Do beneficiaries pay taxes on life insurance?

The short answer is no, not usually. Beneficiaries generally don’t pay taxes on the proceeds from life insurance. Since beneficiaries don’t have to report the payout as income, it is a tax-free lump sum that they can use freely. However, there are a few aspects to life insurance that won’t get past the tax man.

Is my life insurance part of my taxable estate?

Under the estate tax rules, insurance on your life will be included in your taxable estate if: Your estate is the beneficiary of the insurance proceeds, or You possessed certain economic ownership rights (called “incidents of ownership”) in the policy at your death (or within three years of your death).

Do the beneficiaries of death benefits pay taxes?

There are no immediate taxes for the beneficiary because of its tax-deferred status. A lump sum payment is an option for the spouse. This is a viable alternative for other beneficiaries. If the owner paid for the annuity and received a death benefit, then the beneficiary will be responsible for paying taxes on the difference between the two.

Is interest earned on life insurance taxable?

Interest earnings within a life insurance policy are not taxable as are loans against the policy. However, the entire interest earnings WILL be taxable if the policy lapses for any reason, therefore you will want to contact the customer service dept. of the life insurance company prior to a lapse to find out the amount of interest earnings BEFORE you make such a decision.

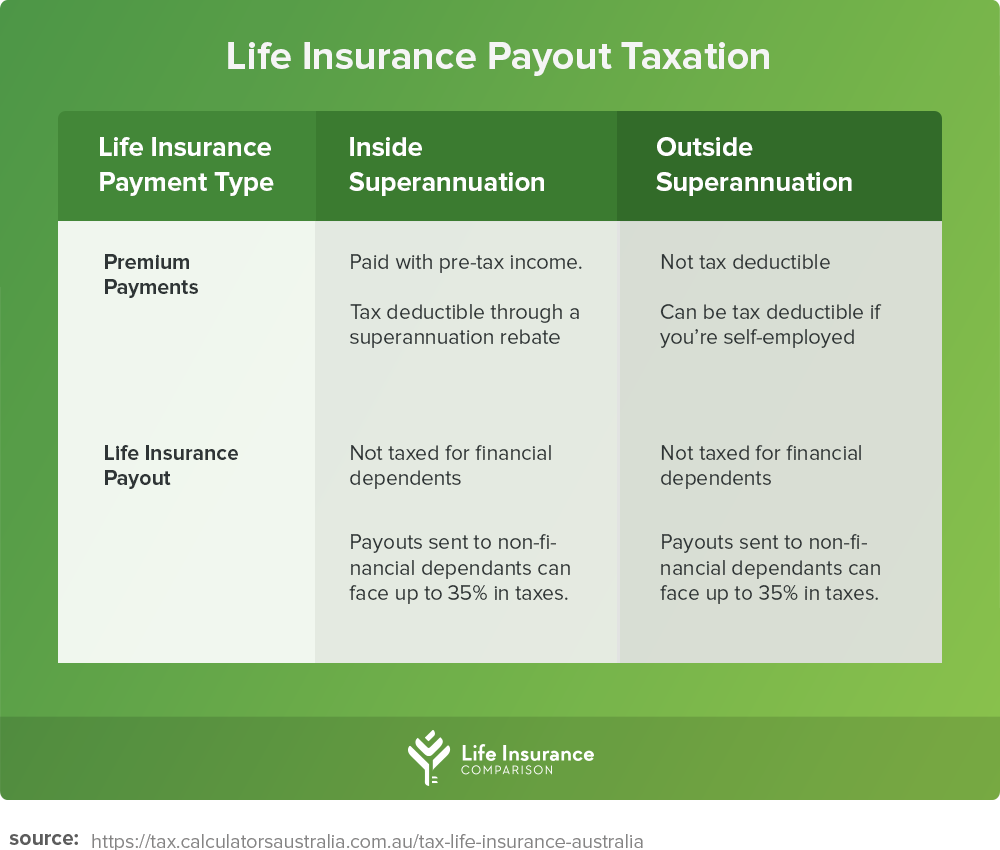

Are Life Insurance Premiums Taxable?

