Is Pua considered earned income?

Unemployment compensation is considered taxable income by the IRS and most states, thus you are required to report all unemployment income as reported on Form 1099-G on your income tax return. You should be mailed a Form 1099-G before January 31, 2022 for Tax Year 2021 stating exactly how much in taxable unemployment benefits you received.

How much is Pua taxed?

You may choose to have federal income tax withheld from your PUA benefit payments at the rate of 10 percent. The amount of withholding is calculated using the payment amount, after being adjusted for earnings (in any). Click here to access your PUA dashboard and change your federal withholding status or access your PUA-1099G.

Does Pua unemployment get taxed?

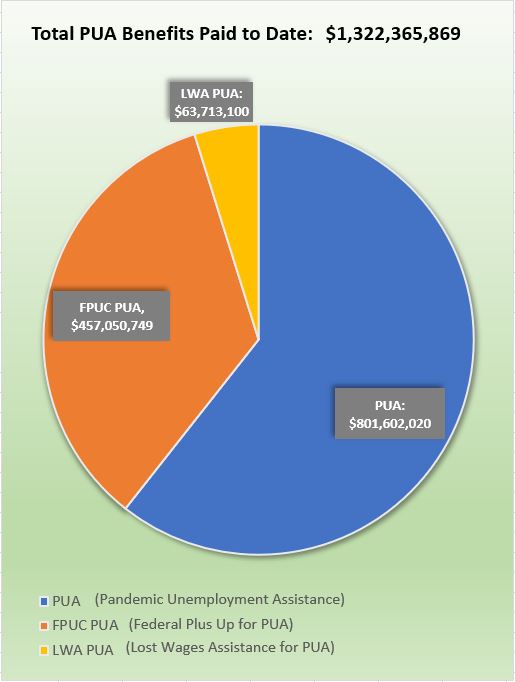

Pandemic Unemployment Assistance (PUA) Federal Pandemic Unemployment Compensation (FPUC) Lost Wage Assistance (LWA) The department reports these benefits to the Internal Revenue Service (IRS) for the calendar year in which the benefits were paid. These benefits are not taxable by the Commonwealth of Pennsylvania and local governments.

Are Pua payments taxable income?

Although many do not know it, unemployment benefits are taxable income and are subject to both state and federal taxes. This includes pandemic fringe benefits such as Pandemic Unemployment Assistance (PUA) and Pandemic Emergency Unemployment Compensation (PEUC).

Is Pua taxable IRS?

Yes. All unemployment benefits (including the extra $300 per week PUC payment) are included in your taxable gross income and Modified Adjusted Gross Income for purposes of eligibility for financial help available through Covered California.

Do I have to pay taxes on stimulus unemployment?

This means you don't have to pay tax on unemployment compensation of up to $10,200 on your 2020 tax return only. If you are married, each spouse receiving unemployment compensation may exclude up to $10,200 of their unemployment compensation. Amounts over $10,200 for each individual are still taxable.

Is PA unemployment taxable for federal taxes?

All benefits are considered gross income for federal income tax purposes. This includes benefits paid under these programs: Unemployment Compensation (UC)

Is the extra 600 unemployment taxable NJ?

The additional $600 per week from the CARES Act is taxable. The $600 emergency federal unemployment benefits you may have received each week on top of your regular unemployment benefits is part of your taxable income for federal taxes and possibly for state taxes.

Do you have to pay taxes on 600 stimulus?

The good news is that you don't have to pay income tax on the stimulus checks, also known as economic impact payments. The federal government issued two rounds of payments in 2020 — the first starting in early April and the second in late December.

Do you have to pay back unemployment during Covid 19?

States tried clawing back overpayments from hundreds of thousands of people earlier in the pandemic. Labor Department officials issued initial rules in May 2021 that let states waive collection in some cases and asked states to refund any amounts already collected toward the overpayment.

Is PA unemployment taxable for federal taxes in 2021?

Yes, any unemployment compensation received during the year must be reported on your federal tax return.

How much taxes does PA unemployment take?

A 0.06 percent (. 0006) tax on employee gross wages, or 60 cents on each $1,000 paid. Employee withholding contributions are submitted with each quarterly report. Employee withholding applies to the total wages paid in 2021.

What is the PA unemployment tax rate for 2021?

0.06%The SUI taxable wage base continues at $10,000 for 2021. The 2021 employee SUI withholding rate remains at 0.06% on total wages. The Department mails SUI rate notices, Form UC-657, on or before December 31 of each year. Employers can access their rate notice information in their UCMS employer portal.

Does the cares act count as income?

