Here's how to estimate how much you will get from Social Security in retirement:

- Consider the average payment.

- Calculate your Social Security payment.

- Factor in your retirement age.

- Subtract Medicare premiums.

- Remember income tax withholding.

- Create a My Social Security account.

How do you determine your Social Security benefit?

The estimated and actual amounts may differ due to:

- Future increases or decreases in your earnings.

- Social Security annual cost-of-living adjustments.

- Changes to U.S. laws and policies.

- Your military service, railroad employment, or pensions earned through work for which you did not pay Social Security tax.

How do you check your Social Security benefit?

Your Social Security Statement (Statement) is available to view online by opening a my Social Security account. It is useful for people of all ages who want to learn about their future Social Security benefits and current earnings history.

How do I determine my social security benefit?

Try refreshing the page. Today's Social Security column addresses questions about how Social Security spousal benefits are calculated, whether it's necessary to file in January to get a given year's COLA and what effects of benefits rates not paying taxes can have.

How to estimate your Social Security benefit?

Your Social Security benefit is decided based on your lifetime earnings and the age when you retire and begin taking payments. Your lifetime earnings are converted to a monthly average based on the 35 years in which you earned the most, adjusted for inflation.

How do I find out my Social Security benefit amount?

Most people can receive an estimate of their benefit based on their actual Social Security earnings record by going to www.socialsecurity.gov/estimator. You also can calculate future retirement benefits by using the Social Security Benefit Calculators at www.socialsecurity.gov.

How do I find out my Social Security amount when I retire?

A personal my Social Security account also gives access to the online Social Security Statement (Statement). In the Statement, a bar graph shows your retirement benefit estimates for up to nine ages when you may want to start benefits.

Can I see my Social Security statement online?

You can get your Social Security Statement (Statement) online by using your personal my Social Security account. If you don't yet have an account, you can easily create one.

How many years do you have to work to get maximum Social Security?

If you were born in 1929 or later, you need 40 credits (usually, this is 10 years of work). If you stop working before you have enough credits to qualify for benefits, the credits will remain on your Social Security record. If you return to work later, more credits may be added.

What is the average Social Security benefit at age 66?

At age 66: $3,240. At age 70: $4,194.

How much Social Security will I get at the age of 65?

How Your Social Security Benefit Is ReducedIf you start getting benefits at age*And you are the: Wage Earner, the benefit amount you will receive is reduced toAnd you are the: Spouse, the benefit amount you will receive is reduced to6593.345.865 + 1 month93.946.265 + 2 months94.446.565 + 3 months95.046.946 more rows

How much Social Security will I get if I make 20000 a year?

If you earned $20,000 for half a career, then your average monthly earnings will be $833. In this case, your Social Security payment will be a full 90% of that amount, or almost $750 per month, if you retire at full retirement age.

What is SSI for disabled people?

We are with those who need a helping hand. The Supplemental Security Income (SSI) program provides support to disabled adults and children who have limited income and resources, as well as people age 65 and older who are not disabled but have limited income and resources.

Why do we pay disability benefits to people who can't work?

We pay disability benefits to those who can’t work because they have a medical condition that’s expected to last at least one year or result in death. Find out how Social Security can help you and how you can manage your benefits. LEARN MORE.

What is the age limit for Medicare?

Medicare. Medicare is our country’s health insurance program for people 65 or older. Certain people younger than age 65 can qualify for Medicare too, including those with disabilities and those who have permanent kidney failure. Social Security works with the Centers for Medicare and Medicaid Services to ensure the public receives ...

Social Security Statement

Your Social Security Statement (Statement) is available to view online by opening a my Social Security account. It is useful for people of all ages who want to learn about their future Social Security benefits and current earnings history.

Sample Statement

We redesigned the Statement to make it easier for you to read and find the information you need!

Fact Sheets Added to Online Statement

We have added new fact sheets to accompany the online Statement. The fact sheets are designed to provide clarity and useful information, based on your age group and earnings situation. They can help you better understand Social Security programs and benefits.

Benefit Calculators

The best way to start planning for your future is by creating a my Social Security account online. With my Social Security, you can verify your earnings, get your Social Security Statement, and much more – all from the comfort of your home or office.

