What is cost-benefit analysis in project management?

Cost-benefit analysis is a relatively straightforward tool for deciding whether to pursue a project. To use the tool, first list all the anticipated costs associated with the project, and then estimate the benefits that you'll receive from it. Where benefits are received over time, work out the time it will take for the benefits to repay the costs.

How can the cost-benefit analysis make decisions less complex?

By reducing a decision to costs versus benefits, the cost-benefit analysis can make them less complex.

What are the limitations of cost-benefit analysis?

It’s difficult to predict all variables: While cost-benefit analysis can help you outline the projected costs and benefits associated with a business decision, it’s challenging to predict all the factors that may impact the outcome.

What is the history of cost-benefit analysis?

Jules Dupuit, a French engineer and economist, introduced the concepts behind CBA in the 1840s. It became popular in the 1950s as a simple way of weighing up project costs and benefits, to determine whether to go ahead with a project.

Is cost-benefit analysis a tool?

By providing an unclouded view of the consequences of a decision, cost benefit analysis is an invaluable tool in developing business strategy, evaluating a new hire, or making resource allocation or purchase decisions.

How accurate is cost-benefit analysis?

Many studies argue that CBA is ineffective and often inappropriate in the areas of safety, health, and environmental regulations (Kornhauser, 2000). Indeed, some CBA factors cannot be accurately measured or quantified.

Why cost benefit tool is useful?

The Purpose of Cost-Benefit Analysis There are two main purposes in using CBA: To determine if the project business case is sound, justifiable and feasible by figuring out if its benefits outweigh costs. To offer a baseline for comparing projects by determining which project's benefits are greater than its costs.

Why is cost-benefit analysis controversial?

Distributional issues have long been a favorite target of critics of cost- benefit analysis. Their objection, in a nutshell, is that because willingness to pay is based on income, cost-benefit analysis assigns unjustifiably large decision weight to high-income persons.

What are the disadvantages of cost-benefit analysis?

Sometimes a cost-benefit analysis turns into a project budget and leads to unrealistic goals and errors. The Cost-benefit analysis estimates the value over some time and can cause serious miscalculations in present value. This leads to inaccurate analysis.

What are the pros cons of a company using cost-benefit analysis?

Advantage: Clarity in Unpredictable Situations. ... Disadvantage: Does Not Account for All Variables. ... Advantage: Helps You Make Rational Decisions. ... Disadvantage: Removes Gut Instinct.

What is the main purpose of cost-benefit analysis?

A cost-benefit analysis is the process of comparing the projected or estimated costs and benefits (or opportunities) associated with a project decision to determine whether it makes sense from a business perspective.

What are the advantages of CBA?

Provides a competitive advantage Cost-benefit analysis can help companies develop an advantage over competing businesses because it can help them quickly create innovative ideas and determine how they can stay relevant in the current market.

What is cost-benefit analysis why it is so important?

Key Takeaways. Cost-benefit analyses help businesses weigh pros and cons in a data-driven way so they can make complex decisions in a systematic manner. For a successful CBA, leaders need to identify and project the explicit and implicit costs and benefits of a proposed action or investment.

What are alternatives to cost-benefit analysis?

Positional analysis (PA) as an alternative to CBA is built on institutional theory and a different set of assumptions about human beings, organizations, markets, etc. Sustainable development (SD) is a multidimensional concept that includes social and ecological dimensions in addition to monetary aspects.

Why cost-benefit analysis Cannot be applied in all policy making of the government?

One difficulty with cost-benefit analysis is that every government agency has an incentive to estimate favourable ratios for its own projects. It must, after all, compete with other agencies for funds. No one can be certain as to the returns to be expected from an irrigation canal or a highway.

How can cost-benefit analysis be improved?

It's possible to improve upon cost-benefit analysis by using social welfare functions to evaluate governmental policy. The social-welfare-function framework is already used in some areas of economic scholarship, although not (yet) in governmental practice.

Why is cost benefit analysis useful?

