Unemployment compensation is considered taxable income by the IRS and most states, thus you are required to report all unemployment income as reported on Form 1099-G on your income tax return. You should be mailed a Form 1099-G before January 31, 2022 for Tax Year 2021 stating exactly how much in taxable unemployment benefits you received.

How does collecting unemployment affect your taxes?

Unemployment compensation is not subject to FICA taxes, the flat-percentage Social Security and Medicare taxes that would normally be withheld from your paycheck if you were working. You'll still pay significantly less in FICA taxes than you would have if you'd been working if you collected unemployment through a significant part of the year.

Are federal taxes owed on unemployment?

The Pennsylvania labor department has compiled a list of companies that are violating state labor and public safety laws. More than 500 Lehigh Valley employers landed on the list due to issues over payment of unemployment compensation taxes, according to a ...

Do you claim unemployment on your taxes?

Unlike stimulus checks that you don't have to pay taxes on, unemployment payments are considered taxable income and will need to be accounted for on your 2021 return. And this tax season, you won't be able to rely on a tax break for unemployment insurance, either.

Do I include unemployment on taxes?

How do ... with a tax professional, like a CPA or enrolled agent. If you’re a parent who received child tax credit payments, you’ll get a letter from the IRS outlining the total amount you received. You’ll need to save that letter and include it ...

How are unemployment benefits funded?

These benefits are mostly funded by taxes that are paid by employers at the federal and state levels. Generally, employees who are laid off or who lose their jobs through no fault of their own typically qualify for unemployment benefits. Taxpayers who want to receive unemployment compensation must apply for benefits through their state programs.

What box do you put income tax withheld from your benefits?

When you receive benefits, you can usually choose to have income taxes withheld from your compensation to avoid owing a large amount of tax on your tax returns. If you choose to have income tax withheld from your benefits, The total federal tax withheld will appear in Box 4. The state tax withheld will appear in Box 11.

What is a 1099 G?

If you received unemployment benefits this year, you can expect to receive a Form 1099-G “Certain Government Payments” that lists the total amount of compensation you received. The IRS considers unemployment compensation ...

Is unemployment taxable income?

The IRS considers unemployment compensation to be taxable income—which you must report on your federal tax return. Some states also count unemployment benefits as taxable income.

Does the above article give tax advice?

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Is unemployment tax free for 2020?

Unemployment benefits are included along with your other income such as wages, salaries, and bank interest (For tax year 2020, the first $10,200 of unemployment income are tax free for taxpayers with an AGI of less than $150,000). The total amount of income you receive, including your unemployment benefits, and your filing status will determine ...

Unemployment Compensation Exclusion Worksheet Schedule 1 Line 8

If you are filing Form 1040 or 1040-SR, enter the total of lines 1 through 7 of Form 1040 or 1040-SR. If you are filing Form 1040-NR, enter the total of lines 1a, 1b, and lines 2 through 7.

Are Taxes Taken Out Of Unemployment Benefits

You choose to withhold federal income taxes on your unemployment checks, just as your former employer withdrew the taxes from your paycheck by filing a voluntary withholding statement. However, this reduces the number of benefits they take home with you at a time when you may need all the money you can get.

