How to Perform a Cost Benefit Analysis

We’ll go through the five basic steps to performing a cost benefit analysis in the sections below, but first, here’s a high-level of overview:

- Establish a framework to outline the parameters of the analysis

- Identify costs and benefits so they can be categorized by type, and intent

- Calculate costs and benefits across the assumed life of a project or initiative

- Compare cost and benefits using aggregate information

- Analyze results and make an informed, final recommendation

- Step One: Brainstorm Costs and Benefits. ...

- Step Two: Assign a Monetary Value to the Costs. ...

- Step Three: Assign a Monetary Value to the Benefits. ...

- Step Four: Compare Costs and Benefits.

What steps are part of doing a cost benefit analysis?

step one identify all the private and external costs and benefits step two assign a monetary value to all costs and benefits step three account for the likelihood of any costs and benefits that are uncertain (cost/benefit multiplied by probability)

Which describes the purpose of doing a cost benefit analysis?

- A cost-benefit analysis simplifies the complex decisions in a project.

- The analysis gives clarity to unpredictable situations. ...

- It helps to figure out whether the benefits outweigh the cost and is it financially strong and stable to pursue it

- It is easy to compare projects of every type in spite of being dissimilar

What is the formula for cost-benefit analysis?

For calculating the cost-benefit ratio, follow the given steps: Calculate the future benefits. Calculate the present and future costs. Calculate the present value of future costs and benefits. Calculate the benefit-cost ratio using the formula Benefit-Cost Ratio = ∑ Present Value of Future Benefits / ∑ Present Value of Future Costs. If the benefit-cost ratio is greater than 1, go ahead with the project. ...

What is a simple way to describing cost benefit analysis?

The costs involved in a CBA might include the following:

- Direct costs would be direct labor involved in manufacturing, inventory, raw materials, manufacturing expenses.

- Indirect costs might include electricity, overhead costs from management, rent, utilities.

- Intangible costs of a decision, such as the impact on customers, employees, or delivery times.

What are the 5 steps of cost-benefit analysis?

The major steps in a cost-benefit analysisStep 1: Specify the set of options. ... Step 2: Decide whose costs and benefits count. ... Step 3: Identify the impacts and select measurement indicators. ... Step 4: Predict the impacts over the life of the proposed regulation. ... Step 5: Monetise (place dollar values on) impacts.More items...

What is a cost-benefit analysis example?

For example: Build a new product will cost 100,000 with expected sales of 100,000 per unit (unit price = 2). The sales of benefits therefore are 200,000. The simple calculation for CBA for this project is 200,000 monetary benefit minus 100,000 cost equals a net benefit of 100,000.

Which is the first step of a cost-benefit analysis?

STEP 1: Determine whether or not the requirements in the rule are worth the cost it would take to enact those requirements. STEP 2: Make a list of one-time or ongoing costs (costs are based on market prices or research).

How do I do a cost-benefit analysis in Excel?

