Why is 401k called a defined contribution plan?

A defined contribution plan is sponsored by an employer, which offers the plan to its employees as a major part of their job benefits. It’s called a defined contribution plan because the account ...

Does a 401k really benefit an employer?

Yes. As mentioned earlier, 401k plans are tax-deductible for employers. Because 401k plans have several tax benefits, they are usually less expensive to offer than defined-benefit plans. The good news is that usually, every dollar a company contributes to a staff member’s 401k is a write-off.

Is a 401k considered a qualified retirement plan?

Yes, a 401k does meet the IRS rules to be considered a qualified retirement plan. Your employer is responsible for ensuring that the reporting and regulatory requirements are met to keep the plan in compliance.

Is a 401K a bad idea?

Your 401 (k) plan is protected by law. That’s why it can be foolish to use 401 (k) money to prevent foreclosure, pay off debt or start a business. In the case of future bankruptcy, your 401 (k) money is a protected asset. Don’t touch your 401 (k) money unless you retire. Should I withdraw my 401k if the market crashes?

What is the difference between a defined benefit plan and a 401k?

A 401(k) and a pension are both employer-sponsored retirement plans. The most significant difference between the two is that a 401(k) is a defined-contribution plan, and a pension is a defined-benefit plan.

Is a 401k a defined contribution or benefit plan?

A 401(k) Plan is a defined contribution plan that is a cash or deferred arrangement. Employees can elect to defer receiving a portion of their salary which is instead contributed on their behalf, before taxes, to the 401(k) plan.

Is a 401k a DB or DC plan?

401(k) and 403(b) are two popular DC plans commonly used by companies and organizations to encourage their employees to save for retirement. DC plans can be contrasted with defined benefit (DB) pensions, in which retirement income is guaranteed by an employer.

What is considered a defined benefit plan?

Defined benefit plans provide a fixed, pre-established benefit for employees at retirement. Employees often value the fixed benefit provided by this type of plan. On the employer side, businesses can generally contribute (and therefore deduct) more each year than in defined contribution plans.

What is the difference between a defined benefit and a defined contribution?

The basic difference is what each plan promises its participants. A defined benefit plan (APERS) specifies exactly how much retirement income employees will get once they retire. A defined contribution plan only specifies what each party – the employer and employee – contributes to an employee's retirement account.

How do I know if my pension is defined benefit or defined contribution?

A defined contribution (DC) pension scheme is based on how much has been contributed to your pension pot and the growth of that money over time. It may be set up by you or an employer. A defined benefit (DB) plan is always set up by an employer and offers you a set benefit each year after you retire.

Is a Solo 401k a defined contribution plan?

An independent 401(k) is a qualified defined-contribution retirement plan established by small business owners and sole proprietors. These plans are only available to small business owners and their spouses as long as they work for the company.

Whats the difference between a pension and a 401k?

What's the difference between a pension plan and a 401(k) plan? A pension plan is funded by the employer, while a 401(k) is funded by the employee. (Some employers will match a portion of your 401(k) contributions.) A 401(k) allows you control over your fund contributions, a pension plan does not.

Is a 401k an IRA?

While both plans provide income in retirement, each plan is administered under different rules. A 401K is a type of employer retirement account. An IRA is an individual retirement account.

Is a Roth IRA a defined benefit plan?

Most plans offered through your employer are qualified retirement plans and qualify for tax breaks. A Roth IRA is not a qualified retirement plan, but there are similar tax advantages for those planning for retirement.

What is 401k retirement plan?

401(k) Plans A 401(k) is a feature of a qualified profit-sharing plan that allows employees to contribute a portion of their wages to individual accounts. Elective salary deferrals are excluded from the employee's taxable income (except for designated Roth deferrals). Employers can contribute to employees' accounts.

Which of the following is not a type of defined contribution plan?

All of the following are defined contribution plans, EXCEPT: Deferred annuities are used to fund defined benefit plans.

What Is A 401 Plan

One of the most powerful ways an individual can save for retirement and prepare for a financially confident future is through periodic investment plans offered at work. A 401 plan, the most common employer-sponsored retirement plan, enables employees to make contributions, which receive special tax considerations, from every paycheck.

Eligibility Criteria To Start A Defined Benefit Plan

A Defined benefit plan is an employer sponsored pension plan, so this is typically set up by a business. All types of businesses can set it up, however, a prudent decision needs to be made based on the goals and the profitability of the business.

