What is the difference between social security and retirement?

Social Security benefits include the following:

- Social Security Disability Income (SSDI) benefits

- Survivor benefits

- Social Security benefits for children

- Supplemental Security Income (SSI) benefits

- Social Security retirement benefits

What is the maximum Social Security benefit for retirement?

- Social Security is an inflation-proof, guaranteed source of income that will last the rest of your life.

- The absolute maximum monthly benefit you can earn from Social Security in 2021 is $3,7895.

- Your Social Security benefit will be based on your highest income earning years and the age you take benefits.

How social security works after retirement?

The SSA states that special payments can include:

- Bonuses

- Accumulated vacation pay or sick pay

- Severance

- Back pay

- Standby pay

- Commissions from sales

- Retirement payments

Can I get SSI benefits if I get retirement?

You can get both SSI and Social Security retirement benefits at the same time, but there are a few requirements for SSI benefits, including: Having countable income below $783 per month for...

What is the difference between retirement and Social Security?

Fewer companies offer guaranteed pensions but offer workers 401(k) plans, which are self-directed investments intended to generate retirement income. Social Security is a government-guaranteed basic income for older Americans, funded through a special tax paid by employees and employers.

Is retirement benefits considered Social Security?

Pension payments, annuities, and the interest or dividends from your savings and investments are not earnings for Social Security purposes. You may need to pay income tax, but you do not pay Social Security taxes.

Do you get Social Security and retirement at the same time?

You can get Social Security retirement benefits and work at the same time before your full retirement age. However your benefits will be reduced if you earn more than the yearly earnings limits.

What are the 3 main types of Social Security benefits?

Social Security Benefits: Retirement, Disability, Dependents, and Survivors (OASDI)

What are the retirement benefits?

The amount of pension is 50% of the emoluments or average emoluments whichever is beneficial. Minimum pension presently is Rs. 9000 per month. Maximum limit on pension is 50% of the highest pay in the Government of India (presently Rs.

What is Social Security benefits?

Social Security replaces a percentage of a worker's pre-retirement income based on your lifetime earnings. The amount of your average wages that Social Security retirement benefits replaces varies depending on your earnings and when you choose to start benefits.

How long does Social Security last?

Social Security retirement benefits start as early as age 62, but the benefits are permanently reduced unless you wait until your full retirement age. Payments are for life. Social Security spousal benefits pay about half of what your spouse gets if that's more than you would get on your own. Payments are for life.

What is the maximum Social Security benefit?

The most an individual who files a claim for Social Security retirement benefits in 2022 can receive per month is: $2,364 for someone who files at 62. $3,345 for someone who files at full retirement age (66 and 2 months for people born in 1955, 66 and 4 months for people born in 1956).

What is the average Social Security benefit per month?

Table of ContentsType of beneficiaryBeneficiariesAverage monthly benefit (dollars)Number (thousands)Total65,5441,538.14Old-Age and Survivors Insurance56,3761,588.89Retirement benefits50,4741,619.6716 more rows

Who is eligible for retirement benefits under Social Security?

You can receive Social Security benefits based on your earnings record if you are age 62 or older, or disabled or blind and have enough work credits. Family members who qualify for benefits on your work record do not need work credits.

How much Social Security will I get if I make 20000 a year?

If you earned $20,000 for half a career, then your average monthly earnings will be $833. In this case, your Social Security payment will be a full 90% of that amount, or almost $750 per month, if you retire at full retirement age.

What is the average Social Security check?

Social Security offers a monthly benefit check to many kinds of recipients. As of March 2022, the average check is $1,536.94, according to the Social Security Administration – but that amount can differ drastically depending on the type of recipient.

Why are pensions called defined benefit plans?

Pensions nowadays are known officially as defined-benefit plans because the payment amount you'll receive in retirement is decided or defined in advance. 3 4 1 .

When do pensions and social security start?

Both pensions and Social Security may provide an income stream to retirees. Pensions can begin as early as 55, are usually taken around age 65, and must begin to be withdrawn at age 72. 14 Social Security can begin at age 62. 9 . Pensions and Social Security operate for the same goal—to provide retirement funds—but they are not funded ...

How is Social Security funded?

Social Security is handled by the federal government and funded through payroll taxes collected from employees and companies. 1 2 . Read on for more about how the two programs are structured and how each may benefit retirees who have paid into such programs.

What is a private pension?

A private pension is a retirement account created by an employer for their employees’ future benefit. Employers, governed by certain laws and regulations, contribute on behalf of employees and invest the money as they see fit. Upon retirement, the employee receives monthly payments.

Does Social Security cover disability?

Social Security offers a disability insurance program that covers workers with enough credits (earned through work and payment into the system) if they become disabled. 12 Pensions normally don’t provide disability benefits unless the employee is disabled in an on-the-job accident.

Can a spouse receive a partial pension?

