A public-benefit nonprofit corporation is a type of nonprofit corporation chartered by a state government, and organized primarily or exclusively for social, educational, recreational or charitable purposes by like-minded citizens.

Why do we became a public benefit corporation?

Why Become a Benefit Corporation? Becoming a benefit corporation has advantages for every stakeholder in your business, from consumers and talent to shareholders and directors. Reduced director liability. Benefit corporation status provides legal protection to balance financial and non-financial interests when making decisions—even in a sale ...

What makes a corporation a nonprofit?

A Nonprofit Corporation is a Corporation whose principal purpose is public benefit and not for producing a profit. A Nonprofit Corporation may not distribute income to benefit its officers and/or directors. More importantly, a Nonprofit Corporation is not an ordinary business and should not be used as an alternative form for a business with the ...

Can a benefit corporation go public?

Yes, the benefit corporation form was designed to protect the mission of a company when it goes public. In February 2017, Laureate Education, the largest degree-granting higher education institution in the world, became the first benefit corporation to go public with an Initial Public Offering (IPO).

What are the advantages of being a public corporation?

What are the Advantages of a Public Company?

- Larger funds: The capital of a public company is generally raised from the public. ...

- Limited liability: The liability of members of a public company is limited. They have to face limited risk.

- Transferability of shares: The shares of a public company are freely transferable. ...

Is a public benefit corporation a 501c3?

Public benefit corporations generally fall under the 501c3 status because of the charitable purpose behind the nonprofit.

Is a benefit corporation nonprofit?

Certified B Corps and Benefit Corporations are neither nonprofits nor hybrid nonprofits. They are for-profit companies that want to consider additional stakeholders, morals or missions in addition to making a profit for their shareholders.

What type of corporation is a public benefit corporation?

A public benefit corporation created by a government, also known as a statutory corporation or government owned corporations, generally provide free or subsidized services or benefits for the public.

What is the difference between nonprofit and public benefit corporation?

A benefit corporation can distribute its profits to its shareholders in the form of dividends. A non-profit corporation has to use its profits to further its charitable purpose.

What is a California nonprofit public benefit corporation?

Under California law, a public benefit corporation must be formed for. public or charitable purposes and may not be organized for the private gain of any person. A public benefit corporation cannot distribute profits, gains, or dividends to any person.

What is the difference between a corporation and a nonprofit?

A corporation is an entity that the law treats as a “person” in the sense of granting it certain rights. Incorporation refers to the actions that form a corporation. A nonprofit is a type of corporation whose structure and purposes differ from a business corporation.

What type of company is a PBC?

What is a public benefit corporation? Public Benefit Corporations or “PBCs” are a type of for-profit corporate entity currently authorized by 35 states and the District of Columbia, similar to a C-corp, S-corp, or LLC.

What is the difference between a PBC and a private company?

Private Business Corporation Allows you to embark in as many business activities because the memorandum of association can list as many business activities as possible. Allows only 3-4 business activities because the PBC statement of incorporation only allows that few business activities to be listed.

Is a public benefit corporation AB corp?

Myth #1 – B Corp and Public Benefit Corporation (PBCs) are the same thing. Wrong. A B Corp is a certification provided to eligible companies by the nonprofit, BLabs. A Public Benefit Corporation is an actual legal entity that bakes into its Certificate of Incorporation a “public benefit”.

Is a 501c6 a nonprofit?

501c3 organizations must serve the public. 501c6 organizations are formed to serve their members. 501(c)(6) organizations, in fact, are often termed as nonprofit membership organizations and non-charitable organizations as well.

What does PBC mean company?

public benefit corporationA public benefit corporation (PBC) is a for profit corporation or domestic cooperative that is intended to produce one or more public benefits and to operate in a responsible and sustainable manner.

What is an example of a public benefit corporation?

In many cases, these corporations offer innovative business models that embed public benefit by design. For example, Broadway Financial (BYFC) is the largest Black-led minority depository institution in the U.S., which in turn can help provide much-needed capital to minority-owned businesses in urban communities.

