Are survivor benefits considered income?

The IRS requires Social Security beneficiaries to report their survivors benefit income. The agency does not discriminate based on the type of benefit — retirement, disability, survivors or spouse benefits are all considered taxable income.

Are pension survivor benefits taxable?

Previously, Nebraska excluded only a portion of military retirement from income taxes. However, survivors receiving SBP payments will still have to pay taxes on their payments. North Carolina also passed legislation joining the list of states that no longer will tax military retirees, with the new rule becoming effective Jan. 1, 2022.

Will working decrease my Spousal survivor benefit?

No, the effect that working has on benefits is only on the benefits of the person who is actually working. It will have no effect on the benefits received by other family members. Learn more about survivors benefits for spouses and survivors benefits for divorced spouses, including the eligibility requirements. Talk to a Disability Lawyer.

Who can collect the Social Security death benefit?

More than 60 million Americans receive Social Security benefits, and just under 10 percent, or about 6 million, receive survivor benefits. Until this year, Renn said, LGBTQ people who contributed part of their paycheck to the pot weren’t getting anything back in terms of survivor benefits — simply because of their sexual identity.

Are survivor benefits considered earned income?

The IRS requires Social Security beneficiaries to report their survivors benefit income. The agency does not discriminate based on the type of benefit -- retirement, disability, survivors or spouse benefits are all considered taxable income.

Does survivor Social Security count as income?

Key Takeaways. Social Security survivor benefits paid to children are taxable for the child, although most children don't make enough to be taxed. If survivor benefits are the child's only taxable income, they are not taxable. If half the child's benefits plus other income is $25,000 or more, the benefits are taxable.

Are Social Security spousal survivor benefits taxable?

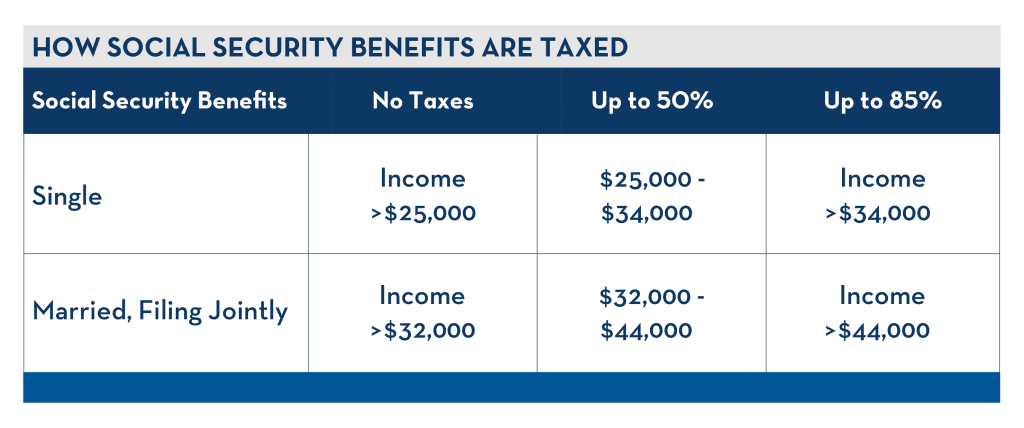

If your combined taxable income is less than $32,000, you won't have to pay taxes on your spousal benefits. If your income is between $32,000 and $44,000, you would have to pay taxes on up to 50% of your benefits. If your household income is greater than $44,000, up to 85% of your benefits may be taxed.

What is the difference between survivor benefits and widow benefits?

It is important to note a key difference between survivor benefits and spousal benefits. Spousal retirement benefits provide a maximum 50% of the other spouse's primary insurance amount (PIA). Alternatively, survivors' benefits are a maximum 100% of the deceased spouse's retirement benefit.

Can I draw survivor benefits and still work?

You can get Social Security retirement or survivors benefits and work at the same time. But, if you're younger than full retirement age, and earn more than certain amounts, your benefits will be reduced. The amount that your benefits are reduced, however, isn't truly lost.

How long does a spouse get survivors benefits?

Widows and widowers Generally, spouses and ex-spouses become eligible for survivor benefits at age 60 — 50 if they are disabled — provided they do not remarry before that age. These benefits are payable for life unless the spouse begins collecting a retirement benefit that is greater than the survivor benefit.

At what age do survivor benefits stop?

Benefits stop when your child reaches age 18 unless that child is a student or has a disability.

How much is a child's Social Security filing?

If the child is single, the base amount for the child's filing status is $25,000. If the child is married, see Publication 915, Social Security and Equivalent Railroad Retirement Benefits for the applicable base amount and the other rules that apply to married individuals receiving social security benefits.