Online Benefits Calculator

These tools can be accurate but require access to your official earnings record in our database. The simplest way to do that is by creating or logging in to your my Social Security account. The other way is to answer a series of questions to prove your identity.

Additional Online Tools

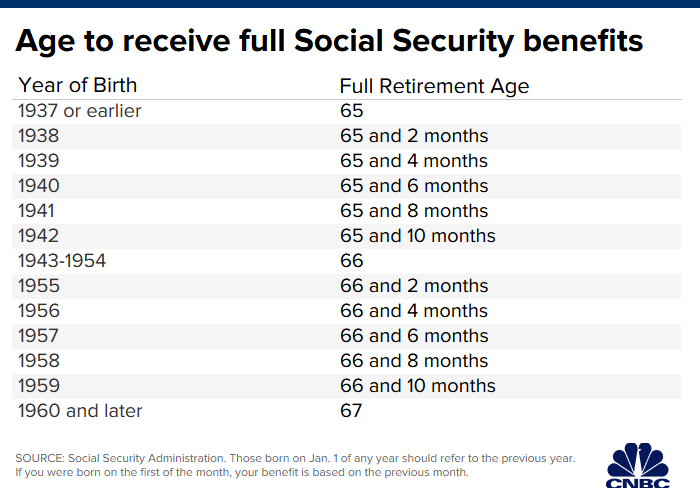

Find your full retirement age and learn how your monthly benefits may be reduced if you retire before your full retirement age.

Retirement Age Calculator

Find out your full retirement age, which is when you become eligible for unreduced Social Security retirement benefits. The year and month you reach full retirement age depends on the year you were born.

Why Did the Full Retirement Age Change?

Full retirement age, also called "normal retirement age," was 65 for many years. In 1983, Congress passed a law to gradually raise the age because people are living longer and are generally healthier in older age.

How to claim old pension?

To claim an old pension, you'll need to contact the PBGC and prove your identity. After successfully claiming your pension, you'll be able to start drawing on the benefits once you hit retirement age.

How long do you have to work to get a pension?

Most employers require you to work for the company for a minimum amount of time (often five years) in order to vest in the pension, meaning that you won't qualify for benefits unless you worked there at least that long.

What to do if your 401(k) is gone out of business?

If you don't have contact information for an old employer, or if the company has gone out of business, try the Department of Labor's Form 5500 search. Form 5500 is a tax form that 401 (k) plan administrators are generally required to file annually, so if you can track down your plan's Form 5500, you'll find the plan administrator's contact ...

Can you track down 401(k) if you have more than one employer?

You may have funded pensions or 401 (k) accounts that you don't even know exist. Here's how to track down these accounts. If you've worked for more than one employer in your lifetime, you may have lost or forgotten retirement benefits just waiting for you to track them down.

How old do you have to be to file for Social Security?

You must be at least age 22 to use the form at right. Lack of a substantial earnings history will cause retirement benefit estimates to be unreliable. Enter your date of birth ( month / day / year format) / /. Enter earnings in the current year: $. Your annual earnings must be earnings covered by Social Security.

What happens if you don't give a retirement date?

If you do not give a retirement date and if you have not reached your normal (or full) retirement age, the Quick Calculator will give benefit estimates for three different retirement ages .

What is the benefit estimate?

Benefit estimates depend on your date of birth and on your earnings history. For security, the "Quick Calculator" does not access your earnings record; instead, it will estimate your earnings based on information you provide. So benefit estimates made by the Quick Calculator are rough. Although the "Quick Calculator" makes an initial assumption ...

How old do you have to be to use Quick Calculator?

You must be at least age 22 to use the form at right.

Check the Status of your Social Security Application

Our online services let you get the information you need from anywhere, on any device. If you applied for Social Security benefits or Supplemental Security Income (SSI), or have a pending reconsideration or hearing request, you can log in to or create a my Social Security account to check the status of your application.

Still have questions?

If you have questions or need help understanding how to check the status of your Social Security application online, call our toll-free number at 1-800-772-1213 or visit your Social Security office. If you are deaf or hard of hearing, call our toll-free TTY number, 1-800-325-0778, between 8:00 a.m. and 5:30 p.m. Monday through Friday.