Extended layoff benefits are another type of payment considered as a supplement to unemployment insurance benefits. Such payments are not wages for benefit eligibility purposes and they do not render the claimant ineligible under Section 1279.

Full Answer

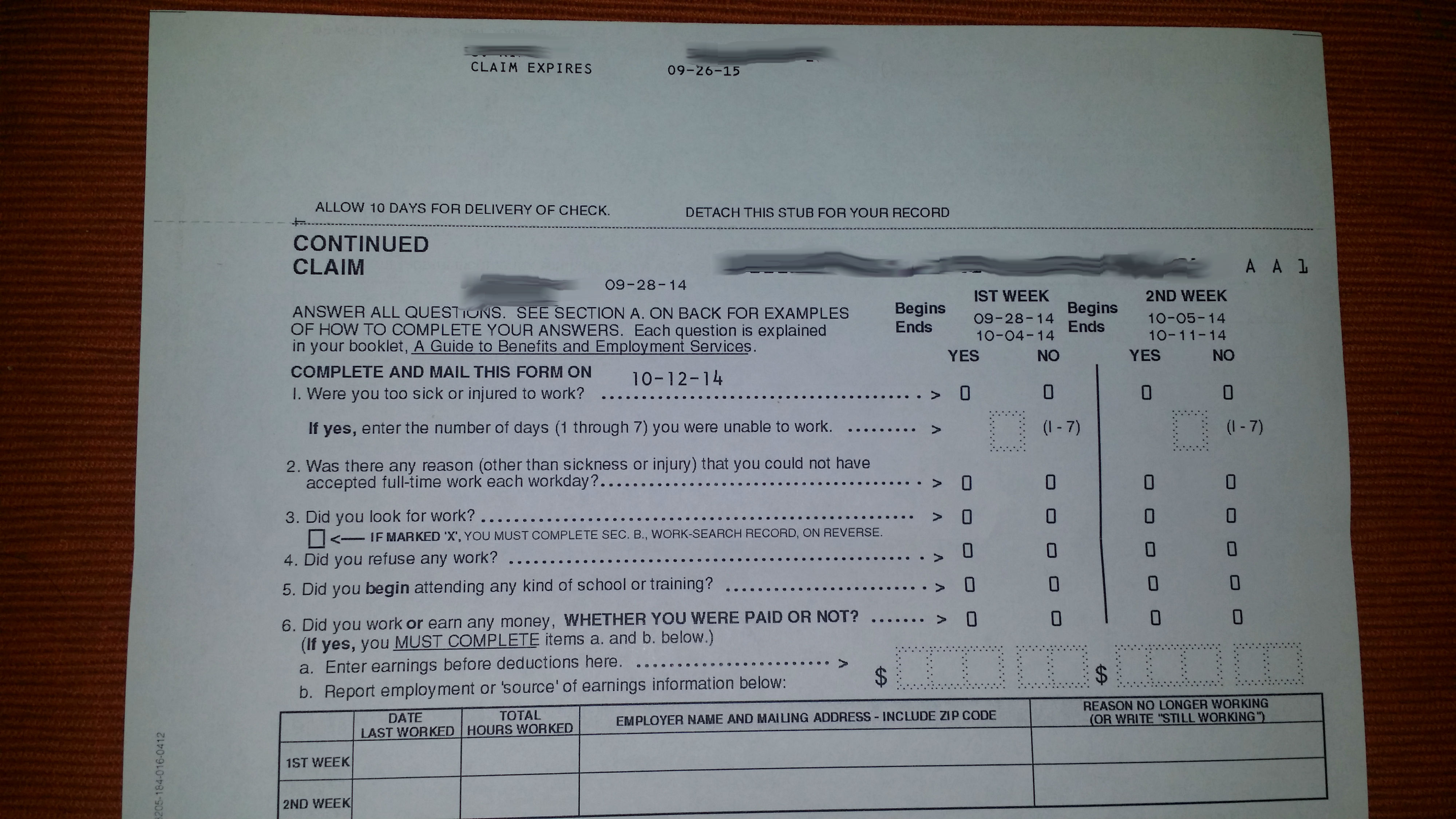

How to certify Edd benefits?

Submit your certification using one of the following:

- Online: UI Online.

- By phone: EDD Tele-Cert.

- By mail: Complete, sign, and mail the paper form.

When will Edd start paying?

“The EDD will begin processing Lost Wages Assistance payments in phases for eligible individuals in the week beginning Sept. 7, 2020,” the EDD said in a disclosure that was tucked away at the end...