Rollovers As Business Start

ROBS is an arrangement in which prospective business owners use their 401 retirement funds to pay for new business start-up costs. ROBS is an acronym from the United States Internal Revenue Service for the IRS ROBS Rollovers as Business Start-Ups Compliance Project.

Defined Benefit Plan Vs Defined Contribution Plan

Think of defined contribution plans as the new kid on the block, and defined benefit plans as the old pro. A defined benefit plan primarily requires employers to make nearly all contributions while a defined benefit plan expects employees to make most of the contributionseven though many employers may choose to provide some matching contributions.

Who Can Set Up A Defined Benefit Plan

Any small or large business can set up a defined benefit plan. Even a self-employed individual can set it up as long as there is significant money to contribute to the plan. Typical examples of businesses that set up a defined benefit plan are:

Can You Combine A Sep With A Defined Benefit Plan Or Cash Balance Plan

This is one question we get asked all the time. The answer is: it depends. You need to understand the difference between model SEPs and non-model SEPs.

Why A Sep In The First Place

A SEP is a plan that basically acts like a profit sharing plan. The contributions are made based on one of the two following structures:

What is a 401(k) plan?

Key Takeaways. A 401 (k) plan is a company-sponsored retirement account that employees can contribute to. Employers may also make matching contributions. There are two basic types of 401 (k)s—traditional and Roth—which differ primarily in how they're taxed. In a traditional 401 (k), employee contributions reduce their income taxes for ...

What is 401(k) defined contribution?

A 401 (k) is what's known as a defined-contribution plan. The employee and employer can make contributions to the account, up to the dollar limits set by the Internal Revenue Service (IRS). By contrast, traditional pensions [not to be confused with traditional 401 (k)s] are referred to as defined-benefit plans —the employer is responsible ...

When did 401(k)s start?

When 401 (k) plans first became available in 1978, companies and their employees had just one choice: the traditional 401 (k). Then, in 2006, Roth 401 (k)s arrived. Roths are named for former U.S. Senator William Roth of Delaware, the primary sponsor of the 1997 legislation that made the Roth IRA possible. 9 .

What is the maximum 401(k) contribution for 2021?

As of 2020 and in 2021, the basic limits on employee contributions are $19,500 per year for workers under age 50 and $26,000 for those 50 and up (including the $6,500 catch-up contribution). 4 . If the employer also contributes—or if the employee elects to make additional, non-deductible after-tax contributions to their traditional 401 (k) ...

What age do you have to withdraw from 401(k)?

(Withdrawals are often referred to as "distributions" in IRS parlance.) After age 72 , account owners must withdraw at least a specified percentage from their 401 (k) plans, using IRS tables based on their life expectancy at the time (prior to 2020, the RMD age had been 70½ years old).

How old do you have to be to take 401(k)?

Both traditional and Roth 401 (k) owners must be at least age 59½— or meet other criteria spelled out by the IRS, such as being totally and permanently disabled—when they start to make withdrawals. Otherwise, they usually will face an additional 10% early-distribution penalty tax on top of any other tax they owe. 7 .

How much can I contribute to my 401(k) in 2021?

The amount that employees can contribute to their 401 (k) Plan is adjusted each year to keep pace with inflation. In 2020 and 2021, the limit is $19,500 per year for workers under age 50 and $26,000 for those aged 50 and above.

What is the maximum 401(k) contribution for 2020?

She is also entitled to the maximum profit sharing amount. This will get her to the maximum annual cap for 2020 of $63,500. But of course – no defined benefit contribution.

How much can I contribute to my 401(k) at 50?

So here are the rules. There is actually no restriction on the employee 401k deferral. This allows a contribution of $19,500 for employees under the age of 50 and $26,000 for those 50 and older.

Can you defer 401(k) if you have a down year?

So if the owner is having a down year financially they can choose to not make the 401k employee deferral or profit sharing contribution. This gives them added flexibility. If the employer has other employees then they may be required to make small safe harbor contributions. But I think you get the point.

Can you combine a defined benefit plan with a 401(k)?

As you can see, you can combine a defined benefit plan with a 401k plan. This is done all the time by many different administrators and financial advisors. But don’t forget the 6% limitation on the 401k plan. Make sure you discuss all the issues of a combo plan with your TPA.

Is a 401(k) a company contribution?

