How to Set Up Direct Deposit for Social Security Benefits

- Go Online. As of March 1, 2013, Social Security checks are a thing of the past. ...

- Go to Your Bank. In a November 9, 2012, memo to its employees, the Social Security Administration gave notice that a new software release would change the way that online ...

- Call Social Security. ...

- Visit a Social Security Office. ...

- Snail Mail. ...

Full Answer

What do you need to set up direct deposit?

You typically need to provide the following personal and bank details:

- Bank's mailing address. Find this on your bank statement or your financial institution’s website. ...

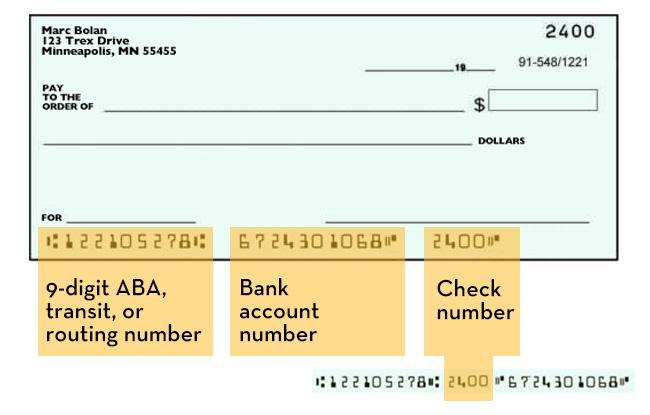

- Bank's routing number. This is the nine-digit number, also known as the American Bankers Association — or ABA — number, printed on your bank statement or along the bottom left ...

- Your account number. ...

- Type of account. ...

- Other. ...

How do you set up a direct deposit?

Set up and manage direct deposit for your contractors. Step 1: Connect your bank account. It can take 1-3 business days to set up a checking account for direct deposit. Once it's set up, you'll use this account to pay your employees and your payroll taxes. You may have already connected your bank account.

How to set up and use direct deposit?

Use of this site involves the electronic transmission of personal financial information. Using this product is consent to such transmission of this information; such consent is effective at all times when using this site. Fidelity supports 128-bit browser encryption.

How do I set up direct deposit of my paycheck?

Step 3 – Set Up Direct Deposit With Your Payroll Service

- Apply for Direct Deposit. Online payroll services don’t come with direct deposit as the default option. ...

- Verify Your Bank Account. If you haven’t already, you’ll be required to verify your company bank account in this step of the process.

- Wait for a Risk Assessment. ...

How do you set up direct deposit with Social Security?

You can sign up online at Go Direct®, by calling 1-800-333-1795, in person at your bank, savings and loan or credit union, or calling Social Security. Then, just relax. Your benefit will go automatically into your account every month. And you'll have more time to do the things you enjoy!

Can I change my direct deposit information with Social Security online?

The most convenient way to change your direct deposit information with us is by creating a my Social Security account online at www.ssa.gov/myaccount. Once you create your account, you can update your bank information from anywhere.

Is there a form to change Social Security direct deposit?

You may need to fill out a new Direct Deposit sign-up form. Section 205(a) of the Social Security Act, as amended, allows us to collect this information. Furnishing us this information is voluntary.

How long does it take to get Social Security direct deposit?

30 to 60 daysOnce you sign up (regardless of the method), it takes 30 to 60 days for any direct deposit changes or new accounts to take effect. Make sure you don't close or switch your bank account before you see that first successful deposit.

How long does it take to switch direct deposit accounts?

The process required to change direct deposit can be cumbersome. They would need to contact your HR department and fill out a form with the credentials of their new institution, authorizing the new bank to receive the direct deposit. This process can take two-to-four weeks, or one-to-two pay cycles.

How do I change my Social Security deposit to another bank?

Once you create your account, you can update your bank information without leaving the comfort of your home. Another way to change your direct deposit is by calling Social Security at 1-800-772-1213 (TTY 1-800-325-0778) to make the change over the phone.

What information is needed for direct deposit?

Be prepared to provide your U.S. Bank deposit account type (checking or savings), account number and routing number, your Social Security Number, and other required information.

Can Social Security check your bank account?

If you receive benefits through the federal Supplemental Security Income (SSI) program, the Social Security Administration (SSA) can check your bank account. They do this to verify that you still meet the program requirements.

