Do I have to pay taxes on my SSDI benefits?

The general rule is that if your total income, including Social Security disability benefits, exceeds $25,000 a year for an individual or $32,000 a year for a married couple, you have to pay federal taxes on that income.

Can I receive both VA and SS disability benefits?

Veterans can obtain both 100% VA Disability and Social Security Disability benefits at the same time. A lot of veterans believe they can only receive one or the other; not both. A lot of veterans receive both VA Disability and Social Security. Can veterans receive Social Security Benefits and VA Disability Benefits? Yes! Here's How.

Do you qualify for SS disability benefits?

To qualify for Social Security disability benefits, you must first have worked in jobs covered by Social Security. Then you must have a medical condition that meets Social Security's definition of disability. In general, we pay monthly benefits to people who are unable to work for a year or more because of a disability.

Are taxes taken out of disability benefits?

Taxes are not taken out of disability benefits – whether it’s for Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI). The Social Security Administration (SSA) will never automatically withhold taxes. In fact, in many cases, you do not have to pay federal income taxes on these benefits at all.

Do I have to file taxes on Social Security disability?

If a portion of your benefits is taxable, usually 50% of your benefits will be taxable. However, up to 85% of your benefits can be taxable if either of these situations applies: The total of half of your benefits and all your other income is more than $34,000 — or $44,000 if married filing jointly.

Do I have to report disability income on my tax return?

Generally, you must report as income any amount you receive for your disability through an accident or health insurance plan paid for by your employer. If both you and your employer pay for the plan, only the amount you receive for your disability that is due to your employer's payments is reported as income.

How much of Social Security disability benefits are taxable?

between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. more than $34,000, up to 85 percent of your benefits may be taxable.

Is Social Security Disability considered income?

The Social Security administration has outlined what does and doesn't count as earned income for tax purposes. While the answer is NO, disability benefits are not considered earned income, it's important to know the difference between earned and unearned income and know where your benefits fit in during tax season.

How do I file taxes on Social Security disability?

You report the taxable portion of your social security benefits on line 6b of Form 1040 or Form 1040-SR. Your benefits may be taxable if the total of (1) one-half of your benefits, plus (2) all of your other income, including tax-exempt interest, is greater than the base amount for your filing status.

How much of my Social Security is taxable in 2021?

For the 2021 tax year (which you will file in 2022), single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income was more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

What is the monthly amount for Social Security disability?

SSDI payments range on average between $800 and $1,800 per month. The maximum benefit you could receive in 2020 is $3,011 per month. The SSA has an online benefits calculator that you can use to obtain an estimate of your monthly benefits.

How much can you make on Social Security disability without being penalized?

During the 36-month extended period of eligibility, you usually can make no more than $1,350 ($2,260 if you are blind) a month in 2022 or your benefits will stop. These amounts are known as Substantial Gainful Activity (SGA).

How long can you be on Social Security disability?

To put it in the simplest terms, Social Security Disability benefits can remain in effect for as long as you are disabled or until you reach the age of 65. Once you reach the age of 65, Social Security Disability benefits stop and retirement benefits kick in.

At what age does SSDI stop?

65When you reach the age of 65, your Social Security disability benefits stop and you automatically begin receiving Social Security retirement benefits instead. The specific amount of money you receive each month generally remains the same.

Federal Taxation of Social Security Disability Benefits

Here's how it works. If you are married and you file jointly, and you and your spouse have more than $32,000 per year in income (including half of...

Taxation of Social Security Disability Backpay

Large lump-sum payments of back payments of SSDI (payments of benefits for the months you were disabled but not yet approved for benefits) can bump...

State Taxation of Social Security Disability Benefits

Most states do not tax Social Security disability benefits. The following states, however, do. Some of these states use the same income brackets as...

How much income is subject to tax on SSDI?

Here's how it works. If you are married and you file jointly, and you and your spouse have more than $32,000 per year in income (including half of your SSDI benefits), a portion of your SSDI benefits are subject to tax. If you are single, and you have more than $25,000 in income per year (including half of your SSDI benefits), a portion of your SSDI benefits will be subject to tax.