It is not a company contribution like a defined benefit plan. The defined benefit plan is actually a company sponsored plan. The employee is not allowed to contribute separately. However, the profit sharing contribution of a 401k plan is company sponsored. What this means is that it is contributed at the discretion of the company ...

What is 401(k) plan?

A 401 (k) plan is a qualified plan that includes a feature allowing an employee to elect to have the employer contribute a portion of the employee’s wages to an individual account under the plan . The underlying plan can be a profit-sharing, stock bonus, pre-ERISA money purchase pension, or a rural cooperative plan. Generally, deferred wages (elective deferrals) are not subject to federal income tax withholding at the time of deferral, and they are not reported as taxable income on the employee’s individual income tax return.

Why is a simple 401(k) plan important?

The SIMPLE 401 (k) plan was created so that small businesses could have an effective, cost-efficient way to offer retirement benefits to their employees. A SIMPLE 401 (k) plan is not subject to the annual nondiscrimination tests that apply to traditional 401 (k) plans. As with a safe harbor 401 ...

How does a 401(k) work?

A traditional 401 (k) plan allows eligible employees (i.e., employees eligible to participate in the plan) to make pre-tax elective deferrals through payroll deductions. In addition, in a traditional 401 (k) plan, employers have the option of making contributions on behalf of all participants, making matching contributions based on employees’ elective deferrals, or both. These employer contributions can be subject to a vesting schedule which provides that an employee’s right to employer contributions becomes nonforfeitable only after a period of time, or be immediately vested. Rules relating to traditional 401 (k) plans require that contributions made under the plan meet specific nondiscrimination requirements. In order to ensure that the plan satisfies these requirements, the employer must perform annual tests, known as the Actual Deferral Percentage (ADP) and Actual Contribution Percentage (ACP) tests, to verify that deferred wages and employer matching contributions do not discriminate in favor of highly compensated employees.

What is safe harbor 401(k)?

A safe harbor 401 (k) plan is similar to a traditional 401 (k) plan, but, among other things, it must provide for employer contributions that are fully vested when made. These contributions may be employer matching contributions, limited to employees who defer, or employer contributions made on behalf ...

What is automatic enrollment in 401(k)?

This feature permits the employer to automatically reduce the employee’s wages by a fixed percentage or amount and contribute that amount to the 401 (k) plan unless the employee has affirmatively chosen not to have his or her wages reduced or has chosen to have his or her wages reduced by a different percentage. These contributions qualify as elective deferrals. This has been an effective way for many employers to increase participation in their 401 (k) plans. These contributions qualify as elective deferrals. For more information about 401 (k) plans with an automatic enrollment feature, refer to Income Tax Regulations section 1.401 (k)-1 (A) (3) (ii).

What are the different types of 401(k) plans?

There are several types of 401 (k) plans available to employers - traditional 401 (k) plans, safe harbor 401 (k) plans and SIMPLE 401 (k) plans. Different rules apply to each. For tax-favored status, a plan must be operated in accordance with the applicable rules. Therefore, it is important that the employer be familiar with the special rules that apply to its plan so the plan is administered in accordance with those rules. To qualify for the tax benefits available to qualified plans, a plan must both contain language that meets certain requirements (qualification rules) of the tax law and be operated in accordance with the plan’s provisions. The following is a brief overview of important qualification rules. It is not intended to be all-inclusive.

What is top heavy 401(k)?

If the 401 (k) plan is top-heavy, the employer may be required to make minimum contributions on behalf of certain employees. In general, a plan is top-heavy if the account balances of key employees exceed 60% of the account balances of all employees. The rules relating to the determination of whether a plan is top-heavy are complex.

What is defined benefit plan?

Defined benefit plans provide a fixed, pre-established benefit for employees at retirement. Employees often value the fixed benefit provided by this type of plan. On the employer side, businesses can generally contribute (and therefore deduct) more each year than in defined contribution plans. However, defined benefit plans are often more complex ...

What is an excise tax plan?

Most administratively complex plan. An excise tax applies if the minimum contribution requirement is not satisfied. An excise tax applies if excess contributions are made to the plan.

What is defined benefit plan?

