Which retirement plans offer tax benefits?

Which Retirement Plans Offer Tax Benefits

- Which Retirement Plans Offer Tax Benefits. When it comes to saving for retirement, there are many potential options and paths to choose, as there’s no one size fits all approach.

- 401 (k) Accounts. Let’s start with the 401 (k), which can only be made available to you through your employer. ...

- Traditional IRA. ...

- Roth IRA. ...

- SEP IRAs. ...

- 403 (b) Accounts. ...

- Closing. ...

Which states won't tax my retirement income?

States That Won't Tax Your Retirement Income Alaska. This is the only state that doesn't collect state sales tax or levy an individual income tax, so even people who aren't retired can benefit. Florida. ... Illinois. ... Mississippi. ... Nevada. ... New Hampshire. ... Pennsylvania. ... South Dakota. ... Tennessee. ... Texas. ... More items...

What pensions are not taxable?

Under current law, veterans who are 65 or older can exempt $30,000 of their military pensions from taxation, no questions asked. But veterans younger than 65 may claim a tax exemption of only $17,500 — and that only if they’re making at least that much at another job. Editorial: SC Senate finally said ‘enough’ to Commerce giveaways.

How will your retirement benefits be taxed?

- Large IRA account balances

- Large taxable (non-retirement) account balances

- Large investments in municipal bonds (non-taxable interest)

- Pensions

- Annuities

- Employment

- Inflation (more on that shortly)

What portion of retirement income is taxable?

between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. more than $34,000, up to 85 percent of your benefits may be taxable.

Is a retirement pension considered income?

Pension payments, annuities, and the interest or dividends from your savings and investments are not earnings for Social Security purposes. You may need to pay income tax, but you do not pay Social Security taxes.

How can I avoid paying taxes on retirement income?

How to minimize taxes on your Social SecurityMove income-generating assets into an IRA. ... Reduce business income. ... Minimize withdrawals from your retirement plans. ... Donate your required minimum distribution. ... Make sure you're taking your maximum capital loss.

At what age is Social Security no longer taxed?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

How much can a retired person earn without paying taxes in 2021?

In 2021, the income limit is $18,960. During the year in which a worker reaches full retirement age, Social Security benefit reduction falls to $1 in benefits for every $3 in earnings. For 2021, the limit is $50,520 before the month the worker reaches full retirement age.

How much can a retired person earn without paying taxes in 2020?

For retirees 65 and older, here's when you can stop filing taxes: Single retirees who earn less than $14,250. Married retirees filing jointly, who earn less than $26,450 if one spouse is 65 or older or who earn less than $27,800 if both spouses are age 65 or older.

How much of my Social Security is taxable in 2021?

For the 2021 tax year (which you will file in 2022), single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income was more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

What income can't be taxed?

Other forms of income that can’t be taxed are municipal bonds interest, life insurance policy loans and reverse mortgages. Bottom Line. Once you reach retirement, it’s mostly time to relax. But it’s important that you don’t forget you’ll still be held responsible for paying certain taxes.

How to fill 401(k) with investments?

If your employer offers a 401(k), take advantage of it. Put a solid amount of your paycheck into the account every pay period. If you fill your 401(k) with investments, make sure it’s the most optimized mix of investments, which you can do with the help of a financial advisor if not on your own.

Do you have to report an annuity on taxes?

The company who distributes your annuity should inform you of your taxable amount. Another bit of income that you’ll have to pay taxes on is any gains you earn from investments. Just as you do now, when you sell investments, you have to report that capital loss or gain on your tax forms.

Do you have to pay taxes on 401(k)?

However, you don’t have to pay full taxes on everything. There are some sources, like IRAs and 401(k)s, that will mostly be taxed. But even then, there are limitations and exceptions. You may also have some accounts that can only be taxed partially, ensuring the accounts aren’t depleted.

Is a Roth IRA safe?

While your Roth IRA may be safe, your 401(k) and pension aren’t entirely tax-free. Keep an eye out for 1099 forms that may come in. . Tips for Saving for Retirement. First things first: it is never too early to start saving for retirement.

Is cashing in life insurance taxable?

Cashing in some of your cash value life insurance policy can also trigger a tax bill. If what you get from cashing in exceeds what you paid in premiums, that’s considered a gain. It’s the gain that becomes taxable. Tax-Free Retirement Income. Luckily, the IRS can’t leave you entirely high and dry in retirement.

Do you have to pay taxes on retirement?

True, you don’t have to pay taxes on every bit of money you have in retirement. But you will need to pay taxes on some of that income. Is Retirement Income Taxable? Unfortunately, while you may want to just relax in retirement, you can’t fully escape taxes.

How many states tax Social Security?

As for state taxes, only 13 states tax Social Security benefits: Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont, and West Virginia. If you live in one of them, you'll also need to learn your state's rules for when and how your benefits will be taxed.

