How is SSDI back pay paid?

Tips for getting as much disability back pay as possible

- The amount of back pay that you receive will depend on when you file your disability application. ...

- How far back your disability began (based on the evidence) will have an effect on how much back pay you can receive. ...

- Your back pay is affected by when you applied for SSD or SSI. ...

How I won my social security overpayment case?

- Social Security thinks you are no longer medically disabled

- Someone is Paying Your Bills

- Someone is giving you money or inheritance

- Someone is giving you a free or discounted place to live

- You are not paying the right amount of rent

- You are working

- You Have Marriage, Divorce, Separation, Boyfriends, Girlfriends

How do I repay Social Security?

- Login to your TurboTax account or open your tax return.

- Click on Federal Taxes and then Deductions & Credits.

- Locate the section Other Deductions and Credits (you may first need to click on show all tax breaks if working online or I’ll choose what I work on if working ...

- Click Start (or Revisit) beside Other Deductible Expenses.

How much of my social security benefit may be taxed?

If your income is above that but is below $34,000, up to half of your benefits may be taxable. For incomes of over $34,000, up to 85% of your retirement benefits may be taxed. For the purposes of taxation, your combined income is defined as the total of your adjusted gross income plus half of your Social Security benefits plus nontaxable interest.

How to find Social Security Administration payee?

What is the remittance ID number?

What is an overpayment?

Can you pay back an overpayment?

Can I change my SSA 634 payment rate?

See more

About this website

Is Social Security repayment taxable?

If you repay income in the same year(such as Social Security benefits) you can net the repayment amount against the amount reportable as income. A taxpayer who repays an amount that was reported as income in an earlier year may claim a tax deduction or tax credit for the repayment in the year the income is repaid.

What happens if I owe money to Social Security?

If you think the overpayment wasn't your fault, and you can't afford to pay it back, you can ask SSA to forgive the overpayment. This is called a “Request for Waiver.” You must file a special form called SSA-632. You should file your Request immediately to stop money from being taken out of your monthly benefits.

How do I repay Social Security overpayment?

You cannot pay back the overpayment because you need the money to meet your ordinary living expenses. You may have to submit proof of your income, as well as bills to show that all of your income is used for your monthly expenses and that it would be a hardship for you to repay.

How do I report my Repayment of Social Security benefits on my tax return 2020?

Repayment of benefits. Your gross benefits are shown in box 3 of Form SSA-1099 or Form RRB-1099. Your repayments are shown in box 4. The amount in box 5 shows your net benefits for 2021 (box 3 minus box 4). Use the amount in box 5 to figure whether any of your benefits are taxable.

How many years can Social Security go back for overpayment?

For Title II Social Security benefits, the time period is 4 years. Only in very limited circumstances, such as fraud, may SSA assess an overpayment beyond the above time limits. Note that this time limit applies only to the original determination that there has been a benefit overpayment.

Can I pay SSI overpayment online?

You can easily make payments online at pay.gov/public/form/start/834689469. You can also access the site by visiting Pay.gov and searching for "SSA" or "Social Security."

Who is responsible for Social Security overpayment?

Section 204(a) of the Social Security Act provides that the overpaid person (whether or not he or she still receives benefits), his or her representative payee, and any other person receiving benefits on the overpaid person's earnings record are liable (responsible) for repayment of an overpayment.

Pay.gov - Repay your Social Security Overpayment Online

You will need your remittance ID in order to repay your Social Security overpayment on Pay.gov. Your remittance ID is displayed on the first page of your overpayment notice and at the top of the payment stub.

How to Pay Back Overpayment of Social Security Benefits

If you receive a notice from the Social Security Administration alerting you of overpayments, you will need to contact the agency to make payment arrangements, or you could have your benefits ...

Overpayments - Social Security Administration

SSA.gov. Social Security Administration. Publication No. 05-10098. January 2022 (Recycle prior editions) Overpayments. Produced and published at U.S. taxpayer expense

Form SSA-632 | Request For Waiver Of Overpayment Recovery Or Change In ...

Where to send these forms. Send the completed forms to your local Social Security office.If you have any questions, you may call us toll-free at 1-800-772-1213 Monday through Friday from 7 a.m. to 7 p.m. If you are deaf or hard of hearing, you may call our TTY number, 1-800-325-0778.