This makes it useful for higher-ups who want to evaluate their employees’ decision-making skills, or for organizations who seek to learn from their past decisions — right or wrong .

How is the cost and benefit tool used?

It’s made possible by placing a monetary value on both the costs and benefits of a decision. Some costs and benefits are easy to measure since they directly affect the business in a monetary way.

What is cost benefit ratio?

Cost benefit ratio is the ratio of the costs associated with a certain decision to the benefits associated with a certain decision. It’s more commonly known as benefit cost ratio, in which case the ratio is reversed (benefits to costs, instead of costs to benefits). Since both costs and benefits can be expressed in monetary terms, ...

Is cost benefit analysis a guiding tool?

In these cases, consider cost benefit analysis as a guiding tool, but look to other business analysis techniques to support your conclusion.

Can cost benefit ratios be numerically expressed?

Since both costs and benefits can be expressed in monetary terms, these ratios can also be expressed numerically. As a result, cost benefit or benefit cost ratios lend themselves well to comparison, which is why cost benefit analysis can be used to compare two or more definitions. The process is simple. For each decision or path in question, ...

How to use the Benefits Analysis tool?

To use the tool, first list all the anticipated costs associated with the project, and then estimate the benefits that you'll receive from it. Where benefits are received over time , work out the time it will take for the benefits to repay the costs. You can carry out an analysis using only financial costs and benefits.

When did cost benefit analysis become popular?

It became popular in the 1950s as a simple way of weighing up project costs and benefits, to determine whether to go ahead with a project. As its name suggests, Cost-Benefit Analysis involves adding up the benefits of a course of action, and then comparing these with the costs associated with it. The results of the analysis are often expressed as ...

What is CBA in finance?

CBA is a quick and simple technique that you can use for non-critical financial decisions. Where decisions are mission-critical, or large sums of money are involved, other approaches – such as use of Net Present Values and Internal Rates of Return – are often more appropriate.

Is it difficult to predict revenues?

This step is less straightforward than step two! Firstly, it's often very difficult to predict revenues accurately, especially for new products. Secondly, along with the financial benefits that you anticipate, there are often intangible, or soft, benefits that are important outcomes of the project.

What is cost benefit analysis?

A cost benefit analysis (also known as a benefit cost analysis) is a process by which organizations can analyze decisions, systems or projects, or determine a value for intangibles. The model is built by identifying the benefits of an action as well as the associated costs, and subtracting the costs from benefits.

Why do organizations use cost benefit analysis?

Organizations rely on cost benefit analysis to support decision making because it provides an agnostic, evidence-based view of the issue being evaluated—without the influences of opinion, politics, or bias. By providing an unclouded view of the consequences of a decision, cost benefit analysis is an invaluable tool in developing business strategy, ...

What are the risks and uncertainties of cost benefit analysis?

These risks and uncertainties can result from human agendas, inaccuracies around data utilized, and the use of heuristics to reach conclusions.

What is sensitivity analysis?

Kaplan recommends performing a sensitivity analysis (also known as a “what-if”) to predict outcomes and check accuracy in the face of a collection of variables. “Information on costs, benefits, and risks is rarely known with certainty, especially when one looks to the future,” Dr. Kaplan says. “This makes it essential that sensitivity analysis is carried out, testing the robustness of the CBA result to changes in some of the key numbers.”#N#EXAMPLE of Sensitivity Analysis#N#In trying to understand how customer traffic impacts sales in Bob’s Pie Shop, in which sales are a function of both price and volume of transactions, let’s look at some sales figures:

