Are SSI and disability the same thing?

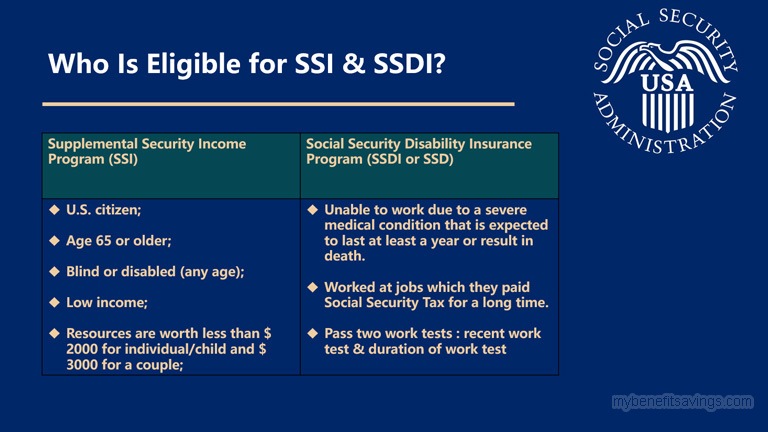

We manage two programs that provide benefits based on disability or blindness, the Social Security Disability Insurance (SSDI) program and the Supplemental Security Income (SSI) program. SSDI provides benefits to disabled or blind persons who are “insured” by workers' contributions to the Social Security trust fund.

Is SSI considered total disability?

Note that while permanent disability is not required to receive benefits, total disability is. Social Security disability insurance (SSDI) and Supplemental Security Income (SSI) are "all or nothing" systems.

Is SSI a disability or retirement?

WHAT IS SSI? SSI stands for Supplemental Security Income. Social Security administers this program. We pay monthly benefits to people with limited income and resources who are disabled, blind, or age 65 or older.

Is SSI and Social Security benefits the same?

Social Security benefits come from a fund that is created by the taxes paid into the system. SSI benefits, on the other hand, come from the U.S. Treasury's general funds. 3. Additional help with medical costs with SSI.

How long can a person get SSI?

For those who suffer from severe and permanent disabilities, there is no “expiration date” set on your Social Security Disability payments. As long as you remain disabled, you will continue to receive your disability payments until you reach retirement age.

Which pays more SSDI or SSI?

In general, SSDI pays more than SSI. Based on data from 2020: The average SSDI payment is $1,258 per month. The average SSI payment is $575 per month.

Can you collect Social Security and SSI at the same time?

Can I get both SSDI and SSI? Yes, you can receive Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) at the same time. Social Security uses the term “concurrent” when you qualify for both disability benefits it administers.

What are the 3 types of Social Security?

Social Security Benefits: Retirement, Disability, Dependents, and Survivors (OASDI)

What qualifies as a disability?

Disability is the umbrella term for any or all of an impairment of body structure or function, a limitation in activities (the tasks a person does), or a restriction in participation (the involvement of a person in life situations).

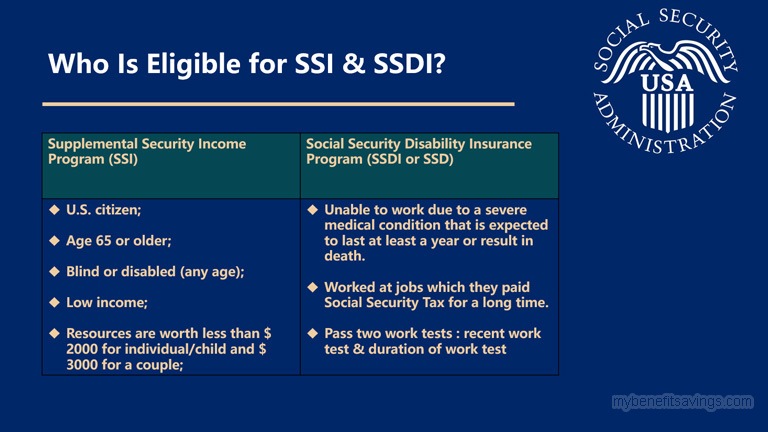

Who qualifies for SSI?