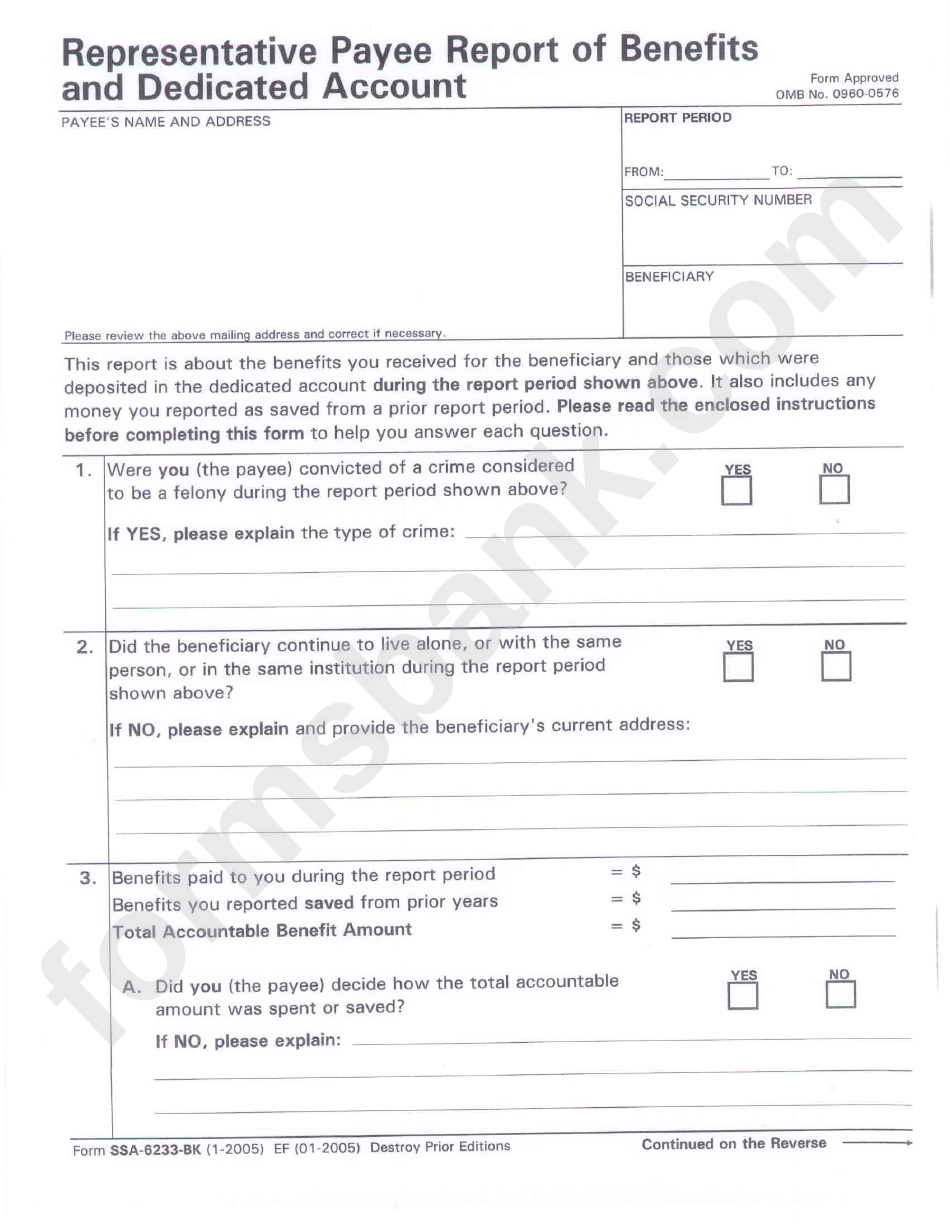

How to find Social Security Administration payee?

Using your bank or financial institution’s online bill pay option, search for “Social Security Administration” as the Payee.

What is the remittance ID number?

The Remittance ID is a 10-digit alphanumeric number used instead of your Social Security number for online payments. To make a payment, follow these steps:

What is an overpayment?

An overpayment is when you receive more money for a month than the amount you should have been paid. The amount of your overpayment is the difference between the amount you received and the amount due.

Can you pay back an overpayment?

You cannot pay back the overpayment because you need the money to meet your ordinary living expenses. You may have to submit proof of your income, as well as bills to show that all of your income is used for your monthly expenses and that it would be a hardship for you to repay.

Can I change my SSA 634 payment rate?

You can submit form SSA-634 Request for Change in Repayment Rate to ask us to withhold less than the proposed amount each month, or you can arrange to make monthly payments if you no longer receive Supplemental Security Income (SSI) benefits.

Where to contact SSA for negative numbers?

If you have any questions about this negative figure, contact your local SSA office or your local RRB field office.

What happens if you refigure your taxable benefits after 1983?

For each year after 1983 for which part of the negative figure represents a repayment of benefits, refigure your taxable benefits as if your total benefits for the year were reduced by that part of the negative figure. Then, refigure the tax for that year.

What does box 5 on SSA 1099 mean?