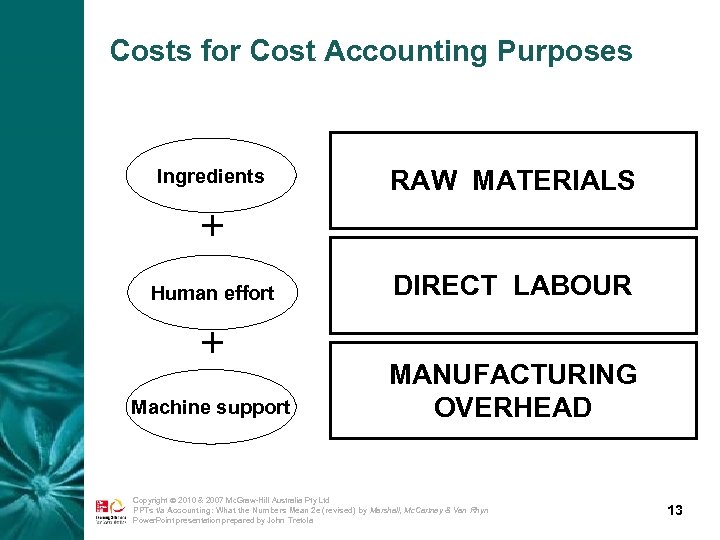

What is the difference between tangible and intangible costs?

Tangible costs are easy to measure and quantify, and are usually related to an identifiable source or asset, like payroll, rent, and purchasing tools. Intangible cost s are difficult to identify and measure, like shifts in customer satisfaction, and productivity levels.

What is direct cost?

Direct costs are often associated with production of a cost object (product, service, customer, project, or activity) Indirect costs are usually fixed in nature, and may come from overhead of a department or cost center.

Who developed the evaluation process?

Dupuit outlined the principles of his evaluation process in an article written in 1848, and the process was further refined and popularized in the late 1800s by British economist Alfred Marshall, author of the landmark text, Principles of Economics (1890).

What is cost benefit analysis?

Cost-benefit analysis is a form of data-driven decision-making most often utilized in business, both at established companies and startups. The basic principles and framework can be applied to virtually any decision-making process, whether business-related or otherwise.

What are the limitations of cost-benefit analysis?

Limitations of Cost-Benefit Analysis 1 It’s difficult to predict all variables: While cost-benefit analysis can help you outline the projected costs and benefits associated with a business decision, it’s challenging to predict all the factors that may impact the outcome. Changes in market demand, materials costs, and global business environment can occasionally be fickle and unpredictable, especially in the long term. 2 It’s only as good as the data used to complete it: If you’re relying on incomplete or inaccurate data to finish your cost-benefit analysis, the results of the analysis will be similarly inaccurate or incomplete. 3 It’s better suited to short- and mid-length projects: For projects or business decisions that involve longer timeframes, cost-benefit analysis has greater potential of missing the mark, for several reasons. It typically becomes more difficult to make accurate predictions the further out you go. It’s also possible that long-term forecasts will not accurately account for variables such as inflation, which could impact the overall accuracy of the analysis. 4 It removes the human element: While a desire to make a profit drives most companies, there are other, non-monetary reasons an organization might decide to pursue a project or decision. In these cases, it can be difficult to reconcile moral or “human” perspectives with the business case.

What happens if you don't give all the costs and benefits a value?

If you don’t give all the costs and benefits a value, then it will be difficult to compare them accurately. Direct costs and benefits will be the easiest to assign a dollar amount to. Indirect and intangible costs and benefits, on the other hand, can be challenging to quantify.

What are intangible costs?

Intangible Costs: These are any costs that are difficult to measure and quantify. Examples may include decreases in productivity levels while a new business process is rolled out, or reduced customer satisfaction after a change in customer service processes that leads to fewer repeat buys.

What are indirect costs?

Other cost categories you must account for include: Indirect Costs: These are typically fixed expenses, such as utilities and rent, that contribute to the overhead of conducting business. Intangible Costs: These are any costs that are difficult to measure and quantify.

How to make an analysis more accurate?

1. Establish a Framework for Your Analysis. For your analysis to be as accurate as possible, you must first establish the framework within which you’re conducting it. What, exactly, this framework looks like will depend on the specifics of your organization.

Is cost benefit analysis difficult?

It’s difficult to predict all variables: While cost-benefit analysis can help you outline the projected costs and benefits associated with a business decision, it’s challenging to predict all the factors that may impact the outcome. Changes in market demand, materials costs, and global business environment can occasionally be fickle and unpredictable, especially in the long term.