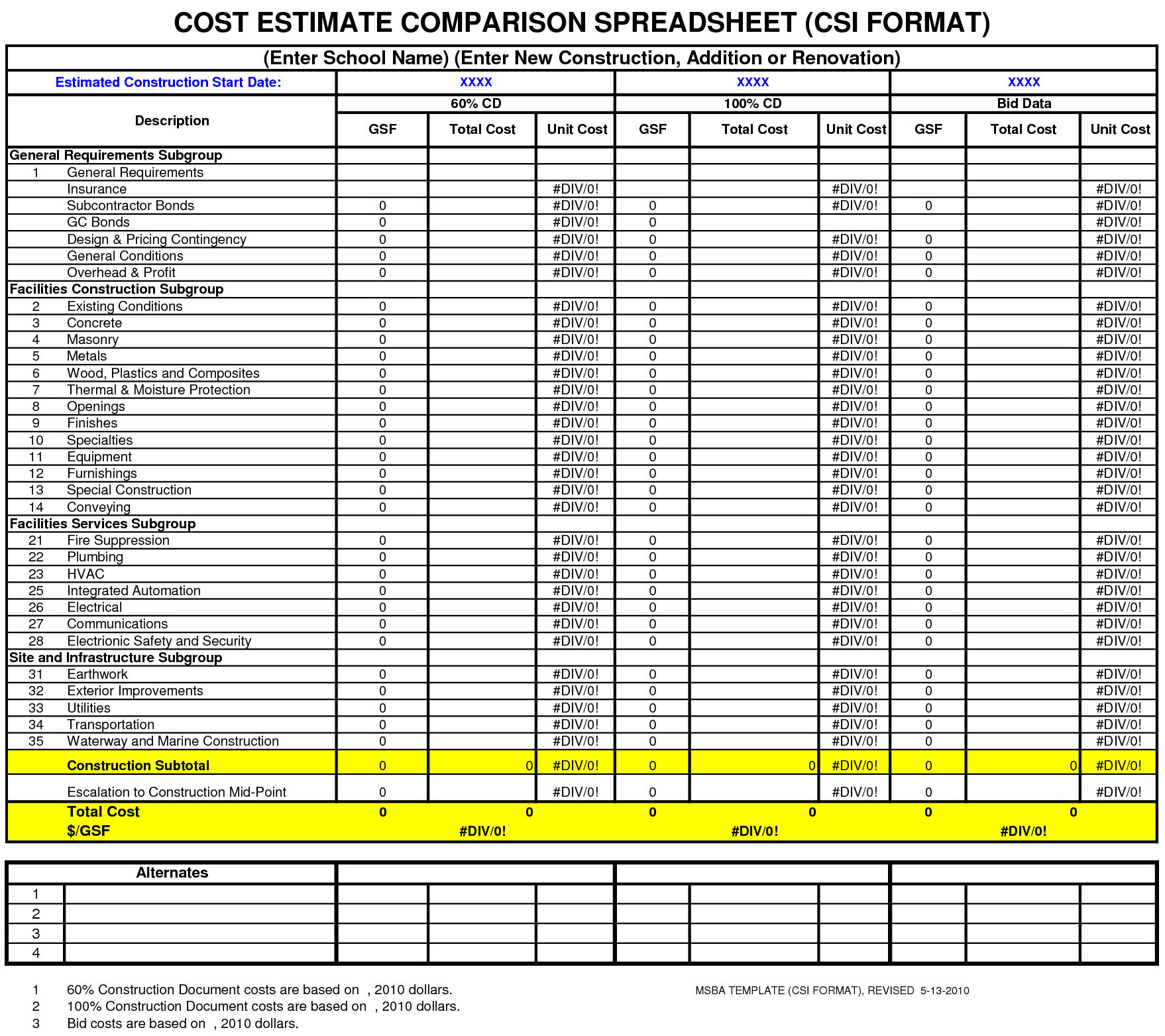

A typical cost benefit analysis involves these steps:Gather all the necessary data.Calculate costs. Fixed or one time costs. Variable costs.Calculate the benefits.Compare costs & benefits over a period of time.Decide which option is best for chosen time period.Optional: Provide what-if analysis.

How do you write a cost-benefit analysis template?

Cost Benefit Analysis Example, Template and its ComponentsStep 1: Analyze lists. ... Step 2: Put a financial value on the costs and benefits. ... Step 3: Equation and comparison. ... Basic project specification. ... Potential scenarios include the following. ... Determine the costs and benefits.

What are the two main parts of a cost-benefit analysis?

the two parts of cost-benefit analysis is in the name. It is knowing the cost and measuring the benefit by that cost.

What are the types of cost-benefit analysis?

The assessment of costs and benefits involves three stages: enumeration, measurement, and explicit valuation.

What is the cost-benefit analysis in project?

A cost-benefit analysis (CBA) is a tool to evaluate the costs vs. benefits in an important business proposal. A formal CBA lists all project expenses and tangible benefits, then calculates the return on investment (ROI), internal rate of return (IRR), net present value (NPV), and payback period.

Why is cost benefit analysis useful?

This makes it useful for higher-ups who want to evaluate their employees’ decision-making skills, or for organizations who seek to learn from their past decisions — right or wrong .

How is the cost and benefit tool used?

It’s made possible by placing a monetary value on both the costs and benefits of a decision. Some costs and benefits are easy to measure since they directly affect the business in a monetary way.

What is cost benefit ratio?

Cost benefit ratio is the ratio of the costs associated with a certain decision to the benefits associated with a certain decision. It’s more commonly known as benefit cost ratio, in which case the ratio is reversed (benefits to costs, instead of costs to benefits). Since both costs and benefits can be expressed in monetary terms, ...

Is cost benefit analysis a guiding tool?

In these cases, consider cost benefit analysis as a guiding tool, but look to other business analysis techniques to support your conclusion.

Can cost benefit ratios be numerically expressed?

