How does health insurance affect your taxes?

- Lower costs for Marketplace coverage

- New qualifications to help pay for health coverage

- Special enrollment periods

- Changes reporting the excess advance payments for the Premium Tax Credit (APTC) on your 2020 tax return only

- 2021 and 2022 Health Plans and Prices.

Are long term care benefits taxable IRS?

When you receive benefits from a long-term care insurance policy, you typically won't owe taxes. The IRS treats these payouts similarly to reimbursements for medical expenses, which they don't consider taxable income.

Are health insurance payouts taxable?

With health insurance payouts, it's more complicated. Payouts to cover medical expenses are never taxable, but sickness and injury benefits for lost work time or disability may be. If you pay your own premiums, the benefits are not taxable. If your employer pays the entire premium, the entire benefit is taxable.

Is employer paid health insurance taxable?

While employers may offer some fringe benefits that are considered to be taxable as income, health insurance is not one of these items. Both insurance premiums and long-term care insurance, when offered by an employer, are non-taxable benefitst s. There are a few exceptions to this rule.

What is considered a taxable benefit?

A taxable benefit is a payment from an employer to an employee that is considered a positive benefit and can be in the form of cash or another type of payment.

Is healthcare a benefit or deduction?

Health insurance premiums are deductible on federal taxes, in some cases, as these monthly payments are classified as medical expenses. Generally, if you pay for medical insurance on your own, you can deduct the amount from your taxes.

