What qualifies as a fringe benefit?

Fringe benefits are the additional benefits offered to an employee, above the stated salary for the performance of a specific service. Some fringe benefits such as social security. Social Security Social Security is a US federal government program that provides social insurance and benefits to people with inadequate or no income. The first Social.

Should you still offer health insurance as a benefit?

You may want to provide the best health insurance possible, but you must be assured you can sustain that level as a company. If you overpromise and stretch to deliver what you’ve sold, you’ll eventually find yourself needing to downgrade.

Which fringe benefits are taxable and nontaxable?

- Employee discounts

- Employee stock options

- Group-term life insurance

- Retirement planning services

- Job-related education assistance reimbursements

What are some examples of common fringe benefits?

What Are Some Examples of Common Fringe Benefits?

- Understanding Fringe Benefits. Most employers offer their employees competitive wages and salaries. ...

- Insurance Coverage. The most common fringe benefits offered to employees include combinations of insurance coverage. ...

- Retirement Plan Contributions. ...

- Dependent Assistance. ...

- Bonus Compensation. ...

- Other Fringe Benefits. ...

- Fringe Benefits FAQs. ...

- The Bottom Line. ...

What are the 7 fringe benefits?

These include health insurance, life insurance, tuition assistance, childcare reimbursement, cafeteria subsidies, below-market loans, employee discounts, employee stock options, and personal use of a company-owned vehicle.

Which type of health insurance is a common fringe benefit?

The most common fringe benefits offered to employees include combinations of insurance coverage. Typically, employers offer up to $50,000 of group term life insurance, short- and long-term disability coverage, and health insurance options.

Is medical considered a fringe benefit?

Non-taxable fringe benefits include health insurance, medical expense reimbursements, health flexible spending accounts, dental insurance, education assistance, retirement planning services, job-related tuition assistance reimbursements, and day care assistance.

What's included in fringe benefits?

Fringe benefits are allowances and services provided by employers to their employees as compensation in addition to regular salaries and wages. Fringe benefits include, but are not limited to, the costs of leave (vacation, family-related, sick or military), employee insurance, pensions, and unemployment benefit plans.

What fringe benefits are not taxable?

Nontaxable fringe benefits can include adoption assistance, on-premises meals and athletic facilities, disability insurance, health insurance, and educational assistance.

What are examples of taxable fringe benefits?

Examples of taxable fringe benefits include:Bonuses.Vacation, athletic club membership, or health resort expenses.Value of the personal use of an employer-provided vehicle.Amounts paid to employees for moving expenses in excess of actual expenses.Business frequent-flyer miles converted to cash.More items...•

Do health insurance premiums reduce taxable income?

Employer-paid premiums for health insurance are exempt from federal income and payroll taxes. Additionally, the portion of premiums employees pay is typically excluded from taxable income. The exclusion of premiums lowers most workers' tax bills and thus reduces their after-tax cost of coverage.

Is health insurance reimbursement considered income?

No. Unlike a healthcare stipend, with a health insurance reimbursement, employers don't have to pay payroll taxes and employees don't have to recognize income tax. In addition, reimbursements made by the company count as a tax deduction.

Are health insurance premiums deducted from payroll pre tax or post tax?

pre-taxMedical insurance premiums are deducted from your pre-tax pay. This means that you are paying for your medical insurance before any of the federal, state, and other taxes are deducted.

Which of the following is a fringe benefit excluded from income?

IRC Sec. 132 defines the following nontaxable fringe benefits: no-additional-cost services, qualified employee discounts, de minimis benefits, working condition fringe benefits, qualified transportation fringe benefits, and qualified retirement planning services.

What are the 4 major types of employee benefits?

There are four major types of employee benefits many employers offer: medical insurance, life insurance, disability insurance, and retirement plans. Below, we've loosely categorized these types of employee benefits and given a basic definition of each.

What is a reportable fringe benefit?

The reportable fringe benefit is the amount that appears on an employee's end of financial year payment summary. The reportable amount is the 'grossed-up' value of the fringe benefit. A grossed up value of both non-exempt and exempt employer fringe benefits totals will appear on the payment summary.

What is fringe benefits and its types?

Fringe benefits are the additional benefits offered to an employee, above the stated salary for the performance of a specific service. Some fringe benefits such as social security and health insurance are required by law, while others are voluntarily provided by the employer.

