To receive PUA benefits, you must file a claim in the state where you worked or were self-employed. To find your state’s program and learn how and where to file your claim, visit the Unemployment Insurance Service Locator. When you file a claim, the state agency will require information such as addresses and dates of former employment, as well as information about your self-employment. To avoid delays, provide complete and correct information, particularly how you became unemployed, partially unemployed, or are not able or available to work due to COVID-19-related reasons.

Why is my Pua still processing PA?

why is my pua still processing pa. February 25, 2021. Answer: The PA UC Application Review Process. Kris says: Friday at 5:40 am. Backdated PUA Claims and Payments PUA claims can be backdated to January 27, 2020 or to the first week you were unemployed due to COVID-19, whichever of the two dates is later. Su says: Tuesday at 11:23 pm.

Who is eligible for pandemic Unemployment Assistance (PUA)?

Who Was Eligible to Receive Pandemic Unemployment Assistance (PUA)? PUA was intended to support workers who didn't otherwise qualify for unemployment insurance. Examples of the types of workers targeted by the PUA program included freelancers, part-time gig workers, and self-employed individuals.

How to apply for pandemic Unemployment Assistance (PUA)?

- File an application for PUA by creating an account or logging in at https://my.unemployment.wisconsin.gov.

- Go to your UI summary page.

- Select link "Click here to file for Pandemic Unemployment Assistance".

What is a Pua claim?

You may qualify for other State programs to help cover food, housing, and healthcare expenses. Pandemic Unemployment Assistance (PUA) was part of the federal assistance that helped unemployed Californians who were not usually eligible for regular unemployment insurance benefits. PUA included up to 86 weeks of benefits, beginning February 2, 2020.

What is PUA in unemployment?

Who is eligible for PUA?