The life insurance premiums you pay are not taxable. They are also not deductible on your tax return.

Do You Pay Inheritance Tax on Life Insurance?

There is no inheritance tax on life insurance. Life insurance death benefits are paid tax-free to your life insurance beneficiaries.

Is There a Penalty for Cashing Out Life Insurance?

If you surrender a cash value life insurance policy, the only “penalty” is that you may have to pay a surrender fee. The life insurance company wil...

When are life insurance proceeds tax-free?

Generally, your beneficiaries can dodge taxes in these situations.

Are life insurance premiums tax-deductible?

Unfortunately premiums aren’t tax-free, even if you’re paying for an individual policy. You also can’t use a Flexible Spending Account (FSA) or Hea...

When is life insurance taxable?

With so much riding on your life insurance, speak with a licensed accountant if you’re still unsure about the tax implications of your specific pol...

What is the unlimited marital deduction?

The unlimited marital deduction is a provision in the federal Estate and Gift Tax Law that allows you to pass any amount of assets to your spouse d...

Life Insurance Death Benefits Are NOT Taxable

Let’s get straight to the point: No, your life insurance policy’s death benefit is not subject to taxes. While that money can be used in ways that trigger a taxable event, the payout itself is not taxable.

How the Money is Used Matters

Depending on how your loved ones use the money from a life insurance death benefit, there can indeed be taxes involved. They just won’t be triggered from the initial payout.

How the Money is Received Matters

Generally, life insurance proceeds are paid out to your loved ones in a lump sum. In some cases, though, you or your beneficiaries can choose an annuity (also known as a life income payout), which will instead spread payments out over a determined period of time.

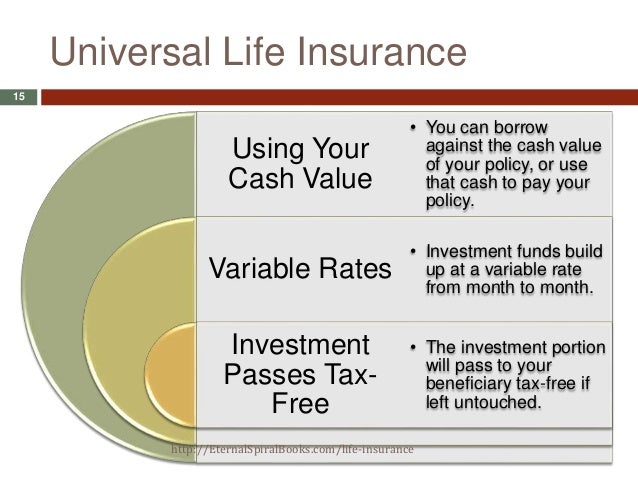

Certain Policy Benefits Can Trigger Taxes

If your life insurance policy builds a cash value over time — as is the case with many whole and universal life policies — you, as the primary insured, can generally borrow from this balance as needed.

Surrendering Your Policy is Taxable

Another benefit to the cash value of permanent life insurance policies is that if you decide to cancel your coverage down the line, you’ll get at least a portion of that money back thanks to the policy’s accumulated cash value .

Bottom Line

Buying life insurance coverage is an excellent way to provide your loved ones with a financial safety net in case something were to happen to you. While there are some caveats, life insurance benefits are generally not subject to taxes, meaning that your beneficiaries can keep every dollar of your policy’s proceeds, when they need it most.

How much money do you owe if you cancel a life insurance policy?

If you cancel your policy, you’ll likely owe taxes on the $30,000 you’ve earned.

How long before death can you transfer a life insurance policy?

Just keep in mind that if you transfer the policy less than three years before your death, it might still be subject to the estate tax. Note that the IRS offers an unlimited marital deduction that allows you to transfer unlimited assets to your spouse, free of any estate or gift taxes.

What happens if you cancel your life insurance policy?