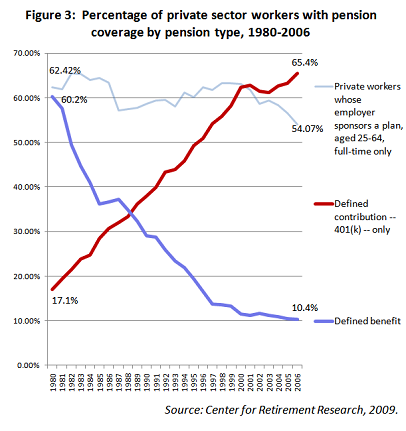

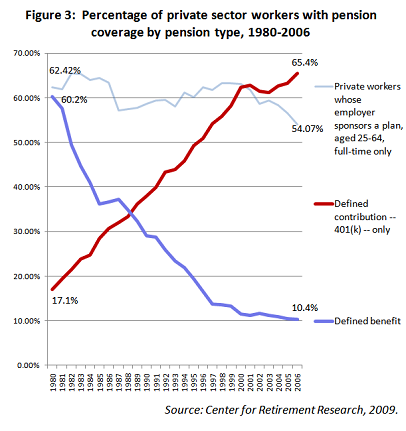

A defined benefit plan is a retirementplan in which employers provide guaranteed retirement benefits to employees based on a set formula. These plans, often referred to as pension plans, have become less and less common over the last few decades. This decline is especially pronounced in the private sector, where more and more employers have shifted ...

What is the difference between defined benefit and defined contribution?

Some companies offer both defined benefit and defined contribution plans. The key difference between each of these employer-sponsored retirement plans is in their names. With a defined contribution plan, it’s only the employee’s contributions (and the employer’s matching contributions) that’s defined. The benefits they receive in retirement depend ...

Why do you have to keep funding a defined benefit plan?

Because the benefits of a defined benefit plan are very specific, you have to keep funding the plan to make sure it will pay those benefits in your retirement. Plus, you’ll need to have an actuary perform an actuarial analysis each year.

Do defined benefit plans grow with inflation?

Many defined benefit plans also grow with to inflation. As a result, inflation over long periods of time won’t affect your money as much as a defined contribution plan participants. Defined benefit plans also feature low fees, meaning more of your money will stay in your pocket.

Is the defined benefit plan frozen?

This has led to the shift in responsibility from employers to employees. Many of the today’s remaining defined benefit plans have been “ frozen.”. This means the company is phasing out its retirement plan, though it’s waiting to do so until the enrollees surpass the age requirement.

Is 401(k) a high employer match?

Between their defined benefit plans and Social Security benefits, workers could expect to sail into a dignified retirement. These days, companies still with the much cheaper 401(k). Therefore, having a generous 401(k) with a high employer match is the new gold standard for employees.

Can you deduct contributions to a defined benefit plan?

The problem with making your own defined benefit plan is that you have to meet the annual minimum contribution floor.

What Is A 401(k) Plan?

How 401(k) Plans Work

- The 401(k) plan was designed by the United States Congress to encourage Americans to save for retirement. Among the benefits they offer is tax savings. There are two main options, each with distinct tax advantages.

Contributing to A 401(k) Plan

- A 401(k) is a defined contribution plan. The employee and employer can make contributions to the account up to the dollar limits set by the Internal Revenue Service (IRS). A defined contribution plan is an alternative to the traditional pension, known in IRS lingo as a defined-benefit plan. With a pension, the employer is committed to providing a s...

Taking Withdrawals from A 401

- Once money goes into a 401(k), it is difficult to withdraw it without paying taxes on the withdrawal amounts. "Make sure that you still save enough on the outside for emergencies and expenses you may have before retirement," says Dan Stewart, CFA®, president of Revere Asset Management Inc., in Dallas. "Do not put all of your savings into your 401(k) where you cannot easily access it, i…

Required Minimum Distributions

- Traditional 401(k) account holders are subject to required minimum distributions, or RMDs, after reaching a certain age. (Withdrawals are often referred to as "distributions" in IRS parlance.) After age 72, account owners who have retired must withdraw at least a specified percentage from their 401(k) plans, using IRS tables based on their life expectancy at the time. (Prior to 2020, the …

Traditional 401

- When 401(k) plans became available in 1978, companies and their employees had just one choice: the traditional 401(k).7 Then, in 2006, Roth 401(k)s arrived. Roths are named for former U.S. Senator William Roth of Delaware, the primary sponsor of the 1997 legislation that made the Roth IRA possible.8 While Roth 401(k)s were a little slow to catch on, many employers now offe…