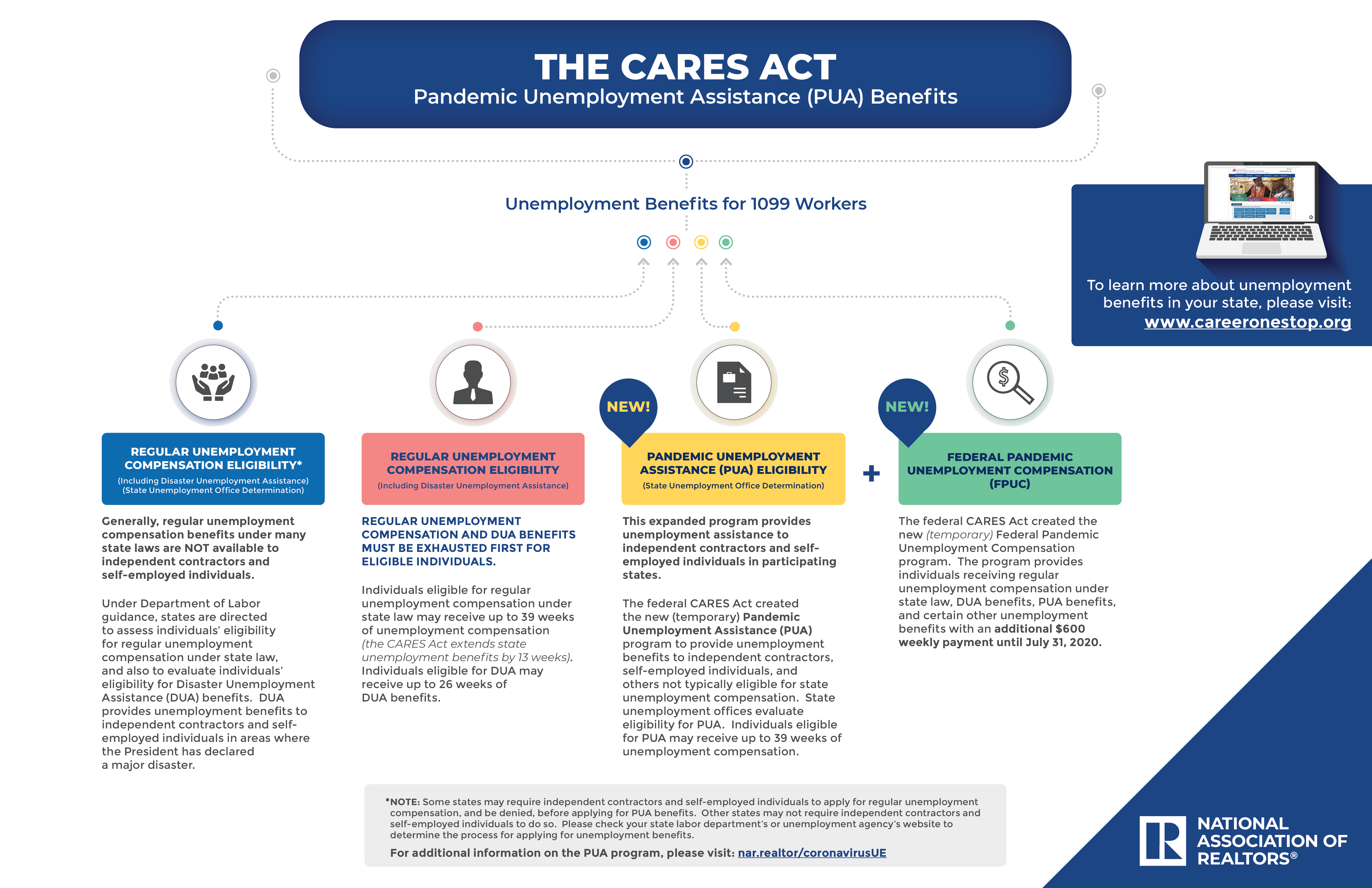

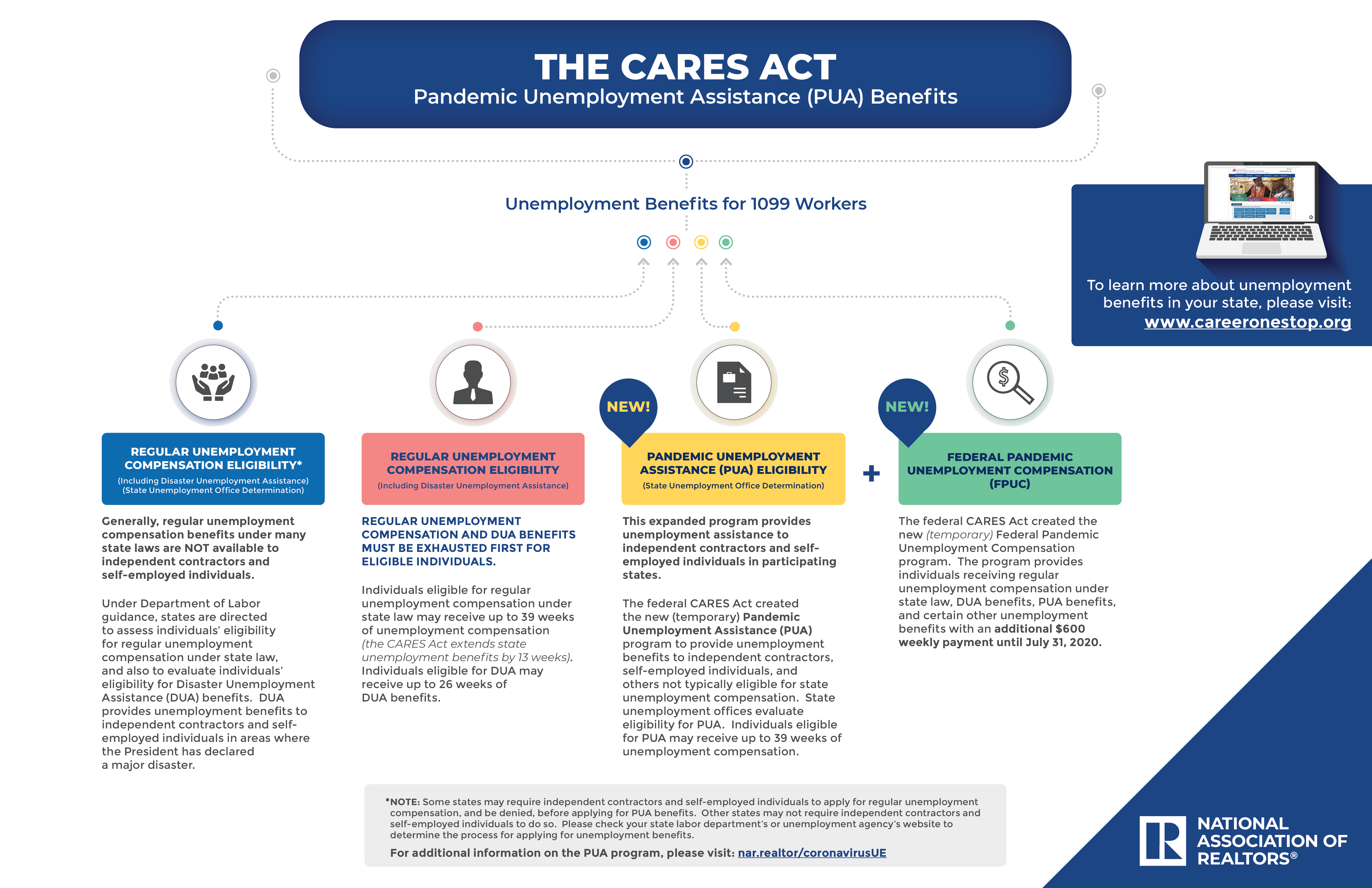

