Short-Term Disability Benefit Payment Taxation

- Maternity Leave. Short-term disability for maternity leave is taxable when the employer pays the premium or the mother chooses a pre-tax deduction.

- State Disability. State temporary disability payments are sometimes income taxable. ...

- Employer Paid. Short-term disability benefits are taxable if your employer paid the premiums. ...

- Employee Paid. ...

Does my state tax Social Security disability benefits?

State Taxation of Social Security Disability Benefits. Most states do not tax Social Security disability benefits. The following states, however, do tax benefits in some situations. Some of these states use the same income brackets as the federal government (above) to tax SSDI benefits, but others have their own systems. To find out how your state taxes SSDI benefits, see our article on state taxation of SSDI benefits.

Are taxes taken out of disability benefits?

Taxes are not taken out of disability benefits – whether it’s for Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI). The Social Security Administration (SSA) will never automatically withhold taxes. In fact, in many cases, you do not have to pay federal income taxes on these benefits at all.

What states have temporary disability benefits?

- Employer Sponsored Short-Term Disability Plans. Many, though not all, employers offer disability insurance for their employees. ...

- State and Local Disability Programs. ...

- Social Security Disability Benefits. ...

- Getting Help with a Social Security Disability Claim. ...

Do disability benefits vary by state?

These disability benefits can help cover the costs of any medical expenses and every cost of living. Some types of benefits are the same across all states, while others may slightly, or largely differ state to state.

Do I have to report disability income on my tax return?

Generally, you must report as income any amount you receive for your disability through an accident or health insurance plan paid for by your employer. If both you and your employer pay for the plan, only the amount you receive for your disability that is due to your employer's payments is reported as income.

Are disability payments considered income?

The Social Security administration has outlined what does and doesn't count as earned income for tax purposes. While the answer is NO, disability benefits are not considered earned income, it's important to know the difference between earned and unearned income and know where your benefits fit in during tax season.

Are California SDI benefits taxable?

As a result, the SDI payments are taxable because the IRS considers the payments a substitute for unemployment. In these cases, California issues the worker a 1099-G form listing the total amount of taxable benefits and also forwards a copy to the IRS.

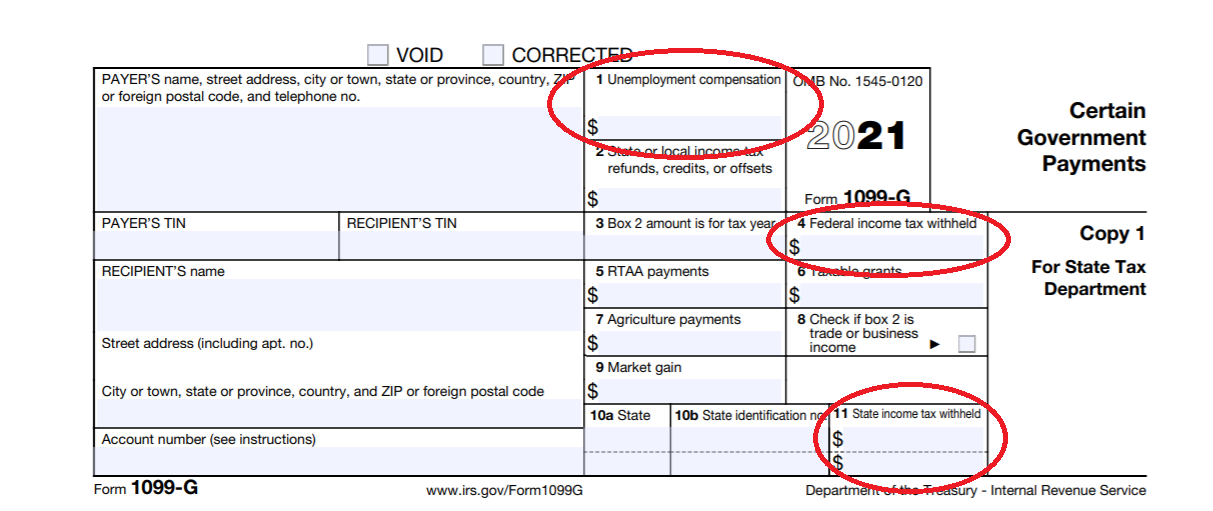

Do you get a 1099 g for disability?

Receive Form 1099G You can access your Form 1099G information in your UI OnlineSM account. If you received taxable unemployment compensation, including if you became disabled and began receiving disability benefits, your UI Online account will be updated with this information by January 31.

Does disability send you a w2?

Do I receive a W-2 form for Disability claim payments? A W-2 form lists the benefits paid and taxes withheld. It is required for every calendar year that you receive disability benefit payments. Your policy will dictate whether Guardian or your employer produces the W-2.

Where does 1099 G go on tax return?

Form 1099-G is issued by a government agency to inform you of funds you have received that you may need to report on your federal income tax return. Box 1 of the 1099-G Form shows your total unemployment compensation payments for the year, which generally need to be reported as taxable income on Form 1040.

Is CA SDI deductible on federal return?