Since both costs and benefits can be expressed in monetary terms, these ratios can also be expressed numerically. As a result, cost benefit or benefit cost ratios lend themselves well to comparison, which is why cost benefit analysis can be used to compare two or more definitions. The process is simple. For each decision or path in question, ...

What is cost benefit analysis?

A cost benefit analysis (also known as a benefit cost analysis) is a process by which organizations can analyze decisions, systems or projects, or determine a value for intangibles. The model is built by identifying the benefits of an action as well as the associated costs, and subtracting the costs from benefits.

Why do organizations use cost benefit analysis?

Organizations rely on cost benefit analysis to support decision making because it provides an agnostic, evidence-based view of the issue being evaluated—without the influences of opinion, politics, or bias. By providing an unclouded view of the consequences of a decision, cost benefit analysis is an invaluable tool in developing business strategy, ...

What are the risks and uncertainties of cost benefit analysis?

These risks and uncertainties can result from human agendas, inaccuracies around data utilized, and the use of heuristics to reach conclusions.

What is sensitivity analysis?

Kaplan recommends performing a sensitivity analysis (also known as a “what-if”) to predict outcomes and check accuracy in the face of a collection of variables. “Information on costs, benefits, and risks is rarely known with certainty, especially when one looks to the future,” Dr. Kaplan says. “This makes it essential that sensitivity analysis is carried out, testing the robustness of the CBA result to changes in some of the key numbers.”#N#EXAMPLE of Sensitivity Analysis#N#In trying to understand how customer traffic impacts sales in Bob’s Pie Shop, in which sales are a function of both price and volume of transactions, let’s look at some sales figures:

What is the difference between tangible and intangible costs?

Tangible costs are easy to measure and quantify, and are usually related to an identifiable source or asset, like payroll, rent, and purchasing tools. Intangible cost s are difficult to identify and measure, like shifts in customer satisfaction, and productivity levels.

What is direct cost?

Direct costs are often associated with production of a cost object (product, service, customer, project, or activity) Indirect costs are usually fixed in nature, and may come from overhead of a department or cost center.

Who developed the evaluation process?

Dupuit outlined the principles of his evaluation process in an article written in 1848, and the process was further refined and popularized in the late 1800s by British economist Alfred Marshall, author of the landmark text, Principles of Economics (1890).

Why do we need cost benefit analysis?

A cost-benefit analysis can help you determine where to efficiently spend your money for the best potential returns on your investment.

What is intangible cost?

Intangible costs. Ongoing or future costs. Any potential risks that may have a cost. Consider using a mind map to brainstorm the potential costs of each project and link them back to expected benefits.

How to calculate payback period?

To calculate the payback time, divide the projected total cost by the projected total revenues.

Do all costs and benefits need to be measured in the same unit?

All costs and benefits need to be measured in the same monetary unit. If you are doing a cost-benefit analysis for a global company, don’t try to separate the costs of a project into different denominations based on country or region.

How is cost benefit analysis performed?

The cost benefit analysis is performed by computing the net present value of the project with the net present value of the project’s benefits.

What is cost benefit analysis?

Cost benefit analysis is used to compare projects to each other, but also to compare alternatives within projects. For example, the type of environmental solution, or the size of the safety program, or the width and length of the road. All the alternatives must be considered in tandem with the benefits of each option.

How much is the benefit of restoring 200 acres?

Since the project is to restore 200 acres, the benefit is $2 million, double the project budget. Hence, the project should be approved. Environmental remediation projects, on the other hand, can usually be valued more directly, whereby a new development can proceed because the previous environment has been cleaned up.

What is the value of remediation?

The value of the remediation is the value of the new development that can occur. A developer wants to build a large condo on a hill with a pristine view. The value of the view is determined based on how many people view it, and how much they would pay to use it. Value of social impact.

What is cost benefit analysis?

A cost-benefit analysis (CBA) is a process that is used to estimate the costs and benefits of decisions in order to find the most cost-effective alternative. A CBA is a versatile method that is often used for the business, project and public policy decisions. An effective CBA evaluates the following costs and benefits:

What to consider when comparing cost-benefit cash flows?

For this reason, you’ll need to consider the time value of money, discount rate, net present value when comparing cost-benefit cash flows.

What is the purpose of CBA?

There are two main purposes in using CBA: To determine if the project business case is sound, justifiable and feasible by figuring out if its benefits outweigh costs. To offer a baseline for comparing projects by determining which project’s benefits are greater than its costs.