Which of the following is an example of fringe benefits Mcq?

Common fringe benefit examples are health insurance, medical care, retirement plans, worker's compensation, paid leave, etc.

What is a fringe benefit quizlet?

Fringe Benefit. any good, service or benefit other than the regular salary and allowances received by an employee, and which may be furnished or granted in cash or in kind by an employer to an individual employee.

Which of these types of employees may be subject to final fringe benefit tax?

Fringe benefits provided to managerial and supervisory employees are subject to the 32% fringe benefit tax. According to Section 33(A) of the NIRC, fringe benefit is a final tax on employee's income to be withheld by the employer. It is the company that is liable for the fringe benefit tax and not the employee.

Is long term care insurance taxed?

The IRS has implemented an exemption specifically for long-term care insurance, so these benefits are not taxed.

Is health insurance taxed?

As previously discussed, health coverage, despite being considered a fringe benefit, is not usually taxed. However, there are exceptions to this. Flexible Health Savings Accounts are taxed as income because the beneficiary could take the money out and spend it on other expenses.

Is health insurance fringe benefits?

As with many health insurance issues, there is no simple answer to the question heading the article. Some forms of health coverage are considered to be fringe benefits (and thus are taxable) and some are not. You have to do your own research and contrast and compare the best options for your own situation.

What is fringe benefits?

Fringe Benefits Group is a provider of healthcare insurance coverage, but not in the way we would normally expect. Rather than offering insurance policies to any individuals or businesses who want them, Fringe Benefits Group specializes in a very specific type of employer. Roughly, 30 years ago the company pioneered health care coverage ...

Where is Fringe Benefits located?

Fringe Benefits Group operates its headquarters in Austin, Texas. They also maintain six regional offices scattered around the country. The business is divided into two categories as mentioned earlier: Davis-Bacon and Service Contract. Their Davis-Bacon business is further subdivided into eight regions while the Service Contract portion is subdivided into three regions.

Does fringe benefit cover government employees?

Health insurance rates from America’s most well-known carriers can be seen by entering your ZIP code now. The specific type of workers covered under Fringe Benefit policies is important to the extent that the company does not cover all government employees. The two Acts specifically mentioned earlier have to do with legislation detailing government ...

Is fringe health insurance direct to customer?

For this reason, Fringe Benefits Group utilizes a standard direct-to-customer model. This business model also suggests that individuals will not be able to procure health or life insurance from Fringe Benefits Group without being employed by a member contractor or belonging to one of the groups covered. In other words, you will not be able ...

Does fringe benefit work directly with customers?

The complexity of preva iling wage benefits packages dictates that Fringe Benefits Group work directly with customers rather than through independent agents. While independent agents do possess a vast body of knowledge regarding the insurance industry, that knowledge is usually generic in scope.

What is fringe benefit?

A fringe benefit is a form of pay for the performance of services. For example, you provide an employee with a fringe benefit when you allow the employee to use a business vehicle to commute to and from work.

When to figure lease value for fringe benefits?

If you use the special accounting rule for fringe benefits discussed in section 4, you can figure the annual lease value for each later 4-year period at the beginning of the special accounting period that starts immediately before the January 1 date described in the previous paragraph .

