How to Read an Insurance EOB (Explanation of Benefits)

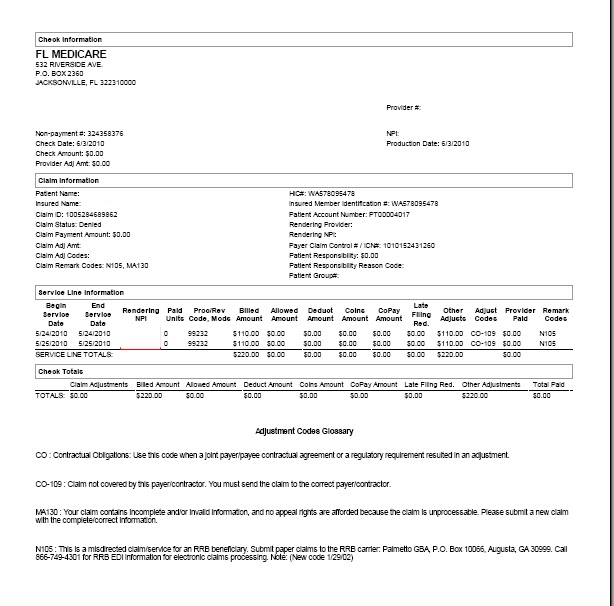

- The top part of an EOB. There are many important parts of an Explanation of Benefits. ...

- Main part of the insurance EOB. The main part of the Explanation of Benefits tells you how the claim was processed. ...

- Types of patient balances. You'll also notice on the above Explanation of Benefits that there are 3 different types of patient balances.

- The bottom line. ...

- Provider—The name of the doctor or specialist who provided the service.

- Service/Procedure—The type of service you received.

- Total Cost—The amount we pay for the service. ...

- Not Covered—The amount of the service not covered (this usually only occurs if the service is denied).

What does the explanation of benefits really mean?

The insurance company sends you EOBs to help make clear:

- The cost of the care you received

- Any money you saved by visiting in-network providers

- Any out-of-pocket medical expenses you’ll be responsible for

What is the purpose of the explanation of benefits?

Regular exercise and physical activity may:

- Help you control your weight. ...

- Reduce your risk of heart diseases. ...

- Help your body manage blood sugar and insulin levels. ...

- Help you quit smoking. ...

- Improve your mental health and mood. ...

- Help keep your thinking, learning, and judgment skills sharp as you age. ...

- Strengthen your bones and muscles. ...

What is explanation of benefits vs. a bill?

- Deductible (if your plan has one) and copay amount

- Your share of coinsurance

- Amount not covered, if any

- Amount you may owe the provider. You may have paid some of this amount, like your copay, at the time you received the service.

What is the summary of benefits?

The Coverage Examples are:

- Having a Baby

- Managing Type II Diabetes

- Simple Fracture

How do you read an Explanation of Benefits?

How do I read an EOB?The name of the person who received services (you or a family member your plan covers)The claim number, group name and number, and patient ID.The doctor, hospital or other health care professional that provided services.Dates of services and the charges.More items...

Can you read and understand an Explanation of Benefits EOB )?

An Explanation of Benefits (EOB) is a statement that your insurance company sends that summarizes the costs of health care services you received. An EOB shows how much your health care provider is charging your insurance company and how much you may be responsible for paying. This is not a bill.

How do you read an EOB for dummies?

1:342:35How to Read Your Medical EOB - YouTubeYouTubeStart of suggested clipEnd of suggested clipThe amount you pay for the service this is the amount that you will be billed. Remember the EOB isMoreThe amount you pay for the service this is the amount that you will be billed. Remember the EOB is not a bill it just shows you how the costs are distributed. If you have any questions by your EOB.

What key areas do you look at on the EOB and why?

Key Sections of an EOBProvider Information. This section includes the name of your health care provider (doctor, hospital, or other health care professional or service). ... Member Information. ... Provided Services and Charges. ... Plan Responsibility. ... Member Responsibility. ... Plan Status. ... Claim Notes.

Are EOBs easy or difficult to understand?

Many people find EOBs difficult to understand since they differ from one insurance company to another. Some insurance companies combine several dates of service or several providers on a single EOB form. Others prepare separate forms for each date of service and provider you visit.

How do you read a health insurance claim?

0:487:57Understanding the Health Insurance Claim Process - YouTubeYouTubeStart of suggested clipEnd of suggested clip- any of the following that you are responsible for under that contract for example number one yourMore- any of the following that you are responsible for under that contract for example number one your deductible. This is the amount of money you must pay towards coverage.

What are 3 figures that are commonly depicted on an EOB?

the payee, the payer and the patient. the service performed—the date of the service, the description and/or insurer's code for the service, the name of the person or place that provided the service, and the name of the patient.

How do you read a claim form?