Why are state taxes so complicated?

Things get even more complicated when it comes to state taxes, because there are big differences from one state to another. Here's what you need to know about how the federal government and the state you live in may tax different benefits.

How is Social Security income determined?

Your income is determined by adding half your Social Security benefits to all your other taxable income from other sources. Some tax-free income, such as municipal bond interest, is also added to determine your total income.

What do you need to know when you're retired?

Passionate advocate of smart money moves to achieve financial success. When you're retired, you need all the income you can get. This income may derive from many sources, including retirement investment accounts, pensions, and Social Security.

Does pension income have to be taxed in Alaska?

As far as state taxes go, if you live in Alaska, Florida, Illinois, Mississippi, Nevada, New Hampshire, Pennsylvania, South Dakota, Tennessee, Texas, Washington, or Wyoming, your pension income won't be taxed. If you live in any other state, you'll need to find out your local rules.

Is pension income taxable?

Pension income. If you're lucky enough to get a pension from your employer, the entire amount you receive is probably taxable income federally. This is the rule if you didn't contribute any of your own money to your employer's pension plan.

Do you pay taxes on 401(k) withdrawals?

That means you'll pay taxes based on whatever your tax rate is . If you have Roth accounts, on the other hand, you aren't subject to any federal taxes on withdrawals as long as you've complied with requirements related to your age and how long you've had your accounts open.

How much of your Social Security benefits can you be taxed?

If the total is between $25,000 and $34,000 and you're single, or if you're jointly filing and the total is between $32,000 and $44,000, then you can be taxed on up to 50 percent of your social security benefits.

How to work out if you need to pay taxes on Social Security?

To work out whether you'll need to pay tax on these benefits, calculate your total income (excluding social security) and add any tax-free interest you receive. Finally, add half your social security benefit to the total. Article continues below advertisement.

What happens if you withdraw from 401(k) early?

If you withdraw early, you'll have to pay tax and face a 10 percent early withdrawal penalty. You can only make penalty-free withdrawals before retirement age if you leave your job associated with the 401 (k) at age 55 or older. Source: istock. Article continues below advertisement.

What is the minimum age to withdraw from retirement?

However, after the age of 72 , a minimum distribution becomes mandatory, and you can face substantial fees of 50 percent if you fail to withdraw.

Is Roth IRA withdrawal taxable?

You may have also saved money into a Roth IRA. Withdrawals from this type of account are not taxable because contributions were made with after-tax income. As long as the account is at least five years old, and the account owner is more than 59.5 years old, then you won't face tax on withdrawals.

Do you have to pay taxes on 401(k) contributions?

Since your contributions to this type of account were taken before tax, you'll have to pay tax when you retire. Income from a traditional IRA is taxed as regular income.

Is Social Security taxable?

And in some cases, social security can also be taxed. It's essential to plan for any tax that you may have to pay on your retirement benefits. Let's break down which retirement benefits are taxable. Article continues below advertisement.

How much of Social Security is taxable?

A formula determines the amount of your Social Security that's taxable. You might have to include up to 85% of your benefits as taxable income on your return. 2. The taxable amount—anywhere from zero to 85%—depends on how much other income you have in addition to Social Security.