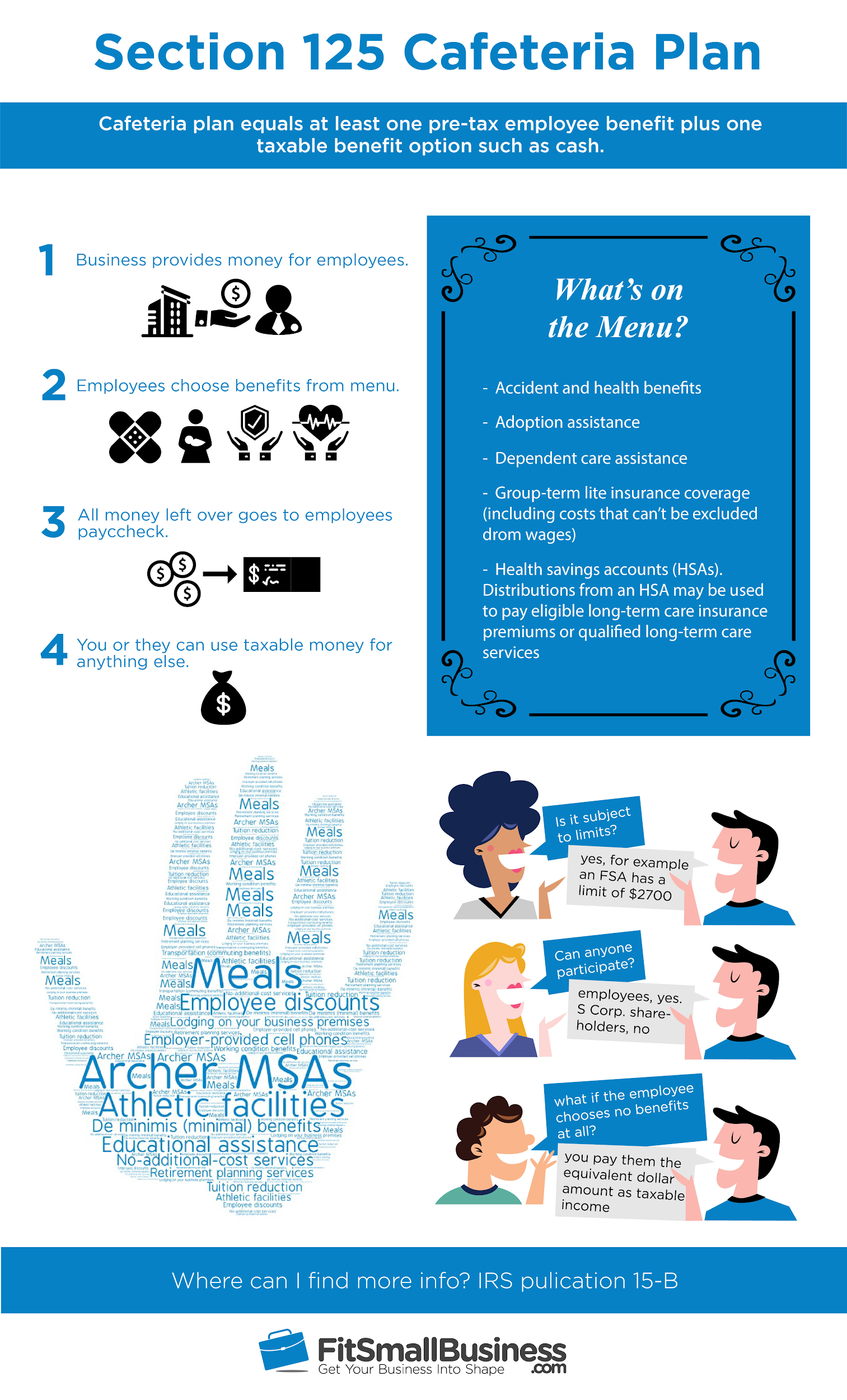

What is an FSA cafeteria plan?

A cafeteria plan, including an FSA, provides participants an opportunity to receive qualified benefits on a pre-tax basis. It is a written plan that allows your employees to choose between receiving cash or taxable benefits, instead of certain qualified benefits for which the law provides an exclusion from wages. If an employee chooses to receive a qualified benefit under the plan, the fact that the employee could have received cash or a taxable benefit instead won't make the qualified benefit taxable.

What is the exclusion for accident and health benefits?

The exclusion for accident and health benefits applies to amounts you pay to maintain medical coverage for a current or former employee under the Combined Omnibus Budget Reconciliation Act of 1986 (COBRA). The exclusion applies regardless of the length of employment, whether you directly pay the premiums or reimburse the former employee for premiums paid, and whether the employee's separation is permanent or temporary.

Can Joan live in a hospital?

If Joan chooses to live at the hospital, the hospital can't exclude the value of the lodging from her wages because she isn't required to live at the hospital to properly perform the duties of her employment.

Can you furnish lodging for your convenience?

Whether or not you furnish lodging for your convenience as an employer depends on all the facts and circumstances. You furnish the lodging to your employee for your convenience if you do this for a substantial business reason other than to provide the employee with additional pay. This is true even if a law or an employment contract provides that the lodging is furnished as pay. However, a written statement that the lodging is furnished for your convenience isn't sufficient.

Do you furnish meals for convenience?

