The value of a defined benefit pension plan is decided by your employer. Usually, the amount you receive depends on: the number of years you worked for the company your salary when you retire your pension scheme's 'accrual rate'

How do I calculate the value of a pension?

- Yes I do thank goodness! My pension amount is/will provide a significant amount to live off during retirement.

- Drats, no I don't. It's all up to me to contribute to my 401k, IRA, and after-tax investment accounts

- I've got such a weak pension that I almost wouldn't consider it a real pension. It'll hardly pay for anything.

- Other.

How much is a defined benefit pension worth?

The amount being offered for defined benefit Pension Transfers varies hugely from scheme to scheme with some schemes offering as much as forty times your pensionable income. Industry averages are between 20 - 33 times pensionable income.

How do you calculate defined benefit?

How do you calculate the present value of a defined benefit pension? The formula is simple: Net present value = CF/[(1 + r) ^ n] — where CF, or “cash flow,” is the final number from the last section’s calculation. This formula accounts for the number of years you have left until you retire and the pension begins to pay out.

What companies offer defined benefit pension plans?

Who has the best pension plan?

- The Typical 401 (k) Match. When an employer decides to offer a 401 (k) plan for its workers, there are different types of plans on the market to choose from. ...

- Generous Employer 401 (k) Matches. …

- Amgen.

- Boeing. …

- BOK Financial. …

- Farmers Insurance. …

- Ultimate Software.

How do you value a defined pension?

The value of a pension = Annual pension amount divided by a reasonable rate of return multiplied by a percentage probability the pension will be paid until death as promised.

How do you calculate the present value of a defined benefit plan?

Present value is calculated as PV = FV / (1 + i)^n, where the present value equals the future value divided by one plus the expected interest rate over “n” number of years.

How do you include a defined benefit pension in net worth?

Calculating The Present-Day Value Of Your Pension Determining the value of your pension is a two-step calculation. The first step is calculating how much annuity you will receive in retirement, converting it to a lump sum if it will be monthly payments. Then you take the lump sum and bring it into present value terms.

How do you value a defined benefit pension in a divorce?

This means that 75% of the pension value would be considered a marital asset. So if you had $200,000 total in a pension, that amount would be multiplied by 75%, meaning the marital value would be $150,000 to be divided. The pension owner would keep the other $50,000 as a separate asset.

How much is a 3000 a month pension worth?

I estimate that you'd be offered $470,000 for a $3,000 monthly pension that is about to start at age 65. (I can only estimate because plans vary in how quickly they adopt interest rate updates.) If you are a 65-year-old nonsmoking female, the pension is worth more like $626,000.

How do I calculate the future value of my pension?

Rein uses a simple rule of thumb when it comes to valuating a pension or a stream of cashflow, “For every $100 per month of income, you have an asset worth $18,000.” If you have a pension that pays you $3,000 per month, that pension is worth $540,000. If you get $800 per month from CPP, then that is worth $144,000.

How is the commuted value of a defined benefit pension calculated?

The commuted value is then divided by the life expectancy of the employee to calculate the annual pension benefit payable to the employee. If you're a mathematician, here's the typical formula to calculate commuted value: PV = FV/ (1 + k)^n.

How do you calculate the present value of a monthly pension?

The formula for determining the present value of an annuity is PV = dollar amount of an individual annuity payment multiplied by P = PMT * [1 – [ (1 / 1+r)^n] / r] where: P = Present value of your annuity stream. PMT = Dollar amount of each payment.

Is the transfer value of a pension the same as the cash value?

Pension fund value is the current value of a defined contribution pension pot. Transfer value (CETV) is the amount your provider will offer you for transferring out of your defined benefit scheme. In other words, your CETV will become your pension fund value after you've transferred out.

Will my wife get half my pension if we divorce?

Can My Spouse Take Half My Pension If We Divorce? Generally, your spouse is entitled to half of the earnings generated during the marriage; however, each state's law will determine the outcome. Some states are equitable distribution states, though this does not always mean a 50/50 split.

Can my husband take half my pension if we divorce?

The pension can be split if your ex-spouse was on a personal pension scheme. The pension can be split if your ex-spouse had a current or past workplace pension. The pension can be split if your ex-spouse had additional state pension in place.

Am I entitled to half my husband's pension when we divorce?

The only way to divide your husband's pension during the divorce will be via a court order. Whether the courts will agree to splitting the pension in the divorce will usually depend on the pension provisions of the two parties.