How to determine taxability of benefits?

The taxability of benefits must be determined using the income of the person entitled to receive the benefits. If you and your child both receive benefits, you should calculate the taxability of your benefits separately from the taxability of your child's benefits. The amount of income tax that your child must pay on that part ...

How to find out if a child is taxable?

To find out whether any of the child's benefits may be taxable, compare the base amount for the child’s filing status with the total of: All of the child's other income, including tax-exempt interest. If the child is single, the base amount for the child's filing status is $25,000.

Is a child's Social Security payment taxable?

If the total of (1) one half of the child's social security benefits and (2) all the child's other income is greater than the base amount that applies to the child's filing status, part of the child's social security benefits may be taxable.

How do survivors benefit amounts work?

We base your survivors benefit amount on the earnings of the person who died. The more they paid into Social Security, the higher your benefits would be.

Who receives benefits?

Certain family members may be eligible to receive monthly benefits, including:

Are other family members eligible?

Under certain circumstances, the following family members may be eligible:

How long do you have to wait to receive Social Security if you die?

If the eligible surviving spouse or child is not currently receiving benefits, they must apply for this payment within two years of the date of death. For more information about this lump-sum payment, contact your local Social Security office or call 1-800-772-1213 ( TTY 1-800-325-0778 ).

What percentage of a widow's benefit is a widow?

Widow or widower, full retirement age or older — 100 percent of the deceased worker's benefit amount. Widow or widower, age 60 — full retirement age — 71½ to 99 percent of the deceased worker's basic amount. A child under age 18 (19 if still in elementary or secondary school) or disabled — 75 percent.

What happens if you die on reduced benefits?

If the person who died was receiving reduced benefits, we base your survivors benefit on that amount.

How much can a family member receive per month?

The limit varies, but it is generally equal to between 150 and 180 percent of the basic benefit rate.

What to do if you are not getting survivors benefits?

If you are not getting benefits. If you are not getting benefits, you should apply for survivors benefits promptly because, in some cases, benefits may not be retroactive.

How old do you have to be to get a mother's or father's benefit?

Mother's or Father's Benefits (You must have a child under age 16 or disabled in your care.)

Can you get survivors benefits if you die?

The Basics About Survivors Benefits. Your family members may receive survivors benefits if you die. If you are working and paying into Social Security, some of those taxes you pay are for survivors benefits. Your spouse, children, and parents could be eligible for benefits based on your earnings.

Can you collect survivors benefits if a family member dies?

You may receive survivors benefits when a family member dies. You and your family could be eligible for benefits based on the earnings of a worker who died. The deceased person must have worked long enough to qualify for benefits.

Who Qualifies for Social Security Survivor Benefits?

Monthly survivor benefits are available to certain family members, including: 1

How Are Social Security Survivor Benefits Calculated?

A one-time death benefit payment of $255 can be paid to your surviving spouse if they were living with you or if you were living apart and your spouse was receiving certain Social Security benefits on your record. In cases where there is no surviving spouse, the one-time payment can be made to a child who is eligible for benefits on the deceased's record in the month of death. 5

How Do You Apply for Survivor Benefits?

However, you can apply over the phone or by appointment at your local Social Security office. Current requirements and contact information are always available on the Social Security Administration website. 11

How Big Are the Benefits?

Benefits also vary according to the survivor's relationship to the deceased and the age at which they begin receiving benefits.

Who Is Entitled to Social Security Death Benefits?

Social Security death benefits are available to surviving spouses and dependents of workers who paid into the Social Security fund and worked long enough to earn benefits. 12

What Percentage of Social Security Benefits Does a Widow or Widower Receive?

The surviving spouse can receive 100% of the benefits at full retirement age. If the surviving spouse is between age 60 and their full retirement age, they can receive reduced benefits— usually 71.5–99%. If the surviving spouse is disabled, they can begin receiving 71.5% of the benefits at age 50. Surviving spouses with children under 16 receive 75% of the benefits 15 16

What are the variables to consider when deciding on a retirement plan?

Ideally, you want to be sure you're choosing the option that best fits your financial circumstances by considering all of the variables, which could include your age, your deceased spouse's age, and your eligible benefits—including both the survivor and your own retirement benefits.

What can you spend Social Security survivor benefits on?

The Social Security Administration requires that the money be spent first for the beneficiary's food, shelter, and medical needs. Any surplus must be saved in a federally insured, interest-bearing savings account or bond. You'll need to account for how you use the money by filling out a Representative Payee Report once a year.