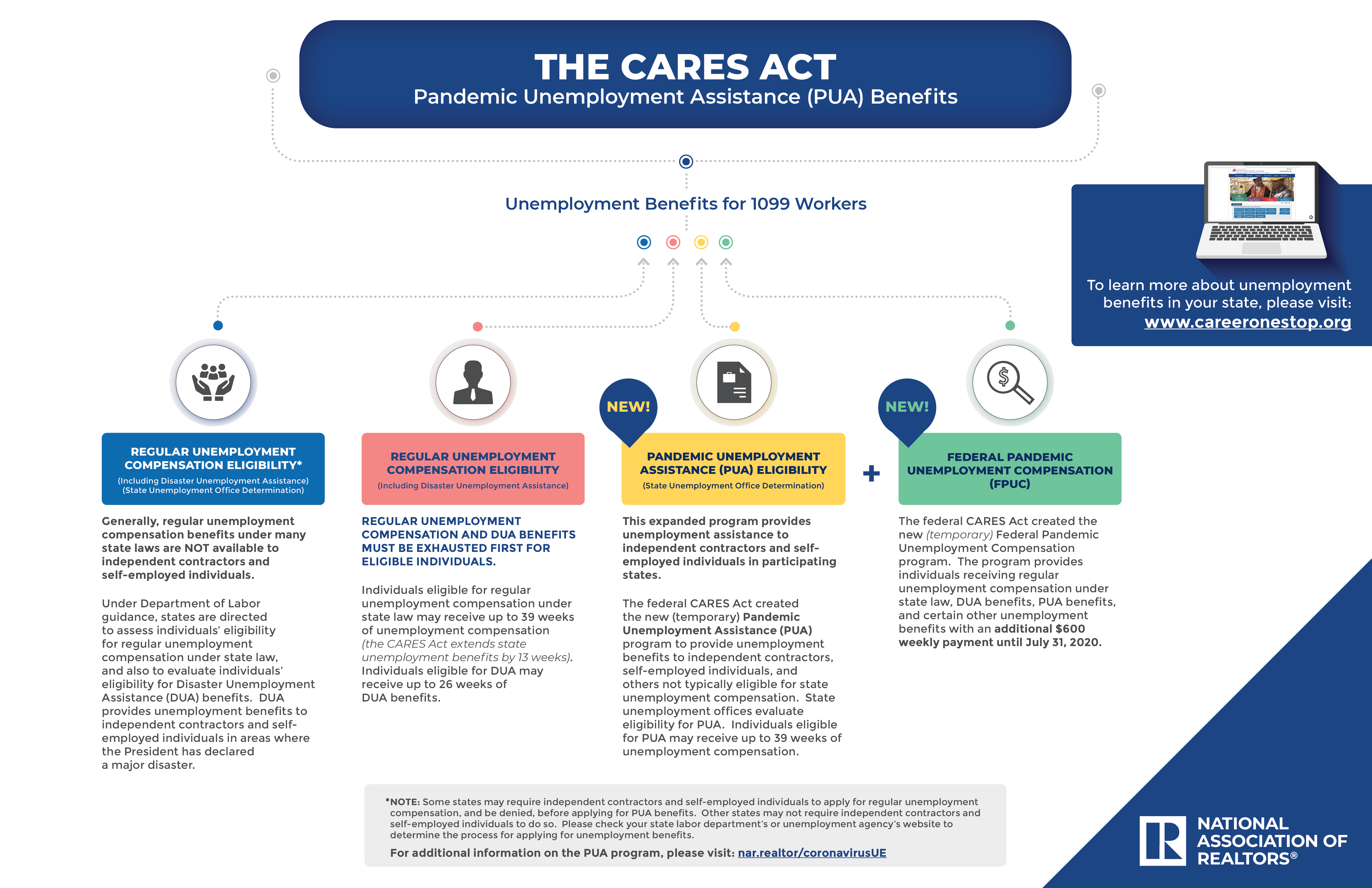

What are the new programs under the Cares Act?