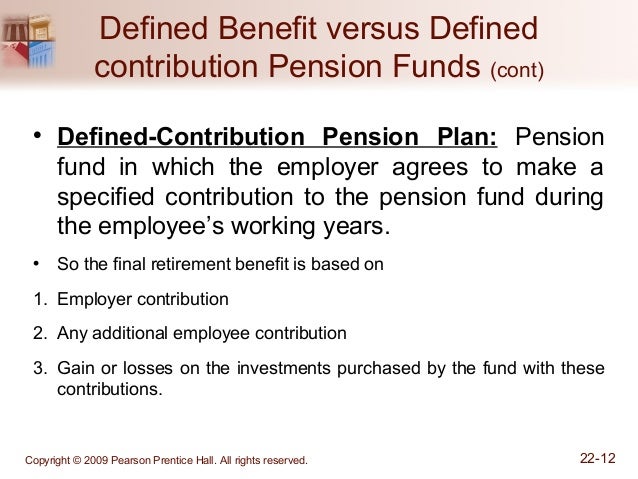

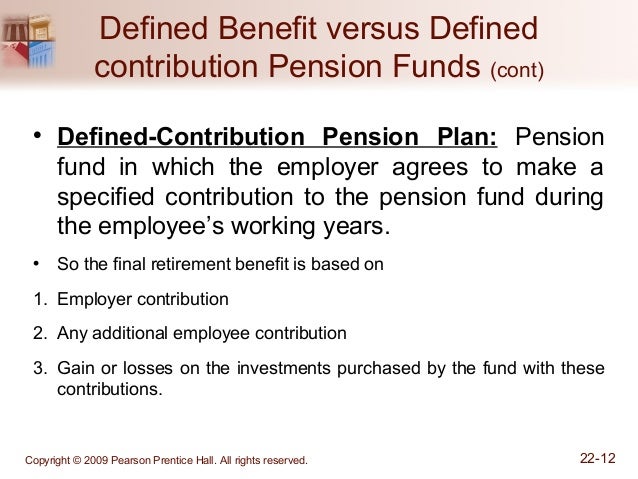

What is defined benefit pension?

Pensions, also known as Defined Benefit plans, have become rarer as companies force their employees to save for themselves mainly through a 401k, 457, 403b, Roth 401k or IRA. These savings vehicles are also known as Defined Contribution plans.

Why are pensions so valuable?

Therefore, the value of a pension has gone WAY UP because the value of cash flow has gone way up.

How does pension work?

Most pensions start paying out at a certain age and continue paying out until death. The amount of pension you receive is determined by years of service, age in which you elect to start collecting, and usually the average annual income over your last several years of service.

Can a pension be paid out to a spouse?

Although, in some cases, a pension can keep paying out to a surviving spouse. The reality is one’s pension value fades as the owner inches closer towards the end. Therefore, it behooves every pension owner to live as long and healthy of a life as possible to maintain the value of his/her pension.

Do pensions have inflation adjusters?

Most pensions also have an inflation adjuster built in order to keep up with inflation. Although sometimes, the inflation adjustments don’t keep up. Here’s a chart I put together highlighting the values of a $35,000 and $50,000 pension (in the range of the most common pension amounts).

What is a Cash Equivalent Transfer Value (CETV)?

A CETV (also known as a Final Salary Pension Transfer Value) is an amount that is offered to you in exchange for you giving up your entitlement to an inflation adjusted, guaranteed-for-life pension.

How is a CETV calculated?

Unfortunately, the calculations that are used to value defined benefit pension transfer entitlements differ from scheme to scheme.

Why are interest rates the biggest threat to your pension transfer value?

Pension schemes have a considerable reliance on government bonds and government bonds produce a yield based on interest rates set by the Bank of England.

Conclusion

The purpose of this post is to be informative and shed some light on the “black box” that is the pension transfer value calculation process.

Take action

As a deferred member of a defined benefit pension scheme, you are entitled to one free CETV statement a year.

Get in touch

If you would like to understand more about this topic, drop me a line.

What is defined benefit pension?

A defined-benefit pension plan requires an employer to make annual contributions to an employee’s retirement account. Plan administrators hire an actuary to calculate the future benefits that the plan must pay an employee and the amount that the employer must contribute to provide those benefits. The future benefits generally correspond ...

How much does a defined benefit plan pay?

One type of defined-benefit plan might pay a monthly income equal to 25% of the average monthly compensation that an employee earned during their tenure with the company. 3 Under this plan, an employee who made an average of $60,000 annually would receive $15,000 in annual benefits, or $1,250 every month, beginning at the age of retirement (defined by the plan) and ending when that individual died.

What is the vesting period?

This required period of employment is known as the vesting period. 2. Employees who leave a company before the end of the vesting period may receive only a portion of the benefits. Once the employee reaches the retirement age, which is defined in the plan, they usually receive a life annuity.

How does a straight life annuity work?

In a straight life annuity, for example, an employee receives fixed monthly benefits beginning at retirement and ending when they die. The survivors receive no further payments. In a qualified joint and survivor annuity, an employee receives fixed monthly payments until they die, ...

What is future benefit?

