5 tips to help you pick the right benefits plan

- Consider your health needs Most benefits include predetermined categories like dental, vision, professional services...

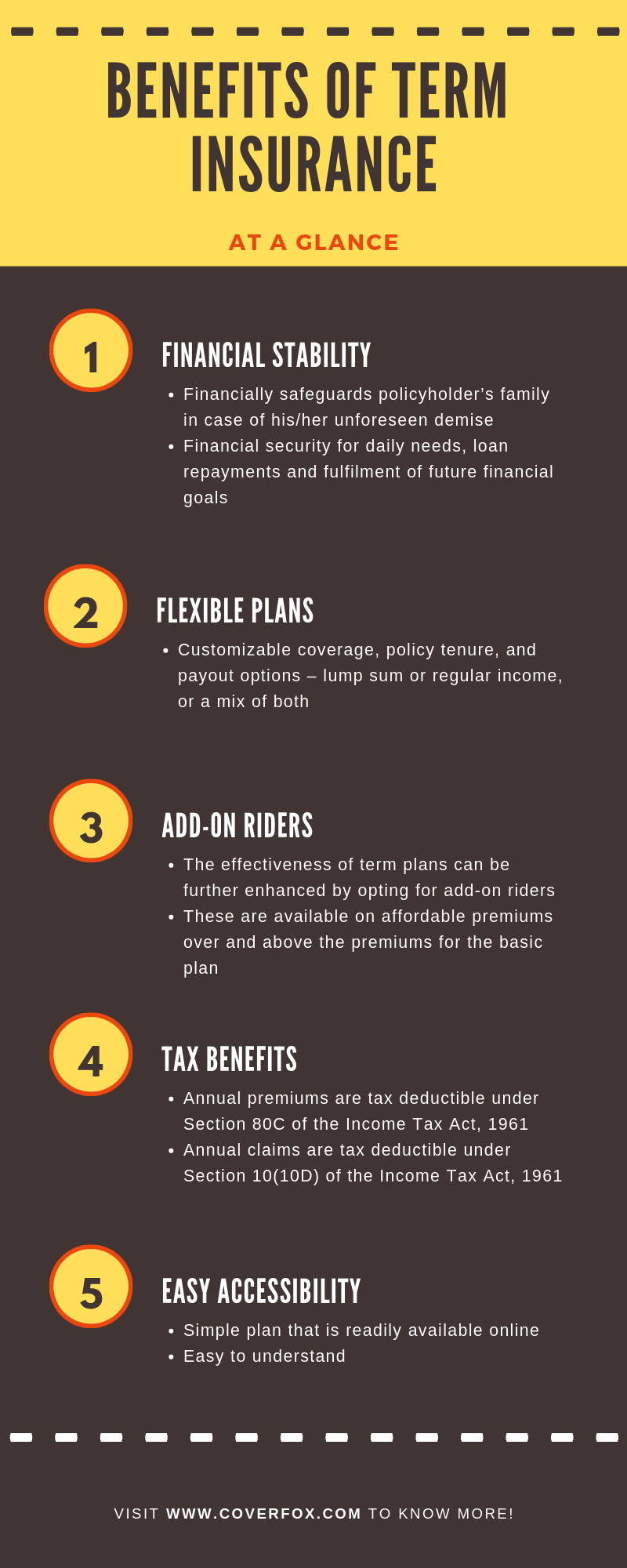

- Weigh your insurance options It’s hard to know exactly what the future holds, but insurance can offer some...

- Take a look at your current situation The only constant about life is change. When...

- 1 - Figure out where and when you need to enroll. ...

- 2 - Review plan options, even if you like your current one. ...

- 3 - Compare estimated yearly costs, not just monthly premiums. ...

- 4 - Consider how much health care you use. ...

- 5 - Beware too-good-to-be-true plans.

What should I know before choosing a health insurance plan?

Choosing a health insurance plan can be complicated. Knowing just a few things before you compare plans can make it simpler. The 4 “metal” categories: There are 4 categories of health insurance plans: Bronze, Silver, Gold, and Platinum. These categories show how you and your plan share costs. Plan categories have nothing to do with quality of care.

