Add Fringe Benefits to your pay types.

- Select the Employees tab.

- Select the employee's name.

- Select Edit in the Pay section.

- Select Show all pay types.

- Select all relevant fringe benefits.

- Select OK.

Full Answer

What are fringe benefits?

“Eden Terrace is an increasingly popular growth hub on the city fringe. The area surrounding the France Street ... Wallace said any future development at the France Street site would benefit from its strategic location on the edge of the CBD and a ...

What is considered fringe benefit?

What Is a Fringe Benefit? A fringe benefit is a form of pay (including property, services, cash or cash equivalent) in addition to stated pay for the performance of services. Under Internal Revenue Code (IRC) Section 61, all income is taxable unless an exclusion applies. Some forms of additional compensation are

How do you report fringe benefits?

- Gift Cards or Cash Equivalents. If you received a gift card, no matter how small the amount, you should report it as wages — even a $5 gift card.

- Prizes and Awards. Did you win a contest at work? ...

- Personal Use of Company Car. Do you use a company car for work? ...

- Moving Expenses. ...

- Expense Reimbursements Under a Nonaccountable Plan. ...

What are payroll fringe benefits?

Fringe benefits - often called "perks" - are a form of compensation for services beyond the employee's normal rate of pay. Companies are providing more fringe benefits to employers more than ever before, thus reducing company costs but raising employee morale. Due to changes in both, the economy and the Internal Revenue Code and COVID-19 ...

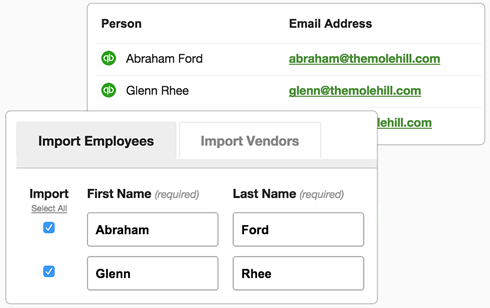

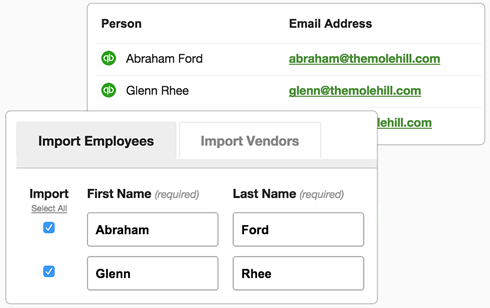

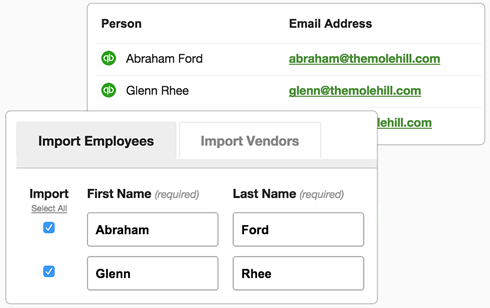

How do I add fringe benefits in QuickBooks desktop?

Add Fringe Benefits to your pay typesSelect the Employees tab.Select the employee's name.Select Edit in the Pay section.Select Show all pay types.Select all relevant fringe benefits.Select OK.

How do you make taxable fringe benefits payroll items in QuickBooks desktop?

To set up a taxable fringe benefit payroll item:From Lists, select Payroll Item List.Select Payroll Item then select New.Select Custom Setup.Select either Company Contribution or Addition, and select Next. ... Enter a name for this item and select Next.More items...

How do you account for fringe benefits?

To calculate this amount of fringe benefits or imputed income:Identify and exclude de minimis fringe benefits.Calculate the total value of the fringe benefits.Calculate and subtract the value of business use.Subtract exemptions.Record the fringe benefits in your payroll system.More items...

How do I add fringe to my salary?

How To Calculate A Fringe Benefit Rate?Add together the cost of an employee's fringe benefits for the year.Divide it by the employee's annual salary.Multiply the total by 100 to determine the percentage of fringe benefit rate.

How do you record fringe benefits journal entry?

Journal Entries When recording wages paid, include fringe benefits paid to your employees, as a debit. Subtract your total credits from your total debit to get your net payroll payable amount. Make a separate journal entry to record your expenses as an employer as a debit.

How do I record taxable benefits in QuickBooks?

How to payroll a taxable benefit?Log into your QuickBooks account.Select Payroll Settings, then Deduction Categories.To add a new deduction category, select Add.Enter a name for the deduction category.Select whether it will be a pre tax or post tax deduction.More items...•

Are fringe benefits included in salary expense?