What is the difference between a non profit and a benefit corporation?

The chief difference between a non-profit corporation and a benefit corporation —sometimes called a B Corporation —is the ownership factor. There are no owners or shareholders in a non-profit company. A benefit corporation, however, does have shareholders who own the company.

What is a benefit corporation?

A benefit corporation, however, does have shareholders who own the company. A traditional non-profit (or not-for-profit) company aims to serve a public benefit without making a profit, as defined by the IRS. If a non-profit company decides to stop doing business and dissolve, it must distribute its assets among other non-profits.

How to create a non profit corporation in Delaware?

Creating a non-profit corporation is a two-step process. First, the organization should form a Delaware Non-Stock company. When preparing your Certificate of Incorporation, you must create a mission statement acceptable to the IRS. It should state the altruistic purpose to which the corporation is dedicated.

How long does it take to get a non profit status?

The second step to forming a non-profit corporation is to submit the proper application to the IRS—within 15 months of entity formation—to request non-profit status. This is accomplished by submitting IRS Form 1023.

How to form a public benefit corporation in Delaware?

To form a public benefit corporation, file a Certificate of Incorporation in the state of Delaware for a General Corporation with a public benefit clause in it. No subsequent filing with the IRS is necessary.

What happens if a non profit company dissolves?

If a non-profit company decides to stop doing business and dissolve, it must distribute its assets among other non-profits. The non-profit company isn’t really owned by anyone because there aren’t any shareholders. However, a benefit corporation (called a public benefit corporation in Delaware) is a specific type of Delaware General Corporation —it ...

What happens to a benefit corporation when it dissolves?

If a benefit corporation decides to stop doing business and dissolves, the shareholders receive the proceeds of the sales of assets, after liabilities are paid. The shareholders of a benefit corporation actually own the company as well as its assets. There are other significant differences between the two entities.

WHAT IS A NONPROFIT PUBLIC BENEFIT CORPORATION?

A Nonprofit Public Benefit Corporation must be formed for public or charitable purposes and cannot be formed for private gain of any individual.

