What is the difference between social security and Medicare?

The main differences between SSI and SSDI concern:

- The basic qualifying eligibility criteria.

- Amount of monthly benefits available.

- Access to government health insurance (Medicaid and Medicare).

- When payments start.

Is Social Security and Medicare the same thing?

Social Security and Medicare are federal programs for Americans who are no longer working. Both programs help people who have reached retirement age or have a chronic disability. Social Security provides financial support in the form of monthly payments, while Medicare provides health insurance. The qualifications for both programs are similar.

Does SSI qualify for Medicare?

No benefits are paid for partial disability or short-term disability, she said. The requirements to qualify depend upon your age, income history and other factors, so check the Social Security websiteto learn more about the specific details.

Can you get Medicare without social security?

You can't sign up for Medicare without being enrolled in Social Security This statement is false, but only 35% of people knew that. Once you turn 65, you become eligible for Medicare even if you aren't getting Social Security. And signing up late could lead to higher future premiums.

Is Medicare considered a Social Security benefit?

Social Security offers retirement, disability, and survivors benefits. Medicare provides health insurance. Because these services are often related, you may not know which agency to contact for help. The chart below can help you quickly figure out where to go.

What are the 3 main types of Social Security benefits?

Social Security Benefits: Retirement, Disability, Dependents, and Survivors (OASDI)

Are Social Security and Medicare amount the same?

The Social Security portion (OASDI) is 6.20% on earnings up to the applicable taxable maximum amount (see below). The Medicare portion (HI) is 1.45% on all earnings.

What is a Social Security benefit?

Social Security benefits are payments made to qualified retired adults and people with disabilities, and to their spouses, children, and survivors.

What are the examples of Social Security?

They include old-age, survivor and disability pensions; unemployment, sickness/injury, and health insurance; and maternity/paternity benefits (UNDP, 2016: 35; World Bank, 2018b: 5). The benefits can be paid through a bank or employer, or informally through a community-based pooled fund.

What is the difference between SSI and Social Security benefits?

Social Security benefits may be paid to you and certain members of your family if you are “insured” meaning you worked long enough and paid Social Security taxes. Unlike Social Security benefits, SSI benefits are not based on your prior work or a family member's prior work.

Do I apply for Social Security and Medicare separately?

July 6, 2020, at 11:13 a.m. You don't need to sign up for Social Security and Medicare at the same time. You can enroll in Medicare before or after claiming Social Security, and each program has different eligibility criteria.

Who gets Social Security benefits?

You can receive Social Security benefits based on your earnings record if you are age 62 or older, or disabled or blind and have enough work credits. Family members who qualify for benefits on your work record do not need work credits.

What is the difference between Social Security and retirement benefits?

Pensions are retirement benefits that are provided to people who have paid into a plan or who have been granted pension benefits by an employer. Social Security is a social insurance program in the United States that provides a wide number of services, one of which is taxpayer-funded benefits to the elderly.

What are the Social Security benefits in USA?

Social Security provides you with a source of income when you retire or if you can't work due to a disability....There are four main types of benefits that the SSA offers:Retirement benefits.Disability benefits.Benefits for spouses or other survivors of a family member who's passed.Supplemental Security Income (SSI)

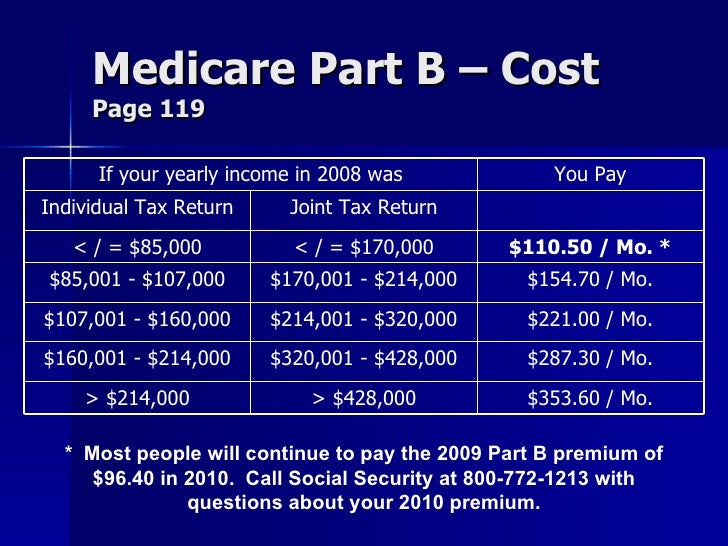

Monthly Medicare Premiums For 2021

The standard Part B premium for 2021 is $148.50. If youre single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

