8 Ways to Increase Your Social Security Benefits

- Work in a high-paying field/job. The Social Security Administration (SSA) takes three things into account when calculating your benefit.

- Work for longer than 35 years. The second factor that the SSA considers when calculating your Social Security benefit is your length of work history.

- Wait to claim benefits for as long as economically feasible. Arguably the most important consideration is the age that you claim Social Security benefits. ...

- Consider a Social Security do-over. Another option to consider, especially for baby boomers with poor saving habits, is a "do-over" known as Form SSA-521 – officially, the "Request for ...

- Weigh your survivor benefit option. While your Social Security claiming decision could rightly be viewed as one of the biggest personal decisions you'll ever make, if you're married or ...

- Use your ex-spouse to boost your benefit. If you're now divorced from your spouse, but you were married for at least 10 years, and you're still unmarried and of ...

- Consider tax benefits and where you retire. Retirees should also pay close attention to tax benefits and where they retire. ...

- Check your Social Security earnings statement. Last, but not least, make a habit of double-checking your Social Security earnings statements. ...

- Work for at least 35 years.

- Earn more.

- Work until your full retirement age.

- Delay claiming until age 70.

- Claim spousal payments.

- Include family.

- Don't earn too much in retirement.

- Minimize Social Security taxes.

How can you maximize your Social Security benefits?

Use these 6 strategies to increase your household's lifetime benefits

- Don’t Take the SSA’s Advice at Face Value. Going straight to the source seems like a great way to get accurate information about the best time to file for ...

- Withdraw Your Social Security Application. Here’s one opportunity to reverse a claiming decision you regret. ...

- Suspend Your Social Security Benefits. ...

- Maximize Your Household Benefits. ...

What can I do to increase my Social Security benefits?

Simple strategies to maximize your benefits

- Work at Least the Full 35 Years. The Social Security Administration (SSA) calculates your benefit amount based on your lifetime earnings.

- Max Out Earnings Through Full Retirement Age. The SSA calculates your benefit amount based on your earnings, so the more you earn, the higher your benefit amount will be.

- Delay Benefits. ...

How can I get more money from SSI/disability?

Think through your condition and life circumstances to find support for your disability.

- Know What You Are Eligible For. If you worked for a number of years and paid Social Security taxes before becoming disabled, your benefit will be based on your earnings ...

- Be Thorough When Applying. Take care to apply for benefits as soon as possible after becoming disabled. ...

- Check in After Life Changes. ...

- Look for Other Kinds of Assistance. ...

How much can you earn with SSI?

- If you work and earn $6,000 throughout the year, you have not hit the $17,640 annual earnings that would trigger withholding of some of your Social Security benefits. ...

- If you work and earn $35,000, you have exceeded the $17,640 limit by $17,360. ...

- If you work and earn $80,000, you have exceeded the $17,640 limit by $62,360. ...

Will SSI get a $200 raise in 2021?

Increased SSI payments will begin on December 30, 2021. When your notice will arrive in the mail: We mail COLA notices throughout the entire month of December. It is possible that your friend or family member will receive their notice in the mail before you.

Will SSI disability get an increase?

Social Security and Supplemental Security Income (SSI) benefits for approximately 70 million Americans will increase 5.9 percent in 2022. Read more about the Social Security Cost-of-Living adjustment for 2022. The maximum amount of earnings subject to the Social Security tax (taxable maximum) will increase to $147,000.

Will SSI get a raise in 2021?

With COLAs, Social Security and Supplemental Security Income (SSI) benefits keep pace with inflation. The latest COLA is 5.9 percent for Social Security benefits and SSI payments. Social Security benefits will increase by 5.9 percent beginning with the December 2021 benefits, which are payable in January 2022.

Is Social Security getting a $200 raise?

A benefits boost: $200, plus COLA changes Anyone who is a current Social Security recipient or who will turn 62 in 2023 — the earliest age at which an individual can claim Social Security — would receive an extra $200 per monthly check.

How much will the SSI checks be in 2021?

SSI Monthly Payment Amounts, 1975-2022YearCOLAaEligible individual20192.8%771.0020201.6%783.0020211.3%794.0020225.9%841.0019 more rows

What state has the highest SSI payment?

States That Pay out the Most in SSI BenefitsNew Jersey: $1,689 per month.Connecticut: $1,685 per month.Delaware: $1,659 per month.New Hampshire: $1,644 per month.Maryland: $1,624 per month.