What is the tax rate for disability?

85%. Keep in mind that if your disability benefits are subject to taxation, they will be taxed at your marginal income tax rate. In other words, your tax rate would not be 50% or 85% of your benefits; your tax rate would probably be more like 15-25% of your benefits. Those with higher incomes (where 85% of your benefits would be taxed) ...

Do you pay taxes on Social Security Disability?

Social Security disability is subject to tax, but most recipients don't end up paying taxes on it. Social Security disability benefits (SSDI) can be subject to tax, but most disability recipients don't end up paying taxes on them because they don't have much other income.

Do you have to pay taxes on SSDI?

Most states do not tax Social Security disability benefits. The following states, however, do tax benefits in some situations. Some of these states use the same income brackets as the federal government (above) to tax SSDI benefits, but others have their own systems.

Can SSDI payments bump up your income?

Large lump-sum payments of back payments of SSDI (payments of benefits for the months you were disabled but not yet approved for benefits) can bump your income up for the year in which you receive them, which can cause you to pay a bigger chunk of your backpay in taxes than you should have to.

How much of a person's income is taxable?

Fifty percent of a taxpayer's benefits may be taxable if they are: Filing single, single, head of household or qualifying widow or widower with $25,000 to $34,000 income. Married filing separately and lived apart from their spouse for all of 2019 with $25,000 to $34,000 income.

How much income do you need to be married to be eligible for a widow?

Filing single, head of household or qualifying widow or widower with more than $34,000 income. Married filing jointly with more than $44,000 income. Married filing separately and lived apart from their spouse for all of 2019 with more than $34,000 income.

Is Social Security taxable if married filing jointly?

If they are married filing jointly, they should take half of their Social Security, plus half of their spouse's Social Security, and add that to all their combined income. If that total is more than $32,000, then part of their Social Security may be taxable .

Do you pay taxes on Social Security?

Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits. Social Security benefits include monthly retirement, survivor and disability benefits. They don't include supplemental security income payments, which aren't taxable. The portion of benefits that are taxable depends on ...

How many states tax Social Security disability?

As of 2020, 12 states imposed some form of taxation on Social Security disability benefits, though they each apply the tax differently. Nebraska and Utah, for example, follow federal government taxation rules.