How much of a survivor's income is taxable?

6 . If the person has any additional income but it’s below $25,000, benefits won’t be taxed. 7 If they earn between $25,000 and $34,000, 50 percent of the survivor benefit is taxable.

How long does it take to get survivor benefits from Social Security?

Social Security generally takes about 30-60 days to start paying benefits after it approves your application. You can check the status of your application at the Social Security Administration's website.

What is survivor benefit?

Survivor benefits are based on the deceased person's income, along with the age of the beneficiary and their relationship to the deceased. Generally, benefits are calculated as follows:

What percentage of Social Security benefits are paid to a deceased parent?

If the family earnings are more than 150 percent to 180 percent of the deceased parent’s earnings, Social Security will reduce the benefits proportionally for everybody except the surviving parent until the total reaches the total maximum amount. 13

What happens if neither spouse claims benefits?

If neither spouse has claimed benefits, and the surviving spouse works, he or she will receive theirs or the deceased spouses —generally whichever is larger. If one was claiming benefits and one was not, the surviving spouse will need help figuring out how to maximize their benefits. 4 .

How much of benefits are taxable?

The tax treatment is much the same as if the person was paying based on their own years of services. Up to 85% of the benefits received might be taxable but that depends on a lot of factors. Most notable is the income test. 6

What is considered earned income for Social Security?

Several sources of income count as earned income when it comes to Social Security benefits. These include wages from a job and self-employment income.

What is the maximum amount you can earn in addition to Social Security?

In 2019, if you decide to collect reduced social security benefits before you’ve reached your full retirement age, the maximum you can earn in addition to your benefits is $17,640 per year.

How much would you get if you were 62 and you earned above the limit?

For example, if you’re 62 with a retirement benefit of $1,000 a month, and you earned $4,000 above the $17,640 limit, your benefit would be reduced by $2,000. The penalty would be applied to your next two $1,000 benefit payments. So you would receive no Social Security income for two months.

What happens if you lose Social Security?

If you lose Social Security benefits because you earned too much, the money isn’t gone forever. The lost benefits will be returned when you reach full retirement age. The money will be repaid to you in equal monthly installments spread over a span of 15 years.

When do you get Social Security if you retire?

If your earnings will be over the limit for the year, but you will be retired for part of that year, you will receive your full Social Security benefits starting with the first whole month you are retired, regardless of your earned wages for that year.

Does Social Security count toward income limit?

Some Income Isn't Counted. If you make contributions to an employee retirement plan from your wages, Social Security doesn’t count that money toward your income limit unless the employer includes it in the gross wages reported in Box 1 on your Form W-2.

Does Social Security count income after expenses?

If you are self-employed, Social Security counts your net earnings after operating expenses. When you work for someone else, your wages count when earned, not when you receive them from the employer. If you are self-employed, your income counts when it is paid to you rather than when you earned it.

What is the difference between SSDI and Supplemental Security?

Two programs provide disability benefits through the SSA. Social Security Disability Insurance (SSDI) is paid to disabled adults who have earned enough work credits through Social Security taxes to qualify, while Supplemental Security Insurance is available to low-income households for disabled children and adults who do not have enough work credits to qualify for SSDI.

What is the SSA?

The Social Security Administration (SSA) manages various benefits programs that pay cash allotments to beneficiaries and, in some cases, their dependents. Although these programs are all managed by the SSA, it’s important to understand how they differ and under which circumstances they might overlap.

What is adjusted gross income?

Adjusted gross income (AGI) is the total taxable amount of earned and unearned income for a tax-filing individual or group, minus qualifying deductions.

Is Social Security income included in household income?

In all cases, SSI benefits are not included in a household’s income when evaluating eligibility for Medicaid services. Otherwise, taxable and non-taxable Social Security income received by the primary beneficiary may be counted as part of the household’s income for Medicaid eligibility.

Can a beneficiary receive more than one Social Security?

In some circumstances, a beneficiary may receive more than one type of Social Security income. For example, if a retiree is disabled, they may receive their retirement income in addition to SSDI or SSI payments.

Can a spouse receive a survivor benefit?

Survivor and dependent benefits. In the case of a beneficiary’s death or disability, their spouse and children may be eligible to receive a survivor or dependent benefit for a certain amount of time.

Does Social Security income count as Medicaid income?

Exemptions exist for children and tax dependents who receive survivor or dependent benefits through Social Security. If the child or tax dependent does not meet tax-filing thresholds for their earned and unearned income amounts, their Social Security income may not be included in the household’s MAGI for Medicaid eligibility.