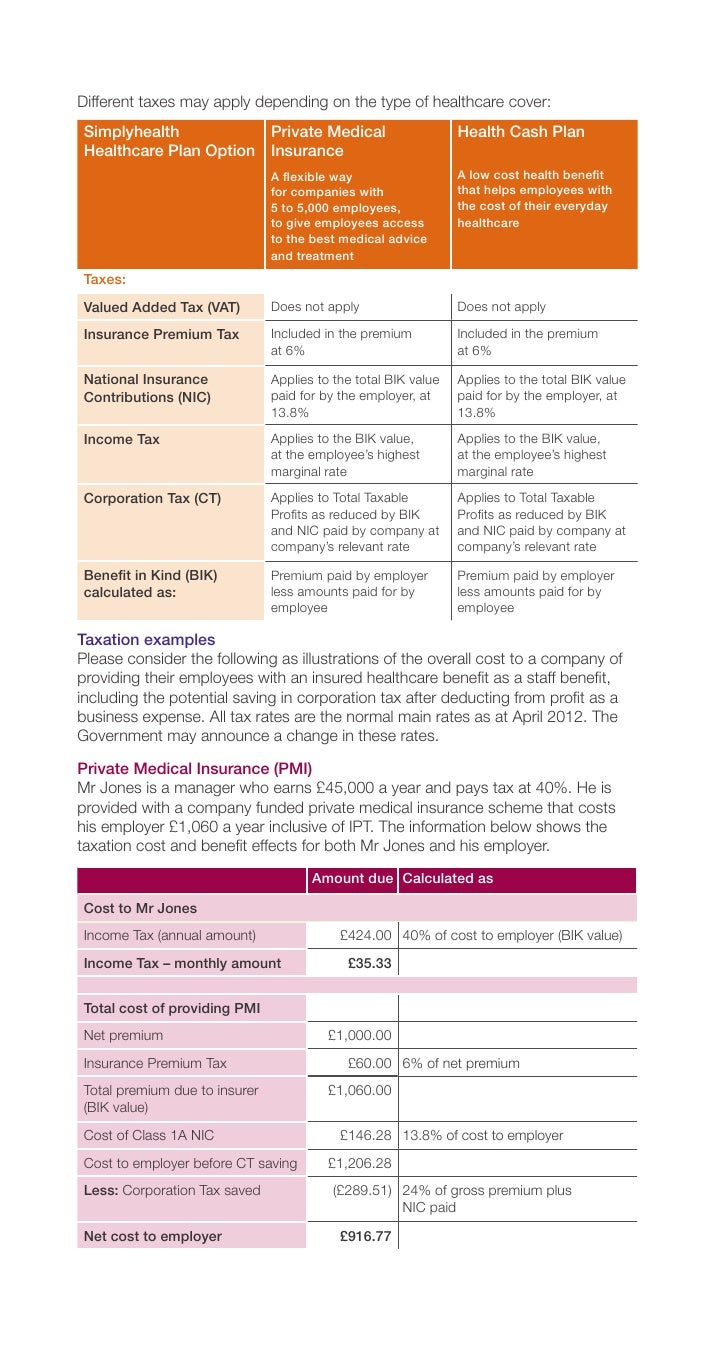

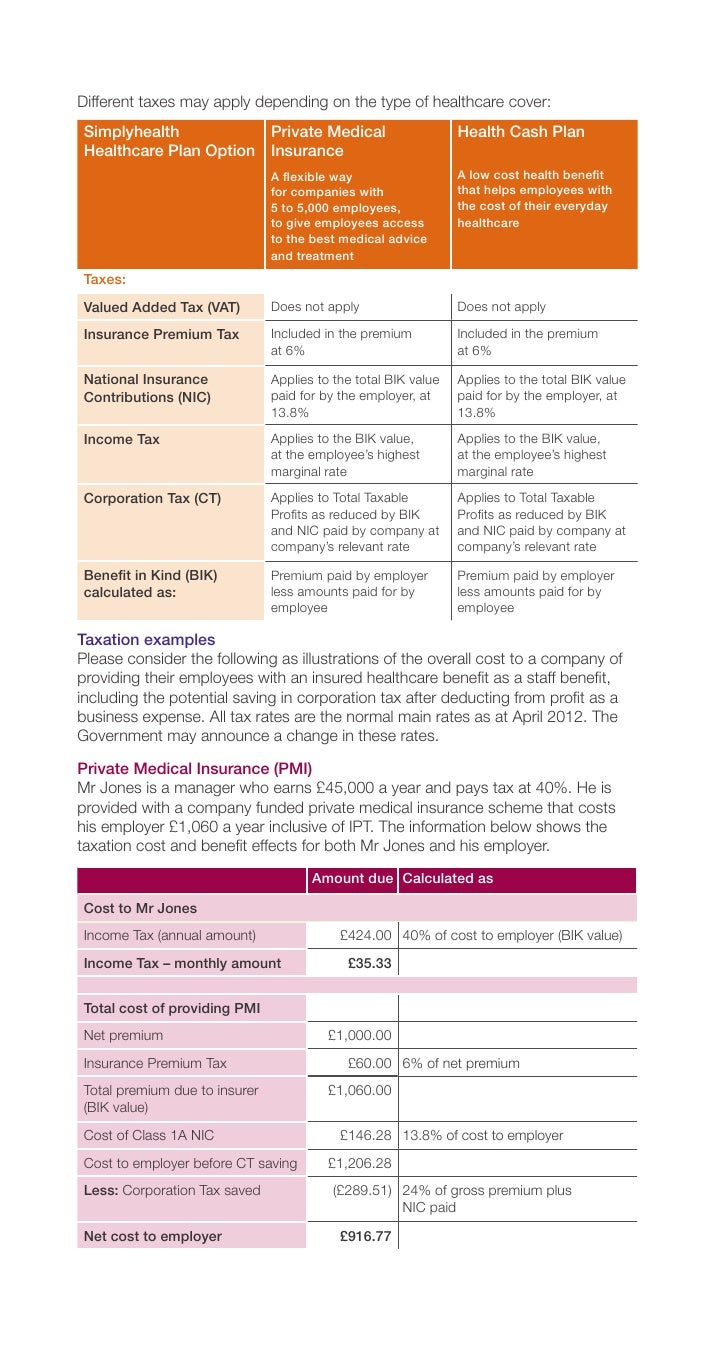

Is healthcare a taxable benefit UK?

Medical insurance paid by the employer, is considered to be a taxable benefit in kind by HMRC. It is a benefit (like cars and gym memberships) that the company paid on the employees behalf and is part of their employment or remuneration package.

Is health insurance reimbursement taxable income?

So...is health insurance reimbursement considered income? No. Unlike a healthcare stipend, with a health insurance reimbursement, employers don't have to pay payroll taxes and employees don't have to recognize income tax. In addition, reimbursements made by the company count as a tax deduction.

What benefits are taxable in payroll?

Examples of Taxable Fringe BenefitsBonuses.Vacation, athletic club membership, or health resort expenses.Value of the personal use of an employer-provided vehicle.Amounts paid to employees for moving expenses in excess of actual expenses.Business frequent-flyer miles converted to cash.More items...•

Is employee health insurance tax-deductible?