How do I find out what health insurance my employer offers?

Depending on your employer, you may just get a “Hey, this is your health insurance” option. Others might let you pick from a couple of plans. Either way, you should know the category and types of plan (s) being offered.

How do employers choose the right benefits for their employees?

Also, some employers pay attention to the demographics of their employee base to give everyone the benefits they need most based on their characteristics. For example, in order to retain and engage millennials, businesses may offer them benefits such as student loan repayment support and co-sign support for auto loans.

How do employers recommend health care plans to employees?

Some employers offer software that allows workers to upload their claims history from the past year and uses that to recommend a health care plan. I wish that were available to everyone. The closest I’ve seen is HealthSherpa, which helps people winnow their ACA marketplace options based on how they generally use health care.

How do I choose my health benefits?

Higher premiums, more coverage In general, the higher your premium, the lower your out-of-pocket costs such as copays and coinsurance (and vice versa). A plan that pays a higher portion of your medical costs, but has higher monthly premiums, may be better if: You see a primary physician or a specialist frequently.

How do I choose employee benefits?

0:081:55Selecting Employee Benefits - YouTubeYouTubeStart of suggested clipEnd of suggested clipEmployers have a wide latitude in creating the total benefits package they offer a logical place toMoreEmployers have a wide latitude in creating the total benefits package they offer a logical place to begin selecting employee benefits is to establish objectives for the package.

How do I choose the right plan?

How to Choose the Right PlanDecide if you want to apply for financial help. ... Know your health care costs. ... Learn about the plans. ... Check that your providers are in-network. ... Compare drug lists and plan ratings. ... Check the "summary of benefits" for each plan. ... You can always get help from an expert.More items...

What are the 4 major types of employee benefits?

There are four major types of employee benefits many employers offer: medical insurance, life insurance, disability insurance, and retirement plans. Below, we've loosely categorized these types of employee benefits and given a basic definition of each.

How do you budget for employee benefits?

Experts suggest that you should expect to pay a range of 1.25 to 1.4 times each employee's base salary. That extra $10,000 might include things like $120 for life insurance—an average cost for your younger and older workers—$5,760 for family health coverage, $520 for dental insurance, and $200 for long-term disability.

What is a good 401k match?

The most common Safe Harbor 401(k) matching formulas are: 100% match on the first 3% of employee contributions, plus 50% match on the next 3-5% (Basic match) 100% match on the first 4-6% of employee contributions (Enhanced match) At least 3% of employee pay, regardless of employee deferrals (Nonelective contribution)

What is a Benefits Plan?

A benefit plan includes, medican insurance, vision insurance, dental insurance, Life insurance, long term/short term disability, spouse/child life insurance, legal plan, identity theft protection and much more.

Benefits Plan Comparison Template

My husband and I have been using a template to compare our insurance plans (within as well as each other plans). If you are looking for a template to plug in information and compare, definitely download it for your use.

How to provide your workforce with the benefits they’ll actually love and use?

2. Your group benefits budget. The next factor you should consider when shopping around for a benefits plan is your budget.

What is group benefits?

Group benefits are a key component of your company’s compensation strategy and can either be a deal maker or breaker in terms of attracting and retaining talent. If you’re shopping around for group benefits plans for your business, there are a few things you should know first. To help you navigate the employee health benefits space, ...

How much does a barebones plan cost?

Some bare-bones plans may cost a mere $75 a month per employee , while others may cost upwards of $500 a month per employee. Think about how much you are willing to pay for employee group benefits and how much you can realistically afford. Your benefits advisor will be able to discuss these matters with you and help you find a plan ...

What is included in a comprehensive insurance package?

Typically, the types of insurance coverage you’ll find in any comprehensive benefits package will include life, AD&D, health, dental, short and long term disability, critical illness, EFAP (employee/family assistance programs), out of country, and plenty of other optional benefits.

Do Gen Y workers care about group benefits?