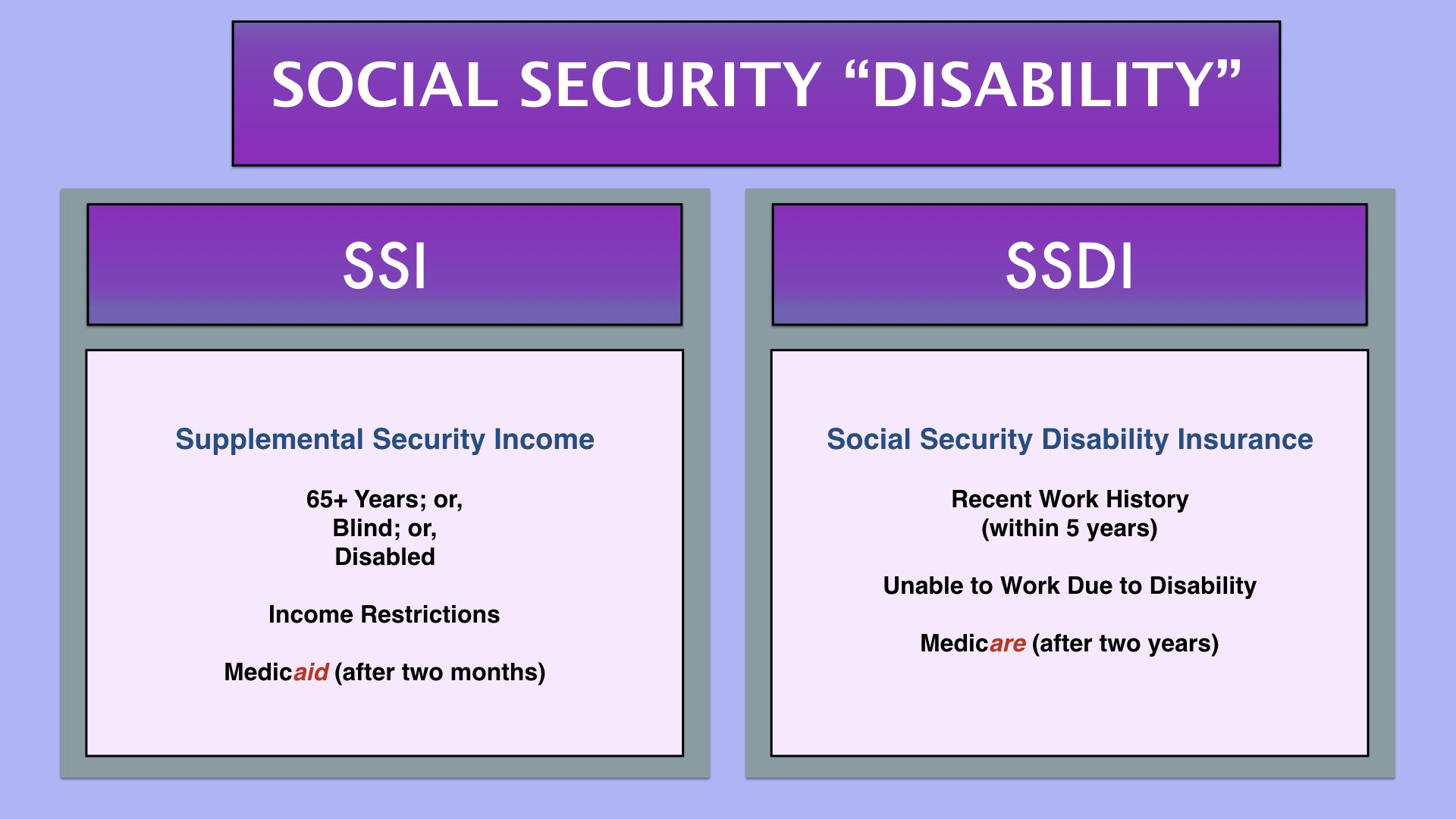

Who is eligible for SSI?

SSI benefits are paid to people who are aged, blind or disabled and have little to no income. These benefits are designed to help meet basic needs for living expenses. Social Security retirement benefitsare paid out based on your past earnings, regardless of disability status.

How long does a disability last?

Your disability must have lasted at least 12 months or be expected to last 12 months. Social Security disability benefits are different from Supplemental Security Income (SSI)and Social Security retirement benefits. SSI benefits are paid to people who are aged, blind or disabled and have little to no income. These benefits are designed ...

How much of my Social Security benefits do I get if I'm married?

Up to 50% of your benefits if your income is between $25,000 and $34,000. Up to 85% of your benefits if your income is more than $34,000. If you’re married and file a joint return, you’d pay taxes on: Up to 50% of your benefits if your combined income is between $32,000 and $44,000.

How much income can you report on Social Security?

This means that if you’re married and file a joint return, you can report a combined income of up to $32,000 before you’d have to pay taxes on Social Security disability benefits. There are two different tax rates the IRS can apply, based on how much income you report and your filing status.

Is disability income taxable?

Whether you receive SSDI or SSI, your disability benefits are generally not taxable. Here's how to determine if you need to pay income tax on your benefits. Menu burger. Close thin.

Is Social Security taxable if you are working part time?

Social Security retirement benefits, on the other hand, can be taxable if you’re working part-time or full-time while receiving benefits. Is Social Security Disability Taxable? This is an important question to ask if you receive Social Security disability benefits and the short answer is, it depends.

How Does Social Security Disability Work?

The Social Security Administration has a few different programs to help individuals and families who become disabled and are unable to work. One of these programs is called Supplemental Security Income, or SSI. This program is intended for people who are disabled, blind, or aged and have a financial need.

Is Social Security Disability Taxable?