Generally speaking, any expenses an employer incurs related to health insurance (for employees or for dependents) are 100% tax-deductible as ordinary business expenses, on both state and federal income taxes.

Is private healthcare a P11D benefit?

Do you need to include private medical insurance on a P11D? Yes! When you pay for an employee's or director's private medical insurance as part of their benefits package, HMRC regard it as a 'benefit in kind'. Each year, the P11D collects details of the cost of these benefits in kind.

What does taxable benefit mean UK?

As an employee, you pay tax on company benefits like cars, accommodation and loans. Your employer takes the tax you owe from your wages through Pay As You Earn ( PAYE ). The amount you pay depends on what kind of benefits you get and their value, which your employer works out.

What are benefits in-kind HMRC?

HMRC's broad definition of a benefit-in-kind is anything of monetary value you provide to your employees that is not 'wholly, exclusively, and necessary' for them to perform their contractual duties.

Is health insurance exempt from federal tax?

Employer-paid premiums for health insurance are exempt from federal income and payroll taxes. Additionally, the portion of premiums employees pay is typically excluded from taxable income. The exclusion of premiums lowers most workers' tax bills and thus reduces their after-tax cost of coverage.

Is health insurance a fringe benefit?

The reimbursement or payment of employee health insurance premiums is an expense payment fringe benefit. The taxable value is the amount you pay.

Does employer paid health insurance go on w2?

The Affordable Care Act requires employers to report the cost of coverage under an employer-sponsored group health plan on an employee's Form W-2, Wage and Tax Statement, in Box 12, using Code DD.

What is health insurance premium?

Health insurance premiums, the amount paid upfront in order to keep an insurance policy active, have been steadily increasing as the cost of healthcare has increased in the United States. Premiums can be thought of as the "maintenance fee" for a healthcare policy, not including other payments ...

What expenses can you deduct from your AGI?

Expenses that qualify for this deduction include premiums paid for a health insurance policy, as well as any out-of-pocket expenses for things like doctor visits, surgeries, dental care, vision care, and mental healthcare. However, you can deduct only the expenses that exceed 7.5% of your AGI.

How much is HDHP insurance?

For the tax years 2020 and 2021, the IRS considers an HDHP an individual insurance policy with a deductible of at least $1,400 or a family policy with a deductible of at least $2,800. 6 .

Why are health insurance premiums increasing?

Health insurance premiums, the amount paid upfront in order to keep an insurance policy active, have been steadily increasing as the cost of healthcare has increased in the United States.

How much is the standard deduction for 2020?

For the tax year 2020, the standard deduction is $12,400 for those filing an individual return and $24,800 for married couples filing jointly.

Is HDHP a tax deductible plan?

You might consider electing a high-deductible health plan (HDHP) as a type of insurance coverage. HDHPs typically offer lower premiums than other plans. They also offer the unique feature of enabling plan subscribers to open up a Health Savings Account (HSA), a tax-advantaged savings account.

Is health insurance tax deductible in 2021?

For some Americans, health insurance is one of their largest monthly expenses, leading them to wonder what medical expenses are tax-deductible to reduce their bill . As the price of healthcare rises, some consumers are seeking out ways to reduce their costs through tax breaks on their monthly health insurance premiums .

What is required to be compliant with healthcare reimbursement?

To be compliant, healthcare reimbursement plans must have formal plan documents that describe how the plan is managed, what expenses are reimbursable, and what documents are required to demonstrate compliance.

What is HRA reimbursement?

The most prominent vehicle for doing so is a health reimbursement arrangement (HRA). When an HRA is compliant with the IRS rules, employers can reimburse health expenses with money that is free of payroll taxes for both the employer and employee—and free of income tax for the employee, as long as the employee has health insurance ...

Can an HRA be 100 percent employer funded?

To get the tax benefits, an HRA must meet the following requirements: 100 percent employer-funded (employees can’t contribute). The organization can’t fund its contribution through wage deductions—even if the employee agrees to it. Employees must have MEC to get reimbursements free of income tax.

Is HRA a good idea?