Did you know that, according to recent Sun Life Financial research, Gen Y doesn’t care as much about group benefits as the older generations? While all generations value dental and medical benefits as a general staple in their employer’s benefits plan, Gen Y workers tend to value paramedicals (such as RMT and acupuncture) and lifestyle benefits (such as lifestyle spending accounts and subsidized gym memberships) over others. Further, studies show that Gen Yers feel entitled to their benefits more so than their elders. In fact, Gen Y employees tend to make a point of maxing out their paramedical coverage.

Do Gen Y employees have paramedical coverage?

In fact, Gen Y employees tend to make a point of maxing out their paramedical coverage. As noted above, there are specific generational differences in preference when it comes to group benefits. Because of this, it’s important for you to take your employee demographics into account when shopping for a group benefits plan.

How do employees choose to invest?

Employees choose how to invest contributions, or how much to contribute from their paycheck through pre-tax deductions. Employers may also contribute, in some cases by matching a certain percentage of employees’ contributions. At retirement, employees receive the balance in their account.

What is retirement benefit?

Retirement. Retirement benefits help employees feel more secure about their future after retirement. In the U.S., for example, a common benefit is the 401 (k) in which both company and employee make defined contributions to the employee’s account on a regular basis.

Why do employers pay attention to demographics?

Also, some employers pay attention to the demographics of their employee base to give everyone the benefits they need most based on their characteristics. For example, in order to retain and engage millennials, businesses may offer them benefits such as student loan repayment support and co-sign support for auto loans.

What is fringe benefit?

Before we get into the nitty-gritty of employee benefits (or fringe benefits), let’s define the term: Employee benefits are any kind of tangible or intangible compensation given to employees apart from base wages or base salaries. This employee benefits definition points to examples of job benefits such as insurance (including medical, dental, ...

How does employee benefit affect HR?

Employee benefits have a significant impact on the administrative aspect of HR, especially when regulatory issues are involved. But there are ways to manage benefit plans more effectively to save time and reduce the possibility of mistakes. Here are five things to consider:

How to find the right software for HR?

To find the right software, do your research and make a compelling business case. Measure benefits and costs diligently . This will be the responsibility of the finance department, but it’s important for HR to keep track of rising or plummeting costs and gains.

Do you receive 401(k) at retirement?

At retirement, employees receive the balance in their account. Before you decide whether to implement a 401 (k) plan, learn about its different forms. There’s also the defined retirement plan which is entirely funded by the employer, so employees can receive a specific monthly benefit at retirement.

What to do if you don't have enough medical insurance?

If you don’t have enough savings to cover medical costs until the deductible is satisfied, consider spending more for a lower-deductible plan. Just don’t pay an extra $500 to lower your deductible by $250, as many people did in that first study. If you’re allowed to choose different deductibles for the same plan, ...

Is a high deductible plan good for health insurance?

But high-deductible plans also can be a good fit for people who need a lot of health care, says Carolyn McClanahan, a physician and certified financial planner in Jacksonville, Florida.

What is a premium plan?

Your total costs for health care: You pay a monthly bill to your insurance company (a "premium"), even if you don’t use medical services that month. You pay out-of-pocket costs, including a deductible, when you get care.

What are the 4 metal categories of health insurance?

The 4 “metal” categories: There are 4 categories of health insurance plans: Bronze, Silver, Gold, and Platinum. These categories show how you and your plan share costs. Plan categories have nothing to do with quality of care. Your total costs for health care: You pay a monthly bill to your insurance company (a "premium"), ...

What happens to your health insurance after you pay your deductible?

Once you hit your out-of-pocket maximum, your health plan will step in to cover your benefits costs moving forward.

What is an EPO plan?

EPOs, or Exclusive Provider Organizations , are plans that require members to stay within their network of doctors and hospitals. EPO networks are typically larger than HMO networks, and may or may not need physician referrals. If members go out-of-network, they will not be covered by their health plan. EPOs are still rather limiting, and so they are a less expensive option, too.

What is an OOPM?

Out-of-Pocket Max (OOPM) is the maximum amount you’re required to pay in claims, copays, and coinsurance over the course of your plan year on covered medical costs. All plans have an OOPM. Once it’s reached, your health plan covers costs (such as claims and prescriptions) for the rest of the plan year.