This is true even if a law or an employment contract provides that the meals are furnished as pay. However, a written statement that the meals are furnished for your convenience isn't sufficient.

What is fringe benefit?

Fringe benefits are the additional benefits offered to an employee, above the stated salary for the performance of a specific service. Some fringe benefits such as social security. Social Security Social Security is a US federal government program that provides social insurance and benefits to people with inadequate or no income.

How does fringe benefit work?

The various fringe benefits that are provided to employees vary from one company to another, since the employer can choose the benefits that will be provided to employees during a certain period. Employees are given the chance to select the fringe benefits that they are interested in during recruitment.

What are fringe benefits? What are some examples?

Examples of optional fringe benefits include free breakfast and lunch, gym membership, employee stock options, transportation benefits, retirement planning services, childcare, education assistance, etc. One of the advantages of fringe benefits is that they are tax-exempt for the employer, provided that the set conditions are met.

Why do employers provide fringe benefits?

Although the goal of providing fringe benefits to employees is to ensure their comfort at the workplace, it also helps the company stand out for potential employees. In highly competitive markets, employers may find it challenging to retain top employees on salary alone.

What is fair value in a business?

Fair value is applicable to a product that is sold or traded in the market where it belongs or under normal conditions - and not to one that is being liquidated. of the benefits in their annual taxable income. Generally, fringe benefits are provided by the employer, even if the actual provider is a third party.

Is fringe benefit taxable?

Fringe benefits not required by law. The following benefits are provided at the employer’s discretion. On the side of the employer, most of these benefits are taxable, but with certain exceptions. Examples of these fringe benefits include: Stock options.

Do fringe benefits include fair value?

On the contrary, the recipients of fringe benefits are required to include the fair value. Fair Value Fair value refers to the actual value of an asset - a product, stock, or security - that is agreed upon by both the seller and the buyer. Fair value is applicable to a product that is sold or traded in the market where it belongs or ...

What is fringe benefit?

2021-01-17 A fringe benefit is non-monetary compensation for employment that is usually taxed less than monetary compensation. Contributions or insurance premiums paid by an employer on behalf of an employee for a health, hospitalization, or accident plan is one of the best fringe benefits, because, not only is it expensive, but it is income for the employee that is exempt from income taxes, Social Security and Medicare ( FICA) taxes, and federal unemployment ( FUTA) taxes. Health insurance has been a tax-free fringe benefit since 1954. Generally, tax-free coverage is provided by making pre-tax salary reduction contributions under the employer's cafeteria plan. Moreover, a C corporation can have a discriminatory plan, where the owners can give themselves a much better plan than is offered to the employees.

What are the rules for group health insurance?

Federal law governs the accessibility of group health plans. A group health plan cannot discriminate among employees based on health status or medical history. Specific conditions or procedures can be excluded or coverage may be limited, but only if the limits apply to all similarly situated employees. Failure to comply with these rules will subject the employer with more than 50 employees to daily penalties. Smaller employers are not subject to the penalties unless it is for the hospital length-of-stay requirements for mothers and newborns. Generally, pre-existing conditions must be covered unless the condition was diagnosed and treated within 6 months before enrollment. Coverage must also be provided to women who are pregnant on the enrollment date and newborn children who were rolled within 30 days of birth. If the parent changes jobs and enrolls in the new plan within 62 days when the previous coverage ended, then the child cannot be excluded. Likewise, for adopted children under age 18, if they're enrolled within 30 days of the adoption.

How much is taxable for highly compensated employees?

So if a highly-compensated employee is entitled to a $3000 reimbursement, but rank-and-file employees are only entitled to a $1000 limit, then up to $2000 of excess reimbursement is taxable to the highly-compensated employee. Another nondiscrimination test applies to plan eligibility.

Can FSA funds be used for medical expenses?

FSA funds can now be used for more types of medical expenses, such as over-the-counter medications and menstrual products. Except for the expanded list of eligible items, which has been made a permanent part of the tax code by the CARES Act, the tax changes apply only for tax years 2020 and 2021.

Can an employer recoup $800?

The employer would not be able to recoup the $800 that the employee has failed to pay. To qualify for favorable tax treatment, a FSA must specify which expenses are eligible for reimbursement and the maximum amount that can be reimbursed and any other reasonable conditions.

Is health insurance a fringe benefit?