The tax-advantaged nature of HRAs makes them a good option for employers that want to offer personalized, flexible health benefits to their employees. Compliance is key, however. Without it, employers and their employees can miss out on the tax savings. Using HRA administration software like PeopleKeep, organizations can set up a fully compliant ...

What percentage of AGI can you deduct for medical expenses?

For example, if your AGI was $60,000, and you have medical expenses totaling $6,500, you can only deduct $500. ($6,500 minus $6,000, which is ten percent of the AGI.) Seniors age 65 and older can deduct expenses above 7.5 percent of AGI. As you can see by this example, most people will not be able to use this deduction.

Why are individual health insurance premiums higher?

Individual premiums tend to be higher for the same coverage because the risk is only on that individual or family group.

How much can I deduct for dental insurance?

Under the current Affordable Care Act (ACA) rules, you can deduct medical and dental expenses that exceed 10 percent of your Adjusted Gross Income (AGI). The AGI is calculated using the Form 1040, Schedule A and includes all of your income in a given year, minus alimony, student loans, and some other items.

Can you deduct employer healthcare premiums?

Employer paid healthcare premiums are never tax deductible. If you pay some portion of your premiums, you may be able to deduct it. Tax rules have become more complicated since the advent of the Affordable Care Act (ACA) so it’s important to understand the current law. su_box]

Can you deduct insurance premiums?

The basic rule of thumb is that if you paid for it, you can deduct it. If the insurer paid it, you can’t deduct it.

Is it worth taking the time to calculate your medical expenses?

However, if you have had major medical expenses such as an extended hospital stay, major surgery, in-vitro fertilization, a new baby, home health care, rehabilitation or some other situation, it is worth taking the time to calculate. Your chances of being able to use it are also greater if your income is lower.

Do companies pay all their employees' premiums?

In past decades, many companies paid all their employees’ premiums. Unfortunately, those days are long gone. Most companies no longer pay one hundred percent of an employee’s premiums, though the amount of burden on the employee varies greatly.

How to reimburse medical expenses?

How to reimburse employees for medical expenses 1 Reimburse Insurance Premiums Only: Employers can limit reimbursements to only go towards eligible premium expenses. Typically, this refers to individual health insurance premiums but could also include eligible dental premiums, vision premiums, etc. as long as the employee has Minimum Essential Coverage (MEC) for QSEHRA or a qualified health plan for ICHRA. 2 Reimburse Insurance Premiums and Medical Expenses: Most employers choose to allow medical expenses to be reimbursed too. Note: Employers can choose to exclude categories of expenses (i.e., “prescriptions”) as long as the exclusion is applied fairly to everyone.

What is 401k reimbursement?

Types of health insurance reimbursement. Sometimes referred to as “401 (K)-style” insurance, two recently created HRAs allow an employer to reimburse for medical expenses and/or insurance premiums on a tax-free basis.

What is the most important benefit provided by an employer?

A health plan can be one of the most important benefits provided by an employer. The Department of Labor's Health Benefits Under the Consolidated Omnibus Budget Reconciliation Act (COBRA) provides information on the rights and protections that are afforded to workers under COBRA.

What is the federal unemployment tax?

The Federal Unemployment Tax Act (FUTA), with state unemplo yment systems , provides for payments of the unemployment compensation to workers who have lost their jobs. Most employers pay both a federal and a state unemployment tax. Only the employer pays FUTA tax; it is not withheld from the employee’s wages.

What is unemployment benefit?

Unemployment insurance payments (benefits) are intended to provide temporary financial assistance to unemployed workers who meet the requirements of state law. Each state administers a separate unemployment insurance program within guidelines established by federal law.

Is fringe income taxed?

Fringe benefits are generally included in an employee’s gross income (there are some exceptions). The benefits are subject to income tax withholding and employment taxes. Fringe benefits include cars and flights on aircraft that the employer provides, free or discounted commercial flights, vacations, discounts on property or services, memberships in country clubs or other social clubs, and tickets to entertainment or sporting events.

Is an employer's health insurance taxable?

If an employer pays the cost of an accident or health insurance plan for his/her employees, including an employee’s spouse and dependents, the employer’s payments are not wages and are not subject to Social Security, Medicare, and FUTA taxes, or federal income tax withholding.

Does the employer pay FUTA tax?