A. Yes. The receipt of a government grant by a business generally is not excluded from the business's gross income under the Code and therefore is taxable.

What is the tax rate for 1099 income 2021?

15.3%By contrast, 1099 workers need to account for these taxes on their own. The self-employment tax rate for 2021 is 15.3% of your net earnings (12.4% Social Security tax plus 2.9% Medicare tax).

Why are federal taxes not being taken out of my check 2021?

If you're considered an independent contractor, there would be no federal tax withheld from your pay. In fact, your employer would not withhold any tax at all. If this is the case: You probably received a Form 1099-MISC instead of a W-2 to report your wages.

What are the costs of PPP?

What makes the PPP even more enticing for business owners is the potential that the loan amount can be forgiven, as long as the money was spent on the following: 1 Payroll expenses 2 Mortgage interest 3 Utilities payments 4 Rent 5 Operational expenses (HR, software, cloud computing, or accounting needs— like Bench) 6 Property damage costs (due to public disturbances in 2020) 7 Supplier costs 8 Worker protection expenditures

What is the purpose of the PPP loan?

The aim of this loan is to provide businesses with the money to keep running and continue paying employees, not to create a tax burden for businesses receiving the funds. With the passing of a second stimulus bill on December 27, 2020, we received clarity on how the expenses covered by a PPP loan will be treated.

Why are tax credits important?

Tax credits are incredibly valuable because—unlike a deduction which reduces your taxable income— tax credits reduce your tax liability on a dollar for dollar basis.

What is a qualified wage?

Qualified wages include the portion of your employees’ earnings you pay FUTA tax on and is reported on IRS Form 940, IRS Form 941, or Form 944. If you qualify for the credit and paid three employees $8,000 in qualified wages during a quarter, you’d be eligible for a credit of $16,800. The employee retention credit can be claimed on your quarterly ...

What is PPP loan?

The Paycheck Protection Program (PPP) is a lifeline for businesses who are currently struggling due to COVID-19. The PPP is a loan intended to provide cash flow help for 8 to 24 weeks, backed by the SBA.

Is Bench's services included in PPP?

In fact, Bench’s services are included the PPP’s forgiveable operations expenses. That means you can use your PPP loan to receive our assistance through the forgivess process, and then get the expense forgiven. Start a free trial today.

Is unemployment taxable income?

One thing that can sometimes take unemployment recipients by surprise is finding out that yes—unemployment benefits are considered taxable income. That means you will have to pay state and federal taxes on the amount of money you receive, though you won’t have to pay medicare or social security taxes on it.

How to change my federal withholding on my PUA?

To change your federal withholding status and access your UC-1099G, please visit your UC dashboard and click on "Unemployment Services" or call PAT at 888-255-4728. You may choose to have federal income tax withheld from your PUA benefit payments at the rate of 10 percent.

What is the 10 percent deduction?

Please note: The 10 percent deduction is based on your net amount payable (i.e., the amount of benefits payable before deductions for earnings, benefit reduction, child support, and bankruptcy intercept and so forth).

Is Pennsylvania taxable for benefits?

The department reports these benefits to the Internal Revenue Service (IRS) for the calendar year in which the benefits were paid. These benefits are not taxable by the Commonwealth of Pennsylvania and local governments.

Is lost wage assistance taxable in Pennsylvania?

These benefits are not taxable by the Commonwealth of Pennsylvania and local governments.

Who is eligible for PUA?

The Pandemic Unemployment Assistance (PUA), which are additional unemployment benefit payments, also included self-employed, independent contractors or freelancers, and gig-economy workers. Essentially, these are unemployment benefits to those who are generally not eligible for regular unemployment insurance benefits.

What is the PUA program?

The Coronavirus Aid, Relief, and Economic Security Act, or CARES Act, created a new, temporary federal program called Pandemic Unemployment Assistance , or PUA. Additionally, the Pandemic Emergency Unemployment Compensation, or PEUC, was created.

When will the IRS refund unemployment?

The IRS announced o n March 31, 2021 that the money will be automatically refunded by the IRS during the spring and summer of 2021 to taxpayers who filed their tax return reporting unemployment compensation on or before March 15, 2021.

When will unemployment be refunded?

The IRS announced o n March 31, 2021 that the money will be automatically refunded by the IRS during the spring and summer ...

Is severance pay taxable?

Remember that any severance pay or unemployment compensation you receive is taxable, in addition to any payouts received for accumulated vacation or sick time. Be sure that enough tax is withheld from these payments. Make sure you receive your final W-2 from your former employer to use for your tax return. Companies are not required to send out W-2s right away, but must provide them to all employees (even former ones) by January 31 of the following year. If you have left the company, this would be the year after you leave.