When was PUA created?

What is the FPUC?

How long does it take to get unemployment benefits after being exhausted?

What are some examples of PUA?

See more

About this website

Do I qualify for the additional $300 in federal benefits during the COVID-19 pandemic?

The additional $300/week in Federal Pandemic Unemployment Compensation is available to claimants receiving unemployment benefits under the state or federal regular unemployment compensation programs (UCFE, UCX, PEUC, PUA, EB, STC, TRA, DUA, and SEA). The funds are available for any weeks of unemployment beginning after Dec. 26, 2020, and ending on or before March 14, 2021. You don’t need to apply separately to receive this supplemental amount.

Are individuals eligible for PUA if they quit their job because of the COVID-19 pandemic?

There are multiple qualifying circumstances related to COVID-19 that can make an individual eligible for PUA, including if the individual quits his or her job as a direct result of COVID-19. Quitting to access unemployment benefits is not one of them.

How can I receive unemployment benefits during the COVID-19 crisis?

To receive unemployment insurance benefits, you need to file a claim with the unemployment insurance program in the state where you worked. Depending on the state, claims may be filed in person, by telephone, or online.

Are self-employed, independent contractor and gig workers eligible for the new COVID-19 unemployment benefits?

See full answerSelf-employed workers, independent contractors, gig economy workers, and people who have not worked long enough to qualify for the other types of unemployment assistance may still qualify for PUA if they are otherwise able to work and available for work within the meaning of the applicable state law and certify that they are unemployed, partially unemployed or unable or unavailable to work for one of the following COVID-19 reasons:You have been diagnosed with COVID-19, or have symptoms, and are seeking a medical diagnosis.A member of your household has been diagnosed with COVID-19.You are caring for a family member of a member of your household who has been diagnosed with COVID-19.A child or other person in your household for whom you have primary caregiving responsibility is unable to attend school or another facility that is closed as a direct result of COVID-19 and the school or facility care is required for you to work.

What if an employee refuses to come to work for fear of infection?

Your policies, that have been clearly communicated, should address this.Educating your workforce is a critical part of your responsibility.Local and state regulations may address what you have to do and you should align with them.

What kinds of relief does the CARES Act provide for people who are about to exhaust regular unemployment benefits?

Under the CARES Act states are permitted to extend unemployment benefits by up to 13 weeks under the new Pandemic Emergency Unemployment Compensation (PEUC) program.

Who can get Paxlovid?

The FDA has authorized Paxlovid for anyone age 12+ who is at high risk for developing a severe case of COVID-19.

Who can apply for the COVID-19 Economic Injury Disaster Loan?

In response to COVID-19, small business owners, including agricultural businesses, and nonprofit organizations in all U.S. states, Washington D.C., and territories can apply for the COVID-19 Economic Injury Disaster Loan (EIDL).

Is there additional relief available if my regular unemployment compensation benefits do not provide adequate support?

See full answerThe new law creates the Federal Pandemic Unemployment Compensation program (FPUC), which provides an additional $600 per week to individuals who are collecting regular UC (including Unemployment Compensation for Federal Employees (UCFE) and Unemployment Compensation for Ex-Servicemembers (UCX), PEUC, PUA, Extended Benefits (EB), Short Time Compensation (STC), Trade Readjustment Allowances (TRA), Disaster Unemployment Assistance (DUA), and payments under the Self Employment Assistance (SEA) program). This benefit is available for weeks of unemployment beginning after the date on which your state entered into an agreement with the U.S. Department of Labor and ending with weeks of unemployment ending on or before July 31, 2020.

Who is considered to be essential worker during the COVID-19 pandemic?

Essential (critical infrastructure) workers include health care personnel and employees in other essential workplaces (e.g., first responders and grocery store workers).

Can I get unemployment assistance if I am partially employed under the CARES Act?

A gig economy worker, such as a driver for a ride-sharing service, is eligible for PUA provided that he or she is unemployed, partially employed, or unable or unavailable to work for one or more of the qualifying reasons provided for by the CARES Act.