Although spouses may receive a partial pension payment, it’s unlikely that a child would also benefit from pension income—as is the case with Social Security. 13 Finally, pensions may offer a lump-sum payout upon retirement. This option is not available through the Social Security system. Both pensions and Social Security may provide an income ...

Is Social Security considered a pension?

Although many seniors receive Social Security benefits in retirement, the Social Security system isn't considered a pension. It may look like a pension because upon retirement (if you have paid into the system during your working years), you are eligible to receive monthly benefits. These benefits can begin at the age of 62. 9 .

How much is SSDI based on lifetime earnings?

This is because the SSA calculates your SSDI benefits as though you have already reached full retirement age, which is equal to 100% of your maximum benefit based on your lifetime earnings.

What age can I collect Social Security?

Once you have amassed enough work credits, paid into Social Security through federal taxes, and reached age 62, you can begin collecting retirement benefits. The amount of your monthly benefit depends on how much you worked, ...

How is SSDI funded?

SSDI is funded by Social Security payroll taxes, so in order to be considered insured, you must have worked long enough, recently enough, and you must have paid Social Security taxes on your earnings. Once you qualify for disability, your benefits will continue unless your disability improves or until you reach retirement age.

How long does a disability last?

In addition, the qualifying condition must have lasted or be expected to last for at least one (1) year (or alternatively, to result in that person’s death). Unlike other Social Security programs such as Supplemental Security Income (SSI), qualifying for disability also requires that you have earned enough work credits.

Can I receive Social Security Disability and Retirement at the same time?

In most cases, you cannot receive Social Security disability and retirement benefits at the same time, since SSDI benefits are meant for those who cannot work due to injury or illness. If you’re receiving retirement benefits, it is already implicit that you are no longer working. There is one exception to this rule, however.

Who administers the Social Security program?

Both are administered by the Social Security Administration (SSA), and both are programs designed to provide financial assistance to Americans who can no longer work. Both programs also have specific requirements beneficiaries must meet in order to qualify for benefits.

Do SSDI benefits stay the same?

Once you successfully get approved for disability benefits, your monthly benefits should stay the same unless your disability improves, you start engaging in Substantial Gainful Employment (SGA), or you have a spouse whose income surpasses SSDI threshold levels.

Learn

Plan for your future and understand how Social Security fits into your retirement.

Apply

Ready to apply? Get everything you need to know about the process and start your application.

Manage

Already receiving retirement benefits? Go here for resources to maximize your retirement.

Retirement Online Services

My Social Security Retirement Estimate Get personalized retirement benefit estimates based on your actual earnings history.

Retirement FAQs see all

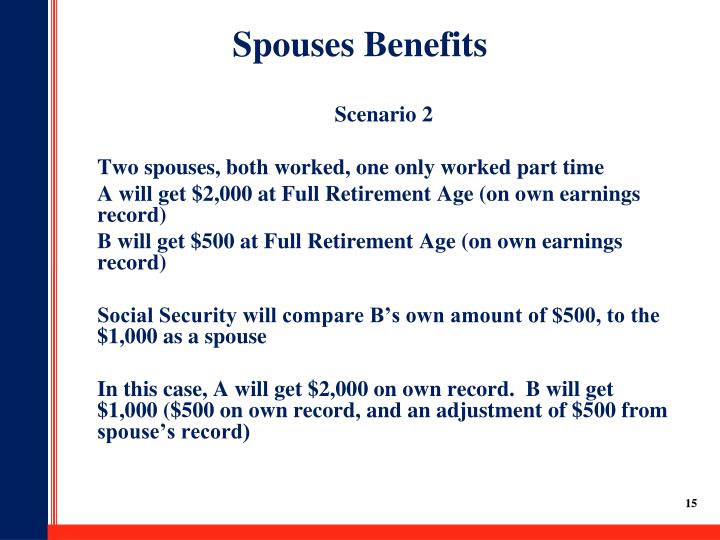

What is the eligibility for Social Security spouse’s benefits and my own retirement benefits?

What percentage of SSDI will I get in 2021?

If you turn 62 in 2021, you’re eligible for only 70.8 percent of that full retirement benefit, so your SSDI benefit will probably be higher. When you reach FRA, the disability benefit automatically converts to a retirement benefit, and you’ll get the same monthly amount you’ve been getting.

When can I start collecting SSDI?

In most cases, if you're already getting Social Security Disability Insurance (SSDI), you're better off sticking with that rather than taking early retirement, which is available starting at age 62. Here's why: Regardless of your age when you start collecting SSDI, you receive what you would get if you claimed benefits at full retirement age (FRA) ...

How long do you have to work to get SSDI?

Since you may have worked fewer than 35 years when you claimed disability benefits, the calculation for SSDI is different: Your full benefit is derived from your adjusted monthly average income from age 21 until the year you became disabled. Updated December 24, 2020.

Can you get a public disability if you didn't pay Social Security?