Does a health plan include dental?

Your health plan must include medical benefits. It will often include dental and vision benefits as well. Confirm what is covered under each. Here are some things to look for.

Can I see a provider without a referral?

If a provider is in-network, then you can see them without added fees and/or without needing a referral from your primary care physician. If a provider is out-of-network, then you can still see that provider — but you may pay more, and in some cases, the entire bill.

Do PPOs require referrals?

PPOs, or Preferred Provider Organizations, don’t require a referral when members are choosing a provider — whether in- or out-of-network. But members may pay more for out-of-network providers. PPOs are much more flexible than other plans, and so they are the most expensive.

How long do employees have to make decisions about health insurance?

The problem is that most people don’t. A recent study showed that 57% of employees spend less than 30 minutes making choices regarding their health insurance during their annual enrollment period. That’s probably because most people just go ...

What is employer based health insurance?

Employer-based health insurance comes in two flavors: defined benefit plans and defined contribution plans. Defined benefit plans are the classic American Dream version of health insurance: your employer offers a group plan, you make your choices based on what’s offered, and you go on your merry way. Defined contribution plans are ...

What happens if you leave your job and don't have health insurance?

And if you’re let go from your job, it triggers a special enrollment period where you can buy new health insurance. But if you had health insurance at your job and no longer do, COBRA is a valuable stopgap until you can get back on your feet.

What is defined contribution plan?

Defined contribution plans are a little different and require a bit of legwork on your part. Instead of giving you plans to choose from, your employer gives you an allowance to spend on private benefits marketplaces like Liazon to buy health insurance, along with other products (like life insurance and disability insurance).

What does it mean when you have to enroll in health insurance separately?

If they’re separate, that means you’ll have to enroll separately or else you’ll miss your chance for coverage for the year. You should also be aware of how much the employee contribution is for those plans, too. It’s an added expense on top of your health insurance contribution that you’ll need to budget for.

Is health insurance complicated?

Health insurance can be complicated to navigate. That’s why a lot of us are lucky to have it provided as a benefit from our employer. Whether it’s covering some of the cost or just narrowing down our options so we don’t get paralyzed by choice, it’s helpful.

Do HRAs save on premiums?

HRAs, on the other hand, have money contributed by the employer . This works well if they provide high deductible plans; they can save on the monthly premiums, but the HRA can help employees handle medical costs when they have to actually use their insurance.

Plans

Health Insurance

- You may have to choose between a Health Maintenance Organization (HMO) and a Preferred Provider Option (PPO) for medical insurance. An HMO allows you to go to doctors that are contracted with a specific insurance company. If you have a specific doctor you like to use, ask to see the list of doctors on that plan or go to the HMO website to find a list of its providers. HMOs …

Life and Disability Insurance

- Employer-provided life insuranceis meant to compensate your survivors for your lost wages and income should you die while employed in your new job. If you are single and not supporting anyone else, you may not require life insurance. If you have a family to support, you need to think about how much they would need to survive in the event of your death. Disability insurance, on t…

Other Employee Benefits

- You may be wondering how your company benefits compare to those offered by other companies. Benefits can vary widely from company to company. The most common are listed above. You might also be offered some of the following: 1. Health savings account 2. Flexible spending account 3. Eldercarebenefits 4. Employee discounts 5. Wellness benefits 6. Counselin…

Making Changes to Employee Benefits

- Many companies allow you to change your choices periodically. Often, your 401(k) contribution amount and investment choices can be changed on a fairly regular basis, but the medical and life insurance choices may be set up so that you can only change them once or year. Check with your benefits administrator if you think you need to make some changes. Making inappropriate choic…

The Bottom Line

- Many people make mistakes and inappropriate choices when filling out their benefits forms. Fortunately, you can still go back and make changes down the road. Younger employees may not require nearly as many insurance choices as an older employee. Younger employees also have an opportunity to build a substantial retirement nest egg. Regardless of age, it's always a good ide…