How do I set up a defined benefit pension plan?

Defined Benefits PlanDetermine the fair value of the assets and liabilities of the pension plan at the end of the year.Determine the amount of pension expense for the year to be reported on the income statement.Value the net asset or liability position of the pension plan on a fair value basis.

Can I set up my own defined benefit plan?

Self-Employed Defined Benefit Plans Allow Large Tax-Deductible Contributions. If you are self-employed, a Defined Benefit Plan significantly reduces your taxes WHILE you save for your OWN retirement.

When can I establish a defined benefit plan?

When must a Defined Benefit Plan be established? Sole proprietorship, partnership or a LLC taxed as a sole proprietorship - A defined benefit plan must be established by the individual's personal tax filing deadline, generally April 15th or October 15 if an extension was filed.

Who sets up a defined benefit plan?

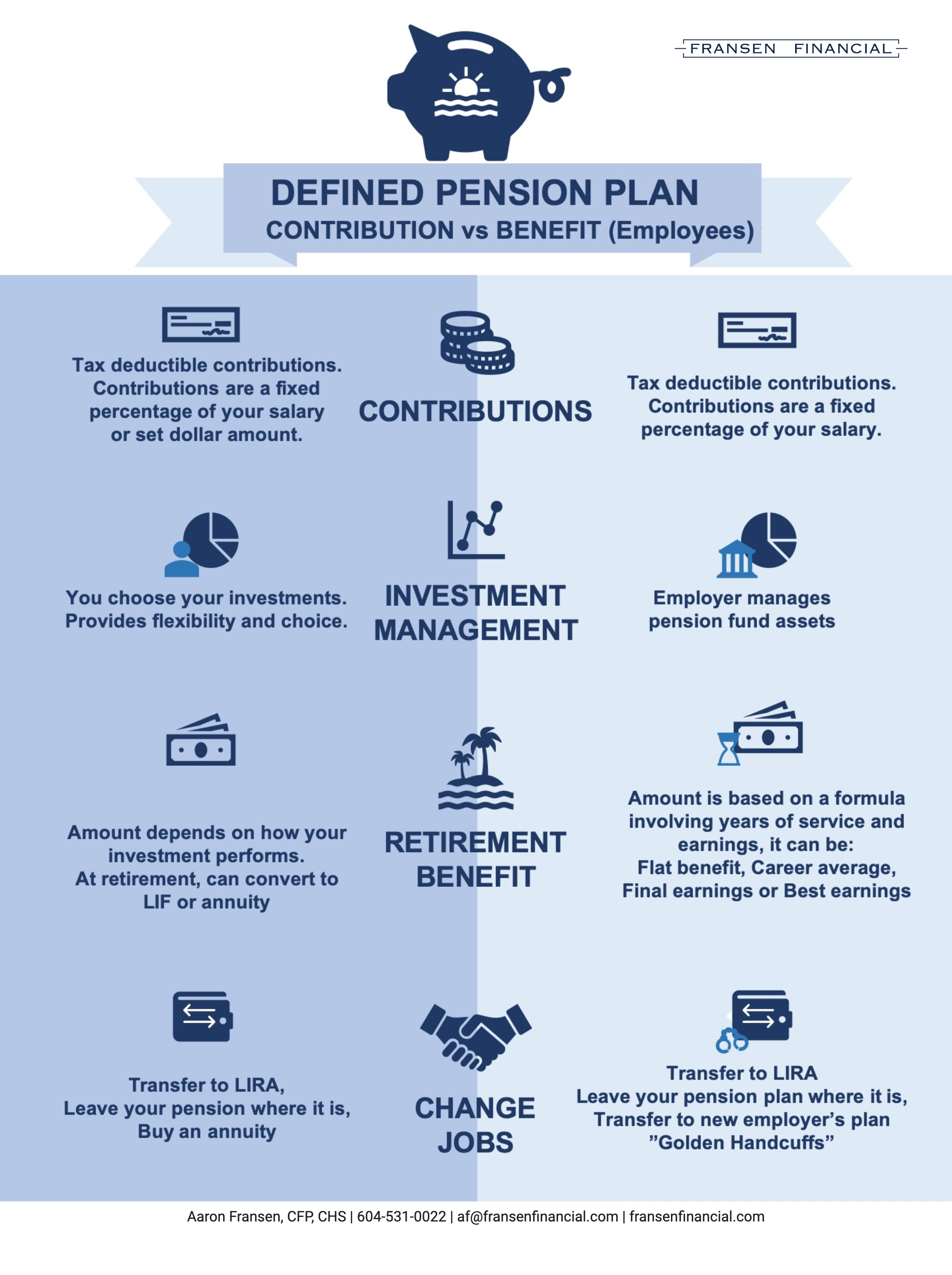

Pensions are defined-benefit plans. In contrast to defined-contribution plans, the employer, not the employee, is responsible for all of the planning and investment risk of a defined-benefit plan. Benefits can be distributed as fixed-monthly payments like an annuity or in one lump-sum payment.

What is one disadvantage to having a defined benefit plan?

The main disadvantage of a defined benefit plan is that the employer will often require a minimum amount of service. Although private employer pension plans are backed by the Pension Benefit Guaranty Corp up to a certain amount, government pension plans don't have the same, albeit sometimes shaky guarantees.

How much does a defined benefit plan cost?

On average, a defined benefit plan should cost around $2,000 to $4,000 to set up. Other costs include administration and tax filing fees which can be around the same amount. But the defined benefit plan cost can vary depending on employee count and plan design.

Can you still get a defined benefit pension?

Defined benefit (DB) pensions are still common in the public sector and there are over 5000 private DB schemes in the UK - though many are now closed to new members.

How does a DB pension work?

A defined benefit (DB) pension scheme is one where the amount you're paid is based on how many years you've been a member of the employer's scheme and the salary you've earned when you leave or retire. They pay out a secure income for life which increases each year in line with inflation.

How does a DB plan work?

As the name implies, a defined benefit plan focuses on the ultimate benefits paid out. Your employer promises to pay you a certain amount at retirement and is responsible for making sure that there are enough funds in the plan to eventually pay out this amount, even if plan investments don't perform well.

Why is defined benefit plan better?

Defined Benefit Plan Advantages Employer tax benefits: Employers generally get a tax deduction for contributions to defined benefit plans. Improved retention: Defined benefit plans can keep employees with a company for a long period of time as they wait to vest and earn the most retirement benefits.

Who is a defined benefit plan best for?

A Defined Benefit Plan can help older owners of highly profitable businesses squeeze twenty years of savings into ten. Once a standard of businesses, defined benefit plans (or pensions, as you may know them) have been replaced nearly wholescale by defined contribution plans such as the 401(k).

Do I need to save if I have a defined benefit pension?

In short, yes. You do need to save for retirement even if you have a pension. While having a pension definitely reduces the amount you need to save, it is still important to do so to full prepare you for retirement! A pension will typically provide you with 40-60% of your working salary in retirement.