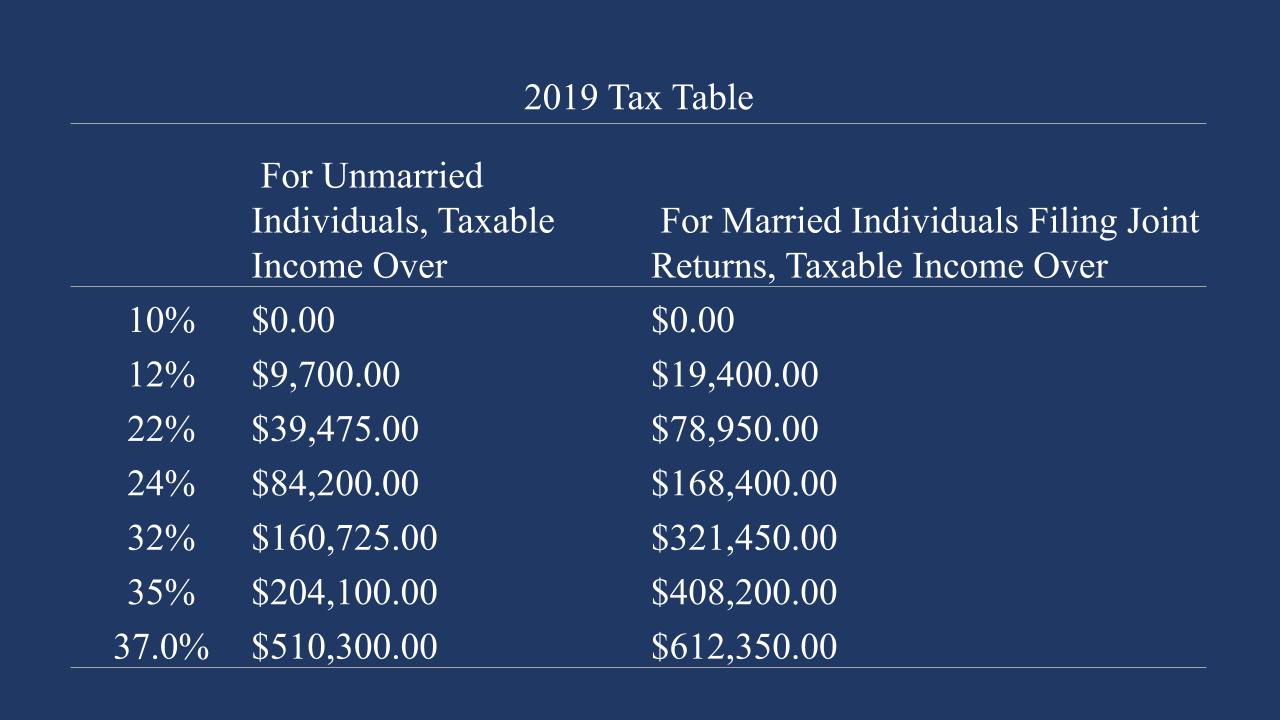

How to calculate tax rate for retirement?

Calculating Your Tax Rate. Your tax rate in retirement will depend on the total amount of your taxable income and your deductions. List each type of income and how much will be taxable to estimate your tax rate. Add that up, and then reduce that number by your expected deductions for the year.

How much is capital gains taxed?

With capital gains, your total income is $45,000. At $45,000, you'll be taxed on up to 85% of your Social Security benefits—that doesn't mean 85% exactly, because it's a formula, so it may be less. 2 Based on all of this information, you'll pay taxes on $15,350 of your Social Security benefits.

How much is your standard deduction for 2020?

Your standard deduction for 2020—the tax return you filed in 2021—would be $24,800 as a married couple filing jointly.

Is a withdrawal from a 401(k) taxed?

Withdrawals from tax-deferred retirement accounts are taxed at ordinary income rates. These are long-term assets, but withdrawals aren't taxed at long-term capital gains rates. IRA withdrawals, as well as withdrawals from 401 (k) plans, 403 (b) plans, and 457 plans, are reported on your tax return as taxable income. 4

Is pension income taxable?

Pension Income. Most pension income is taxable. 1 It will be taxed if you withdraw pre-tax money you contributed to it. Most pension accounts are funded with pre-tax income, so the entire amount of your annual pension income will be included on your tax return as taxable income each year that you take it.

Is a withdrawal from an investment account taxable?

You'll initially be withdrawing earnings or investment gains if your account is worth more than what you contributed to it, so it will all be taxable. You'll begin withdrawing your original contributions after you've withdrawn all of your earnings, and these are not included in your taxable income. 6.

Why is Box 2.A not calculating tax free?

The most common reasons for not calculating the tax-free portion of your annuity is because of one or more of the following : Your case is a disability retirement. You retired prior to November 19, 1996.

How much can you roll over for a tax refund?

You can roll over up to 100 percent of the eligible distribution, including the 20 percent withholding. To do so, you must replace the 20 percent withholding within the 60 day period. You will be taxed on any amount that you do not roll over.

Is a non-disability annuity taxable?

If your non-disability annuity started on or after July 2, 1986, then a portion of each annuity payment is taxable and a portion is considered a tax-free recovery of your contributions to the retirement fund. If you retired under a disability provision, then the disability annuity you receive from CSRS or FERS is taxable as wages ...

How much tax is due on a $200 check?

If you choose to have the payment made to you and it is over $200, it is subject to the 20 percent federal income tax withholding. The payment is taxed in the year in which it is received unless within 60 days after receiving it you roll it over to an individual retirement account or retirement plan that accepts rollovers.

When will OPM send out 1099-R?

OPM mails out 1099-R tax forms to all annuitants by January 31. You may not receive your mailed 1099-R tax form until mid-February, depending on where you live. Generally, starting the third week of January, you can sign in to your online account to view, download, or print your 1099-R. Go to OPM Retirement Service Online.

Who is responsible for the changes to the federal income tax withholding tables?

The IRS is responsible for the changes to the federal income tax withholding tables. OPM has no control over the federal income tax withholding tables. OPM uses the tables provided by the IRS , which are set in law by the U.S. Congress.

Is a 1099 R taxable?

Your retirement contributions are not taxable, but interest included in the payment is taxable. You should contact the IRS for more information. The taxable amount on my 1099-R tax statement is listed as unknown.