Is Edd behind in payments?

There are backlogs in both initial claims and continued claims, the latter of which just means claimants who have received one payment but not subsequent ones. EDD gives three reasons for initial claim delays. According to EDD, initial claims that are currently pending have been backlogged for one of these reasons:

How do I check my unemployment benefits?

Welcome to the CT Unemployment Benefits Center

- File your weekly claim (Sun - Fri only)

- Check status of weekly claim or manage your account

- Select a benefits payment option

- Get tax info (1099G form)

Do I qualify for the additional $300 in federal benefits during the COVID-19 pandemic?

The additional $300/week in Federal Pandemic Unemployment Compensation is available to claimants receiving unemployment benefits under the state or federal regular unemployment compensation programs (UCFE, UCX, PEUC, PUA, EB, STC, TRA, DUA, and SEA). The funds are available for any weeks of unemployment beginning after Dec. 26, 2020, and ending on or before March 14, 2021. You don’t need to apply separately to receive this supplemental amount.

What is the Pandemic Emergency Unemployment Compensation Program for COVID-19?

See full answerTo qualify for PUA benefits, you must not be eligible for regular unemployment benefits and be unemployed, partially unemployed, or unable or unavailable to work because of certain health or economic consequences of the COVID-19 pandemic. The PUA program provides up to 39 weeks of benefits, which are available retroactively starting with weeks of unemployment beginning on or after January 27, 2020, and ending on or before December 31, 2020.The amount of benefits paid out will vary by state and are calculated based on the weekly benefit amounts (WBA) provided under a state's unemployment insurance laws.

Is there additional relief available if my regular unemployment compensation benefits do not provide adequate support?

See full answerThe new law creates the Federal Pandemic Unemployment Compensation program (FPUC), which provides an additional $600 per week to individuals who are collecting regular UC (including Unemployment Compensation for Federal Employees (UCFE) and Unemployment Compensation for Ex-Servicemembers (UCX), PEUC, PUA, Extended Benefits (EB), Short Time Compensation (STC), Trade Readjustment Allowances (TRA), Disaster Unemployment Assistance (DUA), and payments under the Self Employment Assistance (SEA) program). This benefit is available for weeks of unemployment beginning after the date on which your state entered into an agreement with the U.S. Department of Labor and ending with weeks of unemployment ending on or before July 31, 2020.

Can I remain on unemployment if my employer has reopened?

No. As a general matter, individuals receiving regular unemployment compensation must act upon any referral to suitable employment and must accept any offer of suitable employment. Barring unusual circumstances, a request that a furloughed employee return to his or her job very likely constitutes an offer of suitable employment that the employee must accept.

Who can get Paxlovid?

The FDA has authorized Paxlovid for anyone age 12+ who is at high risk for developing a severe case of COVID-19.

How often can you take Paxlovid?

“With Paxlovid, you take three pills, twice a day, for a total of five days," says Rachel Kenney, a pharmacist at Henry Ford Health. "It helps your body fight off the virus, preventing it from replicating before it becomes serious.”

What kinds of relief does the CARES Act provide for people who are about to exhaust regular unemployment benefits?

Under the CARES Act states are permitted to extend unemployment benefits by up to 13 weeks under the new Pandemic Emergency Unemployment Compensation (PEUC) program.

What if an employee refuses to come to work for fear of infection?

Your policies, that have been clearly communicated, should address this.Educating your workforce is a critical part of your responsibility.Local and state regulations may address what you have to do and you should align with them.

Are individuals eligible for PUA if they quit their job because of the COVID-19 pandemic?

There are multiple qualifying circumstances related to COVID-19 that can make an individual eligible for PUA, including if the individual quits his or her job as a direct result of COVID-19. Quitting to access unemployment benefits is not one of them.

Are self-employed, independent contractor and gig workers eligible for the new COVID-19 unemployment benefits?

See full answerSelf-employed workers, independent contractors, gig economy workers, and people who have not worked long enough to qualify for the other types of unemployment assistance may still qualify for PUA if they are otherwise able to work and available for work within the meaning of the applicable state law and certify that they are unemployed, partially unemployed or unable or unavailable to work for one of the following COVID-19 reasons:You have been diagnosed with COVID-19, or have symptoms, and are seeking a medical diagnosis.A member of your household has been diagnosed with COVID-19.You are caring for a family member of a member of your household who has been diagnosed with COVID-19.A child or other person in your household for whom you have primary caregiving responsibility is unable to attend school or another facility that is closed as a direct result of COVID-19 and the school or facility care is required for you to work.