0:226:11How to Read an Insurance Roof Claim Summary - YouTubeYouTubeStart of suggested clipEnd of suggested clipSo you understand it and here's the US aid claim summary for the property damage and usually one ofMoreSo you understand it and here's the US aid claim summary for the property damage and usually one of the first page is going to go ahead and and have the information for the property the homeowner.

What do you do with Explanation of Benefits?

What should you do with an EOB? You should always save your Explanation of Benefits forms until you get the final bill from your doctor or health care provider. Compare the amount you owe on the EOB to the amount on the bill. If they match, that's the amount you'll need to pay.

What does a negative amount on an EOB mean?

Negative EOB: Results from overpayments by the insurance carrier or is due to charges that the insurance carrier bills to the practice or provider after the original services and insurance payments were recorded.

How do you calculate patient responsibility?

The formula can be calculated a couple different ways. The first is: allowed+adjustment = billed charges. The second more detailed method is: payment+adjustment+patient responsibility = billed charges. Even a third method can be used: payment + patient responsibility = allowed amount.

Do prescriptions show up on EOB?

Your prescription drug Explanation of Benefits (EOB) statement shows a summary of your past medication orders. It is not a bill. Express Scripts records your prescription claim on an EOB statement each time you get a prescription filled at a retail network pharmacy or through home delivery.

What is an EOB?

An Explanation of Benefits (EOB) is a statement that your insurance company sends that summarizes the costs of health care services you received. An EOB shows how much your health care provider is charging your insurance company and how much you may be responsible for paying. This is not a bill. If you owe money, you will receive ...

What to do if you are denied EOB?

If you have a complaint or are dissatisfied with a denial of coverage under your health plan, you may be able to appeal the decision or file a grievance.

What happens if you owe money to a health care provider?

If you owe money, you will receive a separate bill from your health care provider. Individual EOBs are likely to differ from the example provided. Depicted in EOB statement example above, are these points for reference:

What is EOB in billing?

Around the time you receive your patient billing statement, you will also receive an explanation of benefits (EOB) from your insurance provider. An explanation of benefits is a document that explains how your insurance processed the claim for the services you received.

What is paid by insurance?

Paid by Insurance: Paid by insurance is the amount of the total charges that insurance is paying towards the claim. Patient responsibility: You may be responsible to pay an amount of the charges/service. This amount is based on your insurance benefits and what the facility and provider charge. The actual billing statement ...

What is an EOB in insurance?

The EOB, or Explanation of Benefits, really is an explanation of how the claim was processed. It is by no means the last say in the adjudication of a claim, as all insurance companies must give you time to enter the claim and resend a correction or appeal. Ultimately, reading an insurance EOB is difficult and very detailed.

What information does an EOB include?

But this information varies a lot. It can include everything from the patient's insurance ID number, date of service and address, to their policy information. Usually, the EOB will at least list the patient's name, patient account number (which is like the claim number), and the date of service.

What happens if you have already met your deductible?

If your patient has already met their deductible but their insurance is still applying services towards it, you have a basis for an appeal of the claim. Coinsurance is a specified percentage of patient responsibility which they have to meet after they have paid their deductible or co-payment amounts.

How many types of patient balances are there?

Types of patient balances. You'll also notice on the above Explanation of Benefits that there are 3 different types of patient balances. These 3 categories will depend on the patient's insurance policy and whether or not they have to meet a deductible, pay a copay, or are responsible for a coinsurance amount.

What is the bottom line of an EOB?

The bottom line. The bottom line of the EOB usually contains total payment information and directions for appeal. If you have questions, or if something just doesn't match up and you can't figure it out, you always have the right to call the insurance company, ask for more information on how the claim was processed, or begin an appeal of the claim. ...

What is the main part of an EOB?

Main part of the insurance EOB. The main part of the Explanation of Benefits tells you how the claim was processed. This includes the payment amount, if any, the estimated patient's responsibility, and the write-off amount. If you have multiple patients with the same insurance, the EOB will usually group these payments together, ...

What is a non-covered amount?

The non-covered amount is the amount that your office charged for a service that wasn't covered by the patient's insurance company. Your office may choose to bill the patient for the entire non-covered amount, decide to discount the amount, or decide to write off the amount completely. It's up to your office.

How to read EOB?

How to read your EOB 1 Provider —The name of the doctor or specialist who provided the service. 2 Service/Procedure —The type of service you received. 3 Total Cost —The amount we pay for the service. It may be less than the amount the provider charged. 4 Not Covered —The amount of the service not covered (this usually only occurs if the service is denied). 5 Deductible —If there is a deductible for the service, you would need to pay this amount before we pay our share. 6 Copay/Coinsurance —The amount you pay. 7 Other Patient Responsibility —Any other costs you may need to pay for the service (usually, this only occurs if the service is denied). 8 Plan’s Share —The amount we pay for the service. 9 Total Your Share —This is the total amount you pay for this service. The EOB is not a bill. You may have already paid the total amount shown.

