Reporting Unemployment Compensation

Unemployment benefits

Unemployment benefits are payments made by back authorized bodies to unemployed people. In the United States, benefits are funded by a compulsory governmental insurance system, not taxes on individual citizens. Depending on the jurisdiction and the status of the person, those sums may be small, covering only basic needs, or may compensate the lost time proportionally to the previous earned salary.

How do I report unemployment benefits on my tax return?

Reporting Unemployment Compensation You should receive a Form 1099-G, Certain Government Payments showing the amount of unemployment compensation paid to you during the year in Box 1, and any federal income tax withheld in Box 4.

Where would I enter current-year repayment of unemployment compensation that was received?

Where would I enter current-year repayment of unemployment compensation that was received in a prior year? If you repaid unemployment compensation in the current year that you included in your income in an earlier year, you may be able to deduct the amount repaid on Schedule A (Form 1040), line 16, if you itemize deductions.

How do I report overpayment of unemployment benefits?

If you repaid the overpayment of unemployment benefits in the same year you received them — Subtract the amount of unemployment repayment from the total taxable amount you received. Report the difference as unemployment compensation.

Do you have to repay the government for unemployment benefits?

If your state asks you to repay the government, you typically have three options as a response, according to Ron Zambrano, employment litigation chair at West Coast Trial Lawyers, a personal injury firm in Los Angeles. You repay the unemployment benefits. Maybe it becomes clear that you really do owe the state money.

How do I report a repayment of income?

Desktop: Section 1341 Repayment - Claim of Right / Social Security Repaymentreduce their income in the current year,deduct the amount repaid as a miscellaneous deduction on Schedule A, Form 1040 in the year in which it is repaid, or.take a refundable credit against tax on Form 1040 for the year that repayment occurs.

How do I report overpayment to EDD?

Call toll-free 1-800-2PAYTAX (1-800-272-9829). Choose option 3. Enter jurisdiction code 1577 and follow the recorded instructions.

How do I pay back unemployment overpayment in NY?

Repayment. Be sure to write your Social Security account number on each check or money order. If you are unable to pay off this overpayment in full, you can set up a payment plan by calling the Collections Unit at 800-533-6600 or writing to the Unemployment Insurance Division at the address listed above.

Where does a 1099-G go on 1040?

Box 1 of the 1099-G Form shows your total unemployment compensation payments for the year, which generally need to be reported as taxable income on Form 1040.

How do I get rid of my unemployment overpayment?

What can you do? File an appeal: If you feel that you received the notice in error, go to your state unemployment website to request a hearing. Request a waiver: If the overpayment is legitimate, then you may be entitled to either a waiver or forgiveness of it.

What happens when you get overpaid by EDD?

If you do not repay your overpayment, the EDD will take the overpayment from your future unemployment, disability, or PFL benefits. This is called a benefit offset. For non-fraud overpayments, the EDD will offset 25 percent of your weekly benefit payments.

Do you have to pay back Pua in NY?

If you collected benefits that you should not have received from another state or federal program, the Department of Labor must deduct repayment of those funds from your Unemployment Insurance benefits.

Can you go to jail for EDD overpayment?

A misdemeanor conviction carries up to one year in the county jail and a $1,000 fine. If convicted of a felony case of unemployment insurance fraud, it's punishable by 16 months, 2 or 3 years in a California state prison, and a fine up to $20,000.

Can NY unemployment ask for money back?

Some people received unemployment overpayments in April and May of 2020. Now, they're being asked to repay it or apply for a financial hardship waiver.

What happens if I don't report my 1099-G?

If the 1099 income you forget to include on your return results in a substantial understatement of your tax bill, the penalty increases to 20 percent, which accrues immediately.

Does 1099-g count as income?

Form 1099-G is a report of income you received from the Department of Revenue during the calendar year. The Internal Revenue Service (IRS) requires government agencies to report to the IRS certain payments made during the year because those payments are considered gross income to the recipient.

Why is my 1099-G not taxable?

1099-G Form for state tax refunds, credits or offsets This payment may or may not be taxable to you. If you claimed the standard deduction on your previous year's return, the amount is not taxable to you.

How to repay unemployment in 2020?

If you had to repay any unemployment compensation (note the method would be similar for repaying any nonbusiness income) in 2020 which you received in 2020, subtract the amount you repaid from the total amount you received and enter the difference on your return. On the dotted line next to your entry, enter "Repaid" and the amount repaid.

How to enter unemployment income?

To enter your unemployment income: From within your TaxAct return ( Online or Desktop), click Federal. On smaller devices, click in the upper left-hand corner, then click Federal. Click Other Income in the Federal Quick Q&A Topics menu to expand, then click Unemployment compensation.