Health insurance has been a tax-free fringe benefit since 1954. Generally, tax-free coverage is provided by making pre-tax salary reduction contributions under the employer's cafeteria plan. Moreover, a C corporation can have a discriminatory plan, where the owners can give themselves a much better plan than is offered to the employees.

Can a S corporation deduct health insurance premiums?

Sole proprietors, active partners, and at least 2% shareholder-employees of an S corporation can deduct health insurance premiums as an above-the-line deduction, meaning that it is not an itemized deduction, but this deduction only lowers income tax, not FICA taxes, so it is not as good of a deal as employees of a C corporation get. However, the following equation must be true to claim the full deduction:

What is fringe benefit?

What are fringe benefits? Fringe benefits are benefits in addition to an employee’s wages, like a company car, health insurance, or life insurance coverage. Any benefit you offer employees in exchange for their services (not including salary) is a fringe benefit.

What is fringe benefit statement?

Fringe benefit statement. You can provide your employees with an annual fringe benefit statement to show them their total compensation (regular wages + fringe benefits). For example, you might break down the cost of each fringe benefit and find that the total fringe benefit value is $14,000.

What is the federal tax rate for fringe benefits?

For federal income tax withholding, you can either add the value of the fringe benefits to the employee’s regular wages, or you can withhold at the fringe benefit tax rate of 22% (the same rate for supplemental pay ). Withhold FICA tax (Social Security and Medicare taxes) on the fringe benefits added to the employee’s wages.

Do you have to pay taxes on fringe benefits?

As with wages, most fringe benefits are subject to federal income taxes: FICA and FUTA. Unless the IRS explicitly says a fringe benefit is nontaxable, you will need to withhold taxes from fringe benefits in order to correctly deposit and report taxes.

Can you offer fringe benefits to independent contractors?

You can also offer fringe benefits to independent contractors. Independent contractors are workers you hire for a specific job. Unlike your employees, you do not include independent contractors on your payroll or take out taxes. However, you still pay them for the work they do in regular wages and even fringe benefits.

Is fringe benefit taxable?

Generally speaking, fringe benefits are taxable. But, there are some fringe benefit options that are nontaxable.

Can fringe benefits be included in a cafeteria plan?

The following benefits can be included in a cafeteria plan: These benefits cannot be included in a cafeteria plan: Let’s say you decide to establish a cafeteria plan at your business.

What is the most important benefit provided by an employer?

A health plan can be one of the most important benefits provided by an employer. The Department of Labor's Health Benefits Under the Consolidated Omnibus Budget Reconciliation Act (COBRA) provides information on the rights and protections that are afforded to workers under COBRA.

What is unemployment benefit?

Unemployment insurance payments (benefits) are intended to provide temporary financial assistance to unemployed workers who meet the requirements of state law. Each state administers a separate unemployment insurance program within guidelines established by federal law.

Is an employer's health insurance taxable?

If an employer pays the cost of an accident or health insurance plan for his/her employees, including an employee’s spouse and dependents, the employer’s payments are not wages and are not subject to Social Security, Medicare, and FUTA taxes, or federal income tax withholding.

Is fringe income taxed?

Fringe benefits are generally included in an employee’s gross income (there are some exceptions). The benefits are subject to income tax withholding and employment taxes. Fringe benefits include cars and flights on aircraft that the employer provides, free or discounted commercial flights, vacations, discounts on property or services, memberships in country clubs or other social clubs, and tickets to entertainment or sporting events.

How Fringe Benefits Work

Types of Benefits

- Fringe benefits can be categorized into two categories. Some benefits are required by law and others are provided at the employer’s discretion.

Why Employers Offer Fringe Benefits

- The following are some of the reasons why employers invest in fringe benefit programs: Public perception Companies that offer additional benefits above the salary often stand out from their competitors, and it makes the company attractive to different stakeholders. For example, customers are likely to buy from companies that are recognized in the p...

Additional Resources

- Thank you for reading CFI’s guide to Fringe Benefits. To keep advancing your career, the additional resources below will be useful: 1. CommissionCommissionCommission refers to the compensation paid to an employee after completing a task, which is, often, selling a certain number of products or services 2. Employee MoraleSoft SkillsSoft skills are critical in finance and accounting careers, yet often overlooked. Explore CFI's guides to devel…