What are the advantages of biweekly mortgage payments?

- They can help you pay off a mortgage early by several years.

- They contribute one extra full payment on your principal balance per year and cut down on accumulating interest.

- Biweekly payments build up your home equity. ...

- This payment plan could make personal budgeting easier, especially if you’re paid biweekly for your job.

Should you make bi-weekly mortgage payments?

- As common sense and the example above show, biweekly mortgage does pay off your mortgage faster. Say you're paying a 30-year traditional mortgage. ...

- Biweekly mortgage payments work well with budgets. ...

- You could save on interest since the payments are geared towards the principal.

- You're building equity. ...

Why to pay mortgage biweekly?

Making biweekly payments is a great way to prepay your mortgage, which can reduce the interest you’ll pay over the life of the loan and pay off your loan faster. But you need to set up the payments beforehand, and not every loan servicer will offer this option.

What are the benefits of biweekly payments?

Key Takeaways

- Many biweekly payment programs offered by lenders are not necessarily the best financial choice for homeowners.

- Committing to biweekly mortgage payments may not be affordable on a tight budget.

- Biweekly mortgage payments may not necessarily improve your credit score. ...

What are the pros and cons of biweekly mortgages?

How many mortgage payments are biweekly?

Why pay extra on mortgage each year?

How many half payments can you make on a mortgage?

How long does it take to pay off a mortgage?

Why is homeownership so attractive?

Can you switch back and forth on a biweekly mortgage?

See more

About this website

Is paying your mortgage bi-weekly a good idea?

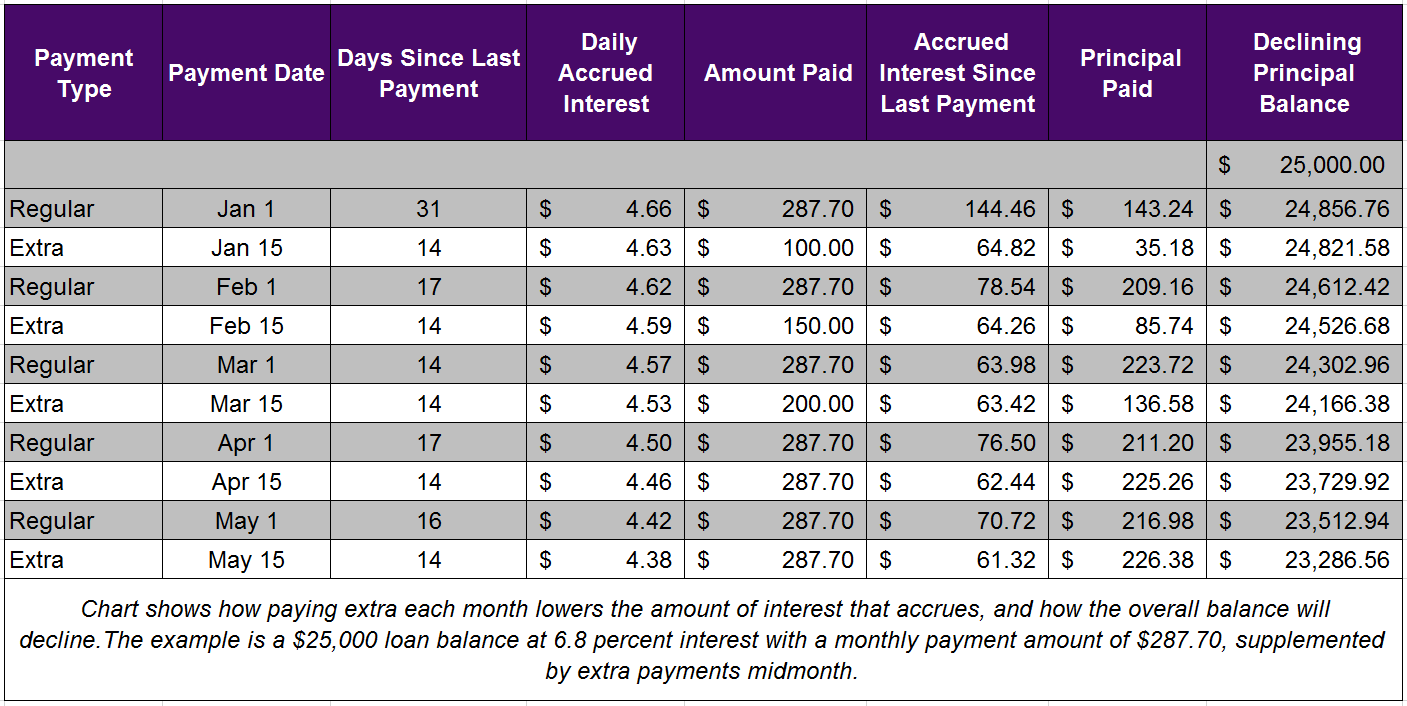

When you make biweekly payments, you could save more money on interest and pay your mortgage down faster than you would by making payments once a month. When you decide to make biweekly payments instead of monthly payments, you're using the yearly calendar to your benefit.

