait at least two years to use this maneuver. But if your spouse is, say, 68 and claiming a benefit, you can file a restricted application for a spousal benefit off his record and let your own grow to age 70. Ex-spouses catch a break.

How long does Social Security benefit grow?

The strategy lets a beneficiary restrict an application to spousal benefits only, giving the beneficiary some Social Security income now while allowing his or her own retirement benefit to grow 8% a year until age 70. If you are a boomer who qualifies, it behooves you to take a good look at when you and your spouse will claim benefits.

Can an ex-spouse file for spousal benefits?

As long as the couple was married at least ten years, an ex-spouse who is still single can file a restricted application for spousal benefits only regardless of whether his or her ex has claimed a benefit. If you try to take advantage of this strategy before it disappears, be prepared if you run into confusion when claiming benefits.

Can couples maximize Social Security benefits?

If you can’t take advantage of this restricted application strategy, that doesn’t mean it’s every man or woman for themselves. A couple can still maximize Social Security benefits by coordinating their claims.

Can a non-earner claim spousal benefits?

A non-earner can’t claim a spousal benefit until the earner claims his benefit. If the couple can afford to go without Social Security income until 70, they may want to wait. If not, they should aim to delay claiming at least until full retirement age.

What is the limit on spousal benefits?

You also need to keep in mind that if you use the restricted application, your spousal benefit may be reduced for the following reasons: Your spouse, who may not have reached their full retirement age, may be subject to the annual earnings limitation, which is $17,640 for 2019.

What is the purpose of restricted application?

The purpose of using the restricted application is to allow the qualifying spouse to collect spousal benefits only, while deferring their own worker benefit to age 70 if they wish, and earn delayed retirement credits, up to an additional 32%.

What is considered filing for Social Security?

Deemed filing is the Social Security rule that says any time you apply for your Social Security benefits, you will be applying for any and all benefits available to you. Since you are always paid your own worker benefit first if you have one , if spousal benefits are available to you , you also will be paid spousal benefits.

When can I start collecting my own worker benefits?

Many times, people think that when they use the restricted application they will wait until 70 to start collecting their own worker benefit, only to find out that by preparing an in-depth analysis they should start their own worker benefits at 69 years and 3 months, or some other age than 70.

Can I use restricted application if I was born before 1/2/1954?

Born before 1/2/1954 – if you are born after 1/2/1954 – you cannot utilize the restricted application. Must be eligible for your own retirement benefit. Your spouse needs to be receiving their own worker benefit. You also need to keep in mind that if you use the restricted application, your spousal benefit may be reduced for the following reasons: ...

Is restricted application good for Social Security?

Although the restricted application is a very valuable tool to use in your Social Security claiming strategy, it needs to be implemented strategically to optimize the results. Always remember, if you take the wrong benefit at the wrong time, it’s always smaller and it’s forever. Dying is cheap – living is expensive!

Can a high earner spouse use restricted insurance?

If the qualifying spouse is the high earner and their Primary Insurance Amount is greater than their non-qualifying spouses Primary Insurance Amount, in almost every situation, it is beneficial for the qualifying high earner spouse to use the restricted application. If the qualifying spouse is the low earner and their Primary Insurance Amount is ...

What does "deemed filing" mean?

Deemed filing means that when you file for either your retirement or your spouse’s benefit, you are required or “deemed” to file for the other benefit as well. The rules for deemed filing apply only to retirement benefits based on your own work record and to the spousal benefits (including divorced spouse’s) you receive based on retirement. ...

Can I apply for spouse's benefits and delay filing for my own retirement?

Can I apply only for spouse’s benefits and delay filing for my own retirement benefit in order to earn delayed retirement credits? No, if you turn age 62 on or after January 2, 2016, you are required or “deemed” to file for both your own retirement and for any benefits you are due as a spouse, no matter what age you are.

When do you have to file deemed filing?

In addition, deemed filing may occur in any month after becoming entitled to retirement benefits. Deemed filing means that when you file for either your retirement or your spouse’s benefit, you are required or “deemed” to file for the other benefit as well. The Bipartisan Budget Act extends deemed filing rules to apply at full retirement age ...

What is voluntary suspension?

The worker’s voluntary suspension permitted a spousal benefit to be paid to their spouse while the worker was not collecting retirement benefits. The worker would then restart their retirement benefits later, for example at age 70, with an increase for every month retirement benefits were suspended.

How old is Maria's husband?

Her husband, Joe, is 65. They have each worked enough years to earn a retirement benefit. In March of 2020, Maria has reached her full retirement age and files for benefits. Maria is eligible for a spousal benefit on Joe’s record. Maria must file for both benefits.

Can a spouse receive spousal benefits at full retirement age?

Previously some spouses received spousal benefits at full retirement age, while letting the retirement benefits based on their earnings record grow by delaying to file for benefits.

Does Jennie receive her own retirement?

She does not start her own retirement benefit, allowing it to grow. At age 70, she starts her own increased retirement benefit, which she will receive for the rest of her life. The new law does not affect her because deemed filing does not apply to widows and widowers. Jennie will receive the higher of the two benefits.

Does deemed filing apply to survivors?

Deemed filing applies to retirement benefits, not survivor’s benefits. If you are a widow or widower, you may start your survivor benefit independently of your retirement benefit. De emed filing also does not apply if you receive spouse's benefits and are entitled to disability, or if you are receiving spousal benefits because you are caring for ...

What does restricted application mean for Social Security?

A restricted application tells the Social Security office that you are not applying for all benefits you are eligible for at the same time. You might be eligible to use a restricted application to claim a spousal benefit while letting your benefit continue to grow. Spouses are able to restrict their benefits when they are caring for a child ...

What does restricted application mean?

A restricted application tells the Social Security office that you are not applying for all benefits you are eligible for at the same time. This is also known as “restricting the scope” of your application. When using a restricted application, you are asking for only one benefit type.

What is reduced benefit situation?

A “reduced benefit situation” means you are filing before you reach FRA. 8 When you file before you reach FRA, you are deemed to be filing for spousal benefits at the same time you file for your own retirement benefits (if your spouse has already filed for their benefits). 7.

What does it mean to file before FRA?

Filing before FRA prevents you from using claiming strategies that might otherwise allow you to later switch between benefits. 9. For those born on or after January 2, 1954, when you file for benefits you will also be deemed to be filing for all benefits you are eligible for.

What is disability insurance?

A benefit if you are disabled; this is known as disability insurance benefits (DIB). 6. You can use a restricted application to claim a spousal benefit while letting your benefit continue to grow if: You were born on or before January 1, 1954.

What is a RIB benefit?

Take a look at why you might use this rule and some of the things you may be eligible for: A benefit based on your own earnings record; this is known as a Retirement Insurance Benefit (RIB). 3. A benefit based on a spouse or ex-spouse’s earnings record; this is known as a spouse’s insurance benefit (SIB). 4.

When can you restrict your child's benefits?

Restricted Applications When Caring for a Child. Spouses are able to restrict their benefits when they are caring for a child under the age of 16. You can choose to restrict your benefits and receive spousal benefits (at any age) while receiving child-in-care spousal benefits. 7. Once the child reaches the age of 16, ...