What is EOB in insurance?

Your EOB includes multiple sections - the main section of your EOB provides details for your claims, including the provider who performed the service, the date, type of procedure, and the costs: [INSERT IMAGE HERE] Provider —The name of the doctor or specialist who provided the service. Service/Procedure —The type of service you received.

What is EOB in medical billing?

Your EOB is a list of the services you received. It shows you how expenses are divided between your doctor, your plan, and your copay, but it’s not a bill. You don’t need to send any payments or take any action. Your EOB makes it easy to keep track of the medical services you received and their costs.

What is EOB in healthcare?

When you decide to take steps to control your healthcare costs, knowing how to read your health insurer's paperwork, called an Explanation of Benefits (EOB), can be helpful. 1.

What is the amount of money paid to your doctor by your insurance called?

You can compare those amounts using your EOB. The amount of money paid to your doctor by your insurer/payer is called a reimbursement.

What does "paid to provider" mean?

"Paid to Provider" means the amount of money that was already paid to the doctor.

Is the reimbursement less than the doctor's charge?

The reimbursement is usually less than the doctor's charge. You can use the EOB to compare those two amounts. You'll learn two things from this: What your insurance has paid to your doctor (reimbursed) on your behalf. (Don't forget, by paying insurance premiums, you have paid the insurer to do this.)

What is an EOB statement?

An Explanation of Benefits, commonly referred to as an EOB is a statement from your health insurance company providing details on payment for a medical service you received. It explains what portion of services were paid by your insurance plan and what part you’re responsible for paying.

What does EOB mean on Medicare?

This might point to medical identity theft, medical fraud, or Medicare fraud. 7. The EOB tells you how much you owe. Your EOB includes how much you owe. It is not a bill, which you will get separately from your provider. The amount you owe that’s listed on your bill should match the amount you owe listed on your EOB.

What is EOB in tax?

The remaining amount to be paid, which is usually your responsibility. The EOB might contain information about whether the amount you need to pay will be applied to your deductible. Sometimes an EOB also lists how much is left of your deductible for the year.

What happens if your EOB doesn't cover a service?

Your insurance company didn’t cover a service they should have, according to your plan. Incorrect dates of service. An error with your deductible. The EOB helps Identify potential medical fraud. If your EOB lists services you didn’t receive, it’s possible your provider is billing fraudulently.

What does EOB mean on a bill?

The amount you owe that’s listed on your bill should match the amount you owe listed on your EOB. If you haven’t received your bill or paid your provider yet, you can plan for making your future payment when you get your EOB. The EOB helps track medical care and costs.

Why is it important to read EOBs?

It’s important to read your EOBs as they arrive. Your EOBs help you understand several important aspects of your health care costs. The EOB helps you find errors. When health insurance claims are completed and filed, errors are sometimes made by humans and computers, and these might be reflected on your EOB.

What to do if your EOB is mistaken?

If your EOB contains any kind of mistake, or if you suspect that it does, you should call your health insurance company, your health care provider, or both. Don’t be shy about going over every line with each of these offices. Your financial and medical well-being are worth the effort. 1 Elmblad, Shelley.

What happens when you receive an EOB?

A health care provider will bill your insurance company after you’ve received your care. Then you’ll receive an EOB. Later, you may receive a separate bill for the amount you may owe. This bill will include instructions on who to direct the payment to--either a health care provider or your health insurance company.

What is an EOB?

An EOB is a statement from your health insurance plan describing what costs it will cover for medical care or products you’ve received. The EOB is generated when your provider submits a claim for the services you received. The insurance company sends you EOBs to help make clear: The cost of the care you received.

What is the EOB page 2?

Any outstanding amount you are responsible for paying. Page 2, contains a glossary of the terms and definitions included on your EOB, as well as instructions for how you can appeal a claim, if necessary. Page 3, provides more specific details about the cost of the care you received.

What is page 3 of a medical deductable?

Depending on your health plan, page 3 may also reflect what portion of your out-of-pocket medical expenses count toward your annual deductible. Additional information, may include language assistance instructions, as well as more specific details about filing an appeal in your state of residence.

Cost summary total chart

You’ll find this chart on page 2 of your EOB. It shows the month and year-to-date totals of what your provider billed for services. Your share is the amount you may owe (such as copay, coinsurance deductible, denied claims). If you owe anything, your provider will send you a bill.

Out-of-pocket maximum cost chart

This chart starts on page 3. It shows the most money you will have to pay for covered services in a plan year.

Monthly claim details

These are the details of the claims that make up your monthly total. It is usually the same total for the month listed in the cost summary above, but this chart lists each claim processed by provider and date. We’ve included notes with more information about your claims.

Remember, your EOB is not a bill

It is simply a statement of services you received with details on how you and your plan will share the costs. To make sure your provider is billing you correctly, you should always compare your EOB to bills you receive from your provider.