How much do you save if you pay your mortgage bi-weekly?

Tens of thousands of dollars can be saved by making bi-weekly mortgage payments and enables the homeowner to pay off the mortgage almost eight years early with a savings of 23% of 30% of total interest costs. With the bi-weekly mortgage plan each year, one additional mortgage payment is made.

Is it better to pay extra on mortgage monthly or biweekly?

The advantage of paying extra principal versus bi-weekly mortgage payments is slight. The extra principal plan offers more flexibility and lower costs. There are no fees involved when extra principal is added to a normal monthly mortgage payment.

What are the pros and cons of biweekly mortgage payments?

Pros and Cons of Making Biweekly Mortgage PaymentsPro 1: Pay Off Your Mortgage Faster. ... Pro 2: Build Equity. ... Pro 3: It's Easier to Budget. ... Pro 4: You May Save on Interest. ... Con 1: There May Be a Set-up Fee. ... Con 2: Requires You to Pay More Over the Course of the Year. ... Con 3: It's a Permanent Agreement.More items...•

How many years does biweekly payments save on 20 year mortgage?

Anything over that amount must be directed toward reducing your remaining principal balance. The bi-weekly scheme actually provides a 13th monthly payment each year, and that extra must be aplied to lowering your balance. At today's mortgage rates, bi-weekly payments shorten your loan term by four years.

What happens if I pay an extra $600 a month on my mortgage?

The additional amount will reduce the principal on your mortgage, as well as the total amount of interest you will pay, and the number of payments. The extra payments will allow you to pay off your remaining loan balance 3 years earlier.

What happens if I pay an extra $500 a month on my mortgage?

Throwing in an extra $500 or $1,000 every month won't necessarily help you pay off your mortgage more quickly. Unless you specify that the additional money you're paying is meant to be applied to your principal balance, the lender may use it to pay down interest for the next scheduled payment.

Does it matter if you pay your mortgage on the 1st or 15th?

Well, mortgage payments are generally due on the first of the month, every month, until the loan reaches maturity, or until you sell the property. So it doesn't actually matter when your mortgage funds – if you close on the 5th of the month or the 15th, the pesky mortgage is still due on the first.

What happens if I pay 2 extra mortgage payments a year?

Making additional principal payments will shorten the length of your mortgage term and allow you to build equity faster. Because your balance is being paid down faster, you'll have fewer total payments to make, in-turn leading to more savings.

How can I pay off my 30 year mortgage in 15 years?

Options to pay off your mortgage faster include:Adding a set amount each month to the payment.Making one extra monthly payment each year.Changing the loan from 30 years to 15 years.Making the loan a bi-weekly loan, meaning payments are made every two weeks instead of monthly.

What happens if you make 1 extra mortgage payment a year?

Okay, you probably already know that every dollar you add to your mortgage payment puts a bigger dent in your principal balance. And that means if you add just one extra payment per year, you'll knock years off the term of your mortgage—not to mention interest savings!

Is it better to pay lump sum off mortgage or extra monthly?

Regardless of the amount of funds applied towards the principal, paying extra installments towards your loan makes an enormous difference in the amount of interest paid over the life of the loan. Additionally, the term of the mortgage can be drastically reduced by making extra payments or a lump sum.

Should You Make Bi-Weekly Mortgage Payments? - Experian

Homeowners looking to cut their overall mortgage debt can get the job done by doubling the number of payments they make to their mortgage company every year. Paying your mortgage every two weeks adds one full payment each year. Find out more.

What is the benefit of paying biweekly?

More benefits to paying bi-weekly. Shortens the term of the loan: Paying bi-weekly means you’ll get the lower payments of a 30-year term, without the aggressive (and more expensive) monthly payment tied to a 15-year mortgage.

How many biweekly payments are there in a year?

Since there are 52 weeks in a year, 26 bi-weekly payments mean homeowners who pay this way are making 13 monthly payments each year, instead of the standard 12. This equates to just one additional mortgage payment a year, but this one extra payment substantially shortens the lifespan of the loan.

How many half payments a year for mortgage?

Another important decision for potential homeowners (or those who want to change their bill pay structure) is to consider whether to pay the mortgage monthly (in 12 full payments a year) or bi-weekly (26 half-payments a year.)

How much interest does a $300000 loan save?

This shortens payoff on a standard 30-year mortgage by five years and saves over $35,000 in interest over the life of the loan.