Only the employer pays FUTA tax; it is not withheld from the employee’s wages. The Department of Labor provides information and links on what unemployment insurance is, how it is funded, and how employees are eligible for it. In general, the Federal-State Unemployment Insurance Program provides unemployment benefits to eligible workers who are ...

What are the benefits of working abroad?

You can get some tax-free health benefits from your employer, including: 1 medical insurance when you’re working abroad 2 annual check-ups

Do you pay tax on living in accommodation?

Living accommodation. If you (or one of your relatives) is living in accommodation provided by your employer you may pay tax. How the tax is worked out depends on whether the accommodation cost more than £75,000. Check how your employer works out how much tax to deduct from your pay.

How often are non cash awards taxable?

are not eligible for such an award more often than every five years. However, your taxable income includes incentive awards and performance bonuses.

Is non group insurance taxable?

Are non-group insurance plans a taxable benefit? Employer contributions to a non-group insurance plan* are a taxable benefit even if the plan is for sickness, accident or disability insurance. (*A non-group insurance plan is a plan for an individual employee.) For example, an executive may negotiate individual paid participation in ...

Is a flat rate deduction taxable in 2020?

Before the COVID-19 pandemic forced most people to work from home, equipment and supplies provided by your employer were not taxable benefits. However, for the 2020 tax year, the Canada Revenue Agency (CRA) issued a temporary flat rate deduction.

Is group life insurance taxable in Quebec?

group life insurance, dependant life insurance, accident insurance and. critical illness insurance. What's more, your taxable income includes the amounts paid on your behalf. Outside of Quebec, employer-paid premiums for health insurance benefits like prescription drug coverage, eye and dental care, and the like are not taxable.

Is short term disability taxable?

Employer-paid short-term disability or long-term disability premiums are not taxable benefits. But any short- or long-term disability benefits you receive in the future from your employer will be taxable. Conversely, if all employees pay their own short or long-term disability premiums, any benefits they receive are tax-free.

Is tuition paid by your employer taxable?

Tuition paid by your employer isn't a taxable benefit if you need the training to progress in your job. For example, let's say you're employed by a bank and are working towards becoming a Certified Financial Planner. In this case, any tuition reimbursed by the bank for this program would not be taxable.

Is a $500 gift taxable?

Employers sometimes give non-cash gifts or awards, worth under $500, for things like: outstanding service, or. milestones (such as a wedding or the birth of a child). In these cases, the value of the award is not a taxable benefit. Similarly, non-cash awards worth less than $500 aren't taxable benefits if you: ...

How much can an employee contribute to an HSA in 2021?

And, an employee can leave your company and take their HSA funds with them. For 2021, individuals can contribute up to $3,600 each year for self-only coverage and $7,2000 per year for family coverage.

How much can an employer reimburse for QSEHRA?

With a QSEHRA, employers can reimburse up to $5,300 for single employees or $10,700 for family coverage in 2021. Only small employers can set up and take advantage of a QSEHRA standalone plan. You can reimburse employees for individually-obtained premiums and any qualifying medical expenses (e.g., medication).

How much do you deduct for Section 125?

Let’s say you purchase a Section 125 cafeteria plan for your employees. The premiums are $600, and you pay 50% of the premiums. So, you deduct $300 from your employees’ paychecks and contribute $300 to the premiums. You have an employee who earns $2,000 biweekly.

What happens to FSA if employee leaves?

If an employee leaves, they forfeit their remaining FSA funds to the employer. Employees receive their full funds at the start of the year. If they leave mid-year and spend more than they’ve contributed, they must pay the employer the difference. The maximum contribution for 2021 is $2,750.

Can you use EBHRA instead of health insurance?

You cannot offer an EBHRA instead of traditional health insurance. Reimbursements under EBHRAs cover any premiums not included in your traditional group plan (e.g., dental insurance), copays, and deductibles. You cannot use an EBHRA to reimburse your employees for premiums for the company health insurance plan.

Can an employer reimburse employees for medical expenses?

An employer can reimburse employees for medical costs, including payments on premiums, using nontax able funds. With HRAs, employees can choose the health plan they want or need. Take a look at three HRA options available to employers.

Can employees have post-tax health insurance?

However, employees can still have post-tax premium payments. Employees who purchase coverage through an insurance company and do not elect to enroll in employer-sponsored plans have post-tax premiums. The distinction between pre-tax or after-tax health insurance matters.