Can I get unemployment assistance if I am partially employed under the CARES Act?

A gig economy worker, such as a driver for a ride-sharing service, is eligible for PUA provided that he or she is unemployed, partially employed, or unable or unavailable to work for one or more of the qualifying reasons provided for by the CARES Act.

Can an employee's temperature be taken by the employer when they report for work?

Businesses should follow CDC and FDA guidance for screening employees who have been exposed to COVID-19.Pre-screen employees for symptoms or fever before starting work.Employees with fever and symptoms should be advised to see a doctor for evaluation and should be deferred to Human Resources for next steps.

What are supplemental unemployment benefits (SUB)?

Supplemental unemployment benefits (SUB) are tax benefits paid out to terminated employees due to training, illness or injury, Reduction in Force (...

How do you apply for supplemental unemployment benefits?

Laid-off employees are required to file a claim with the unemployment insurance office in the state where they worked.

How long will the supplemental unemployment last?

Supplemental unemployment benefits last until the employee is rehired or finds alternative work.

Are supplemental unemployment benefits taxable?

Supplemental unemployment benefits are exempt from payroll taxes (FICA, FUTA, SUTA) but subject to federal and state income taxes.

How long can a company furlough an employee?

Employees can be furloughed until the company for which they work reopens.

What can't a SUB plan provide for?

Termination for cause or resignation.

What is EDD in California?

The EDD provides a variety of support services to people who have lost their jobs, had their hours reduced, or had their businesses affected due to the impacts of COVID-19 in California. Learn More >

How often do you need to certify for unemployment?

You certify for benefits by providing us your eligibility every two weeks. Register and create an account with Benefit Programs Online. You can access your UI Online account to certify for benefits.

How long does it take to reopen unemployment?

If you had an active claim and stopped certifying for continued benefits, you can reopen an unemployment insurance claim if it was filed within the last 52 weeks and you have not exhausted your benefits. Save Time.

What is a SUB in unemployment?

Supplemental unemployment benefits (SUB) are tax benefits paid out to terminated employees due to training, illness or injury, Reduction in Force (RIF), or temporary layoff. These benefits are a supplemental income to state unemployment benefits and are exempt from payroll taxes.

How to apply for sub pay?

How to apply for SUB: To receive SUB pay, former employees must be eligible for state unemployment benefits and willing participants of their employer's SUB plan. They are also required to file a claim with the unemployment insurance office in the state where they worked (SUB rules may differ depending on the state you are in).

What is the EDD in California?

California’s Employment Development Department (EDD) manages the Unemployment Insurance (UI) and State Disability Insurance (SDI) programs for the State of California. This includes all the systems, programs and processing of unemployment claims funded at a state and federal level. Many of the federally funded enhanced unemployment benefit programs ...

When will the extra 300 unemployment end in California?

So it is highly likely that claimants in CA will keep ALL pandemic unemployment benefits, including the extra $300 weekly payment, until the current program end date which would be the week ending September 4th, 2021.

What is the 900 billion unemployment package?

27, 2020, which among several other pandemic relief measures extends and provides additional federal funding for enhanced unemployment benefits. This includes the Pandemic Unemployment Assistance ( PUA ), Pandemic Emergency Unemployment Compensation ( PEUC) and a reinstatement, but halving of the Federal Pandemic Unemployment Compensation (FPUC) Program which provides a $300 supplemental weekly unemployment payment. The PUA and PEUC program will be extended by 11 weeks, for a total of 57 weeks of PUA and 24 weeks in PEUC benefits

How many weeks of PUA benefits are there?

If you received your last benefit payment for weeks you spent unemployed between February 2 and March 21, but are still within the one year that your claim is good for, you could be eligible for 13 weeks of PUA benefits for the weeks you are eligible for between February 2, 2020 and March 28, 2020.

How long will the 300 unemployment payment last?

Payments for the $300 weekly payment will continue until early September for a total of 25 weeks and eligible claimants – those getting at least $1 from state and federal unemployment programs – can get a maximum of $7,500 if they qualify for all weeks covered in this new extension.

How often do you have to certify for unemployment?

After your extension is filed, you will need to certify for benefit payments. Certifying is answering basic questions every two weeks that tells us you’re still unemployed and eligible to continue receiving payments. Payments will be the same as the weekly benefit amount from your regular UI claim.