If you decide to cancel your life insurance policy before it matures, you’re eligible to gain access to your accrued cash value minus any surrender fees. This is called a “life insurance surrender,” and as long as your settlement amount is less than the total you paid in premiums, your surrender payout is tax-free.

How to avoid estate tax?

To avoid this tax, consider setting up an irrevocable life insurance trust (ILIT). It will stop the proceeds from your policy from being counted as part of your estate. Just keep in mind that if you transfer the policy less than three years before your death, it might still be subject to the estate tax.

What is an accelerated death benefit rider?

Many life insurance policies offer an accelerated death benefit rider, which allows you to access part of your death benefit while you’re alive if you’re diagnosed with a chronic or terminal illness.

Who is exempt from inheritance taxes?

Life insurance beneficiaries are usually exempt from inheritance taxes —but there is an exception called the Goodman Triangle that may prevent them from receiving the full death benefit. Generally, life insurance policies involve three parties: Person A — the insured. Person B — the policy owner.

Does life insurance pay taxes on interest earned?

In this case, the benefit’s principal avoids taxation, but any interest earned is taxed. So if your $250,000 life insurance benefit gains $25,000 in interest between time of your death and payout, your beneficiaries would likely owe taxes on the accrued $25,000.

How to keep life insurance out of your estate?

One way to keep your life insurance death benefit out of your estate is to transfer ownership to someone else before you die. But be mindful of the three-year rule, which states a policy is still part of your estate if a transfer of ownership occurs within three years of your death.

What happens when you surrender a life insurance policy?

When you surrender a permanent life insurance policy, you’re essentially canceling the coverage, and the insurer pays out the policy’s cash value, minus any surrender fees. The portion of the cash value that exceeds the policy basis is taxable.

Are life insurance dividends taxable?

You don’t typically pay taxes on dividends because the IRS considers them refunds of your premiums. However, if the insurer places the dividends in an interest-bearing account, the gains you receive are subject to income tax. Similarly, if you receive more in dividends than what you’ve already paid in premiums, the difference is typically taxable.

What is the federal estate tax exemption limit?

The federal estate tax exemption limit is $11.58 million, which means if your estate’s total taxable value is greater than this amount, the IRS levies an estate tax. The bottom line is that if you know your estate won’t exceed $11.58 million, you don’t need to worry about this tax. Plus, proceeds left to your spouse are typically exempt from estate tax, even if they exceed the federal limit.

What happens if an insurance company cancels a loan?

If the insurer cancels the policy, it typically uses cash value to repay the loan, and you pay tax on the amount that exceeds the policy basis, which in the above example is $5,000. This is where you can run into trouble. Not only were you struggling to repay the loan, but you’re now also hit with a big tax bill.

Is life insurance tax deductible?

No, most life insurance premiums are not tax deductible. The IRS considers premiums for an individual policy a personal expense.

Is life insurance paid to spouse taxable?

Plus, proceeds left to your spouse are typically exempt from estate tax, even if they exceed the federal limit. However, if you own your life insurance policy when you die, the IRS includes the payout in your estate, regardless of whether you name a beneficiary. This could push your estate’s total taxable value over the federal exemption limit ...

How to remove life insurance from taxable estate?

Using Life Insurance Trusts to Avoid Taxation. A second way to remove life insurance proceeds from your taxable estate is to create an irrevocable life insurance trust (ILIT). To complete an ownership transfer, you cannot be the trustee of the trust and you may not retain any rights to revoke the trust.

What happens when you transfer a life insurance policy?

In transferring the policy, the original owner must forfeit any legal rights to change beneficiaries, borrow against the policy, surrender, or cancel the policy, or select beneficiary payment options. Furthermore, the original owner must not pay the premiums to keep the policy in force.

How to transfer insurance policy?