Will You Get Part A Coverage Immediately With Social Security

Those under age 65 on disability will get benefits from Part A automatically and immediately if they have Amyotrophic Lateral Sclerosis. Otherwise, those on disability will begin Part A benefits after 24 months of collecting benefits. Those turning 65 that plan to obtain Social Security at 65 can have the effective dates for both coincide.

Premiums For Part A Only

Social Security determines if someone has to pay any premium for Part A based on work history while paying taxes. Most people get Part A premium-free, but not all do.

Medicare Part B Premiums

Beneficiaries enrolled in Medicare Part B must pay premiums . 35 By law, individuals receiving Social Security benefits have their Medicare Part B premiums automatically deducted from their benefit checks.

Delaying Enrollment Into Social Security Will Increase Your Monthly Benefit

Just as filing early will reduce your benefit, waiting toclaim your benefits will increase them.

Funding For Social Security And Medicare

Both programs are primarily funded by payroll taxes, which are split evenly between employees and employers . The Social Security tax rate is higher, but theres an upper income limit above which Social Security taxes are not levied. The Medicare tax rate is lower, but it applies to all wages.

Already Enrolled In Medicare

If you have Medicare, you can get information and services online. Find out how to .

What is the difference between Medicare and Social Security?

Both programs help people who have reached retirement age or have a chronic disability. Social Security provides financial support in the form of monthly payments, while Medicare provides health insurance. The qualifications for both programs are similar.

When will I get Medicare if I am already on Social Security?

You’ll get Medicare automatically if you’re already receiving Social Security retirement or SSDI benefits. For example, if you took retirement benefits starting at age 62, you’ll be enrolled in Medicare three months before your 65th birthday. You’ll also be automatically enrolled once you’ve been receiving SSDI for 24 months.

How long do you have to wait to get Medicare?

Waiting period. You can also qualify for full Medicare coverage if you have a chronic disability. You’ll need to qualify for Social Security disability benefits and have been receiving them for two years. You’ll be automatically enrolled in Medicare after you’ve received 24 months of benefits.

How much does Medicare cost in 2020?

In 2020, the standard premium amount is $144.60. This amount will be higher if you have a large income.

What is Medicare Part A?

Medicare Part A (hospital insurance). Part A covers services such as hospital stays, long-term care stays, and hospice care.

What is Medicare and Medicaid?

Medicare is a health insurance plan provided by the federal government. The program is managed by the Centers for Medicare & Medicaid Services (CMS), a department of the United States Department of Health and Human Services.

How much can my spouse get from my retirement?

Your spouse can also claim up to 50 percent of your benefit amount if they don’t have enough work credits, or if you’re the higher earner. This doesn’t take away from your benefit amount. For example, say you have a retirement benefit amount of $1,500 and your spouse has never worked. You can receive your monthly $1,500 and your spouse can receive up to $750. This means your household will get $2,250 each month.

How are Social Security and Medicare funded?

Funding for Social Security and Medicare. Both programs are primarily funded by payroll taxes, which are split evenly between employees and employers (self-employed workers pay both portions, but can deduct half of the self-employment tax from their business income).

What is the Medicare eligibility age?

Congressman Paul Ryan has proposed various Medicare reforms in budget proposals over the last few years, including privatization, means testing, and raising the eligibility age to 67. Not surprisingly, Ryan’s proposals have failed to gain bipartisan support, but have been quite popular with Republicans. Similar proposals have been advanced ...

What is Medicare payroll tax?

Together, Medicare and Social Security payroll taxes are known as FICA taxes (Federal Insurance Contributions Act taxes). Lawmakers on both sides of the aisle have proposed a variety of reforms for both Social Security and Medicare, but Republicans are much more likely to focus on privatization, means testing, and increasing ...