Can COVID-19 be spread through sex?

The virus spreads by respiratory droplets released when someone with the virus coughs, sneezes or talks. These droplets can be inhaled or land in the mouth or nose of a person nearby. Coming into contact with a person's spit through kissing or other sexual activities could expose you to the virus.

2022 to 2023 Maximum Weekly Unemployment Insurance Benefits and Weeks ...

Listed in the table below are the latest maximum weekly unemployment insurance benefit/compensation amounts by state. The Unemployment compensation (UC) program is designed to provide benefits to most individuals out of work or in between jobs, through no fault of their own. Note, the table below contains the the maximum regular weekly state unemployment insurance compensation (benefit)

No, a tax break on 2021 unemployment benefits isn’t available

Tax season is fast approaching — and recipients of unemployment benefits in 2021 don't appear to be getting a tax break like they did for 2020.

Frequently Asked Questions about UI and PUA benefits Anchors

Frequently Asked Questions about UI benefits – The Basics. What does the American Rescue Plan Act mean for me, an unemployed worker? The pandemic benefits that Congress passed in December are set to expire on March 14.

What is PUA?

The Pandemic Unemployment Assistance (PUA) provided up to 79 weeks of unemployment benefits to individuals not eligible for regular unemployment compensation or extended benefits due to COVID-19. PUA benefits ceased on September 4, 2021.

Understanding your Benefit Summary

Some claimants may still be seeing issue codes on their PUA claim. To better understand your benefit summary , please access the full alphabetical list of issue codes and their meanings . For your convenience, we have gathered the most common codes below:

What is PUA in unemployment?

Pandemic Unemployment Assistance (PUA) is a program that temporarily expands unemployment insurance (UI) eligibility to self-employed workers, freelancers, independent contractors, and part-time workers impacted by the coronavirus pandemic. PUA is one of the programs originally established by the Coronavirus Aid, Relief, ...

Who is eligible for PUA?

Pandemic Unemployment Assistance (PUA) extends unemployment benefits to eligible self-employed workers, including: 2. Freelancers and independent contractors. Workers seeking part-time work. Workers who don't have a work history long enough to qualify for state unemployment insurance benefits. Workers who otherwise wouldn't qualify ...

What are the new programs under the Cares Act?

In addition to the PUA program, the CARES Act extended unemployment benefits through two other initiatives: the Pandemic Emergency Unemployment Compensation (PEUC) program and the Federal Pandemic Unemployment Compensation (FPUC) program.

When was PUA created?

PUA is one of the programs originally established by the Coronavirus Aid, Relief, and Economic Security (CARES) Act, a $2 trillion coronavirus emergency stimulus package that President Donald Trump signed into law on March 27, 2020. The act expanded states' ability to provide unemployment insurance to many workers affected by COVID-19, ...

What is the FPUC?

FPUC is a flat amount given to people who receive unemployment insurance, including those who get a partial unemployment benefit check. It applies to people who receive benefits under PUA and PEUC. The original amount of $600 was reduced to $300 per week after the program was extended in August 2020.

How long does it take to get unemployment benefits after being exhausted?

Extends benefits up to an extra 53 weeks after regular unemployment compensation benefits are exhausted. Federal Pandemic Unemployment Compensation (FPUC) Provides a federal benefit of $300 a week through Sept. 6, 2021. Provided $600 a week through July 31, 2020.

What are some examples of PUA?

Examples of the types of workers targeted by the PUA program include freelancers, part-time “gig workers,” and those who are self-employed. To qualify, workers must certify they are unable to work due to one or several conditions related to COVID-19.

What is the PUA benefit for 2019?

Individuals who received at least $5,000 a year in self-employment income during 2019 now will receive an additional $100 weekly benefit, in addition to the benefit amounts they otherwise would be entitled to receive from regular state unemployment. Previously, such individuals were not eligible for PUA benefits if they received some regular state unemployment benefits for traditional employment, and regular state law benefits did not consider self-employment in calculating the benefit amounts. The new federally-funded “mixed earner” benefit is in addition to the $300 supplementary FPUC weekly benefit under FPUC.

What is PUA unemployment?

The Pandemic Unemployment Assistance (PUA) program was put in place primarily for those out-of-work Americans who are not eligible for regular state unemployment benefits and are unemployed, partially unemployed, or unable or unavailable to work because of certain health or economic consequences of the COVID-19 pandemic. This group of jobless workers are generally self-employed (e.g. independent contractors, freelancers or gig economy workers) who did not contribute taxes towards regular state unemployment (1099 wages). The PUA program has been extended several times over the last year and you can jump to the relevant extension section via the links below for further information on each extension, including FAQs around the evolution of the program.

