What are the benefits of having a 529 plan?

You can transfer wealth with a 529 plan

- Use the College Planning Calculator to estimate your student's education costs and find out how much to invest each month to pursue your goal

- Learn about investing in a 529 plan

- Get strategies to help you save and invest for a child's education

How does 529 plan affect my taxes?

When the Form 1099-Q is issued to the 529 plan beneficiary, any taxable amount of the distribution will be reported on the beneficiary’s income tax return. This typically results in a lower tax obligation than if the Form 1099-Q is issued to the parent or 529 plan account owner.

What states offer tax deduction for 529 plans?

- Arizona – Up to $2,000 per year per person can be deducted on any 529 plan

- Arkansas – Up to $5,000 per year per person for in-state 529 plans, or up to $3,000 per person per year for out-of-state plans; rollover contributions qualify for a deduction ...

- Kansas – Up to $3,000 per person per year; rollover contributions not deductible

What is tax reform really means for 529 plans?

529 plans and ABLE accounts. ABLE accounts and rollovers from a 529 plan. The TCJA increases the amount of contributions allowed to an ABLE account and adds special rules for the increased contribution limit. It also allows an ABLE account’s designated beneficiary to claim the Saver's Credit for contributions to the account. Rollovers in ...

Why are 529 plans so attractive?

Tax benefits of 529 plans make them especially attractive to families and individuals looking to maximize their savings. However, thinking about those advantages only when choosing or setting up a plan can cause one to miss out on valuable account growth opportunities, possibly for years down the road.

How much can a parent deduct from a 529?

That means a parent or grandparent who contributes $4,000 to three accounts can deduct $12,000 ($4,000 times three) from his or her Virginia adjusted gross income. There is a carryover allowance as well. Some individuals may be equipped to use gift provisions of federal tax code to grow a 529 account.

How much can I deduct from my 529?

For example, if you contribute $10,000 to your child’s 529 plan this year, your state might only allow a $4,000 deduction.

What are the different types of 529 plans?

There are two types of 529 plans: college savings and prepaid tuition plans. As a general rule, both offer the same tax results but have very different ways of going about it. College savings plans are individual investment accounts.

What is a prepaid tuition plan?

Prepaid tuition plans allow you to pay future tuition expenses at today’s prices. They are operated either by your state or an individual educational institution. State-run plans let you prepay tuition costs at one or more state colleges and universities.

How long does it take to get a refund from a 529 plan?

Tuition paid from a 529 plan that is later refunded can be recontributed to the 529 plan within 60 days, preventing any adverse tax treatment as a result of the refund. You can avoid the 10 percent penalty if: The beneficiary receives a scholarship and doesn’t need the funds. The beneficiary dies or becomes disabled.

How to determine nontaxable portion of a nonqualified withdrawal?

To determine the nontaxable portion of a nonqualified withdrawal, multiply the distribution by the ratio of total contributions over the account balance on the last day of the calendar year.

How much is the American Opportunity Tax Credit?

As a point of reference, the maximum amount of the American Opportunity Tax Credit is $2,500 and will consume $4,000 of qualified expenses, which results in a $4,000 reduction to your 529 expenses that are eligible for tax-free treatment.

Can I open a 529 plan?

Most 529 plans have high lifetime maximum contribution limits. Anyone can open a 529 plan account regardless of income. Both types of plans offer professional money management. The account owner can change the beneficiary and roll over the money from one 529 plan to another.

What are the benefits of a 529 plan?

This will allow you to find the one that offers the options best suited to your needs. 529 plans offer several benefits, including: Federal tax breaks.

What is a 529 plan?

529 plans are education investment accounts with special rules and tax benefits that help families save for college—and even for K-12 tuition. These plans come in multiple forms: a prepaid tuition plan or a savings plan that allows after-tax contributions toward investments in mutual funds and exchange traded funds.

What are qualified higher education expenses?

Qualified higher education expenses include tuition and fees, room and board (as long as you are enrolled at least half-time), books and computers or computer equipment for the student’s use. State tax breaks. States may offer tax benefits such as tax credits or a tax deduction for contributions to 529 plans.

How much can you make with a K-12 tax free withdrawal?

Now, they also can be used for some K-12 costs in certain states. You can now make up to $10,000 in tax-free withdrawals annually to pay for expenses at public, private or religious elementary and secondary schools.

How many states offer guaranteed tuition?

About a dozen states offer guaranteed tuition plans that allow you to save for future tuition at today’s prices. This allows you to sidestep tuition price hikes and inflation. You can compare plans by state to see if your home state offers a prepaid tuition plan.

Is it safe to invest in a 529 plan?

As with any investment, there are risks to using a 529 plan to save for college. There are pitfalls you should look out for when investing in a college savings plan, including: Tax penalties for certain withdrawals.