How much does Medicare cost at 65?

The current premium for Part A is $252/month if you’ve worked at least 30 quarters in the US, and $458/month if you’ve worked fewer than 40 quarters.

What did Paul Ryan propose for Medicare?

Former Speaker of the House, Paul Ryan, proposed various Medicare reforms in budget proposals during his time in office, including privatization, means testing, and raising the eligibility age to 67. Not surprisingly, Ryan’s proposals failed to gain bipartisan support, but have remained quite popular with Republicans.

How to appeal a Medicare denial?

If you believe your Medicare Savings Program application was wrongly denied (and that you were, in fact, eligible and had submitted all of the required documents), you can appeal the denial by requesting a “Fair Hearing.” This is where your state’s agency reviews its earlier decision. You can request this by calling the agency you worked with to apply.

When do you get Medicare if you are 65?

Beneficiaries qualify for Medicare when they turn 65, with a seven-month enrollment window that straddles the month they turn 65.

What is the age limit for Medicare?

Medicare. Medicare is our country’s health insurance program for people 65 or older. Certain people younger than age 65 can qualify for Medicare too, including those with disabilities and those who have permanent kidney failure. Social Security works with the Centers for Medicare and Medicaid Services to ensure the public receives ...

What is SSI for disabled people?

We are with those who need a helping hand. The Supplemental Security Income (SSI) program provides support to disabled adults and children who have limited income and resources, as well as people age 65 and older who are not disabled but have limited income and resources.

Why do we pay disability benefits to people who can't work?

We pay disability benefits to those who can’t work because they have a medical condition that’s expected to last at least one year or result in death. Find out how Social Security can help you and how you can manage your benefits. LEARN MORE.

How much does Medicare Part A cost in 2021?

However, with Medicare Part B, the portion of Medicare that provides standard health insurance, you will pay a standard premium for this coverage, which is currently $148.50/month in 2021.

Will Social Security be reduced if you have Medicare?

For some of you who are collecting Social Security and enrolled in Medicare, you may have already experienced a surprise reduction in your Social Security benefits. But for those of you who have not filed yet, here is some insight so you won’t be as surprised if and when your Social Security deposits are perhaps a bit less than you were expecting.

Does Medicare Part B reduce Social Security payments?

If you enroll in Medicare Part B and are also collecting Social Security, your premiums will be automatically deducted from your monthly Social Security payments, reducing those payments.

Is pre-tax retirement included in MAGI?

Remember that withdrawals from your pre-tax retirement accounts are treated as income, so those withdrawals will be included in your MAGI as reported on your tax return. It’s important to note that tax-exempt interest is also included in the MAGI calculation as well. If your MAGI is above those thresholds on the previous chart, you’ll see your Medicare premiums go up accordingly, which will reduce your monthly Social Security payments.

How long is Medicare for a person born in 1955?

For people born in 1955, it is 66 years and 2 months; it settles at 67 for people born in 1960 or later. Even if you don’t qualify for Social Security, you can sign up for Medicare at 65 as long you are a U.S. citizen or lawful permanent resident.

How long do you have to sign up for Medicare if you don't sign up?

Here’s why you need to be on top of your deadline: If you don’t sign up during those seven months , you may be subject to a permanent surcharge once you do enroll. You’ll find more information on sign-up periods in Medicare publications on enrolling in Part B and Part D.

What is the FRA age for Medicare?

Keep in mind. The Medicare eligibility age of 65 no longer coincides with Social Security’s full retirement age (FRA) — the age when you qualify for 100 percent of the Social Security benefit calculated from your lifetime earnings. FRA was long set at 65 but it is gradually going up . For people born in 1955, it is 66 years and 2 months;

Does Social Security automatically sign you up for Medicare at 65?

But you should be aware of the enrollment deadlines, as Social Security will not sign you up automatically at 65 for “traditional Medicare” — Part A (hospitalization) and Part B (health insurance) — as it typically does for people already collecting Social Security benefits.

Can you deny Medicare if you have a preexisting condition?

Your Part D provider cannot deny coverage even if you are in poor health or have a preexisting condition. You can choose between paying Medicare directly or having Part D costs deducted from your Social Security payment.