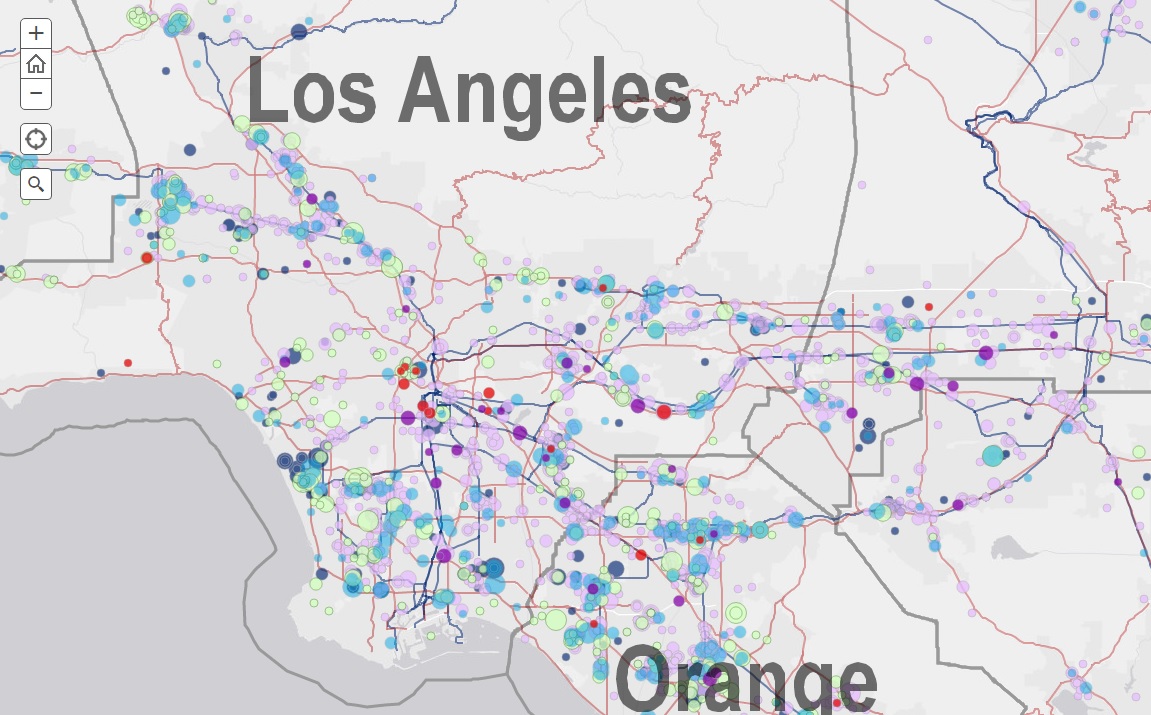

LOS ANGELES BUSINESS LAWYER

If you need to form a nonprofit public benefit corporation, contact a business attorney at The Sterling Firm. We have an attorney experienced in forming nonprofits. We can help! Call now to speak with an attorney!

What is public benefit corporation?

A public benefit corporation is a corporation created specifically to benefit the public in some way. The focus is on both profit and mission alignment. A benefit corporation preserves a company's mission in the following ways: Creates extra options when making choices about liquidation or selling.

When did benefit corporations start?

Many types of companies have grown to be benefit corporations after Maryland passed the first legislation allowing this type of business to be formed in 2010. Benefit corporations presently operating in America come from various industries, including the following:

Why do companies change to benefit corporations?

Changing into a benefit corporation provides companies with more sale options since they can: Encourage competitors based mostly on dedication to mission along with value. Contemplate elements other than value when choosing if they want to sell and who they would sell to.

What are the rights of shareholders in a corporate model?

All of the protections normally in a corporate model are available. Shareholders first have all normal company governance rights. Things like voting on company transactions like mergers or amendments and electing directors fall to them. Any transactions that result in conflict must go through a fairness evaluation any time there is a challenge. This ensures that administrators can't focus on their individual interests over the shareholders’ interests.

Can a third party sue a benefit corporation?

Third parties would not be authorized to sue a benefit corporation until granted by the shareholders.

Is Unilever a member of MPMAC?

Unilever and Danone will soon become members of the MPMAC together with the following companies:

Is a benefit corporation a hybrid?

Benefit corporations are neither nonprofits nor hybrid nonprofits. Benefit corporations are for-profit corporations that need to consider stakeholders, morals, or missions in addition to making a profit for their shareholders. Nonprofits can't be benefit corporations, but they may create one. Due to the public benefit purpose provisions, expanded fiduciary duties of administrators, and extra shareholder rights created within the model benefit corporation laws, this structure may be helpful to operate and scale the earned-income activities of a nonprofit.

What is the difference between a non profit and a benefit corporation?

The chief difference between a non-profit corporation and a benefit corporation—sometimes called a B Corporation—is the ownership factor.

What is a non profit company?

A traditional non-profit (or not-for-profit) company aims to serve a public benefit without making a profit, as defined by the IRS. If a non-profit company decides to stop doing business and dissolve, it must distribute its assets among other non-profits.

Why is a non profit company not owned by anyone?

The non-profit company isn’t really owned by anyone because there aren’t any shareholders.

Is personal gain prohibited in a non profit?

There are other significant differences between the two entities. Personal gain is prohibited in a non-profit corporation, except as the benefits of membership imply; in fact, the express purpose of a non-profit corporation’s existence is to serve a public benefit without making a profit.

Is a C corporation a benefit corporation?

Many C corporations and S corporations already commit some of their profits to charitable events and endeavors, without the legal distinction of being a benefit corporation.

Why is public confidence important for nonprofits?

For a nonprofit that seeks to finance its operations through donations, public confidence is a factor in the amount of money that a nonprofit organization is able to raise. The more nonprofits focus on their mission, the more public confidence they will have. This will result in more money for the organization.

What is the difference between a non profit and a non profit?

Another difference between nonprofit organizations and not-for-profit organizations is their membership. Nonprofits have volunteers or employees who do not receive any money from the organization's fundraising efforts.