Since it is levied as a percentage of your wage income, the California SDI tax is deductible on your federal return. The amount you paid in SDI would be included in line 5, as long as you are deducting income and not sales taxes.

Do I have to claim my SDI California benefits as income on my federal taxes for tax year 2021?

Yes, if someone received California State Disability Insurance (SDI) benefit payments (checks) from California Employment Development Department (EDD). No, if you are referring to the payroll deduction you see on your paystub that is also called CA-SDI and is included on someone's W-2.

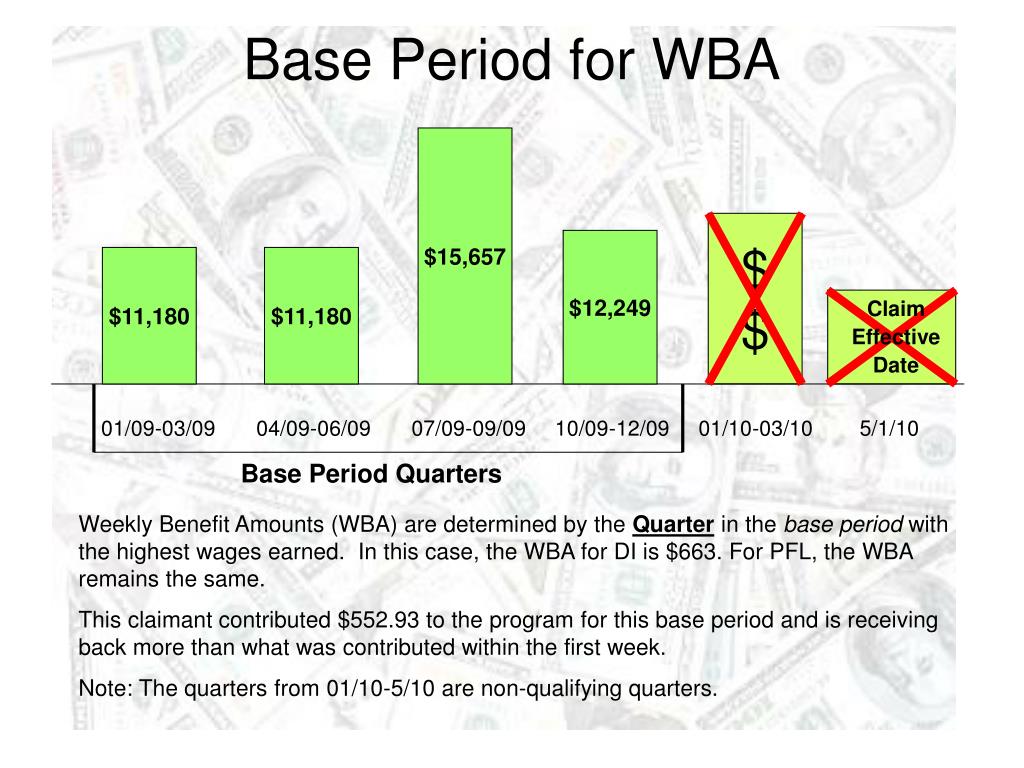

How are CA SDI taxable wages calculated?

To compute the dollar value of the SDI tax multiply the total taxable wages for the current payroll period by the current SDI tax rate. For example, assuming the 2021 SDI tax rate of 1.2 percent, or 0.0120, an employee who receives $1,000 wages in 2021 would be subject to $12 SDI tax (1000 x 1.0120 = 1,012).

How do I get my w2 from disability?

Go to Sign In or Create an Account. Once you are logged in to your account, select the "Replacement Documents" tab; Calling us at 1-800-772-1213 (TTY 1-800-325-0778), Monday through Friday, 8:00 am – 7:00 pm; or. Contacting your local Social Security office.

Do you get a tax refund if you are on disability 2022?

Tax Refunds Receiving SSDI or SSI benefits doesn't prevent you from receiving a tax refund. Whether you owe taxes or not, you should file a tax return if you think you qualify for any of the above credits discussed above. If you don't file a tax return, you will miss out on many of the credits.

What is disability insurance?

Disability insurance is protection against the financial burden of losing your income should you become disabled and can’t work. Coverage comes in the form of benefits paid to you monthly as if they were paychecks, and the amount should be about 60% of the income you were earning before you became disabled. You pay for disability insurance in the ...

What happens if you don't pay disability insurance premiums?

Premiums keep your disability insurance policy in force and failing to pay the premiums could result in a loss of coverage. Although disability insurance benefits account for only 60% of your income, that amount comes close to matching your regular take-home pay.

When did the IRS update the tax tables?

In March 2018, the IRS released updated tax tables, which were mandated by the 2017 Tax Cuts and Jobs Act. The new rates are as follows, sorted by filing status:

Do you have to pay taxes on disability?

You do not have to pay taxes on disability benefits you receive if you purchased your policy with after-tax dollars. But those who receive their policy through their employer may have to. Taxable disability insurance benefits are classified as “sick pay,” so if you anticipate receiving benefits, you have to submit IRS Form W-4S, titled “Request for Federal Income Tax Withholding From Sick Pay” to the insurance company. You can also make estimated tax payments using Form 1040-ES, “Estimated Tax for Individuals,” which you’ll file directly to the IRS.