When will the $300 unemployment be paid out?

The Lost Wages Assistance program provided an extra $300 per week in addition to your unemployment benefits if you received (existing) unemployment benefits for any weeks between July 26 and September 5, 2020. This program has now been paid out, other than retroactive payments to claimants who were eligible or working through payment issues.

How Do Supplemental Unemployment Benefits Plans Work?

SUBs got popular in the ‘50s as a way to help workers in industries with cyclical employment patterns get a more steady income. SUBs were often fought for in collective bargaining agreements. They’re growing in popularity again across industries.

Benefits of SUB Plans for Employers

The main benefit for employers is that they avoid the pain of a lump sum severance payment. This will be especially helpful if your business just went through a painful downsizing and cash reserves are low or nonexistent.

Drawbacks of SUB Plans for Employers

Creating an SUB plan can require a lot of administration and it can’t be used in all situations (which means you may have to develop different versions—again, it can be a time suck). The viability of the strategy is very dependent on state-specific rules. And it’s not easy to create a SUB plan quickly.

How Do You Create an SUB Fund?

SUB plans can be funded entirely by an employer or by employees, or by some mix. The standard plan is entirely employer funded, with individual funds for each worker. These replace normal severance payments. Employee-funded SUB plans are different, contributions being shared into a collective fund for all employees.

Paycor is Here for You

Paycor builds HR software for leaders of medium & small business. For 30 years, we’ve been listening to and partnering with leaders, so we know what they need: HCM technology that saves time, powerful analytics and expert HR advice to help them solve problems and achieve their goals.

How much is the extra unemployment payment?

Further the extra unemployment payment amount will range between $300 and $400, depending on how much states can fund their portion of the payment.

When will the unemployment stimulus be extended?

It includes further unemployment program extensions until September 6th, 2021 for the PUA, PEUC and FPUC programs originally funded under the CARES act in 2020 and then extended via the CAA COVID Relief Bill. The need for another unemployment stimulus was reinforced by the prevailing high unemployment situation in many parts of the country due to the ongoing COVID related economic fallout.

How much is the stimulus package for 2021?

This provides another 25 weekly payments for a maximum of $7,500.

When will the $300 supplement be extended?

This amount is the same as the $300 weekly supplement approved under the CAA COVID relief bill (discussed in earlier updates below) was funded until March 14th, 2021 but will now be extended through to week ending September 4th, 2021. This provides another 25 weekly payments for a maximum of $7,500.

Is the $10,200 unemployment tax taxable?

Another valuable provision in the ARP bill for unemployed workers is to make the first $10,200 in unemployment payments non-taxable to prevent the surprise tax bills many jobless Americans faced in 2020 when filing their tax return. The provision will only be applicable to households with incomes under $150,000 and is only available for 2020 unemployment benefit payments. See how this could impact you if you already filed a return.

Is unemployment retroactive?

Are unemployment benefits in the stimulus retroactive. Yes, it is expected that unemployment benefits – both supplementary and extended – would be retroactive to the start of the program or latest extension, so many eligible recipients should get a pretty significant unemployment check payment if and when Congress passes the stimulus relief bill.

What is mixed earner unemployment?

The mixed earner and unemployment compensation is meant to supplement the incomes of freelancers and gig workers who also happen to rely on traditional W-2 income. An example of who this applies to would be a freelance photographer who buses tables on the side.

How long is the ARPA unemployment extension?

The period between March 14 and Sept. 6 spans 25 weeks.

How long does ARPA pay unemployment?

ARPA also increased the maximum period of benefits from 50 weeks to 79 weeks. If you are on unemployment and are not receiving the extra $300 a week, alert your state unemployment system. You are owed some money!

When will the 300 federal stimulus be extended?

The $300 federal benefits will continue through Sept. 6, 2021. Though the way Congress is printing money for COVID-19 relief, another extension is not out of the question. Ironically, Sept. 6 is Labor Day.

Do you have to be on unemployment to get the extra 300?

To be eligible for the $300 a week benefit, you need to be receiving unemployment benefits from any of these programs: Payments under the Self-Employment Assistance (SEA) program. Low-wage, part-time or seasonal workers may fail to quali fy for the extra $300.

Is unemployment taxed?

Unemployment benefits are generally taxable. Most states do not withhold taxes from unemployment benefits voluntarily, but you can request they withhold taxes. But under ARPA, $10,200 of unemployment benefits from 2020 will be tax-free for households with a combined income of less than $150,000 (not counting unemployment benefits).