Advantages Of Biweekly Mortgages

Borrowers can pay off the mortgage sooner by making one extra payment per year. For example, let’s say a borrower has a $200,000 mortgage with a rate of 5% and a 30-year term. If the borrower does the biweekly mortgage, the loan would be paid off in 25 years or five years earlier versus the traditional mortgage with monthly payments.

Making Biweekly Mortgage Payments Can Be A Great Repayment Strategy

Biweekly mortgage payments can be a great early-repayment strategy. Most people will not realize they are making an extra payment twice a year because the payment amount is so small. For most months, you wont pay any more than your current mortgage payment and you will still repay your mortgage early while saving thousands of dollars in interest.

Less Money For Other Needs

Before you commit to making biweekly mortgage payments, consider whether doing so would benefit your overall financial plan. A biweekly plan means putting more money toward your mortgage every year, which could pull from other financial obligations like saving for retirement or paying off high-interest debt.

Beware Of Payment Processing Companies

Some mortgage lenders offer biweekly payment options. For example, Navy Federal Credit Union offers a dedicated program for those who want to make payments every two weeks indefinitely, says Kevin Torres, a mortgage product strategist at the credit union.

The Bottom Line: Are Biweekly Payments Right For You

For the right type of borrower, biweekly payments can help you save on interest and quickly add equity into your home. As with any major financial decision, its important that you weigh the pros and cons of paying your mortgage more frequently.

How To Do It Yourself

The good news is that if your lender doesnt offer a biweekly payment option, you can take matters into your own hands.

Reasons To Make Biweekly Mortgage Payments

There are several benefits of paying a mortgage biweekly. While it may require a little extra work on your end, at least in the beginning, you may find it completely worthwhile.

What Is a Biweekly Mortgage Payment?

The default way to pay your mortgage is monthly, because mortgage payments are typically due once a month. If you pay biweekly, you’ll make half of your monthly principal and interest payment every two weeks instead. That’s 26 half payments a year, or the equivalent of 13 full payments a year, instead of 12.

Pros and Cons of Biweekly Mortgage Payments

Paying less interest and getting out of debt faster are enticing reasons to make biweekly mortgage payments. But your plan might not work out as well as you expect if you don’t understand how to manage the downsides.

Is a Biweekly Mortgage Payment Right for Me?

Now that you know the pros and cons of making biweekly mortgage payments, you can evaluate how this strategy applies to your situation.

How to Set Up a Biweekly Mortgage Payment

If you want to pay your mortgage biweekly, there are several ways to do it, and one method to avoid.

What is biweekly mortgage payment?

Biweekly payments are a mortgage payment option that can allow you to make an extra full payment each year. This can help you pay off your mortgage earlier and reduce the amount you pay in interest in the long run by thousands of dollars.

How many payments are there in a biweekly mortgage?

A biweekly plan equates to 13 full payments each year (or 26 biweekly half payments). Bimonthly mortgage payments could also be an option, but they differ from biweekly payments.

What is the difference between biweekly and monthly payments?

As you can see from the example above, there are a few big differences between biweekly and monthly payments: the number of payments you make, how long it takes to pay off your mortgage and the amount of money you end up paying on the loan.

Why is biweekly payment better than monthly?

By making an extra payment every year, bi-weekly payments pay off your mortgage faster than monthly payments, which, in turn, saves you more money.

How much interest savings do you get from biweekly payments?

With biweekly payments, you’ll have total interest savings of $18,703. Biweekly Vs. Monthly Mortgage Payments.

What happens when you pay your mortgage faster?

When you pay your principal balance down faster, there’s less money to charge interest on, which lowers your interest charge. On top of that, when your mortgage is paid off earlier, it shaves off several years’ worth of interest payments.

Is a mortgage a debt?

Share: A mortgage is one of the biggest debts you’ll have in your life. And while you may be tackling your credit debt, car loan or student loans, your mortgage may be a little harder to chip away.

What is biweekly mortgage?

A biweekly mortgage is “regular” mortgage. The only difference is that you structure your payments so that, instead of making one payment at the beginning of each month, you make half of one payment every two weeks. Because there are 52 weeks in a year, you make 26 of these half-payments, which is like making an extra monthly payment each year.

Why should I not pay my mortgage biweekly?

The first — and most obvious — reason to avoid bi-weekly mortgage payment programs is that homeowners choosing to self-manage their bi-weekly payments get better results than via a bank-managed bi-weekly payment program .

How many payments are there in a biweekly mortgage?

The bi-weekly mortgage plan: 13 payments a year. A bi-weekly mortgage payment program is meant to short-circuit your loan’s amortization schedule. Instead of taking 12 payments per year, the bi-weekly payment plan asks for one payment every two weeks, which adds up to 13 payments per year.