What is a CBA project?

Project managers strive to control costs while getting the highest return on investment and other benefits for their business or organization. A cost-benefit analysis (CBA) is just what they need to help them do that. In a project, there is always something that needs executing, and every task has a cost and expected benefits.

What is sensitivity analysis?

A sensitivity analysis is a probability method used in management and business to determine how uncertainty affects your decisions, costs and profits.#N#In a project management CBA, sensitivity analysis is used to determine the benefit-cost ratio of probable scenarios. You can use Excel or more specialized software to do sensitivity analyses.

Can you compare current monetary value with future rate?

As mentioned on the last step, you can’t compare the current monetary value of costs and benefits with future rates. That’s why you’ll have to calculate the time value of money, discount rate, and net present value of cash flows.

Can you do cost benefit analysis without outlining expenses?

You can’t do a cost-benefit analysis without outlining all your expenses first. That’s where our free project budget template comes in. It helps you capture all the expenses related to your project from labor costs, consultant fees, the price of raw materials, software licenses and travel.

How is cost benefit analysis used?

Cost-benefit analysis is useful in making decisions on whether to carry out a project or not. Decisions like whether to shift to a new office, which sales strategy to implement are taken by carrying out a cost-benefit analysis. Generally, it is used for carrying out long term decisions that have an impact over several years. This method can be used by organizations, government as well as individuals. Labor costs, other direct and indirect costs, social benefits, etc. are considered while carrying out a cost-benefit analysis. The costs and benefits need to be objectively defined to the extent possible.

Why is cost benefit analysis important?

Cost-benefit analysis is useful in making decisions on whether to carry out a project or not. Decisions like whether to shift to a new office, which sales strategy to implement are taken by carrying out a cost-benefit analysis.

How to calculate cost-benefit ratio?

For calculating the cost-benefit ratio, follow the given steps: Step 1: Calculate the future benefits. Step 2: Calculate the present and future costs. Step 3: Calculate the present value of future costs and benefits. Step 4: Calculate the benefit-cost ratio using the formula.

What is labor cost?

Labor costs. Labor Costs Cost of labor is the remuneration paid in the form of wages and salaries to the employees.

What are allowances in manufacturing?

The allowances are sub-divided broadly into two categories- direct labor involved in the manufacturing process and indirect labor pertaining to all other processes. read more. , other direct and indirect costs, social benefits, etc. are considered while carrying out a cost-benefit analysis.

What is cost analysis?

Cost analysis is one of four types of economic evaluation (the other three being cost-benefit analysis, cost-effectiveness analysis, and cost-utility analysis). Conducting a cost analysis, as the name implies, focuses on the costs of implementing a program without regard to the ultimate outcome. A cost analysis is an important first step ...

How to keep cost analysis continuity?

If your organization has done cost analyses in the past, use the same or similar methods to categorize costs. Maintaining continuity in this way means the reports can be compared, making them more useful over time.

What is indirect cost?

Indirect costs include general administration or management salaries and benefits, facilities, equipment, and anything else shared across multiple programs or services. What you categorize as an indirect cost will depend on how you have separated the programs or services offered by your organization.

What is a narrower cost analysis?

On the other hand, a narrower or more specific purpose, such as determining whether to bill for a particular service (and how much), might require a narrower cost analysis that only addressed the costs of that particular service.

Is depreciation included in total costs?

If your organization's capital assets, including furniture, equipment, or fixtures, must be used to implement the program or provide the service you're evaluating, depreciation of those assets should be included in your total costs for the program or service. Calculating depreciation can be a complicated endeavor.

What Is A Cost-Benefit Analysis?

How to Conduct A Cost-Benefit Analysis

- 1. Establish a Framework for Your Analysis

For your analysis to be as accurate as possible, you must first establish the framework within which you’re conducting it. What, exactly, this framework looks like will depend on the specifics of your organization. Identify the goals and objectives you’re trying to address with the proposal. W… - 2. Identify Your Costs and Benefits

Your next step is to sit down and compile two separate lists: One of all of the projected costs, and the other of the expected benefits of the proposed project or action. When tallying costs, you’ll likely begin with direct costs, which include expenses directly related to the production or develo…

Pros and Cons of Cost-Benefit Analysis

- There are many positive reasons a business or organization might choose to leverage cost-benefit analysis as a part of their decision-making process. There are also several potential disadvantages and limitations that should be considered before relying entirely on a cost-benefit analysis.