Do you have to report unemployment on your taxes?

Unemployment compensation is considered taxable income by the IRS and most states, thus you are required to report all unemployment income as reported on Form 1099-G on your income tax return.

What is the minimum weekly PUA benefit amount?

§625.6. For purposes of PUA, the minimum weekly benefit amount is 50 percent of the weekly payment ...

Who is eligible for PUA?

PUA applies to self-employed persons, gig economy workers, and independent contractors. PUA is also applicable to those impacted individuals who did not qualify for state unemployment assistance due to an inability to meet state qualifying criteria. All PUA unemployment benefits are paid by the federal government and do not impact state ...

What is PUA in 2020?

Department of Labor (DOL) issued its latest guidance to state unemployment agencies regarding the application of Pandemic Unemployment Assistance (PUA) to impacted individuals in Unemployment Insurance Program Letter No. 16-20. PUA applies to self-employed persons, gig economy workers, and independent contractors. PUA is also applicable to those impacted individuals who did not qualify for state unemployment assistance due to an inability to meet state qualifying criteria. All PUA unemployment benefits are paid by the federal government and do not impact state unemployment accounts. The new advice from the DOL was issued followed a webinar with state unemployment agencies in which states and the DOL discussed the application of many of the key provisions of PUA to ensure uniform application. PUA is now open and available in all 50 states.

What is the WBA for partial unemployment?

The weekly amount of PUA payable to an unemployed individual for a week of partial unemployment shall be the weekly benefit amount (WBA) reduced (but not below zero) by the full amount of any income received during the week for the performance of services, regardless of whether any services were performed during that same week. This reduction is in accordance with provision 20 C.F.R. §626.6 (f) (1).

Is PUA open in all 50 states?

PUA is now open and available in all 50 states . For most employers, PUA will have little to no impact on their workforces. If an impacted individual qualifies for state unemployment benefits, the state unemployment benefit is applied.

When is the PUA review period?

The review period includes January 27, 2020, forward. If an impacted individual may qualify for PUA, the state should provide written notification of the individual’s potential eligibility. Some states are affirmatively asking impacted individuals to resubmit their applications to assist with the processing of claims.

Is PUA a condition of unemployment?

Answer 1. PUA is applicable to any individual who is not eligible for state unemployment and is unemployed, partially unemployed, or unable or unavailable to work because of one of the following COVID-19–related reasons: The individual was diagnosed with COVID-19.

What is PUA in unemployment?

Pandemic Unemployment Assistance (PUA) is a program that temporarily expands unemployment insurance (UI) eligibility to self-employed workers, freelancers, independent contractors, and part-time workers impacted by the coronavirus pandemic. PUA is one of the programs originally established by the Coronavirus Aid, Relief, ...

Who is eligible for PUA?

Pandemic Unemployment Assistance (PUA) extends unemployment benefits to eligible self-employed workers, including: 2. Freelancers and independent contractors. Workers seeking part-time work. Workers who don't have a work history long enough to qualify for state unemployment insurance benefits. Workers who otherwise wouldn't qualify ...

What are the new programs under the Cares Act?

In addition to the PUA program, the CARES Act extended unemployment benefits through two other initiatives: the Pandemic Emergency Unemployment Compensation (PEUC) program and the Federal Pandemic Unemployment Compensation (FPUC) program.

When was PUA created?

PUA is one of the programs originally established by the Coronavirus Aid, Relief, and Economic Security (CARES) Act, a $2 trillion coronavirus emergency stimulus package that President Donald Trump signed into law on March 27, 2020. The act expanded states' ability to provide unemployment insurance to many workers affected by COVID-19, ...

What is the FPUC?

FPUC is a flat amount given to people who receive unemployment insurance, including those who get a partial unemployment benefit check. It applies to people who receive benefits under PUA and PEUC. The original amount of $600 was reduced to $300 per week after the program was extended in August 2020.

How long does it take to get unemployment benefits after being exhausted?

Extends benefits up to an extra 53 weeks after regular unemployment compensation benefits are exhausted. Federal Pandemic Unemployment Compensation (FPUC) Provides a federal benefit of $300 a week through Sept. 6, 2021. Provided $600 a week through July 31, 2020.

What are some examples of PUA?

Examples of the types of workers targeted by the PUA program include freelancers, part-time “gig workers,” and those who are self-employed. To qualify, workers must certify they are unable to work due to one or several conditions related to COVID-19.