Why did I get an extra payment from Social Security this month?

The extra payment compensates those Social Security beneficiaries who were affected by the error for any shortfall they experienced between January 2000 and July 2001, when the payments will be made. Who was affected by the mistake? The mistake affected people who were eligible for Social Security before January 2000.

How much will Social Security go up in January 2021?

The new year will usher in bigger Social Security checks for many beneficiaries starting this month. That's as a record 5.9% cost-of-living adjustment, or COLA, takes effect. It marks the biggest annual increase in about 40 years. In 2021, benefits went up by just 1.3%.

How is Social Security calculated?

Social Security benefits are calculated based on the 35 years in which you earn the most. If you don't work for at least 35 years, zeros are factored into the calculation, which decreases your payout.

How much do you get from Social Security if you don't work?

Increasing your income by asking for a raise or earning income from a side job will increase the amount you receive from Social Security in retirement. Earnings of up to $132,900 in 2019 are used to calculate your retirement ...

How long do you have to work to get Social Security?

Try these strategies to maximize your payments: Work for at least 35 years. Social Security benefits are calculated based on the 35 years in which you earn the most.

Can a spouse inherit a deceased spouse's Social Security?

When one member of a married couples dies, the surviving spouse can inherit the deceased spouse’s benefit payment if it’s more than his or her current benefit. Retirees can boost the amount the surviving spouse will receive by delaying claiming Social Security. Make sure your work counts.

How does Social Security work?

The Social Security Administration allows you to set up an account where you can view a personalized estimate of disability benefits. Your Social Security statement will explain what you are eligible for and how much to expect each month. By and large, the formula used to calculate your disability benefits is set.

How long do you have to wait to apply for disability?

If your impairment makes it impossible to work and is predicted to last, you can apply for disability benefits right away. You don’t have to wait until a full year has passed to apply. Ask your physician for help filling out forms, communicating the diagnosis and reporting the information.

How many people are disabled on Social Security?

(Getty Images) Approximately 1 in 4, or 61 million, adults in the United States report a disability, according to data from the U.S. Department of Health and Human Services.

Can life changes affect disability?

Life changes could impact your disability eligibility. There may be other ways to receive assistance. Read on to learn how Social Security disability checks are issued and what you can do to increase your overall income when facing a disability. A Guide to Social Security Disability. ]