Can you deduct medical expenses on your taxes?

The IRS will let you deduct qualified out-of-pocket medical expenses if you’re eligible to itemize your deductions, so if your disability benefits cover medical care and you owe taxes on them, those medical expenses may negate the tax.

Can I get disability insurance through my employer?

Employer-sponsored disability coverage. Many people get disability insurance through their employer . These are either (or both) long-term and short-term policies that we usually recommend you take because they may be partially or wholly subsidized by your employer.

Do you have to pay taxes on insurance premiums?

Likewise, if your employer pays for all or part of the insurance premium, you’ll have to pay taxes on the benefits. The percentage of the benefit that is taxable is equivalent to the percentage your employer paid and any percentage of the premiums you paid with pre-tax dollars. (The proportion you paid for in post-tax dollars is still tax-free.)

What is SSDI disability?

If you receive Worker’s Compensation or other public disability benefits such as certain state and civil service benefits, your SSDI benefit amount may be reduced. Supplemental Security Income, or SSI, is for eligible disabled adults and children and adults 65 and older who have limited income and resources.

How is Social Security Disability funded?

Social Security Disability Insurance, or SSDI, is funded by the payroll taxes withheld from workers’ paychecks or paid as a part of self-employment taxes. The benefits you may be eligible to receive are based on your earnings or the earnings of your spouse or parents.

How long does short term disability last?

Short-term disability insurance, which may replace part of your income for up to two years, although most last for a few months to a year. Long-term disability insurance, which, after a waiting period, may pay disability benefits for a few years or until your disability ends.

How much was the average disability payment in 2017?

And the percentage of awards has declined every year. Among those who did receive benefits in 2017, the average monthly amount paid was about $1,197.

Is disability insurance a government benefit?

Although SSDI and SSI are government benefits from the SSA, disability insurance is a private-sector source of disability income. It’s a type of insurance that may pay a portion of your salary when you’re disabled. Employers may provide disability insurance and might pay all or part of the premiums for you, but if your employer doesn’t provide the insurance you can purchase your own policy.

Is disability income taxable?

But in some cases, the IRS might view your disability benefits as taxable income. You may hope you never have to receive disability income.

Do I have to pay taxes on SSDI?

You may have to pay federal income tax on your SSDI benefits if the total of half of all your SSA benefits, other than SSI, plus all your other income (including tax-exempt interest) is greater than the base amount for your filing status.

How much of my Social Security disability is taxable?

To figure your provisional income, use Publication 915, Worksheet A. If your provisional income is more than the base amount, up to 50% of your social security disability benefits will usually be taxable. However up to 85% of benefits will be taxable if your provisional income is more than the adjusted base amount.

How are disability payments taxed?

How disability payments are taxed depends on the source of the disability income. The answer will change depending on whether the payments are from a disability insurance policy, employer-sponsored disability insurance policy, a worker’s compensation plan, or Social Security disability.

What is disability insurance?

Disability insurance is a type of insurance that provides income in the event that an employee is unable to perform tasks at work due to an injury or disability. Disability insurance falls in two categories:

How long does a short term disability last?

Short-term disability: This type of insurance pays out a portion of your income for a short period of time – and can last from a few months to up to two years. Long-term disability: This type of insurance begins after a waiting period of several weeks or months – and can last from a few years to up to retirement age.

Is disability income taxable?

Disability benefits may or may not be taxable. You will not pay income tax on benefits from a disability policy where you paid the premiums with after tax dollars. This includes: A employer sponsored policy you contributed to with after-tax dollars.

Can you file taxes if you are disabled in California?

No, per the California State Economic Development Department , if you leave work because of a disability and receive disability benefits, those benefits are not reportable for tax purposes.

Is California disability income taxable?

I found this in our knowledge base: California State Disability Insurance (SDI) benefits are generally not taxable, either on a federal level or on a state level. In fact, they are never taxable, except when considered to be a substitute for unemployment compensation, and when paid to an individual who is ineligible for Unemployment Insurance (UI) ...

Can you claim unemployment if you are injured?

However, if you are receiving unemployment benefits, become ill or injured, and begin receiving disability benefits; those Disability benefits are considered a substitute for Unemployment and are reportable for tax purposes up to your Unemployment maximum benefit amount. According to the IRS, Disability benefits that are considered a substitute ...

Do you report disability as income?

You must report as income any amount you receive for your disability through an accident or health insurance plan paid for by your employer: If both you and your employer have paid the premiums for the plan, only the amount you receive for your disability that's due to your employer's payments is reported as income.

Is disability taxable?

According to the IRS, Disability benefits that are considered a substitute for UI are taxable. Federal Tax Regulation Section 1.85-1 states that Disability benefits are considered to be a substitute for Unemployment benefits when paid to an unemployed taxpayer who is not eligible for UI benefits solely because of the disability.