What is an NPO?

Unsourced material may be challenged and removed. A nonprofit organization ( NPO ), also known as a non-business entity, not-for-profit organization, or nonprofit institution, is a legal entity organized and operated for a collective, public or social benefit, in contrast with an entity that operates as a business aiming to generate a profit ...

Why are NPOs so bad?

Resource mismanagement is a particular problem with NPOs because the employees are not accountable to anyone who has a direct stake in the organization. For example, an employee may start a new program without disclosing its complete liabilities. The employee may be rewarded for improving the NPO's reputation, making other employees happy, and attracting new donors. Liabilities promised on the full faith and credit of the organization but not recorded anywhere constitute accounting fraud. But even indirect liabilities negatively affect the financial sustainability of the NPO, and the NPO will have financial problems unless strict controls are instated. Some commenters have argued that the receipt of significant funding from large for-profit corporations can ultimately alter the NPO's functions. A frequent measure of an NPO's efficiency is its expense ratio (i.e. expenditures on things other than its programs, divided by its total expenditures).

What are the key aspects of a nonprofit?

The key aspects of nonprofits are accountability, trustworthiness, honesty , and openness to every person who has invested time, money, and faith into the organization. Nonprofit organizations are accountable to the donors, founders, volunteers, program recipients, and the public community.

What are the three conditions of a nonprofit organization?

There are three important conditions for effective mission: opportunity, competence, and commitment.

How are nonprofit organizations formed?

In the United States, nonprofit organizations are formed by filing bylaws or articles of incorporation or both in the state in which they expect to operate. The act of incorporation creates a legal entity enabling the organization to be treated as a distinct body (corporation) by law and to enter into business dealings, form contracts, and own property as individuals or for-profit corporations can.

Formation Differences

Fundraising Differences

- Non-profit companies raise money through donations and fundraising activities. If approved by the IRS as a 501c company, the individual donors may deduct their contributions from their ordinary income on their federal tax returns, but they cannot profit from or receive anything of value for their contributions. Delaware public benefit corporations can raise money by selling sto…

Reporting on Progress

- Non-profit companies are not required to report progress to their members but they often do so in order to raise money from donors and members. Delaware Public Benefit Corporations are obligated to complete a biennial report to shareholders, which outlines the corporation’s progress toward its public benefit purpose. However, they are not compelled to share the required biennia…

Federal Taxation Differences

- A non-profit company is tax exempt under Federal Income Tax Law. Since it has no profit, it pays no taxes. It is required to file a tax form each year (IRS Form 990), which is public record and includes information about the company’s finances and Board of Directors. By contrast, a benefit corporation pays taxes on its profits, like any other U.S. ...

Delaware Franchise Tax Differences

- A non-profit company pays only $25 annually in Delaware, and files an annual report; this report is an informational form that lists the names and addresses of the Board of Directors and officers but does not include any financial information. A Delaware PBC is a Delaware corporation, which means it must pay annual Franchise Taxto the state of Delaware based on the number of share…

Structure

- Non-profit corporations are, structurally, non-stock corporations, which means non-profit corporations do not have any shareholders. They are managed by a Board of Directors, sometimes called a Board of Trustees. The Board may elect its own successors (called a perpetual Board) or they may be elected by the members, depending on the structure outlined in …

Stock Certificates

- Another difference between non-profit corporations and benefit corporations is that the stock certificatesof the latter must be clearly marked with the words “Benefit Corporation.” A non-profit company has no shareholders and therefore no stock certificates.

Examples of Non-Profit Corporations

- Some examples of successful non-profit corporations are: 1. Museum of Modern Art 2. Human Rights Campaign 3. Sierra Club 4. Humane Society of the United States 5. Boy Scouts and Girl Scouts 6. Smithsonian Institute 7. Ted Talks 8. World Wildlife Fund 9. PBS 10. Best Friends Animal Society 11. American Civil Liberties Union 12. Susan G. Komen Breast Cancer Foundation On a s…

Examples of Public Benefit Corporations