How long does biweekly mortgage payment last?

At today’s mortgage rates, bi-weekly payments shorten your loan term by four years. Verify your new rate (Jul 23rd, 2021)

How much is a 13th payment on a $300000 mortgage?

By sending $1,300 to your lender monthly, you’ll “overpay” your mortgage by $1,200 annually, which is a 13th payment. Assuming a $300,000 mortgage at 4.000%, look at how the math works : This math works because banks don’t apply that 13th payment until the year is complete.

How does paying down your balance affect your interest?

As you pay down your balance, the interest cost diminishes. That leaves more of your payment for reducing your balance. It’s like a snowball — your balance is lower, so your interest is lower, and every month, your balance goes down faster. This repayment schedule is the reason why during the first five years or so, ...

Is biweekly mortgage better than ARM?

While it’s proven that the bi-weekly repayment scheme can save you money, there may be better options. If you don’t expect to keep your home for many more years, refinancing to a hybrid ARM with a much lower interest rate (5/1 ARM rates often run about 1 percent lower than 30-year fixed rates), while making the same higher payment, could take a bigger bite out of your mortgage faster.

What is a weekly mortgage payment?

Weekly Payments. With weekly payments, the lender multiplies the monthly payment by 12 and divides by 52 in order to calculate the payment. Total payments are unchanged.

How many biweekly payments are there in a year?

A biweekly mortgage is one on which the borrower makes a payment equal to half the fully amortizing monthly payment every two weeks. Since there are 26 biweekly periods in a year, the biweekly produces the equivalent of one extra monthly payment every year.

How early can you pay off a mortgage with 4%?

But if the borrower rounds off the payment to $500, payoff occurs after 659 payments, or 30.5 months early. Biweekly Payments. A biweekly mortgage is one on which ...

Do mortgages with shorter payment periods save money?

Lenders who offer mortgages with shorter payment periods than the standard monthly payment mortgage usually do claim that they will save the borrower money. But they seldom explain how. The Sources of Borrower Savings. There are only three possible sources of savings to the borrower from increasing the frequency of mortgage payments.

Can you budget extra payments biweekly?

The biweekly is only one of many ways that borrowers can budget extra payments. For example, increasing every monthly payment by 1/12 will pay down the balance at a rate almost identical to that with a biweekly. For hundreds of other ways to do it, see my Extra Payment Calculator.

Does amortizing a loan reduce interest?

Amortizing the loan using a shorter period generates a real saving for the borrower, but it doesn’t amount to much.

Is biweekly amortization a monthly payment?

Biweeklies amortize on a monthly basis, so there is no added benefit of biweekly amortization. The only contribution the lender makes to the accelerated payoff is to hold the borrower’s biweekly payments until the first of the month when they are applied.

What are the pros and cons of biweekly mortgages?

Lets consider the pros and cons of entering a biweekly mortgage plan. Pro 1: Pay Off Your Mortgage Faster. By making one extra payment a year, your mortgage will ultimately be paid off faster. For example, if you’re buying a $100,000 home and you put 20% down, you’ll have an $80,000 mortgage.

How many mortgage payments are biweekly?

Making biweekly mortgage payments means paying half of your monthly mortgage payment every two weeks for a total of 13 full mortgage payments a year. Menu burger.

Why pay extra on mortgage each year?

The more you’ve paid toward your mortgage, the more equity in your house you own. By making an extra payment each year, you’ll gain equity more quickly. Pro 3: It’s Easier to Budget. If you are paid biweekly, then having a biweekly mortgage payment can make it easier to budget.

How many half payments can you make on a mortgage?

One option to consider is a biweekly (every two week) payment plan. With biweekly mortgage payments, you make 26 half-payments a year, which equates to 13 total payments in a year. It can be a good option for those wanting to contribute more money toward a mortgage, ...

How long does it take to pay off a mortgage?

With a 30-year mortgage, it will normally take you 30 years to pay this off. But if you make biweekly mortgage payments, you will be making what equates to 13 monthly payments each year. Assuming a 6.5% interest rate and biweekly payments of $252, you would pay off your mortgage in a little over 24 years, or about six years early.

Why is homeownership so attractive?

Pro 2: Build Equity. One of the reasons why homeownership is so attractive to so many people is that it allows you to build equity. Equity is your financial stake in your home. There are a few ways to build equity fasterand one of them is making additional mortgage payments.

Can you switch back and forth on a biweekly mortgage?

When you enter a biweekly mortgage payment program, you are making an agreement to make biweekly payments. You cannot switch back and forth month to month. So if you’d rather not make a binding agreement to pay extra, you shouldn’t commit to this type of payment plan. Con 4: Your Payment Isn’t Applied as You Pay.