Fringe benefits are subject to income tax withholding and employment taxes, and are generally included in an employee's gross income. Taxable fringe benefits must be included as income on the employee's W-2.

Are fringe benefits an expense?

Any fringe benefit you provide is taxable and must be included in the recipient's pay unless the law specifically excludes it.

How do I record employee benefits in Quickbooks?

How do I record payment of a employee benefit liability using Quickbooks Online? I "see" the liability in my Balance Sheet Report.Go to Taxes and select Payroll Tax.Select Payments.Select Make Payment.Follow the on-screen steps to complete your tax payment.

How are monthly fringe benefits calculated?

To calculate an employee's fringe benefit rate, add up the cost of an employee's fringe benefits for the year (including payroll taxes paid) and divide it by the employee's annual wages or salary. Then, multiply the total by 100 to get the fringe benefit rate percentage.

What is a typical fringe benefit rate?

The rate is calculated by adding together the annual cost of all benefits and payroll taxes paid, and dividing by the annual wages paid. For example, if the total benefits paid were $25,000 and the wages paid were $100,000, then the fringe benefit rate would be 25%.

How are reportable fringe benefits calculated?

Calculating reportable fringe benefits amount The lower gross-up rate for the FBT year ending 31 March 2021 is 1.8868. For example, if the taxable value of your fringe benefits is $2,000.00, your reportable fringe benefit amount is calculated as $2,000.00 × 1.8868 = $3,773.

What is a fringe benefit?

A fringe benefit is a form of pay for the performance of services, given by the employer to the employee. For example, Personal Use of a Company Car (PUCC), in which you allow the employee to use a business vehicle for personal use, is a type of fringe benefit.

Are Fringe Benefits Taxable?

Any fringe benefit you provide is taxable and must be included in the recipient's pay unless the law specifically excludes it.

Including Taxable Benefits in Pay

The recipient's pay must include the amount by which the value of a fringe benefit is more than the sum of the following amounts:

Fringe Benefits Valuation Rules

You must use the general valuation rule to determine the value of most fringe benefits. Under this rule, the value of a fringe benefit is its fair market value.

Fair Market Value

The fair market value of a fringe benefit is the amount an employee would have to pay a third party in an arm's-length transaction to buy or lease the benefit.

Examples of fringe benefits

Fringe benefits are compensation other than wages provided to an employee. They can be either taxable or non-taxable. Examples of fringe benefits include:

How to set up fringe benefits to be tracked

Each company-paid benefit or other payroll expense that needs to be tracked requires a separate payroll item. For help in setting up payroll items, see How to create taxable fringe benefits payroll items.

How to generate reports that show employee fringe benefits

After you've determined what fringe benefits you're providing to employees and set them up to be tracked, you can generate reports in QuickBooks to view details. For instructions on generating reports to view employee fringe benefits, go to one or both of the following pages:

What is a fringe benefit?

A fringe benefit is a form of pay for the performance of services, given by the employer to the employee. For example, Personal Use of a Company Car (PUCC), in which you allow the employee to use a business vehicle for personal use, is a type of fringe benefit.

Are Fringe Benefits Taxable?

Any fringe benefit you provide is taxable and must be included in the recipient's pay unless the law specifically excludes it.

Including Taxable Benefits in Pay

The recipient's pay must include the amount by which the value of a fringe benefit is more than the sum of the following amounts:

Fringe Benefits Valuation Rules

You must use the general valuation rule to determine the value of most fringe benefits. Under this rule, the value of a fringe benefit is its fair market value.

Fair Market Value

The fair market value of a fringe benefit is the amount an employee would have to pay a third party in an arm's-length transaction to buy or lease the benefit.

Set up a taxable fringe benefit payroll item

Creating a taxable fringe benefit payroll item is a multi-step process.

How to enlarge an hourly rate in QuickBooks?

Right click on the image to enlarge it. Enter the hourly rate for the benefit item and make sure that the Annual Limit option is NOT checked ( by default QuickBooks always has this option selected. Right click on the image to enlarge it.

What are fringe benefits?

Union fringes often consist of contributions to Vacation/Holiday, Health & Welfare, Pension, Training, and sometimes Travel & Subsistence, Savings, or Fund Administration . Depending upon the Union that you are dealing with, some of the fringe benefits could be subject to payroll taxes, while others are not.