What is the Social Security payment schedule for 2021?

For 2021, you will receive payments on the following days: January 20; February 17; March 17; April 21; May 19; June 16; July 21; August 18; September 15; October 20; November 17; and December 15.

How much money can you have in the bank on Social Security retirement?

$2,000You can have up to $2,000 in cash or in the bank and still qualify for, or collect, SSI (Supplemental Security Income).

What is the best month to start Social Security?

Individuals first become eligible to receive a benefit during the month after the month of their 62nd birthday. So, someone born in May becomes eligible in June. Since Social Security pays individuals a month behind, the person will receive the June benefit in July.

How long does direct deposit take the first time?

In most cases, a direct deposit takes one to two pay cycles before you'll see the amount you're paid live in your bank account. You may be given a physical check until everything is set up and good to go, depending on your employer.

Set Up or Change Your Direct Deposit of Benefit Payment

Do you want to set up or change the direct deposit of your benefit payment? We are constantly expanding and improving our online services, including the ability to set up or change your direct deposit information.

What is Direct Deposit?

Direct deposit is a simple, safe, and secure way to get benefits. If you do not have a bank account, the FDIC website offers information to help you open an account online or at a local bank branch. If you need us to send your payment to a bank or credit union account, have all of the following information ready when you apply.

Additional information related to this service

As of March 1, 2013, you are required to receive your payments electronically. If you applied for benefits before that date and did not sign up for electronic payments at that time, we strongly urge you to do so now.

Still have questions?

If you have questions or need help understanding how to set up or change direct deposit online, call our toll-free number at 1-800-772-1213 or visit your Social Security office. If you are deaf or hard of hearing, call our toll-free TTY number, 1-800-325-0778, between 8:00 a.m. and 5:30 p.m. Monday through Friday.

How to get direct deposit?

Direct Deposit is the best electronic payment option for you because it is: 1 Safe – Since your money goes directly into the bank in the form of an electronic transfer, there's no risk of a check being lost or stolen. 2 Quick – It's easy to receive your benefit by Direct Deposit. You can sign up online at Go Direct®, by calling 1-800-333-1795, in person at your bank, savings and loan or credit union, or calling Social Security. Then, just relax. Your benefit will go automatically into your account every month. And you'll have more time to do the things you enjoy! 3 Convenient – With Direct Deposit, you no longer have to stand in line to cash your check when it arrives. Your money goes directly into your account. You don't have to leave your house in bad weather or worry if you're on vacation or away from home. You don't have to pay any fees to cash your checks. Your money is in your account ready to use when business opens the day you receive your check.

How to request a waiver from Social Security?

For more information or to request a waiver, call Treasury at 855-290-1545. You may also print and fill out a waiver form and return it to the address on the form. If you have any questions, call Social Security at 1-800-772-1213 (TTY 1-800-325-0778 ).

Is direct deposit safe?

Direct Deposit is the best electronic payment option for you because it is: Safe – Since your money goes directly into the bank in the form of an electronic transfer, there's no risk of a check being lost or stolen. Quick – It's easy to receive your benefit by Direct Deposit.

How do I contact Social Security Direct Deposit?

Calling us at 1-800-772-1213 ( TTY 1-800-325-0778). If you currently do not get Social Security benefits or SSI, but plan to apply, sign up for direct deposit when you apply for benefits.

How do I change my direct deposit address for Social Security?

mailing address, or are unable to change your address online, you can start or update direct deposit by: Contacting your bank, credit union, or savings and loan association. Calling us at 1-800-772-1213 ( TTY 1-800-325-0778). If you currently do not get Social Security benefits or SSI, but plan to apply, ...

What is the phone number to call for Social Security?

Call Social Security. Jones stated that Social Security recipients can call the Social Security Administration at 1-800-772-1213 during normal business hours, 9 a.m. to 5 p.m., Monday through Friday, and apply for direct deposit.

How long does it take to get a Social Security check?

If a Social Security payment is due during that 60-day period, you will receive a paper check from the U.S. Treasury Department.

Is Social Security direct deposit electronic?

Instead, payments to Social Security recipients are electronic. To set up direct deposit for Social Security benefits, you have five options, all leading to the same result. The biggest differences among the methods are the time you invest in the application process and the time required for Social Security to make the change to your account.