To get SSI, you must meet one of these requirements: • Be age 65 or older. Be totally or partially blind. Have a medical condition that keeps you from working and is expected to last at least one year or result in death. There are different rules for children.

What age do you have to be to get SSI?

The SSI program provides monthly payments to people who: Are at least age 65 or blind or disabled. Have limited income (wages, pensions, etc.). Have limited resources (the things you own). Are U.S. citizens, nationals of the U.S., or some noncitizens.

Can I get less SSI?

You may get less if you have other income such as wages, pensions, or Social Security benefits. You may also get less if someone pays your household expenses or if you live with a spouse and he or she has income. You may be able to get SSI if your resources are worth $2,000 or less.

What are the factors that affect Social Security eligibility?

Other factors may affect your eligibility, including: Marital status. Income and resources of certain members in your household, like a spouse or a parent of a minor child. If you would like to find out if you may be eligible for any of Social Security's benefit programs, use the Benefit Eligibility Screening Tool.

How do I contact Social Security by phone?

Visit SSA's Publications Page for detailed information about SSA programs and policies. You may also contact Social Security by phone at: 1-800-772-1213 (TTY: 1-800-325-0778) 1-800-772-1213.

Is SSI paid for by taxes?

The U.S. Social Security Administration (SSA) administers the. program, but SSI is not paid for by Social Security taxes. SSI provides financial help. to disabled adults and children who have limited income and resources.

How long can I get SSI?

You may receive SSI for a maximum of 7 years from the date DHS granted you qualified alien status in one of the following categories, and the status was granted within seven years of filing for SSI: Refugee admitted to the United States (U.S.) under section 207 of the Immigration and Nationality Act (INA);

What is considered income for SSI?

Income, for the purposes of SSI includes: money you earn from work; money you receive from other sources, such as Social Security benefits, workers compensation, unemployment benefits, the Department of Veterans Affairs, friends or relatives; and. free food or shelter.

What is a non-citizen on SSI?

the non–citizen must be in a qualified alien category, and. meet a condition that allows qualified aliens to get SSI benefits. A non–citizen must also meet all of the other requirements for SSI eligibility, including the limits on income, resources, etc.

Why does my SSI stop?

For example, your SSI will stop if you lose your status as a qualified alien because there is an active warrant for your deportation or removal from the U.S. If you are a qualified alien but you no longer meet one of the conditions that allow SSI eligibility for qualified aliens, then your SSI benefits will stop.

What is CAL disability?

Compassionate Allowances (CAL) are a way to quickly identify diseases and other medical conditions that, by definition, meet Social Security’s standards for disability benefits. These conditions primarily include certain cancers, adult brain disorders, and a number of rare disorders that affect children.

How long can you be ineligible for Social Security if you give away a resource?

If you give away a resource or sell it for less than it is worth in order to reduce your resources below the SSI resource limit, you may be ineligible for SSI for up to 36 months.

What are resources for SSI?

Resources, for the purposes of SSI, are things you own such as: cash; bank accounts, stocks, U.S. savings bonds; land; vehicles; personal property; life insurance; and. anything else you own that could be converted to cash and used for food or shelter. We do not count the value of all of your resources for SSI.

How much is SSI reduced if you work?

To oversimplify, most non-work income acts as a dollar for dollar offset from SSI benefits. So, if you have a small retirement benefit of $200 per month each and every month, your SSI would be reduced by $200. If you are able to work for limited hours, then your work income acts as a fifty percent reduction in SSI.

How long does disability insurance last?

From the date that you become disabled under the medical rules, SSA will look backward ten years (which is equal to forty “quarters of coverage”).

How much can I own to qualify for SSI?

The maximum amount of assets that you can own and be eligible is $2,000 for an individual and $3,000 for a couple.

How many years of disability do you have to work before you are disabled?

Within that ten year period, you have to have twenty quarters (five years) of coverage. To oversimplify, if you haven’t worked within the five years before you became disabled, you are not covered for disability benefits. It doesn’t matter that you worked for many, many years prior to the end of your working days;

What is the difference between sick and disabled?

If you are sick or disabled enough for one program, then you are sick or disabled enough for the other. The difference is in the financial eligibility. You must meet the financial eligibility for one or the other, regardless of how sick or disabled you are. In other words, if you do not have the quarters of coverage to be eligible ...