How To File Unemployment On Your Taxes

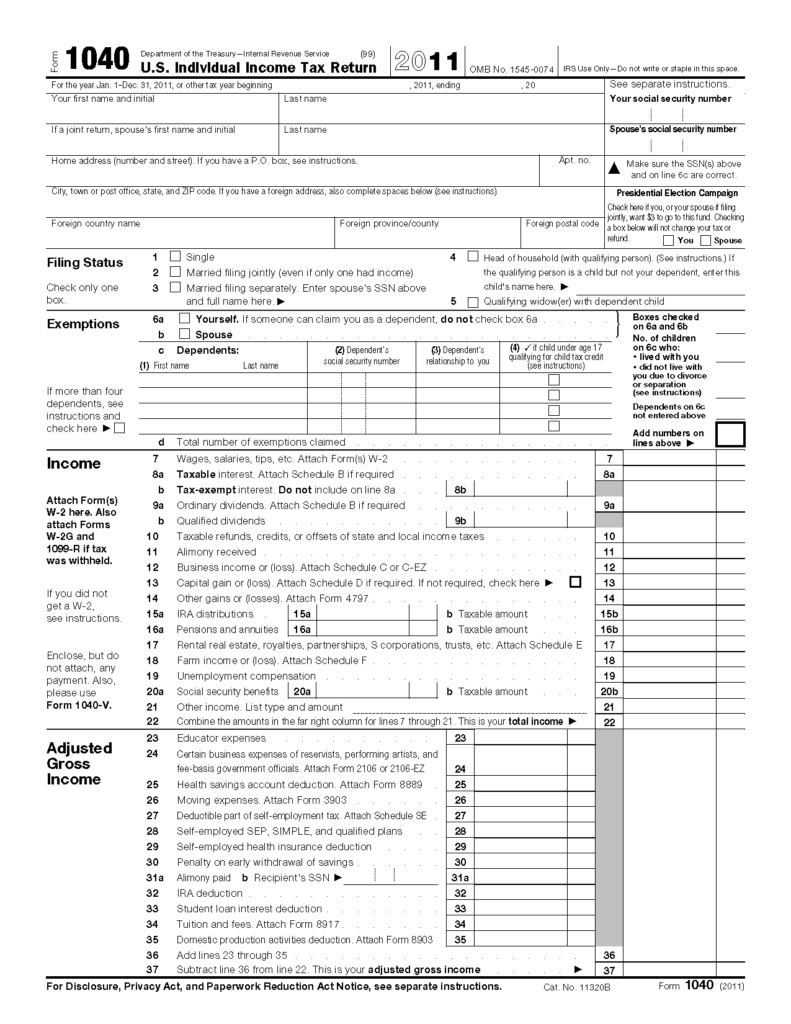

If youre wondering if unemployment is taxed, the answer is yes. These benefits are subject to both federal and state income taxes. The amounts you receive should be reflected on your taxes on Form 1040 .

Start Saving As Soon As Possible

If the bill isn’t too big, you may be able to simply save up enough money before the April 18 due date to pay the bill. The most efficient way of doing this is to set up a savings plan for yourself where you automatically put aside a small amount each week from your checking to your savings account.

Withholding Taxes From Your Payments

If you are receiving benefits, you may have federal income taxes withheld from your unemployment benefit payments. Tax withholding is completely voluntary withholding taxes is not required. If you ask us to withhold taxes, we will withhold 10 percent of the gross amount of each payment before sending it to you.

Where Do I Report A 1099

Here’s where to report your 1099-G for unemployment or paid family leave.

How To Get My 1099 From Unemployment To File Taxes

Many taxpayers are unaware that the unemployment income they received is taxable, just like earned income. The key difference is that unemployment income is taxed at a lower rate. Also, thanks to the American Recovery and Reinvestment Act , the first $2,400 of unemployment income is untaxed.

When will the IRS refund unemployment?

The IRS announced o n March 31, 2021 that the money will be automatically refunded by the IRS during the spring and summer of 2021 to taxpayers who filed their tax return reporting unemployment compensation on or before March 15, 2021.

When will unemployment be refunded?

The IRS announced o n March 31, 2021 that the money will be automatically refunded by the IRS during the spring and summer ...

How long will unemployment be extended in 2021?

Monitor here to see how your state (s) will handle the unemployment compensation exclusion in response to the ARPA. 2020 Unemployment benefit payments were extended from September 6, 2020 to March 14, 2021, and then again until September 6, 2021, thus states will now provide 53 weeks of benefits, up from 23 weeks in 2020.

How long does unemployment last?

In most states, unemployment benefits are paid weekly for 26 weeks after the unemployment application and approval process. Some states offer different maximum weeks for unemployment compensation, such as Montana at 28 weeks or Florida at 12 weeks (see table below).

When will the IRS start issuing tax refunds in 2021?

The IRS has begun issuing these refunds as of May 10, 2021. There is no tracking nor lookup tool, but taxpayers may be able to see a scheduled transaction in their IRS account - see how to create an IRS account. Here, navigate to the View Tax Records on the homepage and click the Get Transcript button.

Does unemployment change with stimulus 3?

If you filed on eFile.com, see how your unemployment income may have been affected . As a result of Stimulus 3 and the American Rescue Plan Act (ARPA), the taxation of unemployment income, benefits changed in reference to 2020 Federal returns.

Is severance pay taxable?

Remember that any severance pay or unemployment compensation you receive is taxable, in addition to any payouts received for accumulated vacation or sick time. Be sure that enough tax is withheld from these payments. Make sure you receive your final W-2 from your former employer to use for your tax return. Companies are not required to send out W-2s right away, but must provide them to all employees (even former ones) by January 31 of the following year. If you have left the company, this would be the year after you leave.

Unemployment Taxes At The Federal Level

At the federal level, unemployment benefits are counted as part of your income, along with your wages, salaries, bonuses, etc. and taxed according to your federal income tax bracket.

Do I Have To Claim My Severance Pay On My Tax Return If I Already Paid Taxes

Severance pay is a lump-sum payment received from a company when you are terminated due to job closings, company reductions, or even company closures. These payments are typically based on time in service and/or job performance, and as such are taxable as wages.

Unemployment Tax Break 2021

The Internal Revenue Service allows taxpayers to waive up to $10,200 earned through unemployment compensation. Most taxpayers can benefit from this tax break. The income limit for this tax break is $150,000 which applies to all taxpayers regardless of their filing status.

Eligibility For Unemployment Benefits

The first big question to tackle is to see if you qualify for unemployment benefits. Though the Department of Labor administers the guidelines, each state has its own separate requirements to qualify.