A possible exception arises if, along with SSDI, you are collecting workers’ compensation or are drawing a “public disability benefit” from a government job at which you didn’t pay Social Security taxes. These could shrink your SSDI payment to the point where you might be better off switching to the reduced retirement benefit at 62.

Apply for Retirement Benefits

Starting your Social Security retirement benefits is a major step on your retirement journey. This page will guide you through the process of applying for retirement benefits when you’re ready to take that step. Our online application is a convenient way to apply on your own schedule, without an appointment.

Ready To Retire?

Before you apply, take time to review the basics, understand the process, and gather the documents you’ll need to complete an application.

Railroad Retirement System: What Is It?

The RRS or Railroad Retirement Program is a special national benefit administered by the Railroad Retirement Board (RRB).

Pros and Cons of Railroad Retirement System

Here are some of the pros and cons of the RRS you need to be aware of:

Pros

Retirement payment grows yearly: The RRS recognizes and applies the cost-of-living adjustments. This means railroad employees are likely to get higher payments each year as retirement payments are adjusted.

Cons

Higher taxes: The taxes paid by employers and employees covered by the Railroad Retirement Act, are higher for Railroad Retirement vs Social Security. While this can be considered a disadvantage, it ultimately leads to higher retirement benefits, particularly for workers who have put in 30 or more years of service.

How to Qualify for Railroad Retirement

First, you need to be a railroad worker to be potentially eligible for railroad retirement benefits.

How Does Railroad Retirement Compare to Social Security?

While Social Security and the RRS share some common elements, there are key differences between the programs in terms of benefit structure and funding.

Can You Receive Social Security and Railroad Retirement Benefits at the Same Time?

Yes, you can apply and receive both benefits if you work in the railroad industry and also qualify for social security.

Where do Social Security benefits come from?

SSI benefits, on the other hand, come from the U.S. Treasury’s general funds. 3. Additional help with medical costs with SSI. In most states, SSI recipients can also get Medicaid to cover medical bills and other health costs. 4.

How many people pay Social Security?

The United States Social Security Administration (SSA) has a lot of different programs available to assist Americans in need and elderly Americans. About 178 million people pay into the Social Security system, and about 64 million people receive monthly Social Security benefits.

Why is SSI denied?

As noted, initial claims for these benefits are often denied by the SSA due to paperwork errors or insufficient medical evidence verifying a disability. There are a number of levels to the appeals system that leaves most people overwhelmed and frustrated.

What is the purpose of Social Security?

Whether the benefits are for retirement, to help those with disabilities, or to pay survivor benefits, the SSA’s goal is to improve the quality of life for many of us. In fact, SSA plays a role in our lives directly or indirectly from the time we are born until we pass away. Most parents apply for a child’s Social Security number at birth.

What is the goal of the SSA?

In sum, the goal of the SSA is a noble one – to help those in our country who are struggling and need a little assistance. Of course, as with any government program, however, there is a considerable amount of paperwork that needs to be done.

Can I apply for SSI and Social Security?

Applying for SSI, and Regular Social Security Benefits. If you are eligible for SSI, then it is highly likely that you are also eligible for Social Security benefits. Indeed, when you apply for SSI, you are also applying for Social Security benefits at the same time. Thus, it is rather easy to apply for SSI and Social Security benefits.

Can SSI recipients get Medicaid?

In most states, SSI recipients can also get Medicaid to cover medical bills and other health costs. 4. Food assistance. Unlike those who receive Social Security benefits, SSI recipients could be eligible to receive food assistance.

What is the maximum amount you can earn before retirement in 2021?

If you will reach full retirement age in 2021, the limit on your earnings for the months before full retirement age is $50,520. Starting with the month you reach full retirement age, you can get your benefits with no limit on your earnings.

Can you report a change in earnings after retirement?

If you need to report a change in your earnings after you begin receiving benefits: If you receive benefits and are under full retirement age and you think your earnings will be different than what you originally told us, let us know right away. You cannot report a change of earnings online.

Pension vs. Social Security: An Overview

Pensions

- Before the advent of IRAs and 401(k) plans, there were pensions. Your parents and grandparents, if they worked for the same company for many years, may have enjoyed generous pension benefits. Pensions nowadays are known officially as defined-benefit plans because the payment amount you'll receive in retirement is decided or defined in advance.341 A private pension is a re…

Social Security

- Although many seniors receive Social Security benefits in retirement, the Social Security system isn't considered a pension. It may look like a pension because upon retirement (if you have paid into the system during your working years), you are eligible to receive monthly benefits. These benefits can begin at the age of 62.9 The amount of the chec...

Key Differences

- There are several other distinctions between pensions and Social Security. Social Security offers a disability insurance program that covers workers with enough credits (earned through work and payment into the system) if they become disabled.12Pensions normally don’t provide disability benefits unless the employee is disabled in an on-the-job accident. Although spouses may recei…