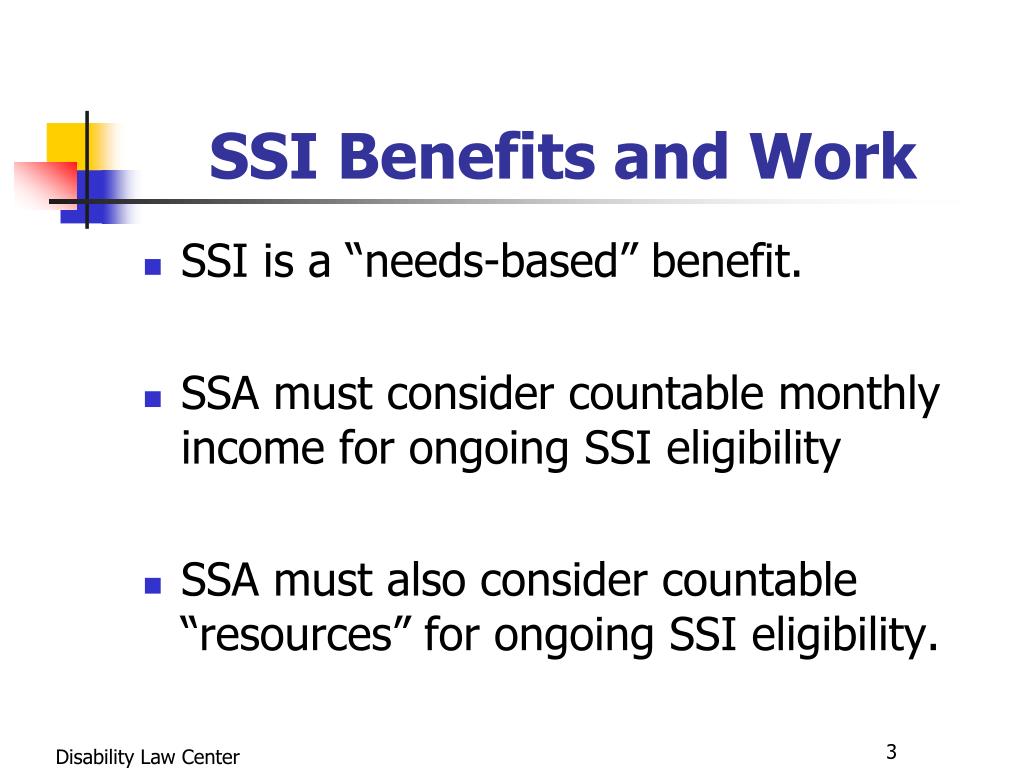

How is SSI payment reduced?

Payment reduction. The monthly amount is reduced by subtracting monthly countable income. In the case of an eligible individual with an eligible spouse, the amount payable is further divided equally between the two spouses. Some States supplement SSI benefits.

What is the maximum federal income tax for 2021?

The latest such increase, 1.3 percent, becomes effective January 2021. The monthly maximum Federal amounts for 2021 are $794 for an eligible individual, $1,191 for an eligible individual with an eligible spouse, and $397 for an essential person.

How do I contact Social Security?

There are a number of things you can do online. In addition to using our website, you can call us toll-free at 1-800-772-1213. We treat all calls confidentially.

What is the number to call for Social Security?

If you are deaf or hard of hearing, you may call our TTY number, 1-800-325-0778. We also want to make sure you receive accurate and courteous service. That is why we have a second Social Security representative monitor some telephone calls.

Can I get a higher Social Security if my ex-husband dies?

For example, if your spouse or ex-spouse dies, you may become eligible for a higher Social Security benefit. To find out if you, or a family member, might be eligible for a benefit based on another person’s work, or a higher benefit based on your own work, see the information about benefits on the Social Security website.

Can my child get Social Security based on work?

Your child may be eligible for benefits based on your work. Are you receiving Supplemental Security Income (SSI) or Social Security benefits and have past military service? If you served in the U.S. military, you may be eligible for benefits through the Veterans Administration.

Can I get Social Security at 65?

If you are at least age 65, you may be eligible for cash benefits on your own record. If you are full retirement age or older, you can work and receive your monthly Social Security benefits, no matter how much you earn. Please review this publication for more information.

Can my survivor benefit increase if my spouse dies?

Has your spouse or ex-spouse died? If your spouse or ex-spouse has died, you may be eligible for a higher survivor benefit based on his or her work. The death of an ex-spouse may allow you to be eligible for a higher survivor benefit even ...

Can you change your Social Security benefits?

It's not unusual for a benefit recipient's circumstances to change after they apply or became eligible for benefits. If you, or a family member, receive Social Security or Supplemental Security Income (SSI), certain life changes may affect eligibility for an increase in your federal benefits.

What is SSI?

The Supplemental Security Income (SSI) program is a federal program which provides monthly payments to adults and children with a disability or blindness who have income and resources below specific financial limits.

How much SSI can you receive?

Not everyone receives the same supplemental security income benefit amount.

Who is eligible for SSI?

The SSI program provides monthly payments to people who are at least age 65 or blind or disabled.

How is SSDI based on income?

Given that Social Security Disability Insurance (SSDI) is based on the money you paid into the SSA system through your employment taxes and your average income, the more you paid and the higher your income the higher your SSDI disability payments will be each month.

How much will Social Security increase in 2013?

The Social Security Administration (SSA) also has announced that the nearly 62 million Americans who are currently receiving Social Security and Supplemental Security Income (SSI) can expect their benefits to increase by 1.7 percent beginning in 2013.

What is SSI disability?

Supplemental Security Income (SSI) is offered to disability applicants who have very limited income and who are unable to work for at least 12 continuous months. Unlike SSDI, SSI does not require you have worked and earned work credits to be insured for benefits.

Can I get SSDI if my spouse is working?

Additionally, unlike SSDI, if you have a spouse who is working and making too much money it can actually lower or eliminate your ability to qualify or receive SSI benefits.

Is SSDI considered full disability?

If you have been given SSDI than the Social Security Administration considers you 100% disabled and you have been given your full SSDI benefits. There are no partial disability payments and no disability ratings, unlike other types of federal benefits.