Do you have to be an investment expert to invest in a 529 plan?

Age-based options. You don’t have to be an investing expert to develop a successful 529 plan savings strategy. You can choose a package of investments based on the age of the student and how risk averse your family is.

What are the benefits of a 529 plan?

529 plan state income tax benefits. Many states offer incentives to encourage residents to save for college. Studies show that children who have even a small amount saved for college are more likely to attend and graduate. Having a highly educated workforce can help drive economic growth and development in the state.

What is the state tax deduction for 529?

Nebraska offers married taxpayers a state tax deduction for 529 plan contributions to a 529 plan of up to $10,000 per year. Ohio offers married taxpayers a state tax deduction for 529 plan contributions of up to $4,000 per year for each beneficiary.

How does a 529 plan work?

However, each state has its own rules regarding the type of tax benefit and the amount of 529 plan contributions that are eligible for a state tax deduction or credit each year.

How much is a 529 plan contribution for K-12?

529 plan contributions for K-12 tuition. The Tax Cuts and Jobs Act of 2017 expanded the definition of 529 plan qualified expenses to include up to $10,000 in K-12 tuition per year, per beneficiary. However, some states have not conformed with the federal law and consider K-12 tuition a non-qualified 529 plan expense.

Which states offer 529 deductions?

Pennsylvania. The most common benefit offered is a state income tax deduction for 529 plan contributions. However, Indiana, Utah and Vermont offer a state income tax credit for 529 plan contributions and Minnesota offers a state income tax deduction or tax credit, depending on the taxpayer’s adjusted gross income.

Can you rollover a 529 plan?

529 plan rollovers. Parents may consider rolling funds from an out-of-state 529 plan to their home state’s 529 plan and claiming a state income tax deduction or credit. Families may also consider switching 529 plans if they move to another state. However, some states do not allow taxpayers to claim a state income tax benefit for rollover ...

Can you carryforward a 529 plan in Ohio?

Carryforward of excess 529 plan contributions. Ohio is also one of 12 states that allow taxpayers to carryforward excess 529 plan contributions to deduct in future tax years. That means if the grandparents want to contribute more than Ohio’s annual limit of $4,000 per beneficiary, they may deduct the excess in future years in increments ...

How much can a spouse contribute to a 529?

Spouses can contribute $15,000 each for a total of $30,000 before taxes. The gift tax limit applies to any individual contributing to a 529 College Savings Plan of which they are not the beneficiary. Grandparents, aunts, and other contributors will also be subject to the gift tax if they exceed the gift-giving limits.

Can grandparents contribute to their grandchild's college education?

It is common for grandparents to contribute to their grandchild’s college education, sometimes in the form of contributions to a 529 plan. Certain states allow anyone who contributes to a 529 plan to take a deduction, while others states only permit a tax deduction for account holders.

Can you use 529 for college savings?

With 529 College Savings Plans, you can save and accrue interest on after-tax dollars. You can use the contributions and earnings tax-free for qualified educational expenses. Owners of 529 plans may also qualify for state-level tax deductions. Federal Tax Deduction for 529 Plans.

Do 529 plans have state tax?

Tax deductions for 529 plans are different in every state. Seven states have no state tax, while seven others have a state tax, but don’t offer a deduction on contributions. Most states provide a tax deduction only if you invest in the state plan.

Is a 529 plan tax deductible?

Federal Tax Deduction for 529 Plans. Although your contributions to a 529 College Savings Planare not tax de ductible, you still receive a benefit. As an investment account, the 529 plan accrues earnings, which allows the 529 plan to grow tax-free.

What is a 529 plan?

A 529 plan – named after Section 529 of the Internal Revenue Code – is a tuition account established and operated by a state. The plan allows a family to set money aside for a student’s education. All 50 states and Washington, D.C., offer 529 plans. There are two types of 529 plans.

How much can you deduct from a 529 plan in Montana?

In Nebraska, contributions to a 529 plan are deductible up to $5,000 for single filers and $10,000 for married filers. Because Nevada does not have a personal income tax, there is no need for deductions.

How much can you deduct on your taxes in Minnesota?

In Minnesota, taxpayers can deduct up to $1,500 (individual filers) or $3,000 (married joint filers). mnsaves.org. Mississippi. In Mississippi, individual tax filers can deduct up to $10,000, and joint filers can deduct up to $20,000.

What is the maximum tax credit for Utah?

my529.org. Vermont. Vermont residents can earn a maximum tax credit of $250 (single filers) or $500 (joint filers) when they contribute to Vermont’s 529 plan.

What is an education savings plan?

An education savings plan (or college savings plan) is a type of investment account where families can save for college. However, unlike a prepaid tuition plan, funds from an education savings plan can be used for tuition and room and board.

When are 529 plans due for 2020?