The short answer to the question, “Is disability income taxable,” is maybe. The long answer depends on several factors, mainly your marital status and total taxable income. Most disability recipients do not pay taxes on their benefits because their total income is not high enough to require it.

What Is The Tax Rate on Disability Benefits?

A lot of people want to know how much Social Security pays, so the next logical question would be how much tax is owed on these payments. The tax rate that you will pay on your benefits depends on your total income for the tax year, not just your disability payments. You must report your net income for the year from your disability payments.

Do You Need to File Taxes If You Receive Social Security Disability Benefits?

Yes, you do need to file your taxes if you receive benefits through Social Security such as retirement benefits or disability payments. Whether or not you owe taxes on these payments is a different story. Most people receiving disability payments do not end up owing any taxes on them because their income is not high enough to require it.

Federal Taxation of Social Security Disability Benefits

As mentioned previously, recipients of SSI benefits get an exemption from taxes on these benefits because they are based on a substantial financial need. However, if you receive disability benefits, these payments may be taxed depending on the amount of your total income.

State Taxation of Social Security Disability Benefits

We already learned that disability payments can be taxed at the federal level, so do you pay taxes on Social Security disability at the state level? Most states do not tax disability income; however, there are a few that have other rules.

Conclusion

If you are receiving SSI payments, then you do not have to worry about paying taxes on those because they are exempt. So, people wondering about the question, “Is SSI taxable,” can relax. However, if you are receiving SSDI or retirement benefits, then you might owe some income taxes on those payments.

What line do you report Social Security benefits on?

You report the taxable portion of your social security benefits on line 6b of Form 1040 or Form 1040-SR. Your benefits may be taxable if the total of (1) ...

Do you have to add spouse's income to joint tax return?

If you're married and file a joint return, you and your spouse must combine your incomes and social security benefits when figuring the taxable portion of your benefits. Even if your spouse didn't receive any benefits, you must add your spouse's income to yours when figuring on a joint return if any of your benefits are taxable.

Is Social Security income taxable?

Social security benefits include monthly retirement, survivor and disability benefits. They don't include supplemental security income (SSI) payments, which aren't taxable. The net amount of social security benefits that you receive from the Social Security Administration is reported in Box 5 of Form SSA-1099, Social Security Benefit Statement, and you report that amount on line 6a of Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors. The taxable portion of the benefits that's included in your income and used to calculate your income tax liability depends on the total amount of your income and benefits for the taxable year. You report the taxable portion of your social security benefits on line 6b of Form 1040 or Form 1040-SR.

How much disability income is taxable?

The portion of your disability income that is subject to taxation depends on by how much your total income exceeds the federal threshold. If your total income is between $25,000 and $34,000, you can expect a maximum of 50% of your disability income to be considered taxable .

What is the tax rate for a person earning over $34,000?

For example, an individual whose total income is mid-range (between $25,000 and $34,000) would likely only pay between a 15% to 25% tax rate on benefits, while those earning above $34,000 could possibly pay a 35% tax rate on their benefits.

When is the deadline to file taxes for Social Security?

Find out more about disability and taxes from Social Security Disability Advocates USA. In light of the ongoing COVID-19 pandemic, the deadline to file your 2019 tax return has been extended to July 15, 2020.

Do you pay taxes on SSDI?

The Social Security Administration (SSA) reports that only about one third of SSDI recipients ultimately pay taxes on their benefits each year. Virtually no beneficiaries who receive Supplemental Security Income will pay taxes on these benefits, as they are already designated for low-income individuals.

Is disability income considered unearned income?

Other types of income, including child support, alimony, retirement income, and disability benefits are all considered unearned income . In short, although disability benefits are income, the way the federal government taxes this income differs from traditional earned income.

Is disability income the same as income?

In this way, disability is income. But when it comes to the Internal Revenue Service (IRS), all income is not treated the same. For taxation purposes, the IRS distinguishes between two kinds of income: earned and unearned.

Do you have to pay taxes on disability?

You will only be required to pay federal taxes on your disability income if your total income exceeds the threshold limit set by the federal government. You can calculate your total income by adding half the amount of your disability benefits to any additional income.