What Kind Of Unemployment Documentation Do I Need For Filing My Taxes

If you received unemployment benefits in 2020, EDD should have already sent you your 1099G form, which is a record of the total taxable income EDD has issued to you in a calendar year.

How The Tax Break Works

As part of COVID relief legislation, federal taxes for individual filers can be waived for up to $10,200 in unemployment income for the 2020 tax year, provided that you made $150,000 or lessthats the make-it-or-break-it threshold with no phase out.

How To Get Cobra

Group health plans must give covered employees and their families a notice explaining their COBRA rights. Plans must have rules for how COBRA coverage is offered, how beneficiaries may choose to get it and when they can stop coverage. For more COBRA information, see COBRA Premium Subsidy. The page links to information about COBRA including:

What If I Lost My Job During The Pandemic

Tax filers will be able to choose whether they want to use either their 2019 or 2020 earned income to calculate the Earned Income Tax Credit on their 2020 income tax returns, thanks to a one-time lookback provision.

Help With Unemployment Benefits And How To File Your Taxes

We understand that you may have a lot on your plate right now. Where your taxes are concerned, H& R Block is here to help. Be sure to visit our Unemployment Tax Resource Center for help with unemployment related topics.

Eligibility For Unemployment Benefits

The first big question to tackle is to see if you qualify for unemployment benefits. Though the Department of Labor administers the guidelines, each state has its own separate requirements to qualify.

How To Get Cobra

Group health plans must give covered employees and their families a notice explaining their COBRA rights. Plans must have rules for how COBRA coverage is offered, how beneficiaries may choose to get it and when they can stop coverage. For more COBRA information, see COBRA Premium Subsidy. The page links to information about COBRA including:

Get A Start Up Period

You may be eligible for a 12 month start up period if youre self-employed. Your work coach can tell you if you can get a start up period for your business.

Will I Owe Taxes On Stimulus Checks

No, stimulus checks aren’t considered income by the IRS. They are prepaid tax credits for your 2020 tax return, authorized by two relief bills passed last year that aimed at stabilizing the struggling U.S. economy in the wake of the pandemic.

Paying Unemployment Taxes At The State And Local Level

At the local and state level, the options to pay for your state and local taxes may differ depending on where you live. Contact your state, county, or local unemployment office to learn about the different options to pay your taxes. These options may include:

Are unemployment benefits tax-free in 2021?

Beverly Bird has been a writer and editor for 30+ years, covering tax breaks, tax preparation, and tax law. She also worked as a paralegal in the areas of tax law, bankruptcy, and family law from 1996 to 2010. Beverly has written and edited hundreds of articles for finance and legal sites like GOBankingRates, PocketSense, LegalZoom, and more.

Unemployment Income Rules for Tax Year 2021

When it went into effect on March 11, 2021, the American Rescue Plan Act (ARPA) gave a tax break on up to $10,200 in unemployment benefits collected in tax year 2020. You had to qualify for the exclusion with a modified adjusted gross income (MAGI) of less than $150,000. The $150,000 limit included benefits plus any other sources of income.

What Qualifies as Unemployment Benefits?

The term “unemployment benefits” casts a wide net. It includes unemployment insurance benefits paid to you by your state, as well as railroad unemployment compensation benefits. It also includes any payments made to you by the Federal Unemployment Trust Fund and Federal Pandemic Unemployment Compensation.

How Taxes on Unemployment Benefits Work

You should receive a Form 1099-G from your state or the payor of your unemployment benefits early in 2022 for unemployment income you received in 2021. The full amount of your benefits should appear in box 1 of the form. The IRS will receive a copy of your Form 1099-G as well, so it will know how much you received.

How To Prepare for Your 2021 Tax Bill

You have the option of having income tax withheld from your unemployment benefits so you don’t have to pay it all at once when you file your tax return—but it won’t happen automatically. You must complete and submit Form W-4V to the authority that’s paying your benefits. Withheld amounts appear in box 4 of your Form 1099-G. 6

If You Owe Tax That You Can't Pay

If you’re receiving unemployment benefits, you could face a hardship if you have a lump sum of tax due when you file your return. For some taxpayers, this could mean deciding between paying the rent and buying groceries, or sending estimated tax payments to the IRS. If you find yourself in this situation, there are some options.

State Income Taxes on Unemployment Benefits

Many states tax unemployment benefits, too. There are several that do not, though; California, Montana, New Jersey, Pennsylvania, and Virginia do not charge taxes on unemployment benefits. Arkansas and Maryland will not charge state taxes on unemployment benefits received in tax year 2021. 10 11

Line 7

You should receive a Form 1099-G showing in box 1 the total unemployment compensation paid to you in 2020. Report this amount on line 7.

Unemployment Compensation Exclusion Worksheet – Schedule 1, Line 8

If you are filing Form 1040 or 1040-SR, enter the total of lines 1 through 7 of Form 1040 or 1040-SR. If you are filing Form 1040-NR, enter the total of lines 1a, 1b, and lines 2 through 7.