How long will unemployment benefits last?

For those who don’t qualify for state unemployment they can get benefits for between 39 and 46 weeks until the end of 2020. At this stage unless Congress extends the PUA program via a new stimulus package, ...

What is the stimulus package for unemployment?

The $900 billion COVID relief stimulus package, under the Continued Assistance Act (CAA) included funding for extending pandemic unemployment programs (PUA, PEUC) and providing supplementary FPUC un employment benefits at $300 per week for millions of unemployed or underemployed Americans. The Department of Labor (DOL) has issued final guidelines for state unemployment agencies on payments and eligibility (as done with the original program) and any delayed payments will be retroactively reimbursed.

How long is the PUA program?

The PUA program, designed for freelancers, gig workers and independent contractors or those that generally don’t qualify for regular state unemployment has been extended by another 29 weeks (though only covers 25 actual weeks) under the Biden Stimulus Plan (ARP) that has been passed into law.

Why is my PUA denied?

Other reasons PUA claims are being denied are due to ongoing “ glitches” in unemployment filing systems/websites that have required a lot more updates to support the new PUA provisions.

When will PUA benefits end in 2021?

After March 14, 2021, new claimants will no longer be permitted to apply for PUA benefits, but eligible individuals who have a PUA claim balance (or remaining weeks) as of March 14th, 2021 will continue to receive benefits until the week beginning April 5, 2021 until their claim balance is exhausted.

Overview

In March of 2020, the federal government created Pandemic Unemployment Assistance (or PUA), a program that provided support for Americans who were unable to work due to the Coronavirus pandemic but did not qualify for traditional Unemployment Insurance (UI). The Continued Assistance Act (CAA) was signed into law on December 27, 2020.

Frequently Asked Questions

Q) When must I provide my proof of employment, self-employment, or proof of the planned beginning of employment or self-employment?

How long does it take to terminate a PUA?

All states and territories, including Washington, D.C., have agreed to participate in the PUA program. However, either the DOL or a state may give thirty days written notice to terminate the PUA Agreement.

Has the PUA been extended?

The only update is that the program has been extended until September 6, 2021. For more information on Pandemic Unemployment Assistance:

What is PUA in unemployment?

Pandemic Unemployment Assistance (PUA) is a program that temporarily expands unemployment insurance (UI) eligibility to self-employed workers, freelancers, independent contractors, and part-time workers impacted by the coronavirus pandemic. PUA is one of the programs originally established by the Coronavirus Aid, Relief, ...

Who is eligible for PUA?

Pandemic Unemployment Assistance (PUA) extends unemployment benefits to eligible self-employed workers, including: 2. Freelancers and independent contractors. Workers seeking part-time work. Workers who don't have a work history long enough to qualify for state unemployment insurance benefits. Workers who otherwise wouldn't qualify ...

What are the new programs under the Cares Act?

In addition to the PUA program, the CARES Act extended unemployment benefits through two other initiatives: the Pandemic Emergency Unemployment Compensation (PEUC) program and the Federal Pandemic Unemployment Compensation (FPUC) program.

When was PUA created?

PUA is one of the programs originally established by the Coronavirus Aid, Relief, and Economic Security (CARES) Act, a $2 trillion coronavirus emergency stimulus package that President Donald Trump signed into law on March 27, 2020. The act expanded states' ability to provide unemployment insurance to many workers affected by COVID-19, ...

What is the FPUC?

FPUC is a flat amount given to people who receive unemployment insurance, including those who get a partial unemployment benefit check. It applies to people who receive benefits under PUA and PEUC. The original amount of $600 was reduced to $300 per week after the program was extended in August 2020.

How long does it take to get unemployment benefits after being exhausted?

Extends benefits up to an extra 53 weeks after regular unemployment compensation benefits are exhausted. Federal Pandemic Unemployment Compensation (FPUC) Provides a federal benefit of $300 a week through Sept. 6, 2021. Provided $600 a week through July 31, 2020.

What are some examples of PUA?

Examples of the types of workers targeted by the PUA program include freelancers, part-time “gig workers,” and those who are self-employed. To qualify, workers must certify they are unable to work due to one or several conditions related to COVID-19.