Tax Deduction Rules for 529 Plans: What Families Need to Know. April is generally tax season (although COVID-19 has pushed back the 2020 filing deadline to July). While filing and paying taxes can be painful, governments offer several deductions that can reduce a family’s tax burden and increase any possible refund.

Can you deduct 529 contributions?

Unfortunately, the federal government does not allow families to deduct contributions to a 529 plan. There is no indication that this rule will change anytime soon.

How to claim 529 contributions?

If you’re interested in deducting 529 plan contributions on your taxes, the first step is determining whether you live in a state that allows it. If you do, the next step is estimating how much of your contributions you can get deduct.

Which states allow 529 deductions?

South Dakota. Tennessee. Texas. Washington. Wyoming. Whether you can get a 529 tax deduction or a tax credit depends on where you live and which state’s plan you contribute. Some states, for example, allow you to claim a tax deduction or credit, regardless of which state’s plan you’re enrolled in.

What states allow 529 contributions?

State tax laws may be more favorable when it comes to getting a deduction for 529 plan contributions. More than 30 states offer some type of tax break in the form of a deduction or credit for 529 plan savers. Currently, the only states that don’t allow some type of tax incentive for contributing to a college savings account include: 1 Alaska 2 California 3 Delaware 4 Florida 5 Hawaii 6 Kentucky 7 Maine 8 Nevada 9 New Hampshire 10 New Jersey 11 North Carolina 12 South Dakota 13 Tennessee 14 Texas 15 Washington 16 Wyoming

What are qualified withdrawals for 529?

Qualified withdrawals include things like tuition, fees and room and board paid to a school that’s eligible to participate in federal student aid programs. In terms of how much you can contribute to a 529 plan, there are two thresholds to keep in mind. The first is the annual gift tax exclusion limit.

How much can you gift someone without triggering the gift tax?

The first is the annual gift tax exclusion limit. This limit says that you can gift someone up to a certain amount of money without triggering the gift tax. For 2021, that limit is $15,000 but if you’re married and file a joint return, you and your spouse can split your gift and contribute up to $30,000 to a 529 savings plan per child.

What is a 529 college account?

A 529 college savings account is a tax-advantaged way to set aside money for education expenses. All 50 states offer at least one 529 savings plan, though some may offer multiple options. You don’t have to be a resident of a particular state to contribute to that state’s plan. The money you save in a 529 account is allowed to grow on ...

What are the benefits of the American Opportunity Credit?

The American Opportunity Credit and the Lifetime Learning Credit can also help reduce your tax liability if you paid out-of-pocket higher education costs. While a tax deduction reduces your taxable income for the year, tax credits reduce what you owe in taxes on a dollar-for-dollar basis.

How much tuition can you pay with a 529 plan?

One of the TCJA changes allows distributions from 529 plans to be used to pay up to a total of $10,000 of tuition per beneficiary (regardless of the number of contributing plans) each year at an elementary or secondary (k-12) public, private or religious school of the beneficiary’s choosing.

When does a 529 plan get a refund?

The PATH Act change added a special rule for a beneficiary of a 529 plan, usually a student, who receives a refund of tuition or other qualified education expenses. This can occur when a student drops a class mid-semester. If the beneficiary recontributes the refund to any of his or her 529 plans within 60 days, the refund is tax-free.

How long does it take to get a 529 refund?

If the beneficiary recontributes the refund to any of his or her 529 plans within 60 days, the refund is tax-free. The Treasury Department and the IRS intend to issue future regulations simplifying the tax treatment of these transactions. Re-contributions would not count against the plan’s contribution limit.

College Savings and Prepaid Tuition Plans

Federal Income Tax Treatment

- Neither type of 529 plan allows a federal income tax deduction. However, there is the opportunity to reduce the account owner’s taxable income by the amount of interest, dividends, and capital gains earned in the account. Withdrawals that are used to pay the beneficiary’s qualified expenses are completely income tax free. Legislation passed late in...

State Income Tax Treatment

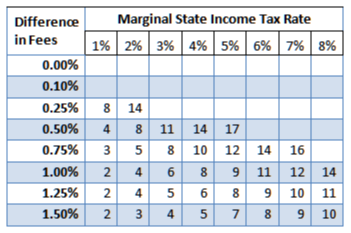

- Depending on where you live, you may be entitled to a state income tax deduction. Keep in mind that most states only allow a deduction for contributions to their own 529 plans. Some states will allow you to exempt the withdrawals and the earnings from your state income. Most of the states that allow deductions have a cap, or some type of limitation, on the amount that you can deduct …

How We Can Help

- Investing in a child’s education has many benefits beyond tax considerations, but when all is said and done, a 529 plan can help lower the total price tag for a degree by reducing your tax burden. Your best approach is to consider the advantages of a 529 in light of a well-designed, goals-based financial plan. Take advantage of the incentives if they help you achieve your goals, but always c…