In some situations, your Form SSA-1099 or Form RRB-1099 will show that the total benefits you repaid (box 4) are more than the gross benefits (box 3) you received. If this occurred, your net benefits in box 5 will be a negative figure (a figure in parentheses) and none of your benefits will be taxable. Don’t use Worksheet 1 in this case. If you receive more than one form, a negative figure in box 5 of one form is used to offset a positive figure in box 5 of another form for that same year.

What is IRS Publication 915?

This is explained in IRS Publication 915 Social Security and Equivalent Railroad Retirement Benefits: Repayment of benefits. Any repayment of benefits you made during 2020 must be subtracted from the gross benefits you received in 2020.

What box is gross benefits on SSA 1099?

Your gross benefits are shown in box 3 of Form SSA-1099 or Form RRB-1099. Your repayments are shown in box 4. The amount in box 5 shows your net benefits for 2019 (box 3 minus box 4). Use the amount in box 5 to figure whether any of your benefits are taxable.

Can you deduct Social Security payments if you repaid them?

If you had to repay an amount of Social Security Benefits that you included in your income in an earlier year, you may be able to deduct the amount repaid from your income for the year in which you repaid it . This is explained in IRS Publication 915 Social Security and Equivalent Railroad Retirement Benefits:

How to repay Social Security overpayment?

You can securely repay your overpayment online using Pay.gov. Your overpayment notice includes a unique Remittance ID that you will need to make a payment. You may also use your bank or financial institution’s online bill payment option. You can search for “Social Security Administration” as the payee.

Can you appeal an overpayment?

You have the right to appeal the overpayment decision or request we waive (not collect) the overpayment.

How much can you reduce your income if you repaid your taxes?

If you had to repay an amount that you included in your income in an earlier year, because at the time you thought you had an unrestricted right to it, you may be able to reduce your income by the amount repaid in the current tax year the amount you repaid is more than $3,000, or you may take a credit against your tax for the year repaid, whichever results in the least tax.

What deductions are made on Schedule A if you pay back less than $3000?

If you pay back less than $3000, you will deduct your repayments as a Miscellaneous Deduction on Schedule A.

Do you report 2015 on SSA 1099?

First of all, you do report the amount received in 2015 as shown on your SSA-1099.

How to find out if you repaid Social Security?

If you're receiving Social Security benefits, the amounts you took in and/or repaid appear on Form 1099-SSA, which arrives in the mail in January for the previous year. The payments appear in Box 3, the repayments in Box 4 and the net amount in Box 5. This last number is the one used to make the income tax calculation; your benefits may be taxable depending on your filing status and the amount of other income you've earned. If the amount in Box 5 is less than $3,000, the IRS notes that it cannot be deducted because it is now considered a miscellaneous itemized deduction. Thanks to the Tax Cuts and Jobs Act that went into effect for the 2018 tax year, miscellaneous deductions are no longer.

What happens if you pay back Social Security disability?

If you have been paying back Social Security disability benefits, and have paid more than you received, then you have a negative net benefit from Social Security. That means you pay no income tax on the benefits you received. If you're filing a joint return, and both you and your spouse received the 1099, then you combine the net amounts showing in the two Box 5's. If the result is a negative, again, you will not be taxed on any of your Social Security benefits.

Can you deduct a negative benefit in Box 5?

If your net benefit is negative in Box 5, you can take an itemized deduction, but only to offset a net positive benefit from a previous year. For instance, if you received $2,000 in Social Security benefits in 2017, then you would only be able to deduct $2,000 of a negative net benefit in 2018 (or following years).

Can you get overpaid on Social Security?

Believe it or not, as a big federal agency, Social Security can make mistakes, and in some cases, will claim an overpayment of benefits. If you're returning money to Social Security, voluntarily or not, you will have a little extra tax accounting on your hands. Fortunately, you can get on a Social Security disability overpayment payment plan.

Is Social Security payment tax deductible?

Social Security repayments are tax deductible, if you paid more than you received. However, they are deductible only to the extent of offsetting net positive benefit you received from a previous year.

How to find Social Security Administration payee?

Using your bank or financial institution’s online bill pay option, search for “Social Security Administration” as the Payee.

What is the remittance ID number?

The Remittance ID is a 10-digit alphanumeric number used instead of your Social Security number for online payments. To make a payment, follow these steps:

What is an overpayment?

An overpayment is when you receive more money for a month than the amount you should have been paid. The amount of your overpayment is the difference between the amount you received and the amount due.

Can you pay back an overpayment?

You cannot pay back the overpayment because you need the money to meet your ordinary living expenses. You may have to submit proof of your income, as well as bills to show that all of your income is used for your monthly expenses and that it would be a hardship for you to repay.

Can I change my SSA 634 payment rate?

You can submit form SSA-634 Request for Change in Repayment Rate to ask us to withhold less than the proposed amount each month, or you can arrange to make monthly payments if you no longer receive Supplemental Security Income (SSI) benefits.