Several sources of income count as earned income when it comes to Social Security benefits. These include wages from a job and self-employment income. Social Security counts income earned from working. If you work for an employer, your monetary compensation for work you performed counts toward your earnings limit.

How are Social Security benefits affected by your income?

Key Points

- Your marital status could affect Social Security benefits.

- Divorce can sometimes leave you with a reduced Social Security check.

- Eligibility for spousal benefits and survivor benefits can depend how long you were married.

Does IRS tax your Social Security benefits?

You will pay tax on only 85 percent of your Social Security benefits, based on Internal Revenue Service (IRS) rules. If you: between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. more than $34,000, up to 85 percent of your benefits may be taxable.

Is Social Security considered taxable wages?

The simplest answer is yes: Social Security income is generally taxable, though whether or not you have to pay taxes on your Social Security benefits depends on your income level. If you have other sources of retirement income, such as a 401 (k) or a part-time job, then you should expect to pay income taxes on your Social Security benefits.

Is SSI considered taxable income?

Supplemental Security Income benefits are considered to be assistance, and that means they aren't taxable. Like welfare benefits, they don't have to be reported on a tax return. However, the IRS differentiates between Social Security retirement benefits and SSI payments—SSI payments are not taxable, but benefits may be.

/GettyImages-550437755-56a636ec5f9b58b7d0e06e89.jpg)

What is the purpose of Social Security?

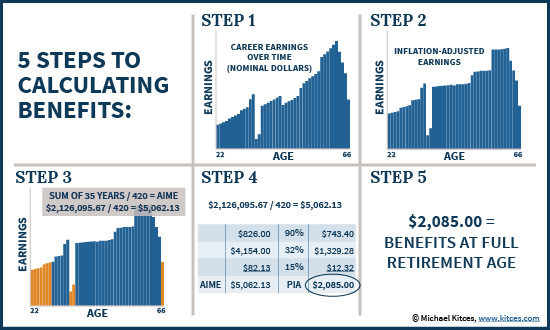

The Social Security Administration (SSA) keeps a record of your earned income from year to year, and the portion of your income that is subject to Social Security taxes is used to calculate your benefits in retirement. The more you earned while working (and the more you paid into the Social Security system through tax withholding), ...

How many years do you have to pay Social Security?

If you paid into the system for more than 35 years, then the Social Security Administration uses only your 35 highest-earning years and does not include any others in its formula. If you did not pay into the system for at least 35 years, then a value of $0 is substituted for any missing years. 3. After you apply for benefits, these earnings are ...

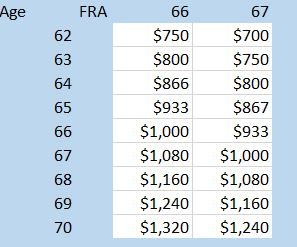

What is the full retirement age for a person born in 1943?

4 The full retirement age for anyone born from 1943 to 1954 is 66. For people born after 1954, the age rises by two months annually until it hits 67 for anyone born in 1960 or later. 5.

Is Social Security income taxable?

Is Social Security Taxable? Your income from Social Security can be partially taxable if your combined income exceeds a certain amount. “Combined income” is defined as your gross income plus any nontaxable interest that you earned during the year, plus half of your Social Security benefits. For example, if you’re married, file a joint tax return ...

What is considered earned income on Social Security?

The only people who really need to worry about earning income while receiving Social Security benefits are those who take early retirement benefits. The Social Security Administration defines an annual limit on how much income people who take early retirement can earn. The definition of earned income used by the Social Security Administration is wages and any other payment you receive as part of employment, including commissions and bonuses. If you’re given a place to live or a discount on rent in exchange for work, that’s considered to be earned income. Net earnings from self-employment and royalties are also seen by the Social Security Administration as earned income.

What is considered SSI income?

People who receive Social Security retirement benefits may also be eligible for Supplemental Security Income (SSI) if they are age 65 or older, blind or disabled and have limited financial resources. For the purposes of SSI benefits, income is defined slightly differently than it is for Social Security. In addition to money earned from wages and self-employment, SSI also looks at unearned income such as retirement benefits, disability and unemployment payment as well as investment returns. Gifts and loans from family and friends are also counted as income for SSI purposes. Income is subtracted directly from the amount of entitled SSI benefits when determining an individual’s final SSI benefit.

What is the limit for Social Security benefits for 2018?

Reduction in Benefits for Exceeding Income Limit. Earning more than the earned income limit of $17,040 for the 2018 calendar year while taking early retirement benefits will result in a reduction of benefits. For every $2 above the earned income limit, Social Security will hold back $1 in benefits. This benefit reduction is collected by ...

How much is Social Security held back?

For every $2 above the earned income limit, Social Security will hold back $1 in benefits. This benefit reduction is collected by the Social Security Administration by withholding benefit payments until the reduction amount has been met. After that, benefit payments will resume. This happens automatically when the Social Security Administration ...

What is the youngest age to collect Social Security?

Social Security Full Retirement Age. In 2018, the youngest age at which you can claim Social Security retirement benefits is 62. Those who claim benefits before their full retirement age are considered to have taken early retirement benefits. If you were born between 1943 and 1954, your full retirement age is 66.

What is the retirement age for a person born in 1958?

Someone born in 1958 would add 8 months, so the full retirement age would be 66 and 8 months. For people born in 1960 and after, full retirement is reached at age 67.

When will reduced retirement benefits be replaced?

Luckily, the reduced benefits will be replaced when you reach your full retirement age. Depending on your individual situation, tax-efficient retirement planning might mean waiting longer to collect retirement benefits or limiting how much you work until your full retirement age is reached.

What is income in SSI?

Income is any item an individual receives in cash or in-kind that can be used to meet his or her need for food or shelter. Income includes, for the purposes of SSI, the receipt of any item which can be applied, either directly or by sale or conversion, to meet basic needs of food or shelter. Earned Income is wages, net earnings from ...

What are some examples of payments or services that do not count as income for the SSI program?

Examples of payments or services we do not count as income for the SSI program include but are not limited to: the first $20 of most income received in a month; the first $65 of earnings and one–half of earnings over $65 received in a month; the value of Supplemental Nutrition Assistance Program (food stamps) received;

What is considered in-kind income?

In-Kind Income is food, shelter, or both that you get for free or for less than its fair market value. Deemed Income is the part of the income of your spouse with whom you live, your parent (s) with whom you live, or your sponsor (if you are an alien), which we use to compute your SSI benefit amount.

What is unearned income?

Unearned Income is all income that is not earned such as Social Security benefits, pensions, State disability payments, unemployment benefits, interest income, dividends and cash from friends and relatives. In-Kind Income is food, shelter, or both that you get for free or for less than its fair market value.

Can I get SSI if my income is over the limit?

Generally, the more countable income you have, the less your SSI benefit will be. If your countable income is over the allowable limit, you cannot receive SSI benefits. Some of your income may not count as income for the SSI program.