The future benefits generally correspond to how long an employee has worked for the company and the employee’s salary and age. Generally, only the employer contributes to the plan, but some plans may require an employee contribution as well. 1 To receive benefits from the plan, an employee usually must remain with the company for ...

How often do you get a pension payment?

Generally, the account holder receives a payment every month until they die. Companies cannot retroactively decrease benefit amounts for defined-benefit pension plans, but that doesn't mean these plans are protected from failing.

How long do you have to work to get a fixed benefit?

In most cases, an employee receives a fixed benefit every month until death, when the payments either stop or are assigned in a reduced amount to the employee’s spouse, depending on the plan.

Understanding the risks

Anyone considering transferring out of a DB Scheme should appreciate that once a transfer has taken place the decision is irrevocable and that the valuable benefits from the scheme are lost.

Find out what your defined benefit scheme is worth

If you’re looking for a financial adviser to support you with your pensions, we’re here to help. Our continued excellence in this area has resulted in Wren Sterling receiving the Pension Transfer Gold Standard for our work with DB transfers.

What are defined benefits pensions?

Defined Benefit pensions have incredibly valuable benefits attached to them which will be lost if you transfer. Pension Benefits could include (but are not limited to): Protected pension age (for early retirement) Guaranteed income for life. Tax-free cash. Life insurance. Spouse/survivor's pension provision.

How long does it take to get a defined benefit pension?

Ideally before or as soon you receive your CETV. Across the industry it’s not uncommon to hear of defined benefit pension transfers taking up to 6 months, sometimes longer.

Why can a pension trustee adjust transfer values?

If the scheme is under-funded, transfer values can be adjusted to protect those still within the scheme .

What is cash equivalent transfer value?

What is a Cash Equivalent Transfer Value? Your Cash Equivalent Transfer value is the amount your pension scheme will give you if you decide to transfer out of your defined benefit pension scheme. It is not the same as your Pension Fund amount. You should receive an annual update from your Pension Scheme Administrator that contains this information ...

What does transfer value mean?

A transfer value only tells you how much you'll receive if you transfer your pension. The true market value of your pension is often far higher than any transfer value you will be offered once you factor in the value of: a guaranteed income. an inflation-proof investment. death in service benefits.

Why do transfer values rise as you get closer to retirement?

This is because there’s less time for the scheme to expand its assets to meet the promised payments.

Is a defined benefit pension transfer in your best interest?

For most people a Defined Benefit pension transfer is not in their best interests. That said, whether or not you should transfer is entirely dependent on your individual circumstances and goals. It’s not possible to give you an answer to this questions without doing a full analysis of your situation.

How to liquidate pension?

One method to liquidate a pension benefit is for a beneficiary to enter into an over-the-counter financial instrument (swap), in which the future pension benefit streams are exchanged for a fixed stream of payments or lump-sum payment. However, one might incur significant fees and costs through this type of transaction.

When valuing the fair market value of such benefits, should adjustments for the lack of liquidity be considered?

Thus, when valuing the fair market value of such benefits, adjustments for the lack of liquidity should be considered, either as an adjustment in the discount rate or separately as a discount for lack of marketability. For pension beneficiaries, estate planners, and executors, it can be critical to understand these key value drivers ...

What are the four variables that are considered fair market value?

Determination of fair market value is a matter of judgment, however, and in valuing a pension plan, or interest thereof, four variables in particular are analyzed: expected cash flows; expected term of the cash flow stream; counterparty risk; and the illiquidity of the pension benefits.

Is a pension plan publicly traded?

An interest in a corporate pension plan is not publicly traded, and thus, cannot be converted to cash quickly or easily.

Can a pension plan be distributed to a spouse?

Upon the death of a pension plan recipient, survivor benefits may be distributed to a spouse or other beneficiary. A valuation may then be necessary to determine the fair market value of the pension plan for estate tax reporting purposes.

Why are there fewer defined benefit pension plans?

The unfortunate reality is that there are going to be fewer and fewer defined benefit pension plans offered in the future because they are more costly and complicated to administer and the employer bears more risk and responsibility.

What is the cornerstone of retirement?

A cornerstone of retirement income planning. In wealth planning, pensions are often ignored but Rein believes that they are incredibly important, “Defined Benefit Pension Plans and Government Benefits form the cornerstone of retirement planning. If you work for an employer that offers a defined benefit pension, ...

What does Rein believe about retirement?

Rein believes that the retirement planning industry largely ignores the value and importance of pension plans as an asset. Rein uses a simple rule of thumb when it comes to valuating a pension or a stream of cashflow,

When was the last update on retirement?

Last Updated: January 24, 2020. Advertiser Disclosure. Whenever the topic of retirement planning comes up, it is often associated with building as much wealth as possible so that you can reach that time when you no longer have to work to create income.