Here are a few guidelines to remember when considering an ownership transfer: 1 Choose a competent adult/entity to be the new owner (it may be the policy beneficiary), then call your insurance company for the proper assignment, or transfer of ownership, forms. 2 New owners must pay the premiums on the policy. However, you can gift up to $15,000 per person in 2020, so the recipient could use some of this gift to pay premiums. 4 3 You will give up all rights to make changes to this policy in the future. However, if a child, family member, or friend is named the new owner, changes can be made by the new owner at your request. 4 Because ownership transfer is an irrevocable event, beware of divorce situations when planning to name the new owner. 5 Obtain written confirmation from your insurance company as proof of the ownership change.

What happens if you get a death benefit of $500,000?

If the death benefit is $500,000, for example, but it earns 10% interest for one year before being paid out, the beneficiary will owe taxes on the $50,000 growth. According to the IRS, if the life insurance policy was transferred to you for cash or other assets, the amount that you exclude as gross income when you file taxes is limited to ...

Do you pay taxes on life insurance after death?

Usually, there are no taxes owed, when a beneficiary of a life insurance policy receives the death benefit; however, there are a few exceptions. If the policyholder has arranged for the insurance company to hold the policy for a few months before transferring it to the beneficiary, then the interest earned in that interim period would usually be ...

Does a life insurance beneficiary have to pay taxes?

Generally speaking, when the beneficiary of a life insurance policy receives the death benefit, this money is not counted as taxable income, and the beneficiary does not have to pay taxes on it. However, a few situations can exist in which the beneficiary is taxed on some or all of a policy's proceeds. If the policyholder elects not ...

Is life insurance income taxable?

Income earned in the form of interest is almost always taxable at some point. Life insurance is no exception. This means when a beneficiary receives life insurance proceeds after a period of interest accumulation rather than immediately upon the policyholder's death, the beneficiary must pay taxes, not on the entire benefit, but on the interest.

How to contact a life insurance agent about estate taxes?

Connect with a licensed life insurance agent online or by calling 1-855-303-4640. ----------.

What is the difference between permanent and term life insurance?

A permanent (or cash value) life insurance plan provides coverage for the insured person's entire life. They also accumulate cash value over time. Term life insurance. Term life plans provide coverage for a set agreed-upon length of time , called a term. They do not accrue cash value like permanent policies.

Does life insurance have to be reported to the IRS?

An exception is if you receive interest on a benefit — any interest that has been earned must be reported to the IRS and is potentially subject to income tax. There are two main categories of life insurance policies: A permanent (or cash value) life insurance plan provides coverage for the insured person's entire life.

Do death benefits fall under estate tax?

Because the insurance policy increases the estate’s value, the benefits may fall under the estate tax if your estate is large enough.

Is life insurance subject to income tax?

Life Insurance Benefits Not Subject to Income Tax. Here’s the good news. For the most part, the federal government doesn’t tax the proceeds benefits from a life insurance policy.

Is life insurance taxable?

If you’re shopping for a life insurance policy, you may be wondering if life insurance is taxable. Income to the beneficiary is one of the main purposes of a life insurance plan. Typically, the death benefit of a life insurance policy is not subject to income tax. However, some exceptions may apply.

Can you exclude long term care insurance from income?

You can generally exclude from income payments you receive from qualified long-term care insurance contracts as reimbursement of medical expenses received for personal injury or sickness under an accident and health insurance contract.

Is interest received taxable?

However, any interest you receive is taxable and you should report it as interest received. See Topic 403 for more information about interest.

Do you have to report life insurance proceeds?

Answer: Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to report them. However, any interest you receive is taxable and you should report it as interest received.

Do you include disability insurance on your tax return?

If you pay the entire cost of a health or accident insurance plan, don't include any amounts you receive for your disability as income on your tax return.

Can you deduct out of pocket medical expenses?

You may be able to deduct your out-of-pocket expenses for medical care above any reimbursements, if you're eligible to itemize your deductions. You'll need to review Publication 502, Medical and Dental Expenses.

Do you report disability as income?

Answer: You must report as income any amount you receive for your disability through an accident or health insurance plan paid for by your employer: If both you and your employer have paid the premiums for the plan, only the amount you receive for your disability that's due to your employer's payments is reported as income.