How to add 1099-G to unemployment?

Click Other Income in the Federal Quick Q&A Topics menu to expand, then click Unemployment compensation. Click + Add Form 1099-G Unemployment to create a new copy of the form or click Edit to review a form already created.

What line do you deduct if you repaid your taxes in 2020?

If you had to repay an amount in 2020 that you included in your income in an earlier year, you can deduct the amount repaid on Schedule A (Form 1040) Itemized Deductions, Line 16, if you itemize deductions and the amount is $3,000 or less.

Can you get a tax credit if you repaid more than $3,000?

If the amount you repaid was more than $3,000, you can take a tax credit for the year of repayment if you included the income under a "claim of right." This means that at the time you included the income, it appeared that you had an unrestricted right to it.

What happens if you can't repay unemployment?

If you can't repay it all at once, you may be able to negotiate a payment plan. Otherwise, if you are entitled to further benefits, you may be able to use those benefits to repay the overpayment. In some states, you will forfeit days or weeks of unemployment to make up what you owe.

How to file an appeal for unemployment?

You may be able to file an appeal online, by fax, by mail, in person, or by phone.

What to do if you are overpaid for a mistake?

If you were overpaid because of an error, you might be able to ask for a waiver to avoid repaying all or some of the benefits you received by mistake.

Why was my unemployment overpaid?

Overpayment of Unemployment Benefits. You could have been overpaid because of an error or because you claimed benefits you were not entitled to receive. For example, some of the reasons a claimant might be overpaid include the following: 1. You made a mistake when claiming benefits.

What is the state unemployment law?

State unemployment laws contain general and state-specific information on unemployment overpayment, unemployment compensation, and benefits. Contact your state unemployment office for a determination of your specific circumstances and clarification about how overpayment is handled in your state. Remember that state laws vary.

Why did my employer dispute my unemployment claim?

Another reason could be that your former employer successfully contested your unemployment claim. If this was the case , the state could have determined that you were not eligible for benefits. In most cases, you will be required to repay the unemployment compensation that was overpaid.

Who decides if you are entitled to unemployment?

Based on the evidence presented at the hearing, the judge will decide whether you are entitled to—or eligible for—unemployment insurance benefits. At the hearing, you, your employer, and any witnesses for either side may testify. The testimony will be recorded.

What is the tax treatment of unemployment?

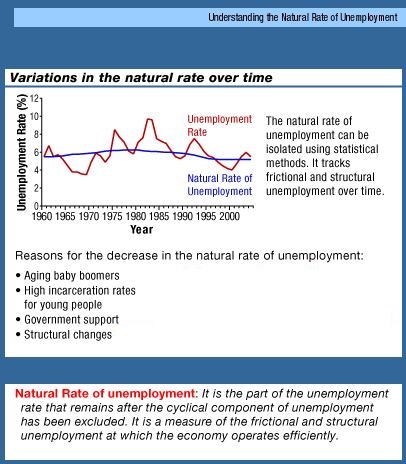

The tax treatment of unemployment benefits you receive depends on the type of program paying the benefits. Unemployment compensation includes amounts received under the laws of the United States or of a state, such as: Benefits paid to you by a state or the District of Columbia from the Federal Unemployment Trust Fund.

Do you have to include unemployment benefits in gross income?

Benefits from a private fund if you voluntarily gave money to the fund and you get more money than what you gave to the fund. If you received unemployment compensation during the year, you must include it in gross income.

Why States May Overpay Unemployment Benefits

Out-and-out fraud is one reason, but there are a lot of perfectly innocent reasons a state might overpay someone's unemployment benefits.

What to Do if You Receive an Overpayment Notice

If you receive a letter notifying you of overpayment, "the first action is to call the number provided on your overpayment notice," Fowler says. "The wait times may be incredibly long, but connecting directly on the phone is the best option for understanding why the overpayment happened and what you can do."

Do You Have to Pay Back Unemployment Benefits?

Usually you never have to pay back unemployment, except in these weird cases, during these weird pandemic times, where states are sending letters to some workers saying that they've been overpaid.

If You Choose to File an Appeal

Alex Pisani, general counsel and executive vice-president of sales for Engage PEO, a professional employer organization based in Fort Lauderdale, Florida, that provides human resources outsourcing solutions, says that if you don't have all of your pertinent paycheck information, you'll want to go back to your last boss or human resources department..

Keeping Track of Unemployment Benefits

In general, especially if you're receiving unemployment benefits right now, it wouldn't hurt to keep careful records of what you receive. For starters, you'll need to have those numbers handy when you do this year's taxes. It also is never a bad idea to keep tabs on what revenue you're bringing in – and what you're spending as well.