Can I claim unemployment insurance on public charge?

Unemployment insurance benefits are not generally taken into consideration by the USCIS for purposes of making a public charge determination. As USCIS explained in its final rule on inadmissibility on public charge grounds,

Are unemployment benefits considered public charge inadmissibility by USCIS?

Additionally, the USCIS Policy Manual states that unemployment benefits are not considered by USCIS in a public charge inadmissibility determination as unemployment insurance is considered by USCIS as an “earned” benefit. See USCIS Policy Manual, Volume 8, Part G, Chapter 10.

Who pays for unemployment insurance?

The unemployment benefit insurance program is administered by the states who pick up the cost of providing the unemployment insurance initially (normally 26 weeks). After this period, the federal government pays for the cost of the unemployment insurance up to a certain maximum number of weeks.

Does receiving public benefits make you a public charge?

However, receiving public benefits does not automatically make an individual likely at any time in the future to become a public charge. This fact sheet provides information about public charge and public benefits to help noncitizens make informed choices about whether to apply for certain public benefits.

When will the $600 unemployment benefit expire?

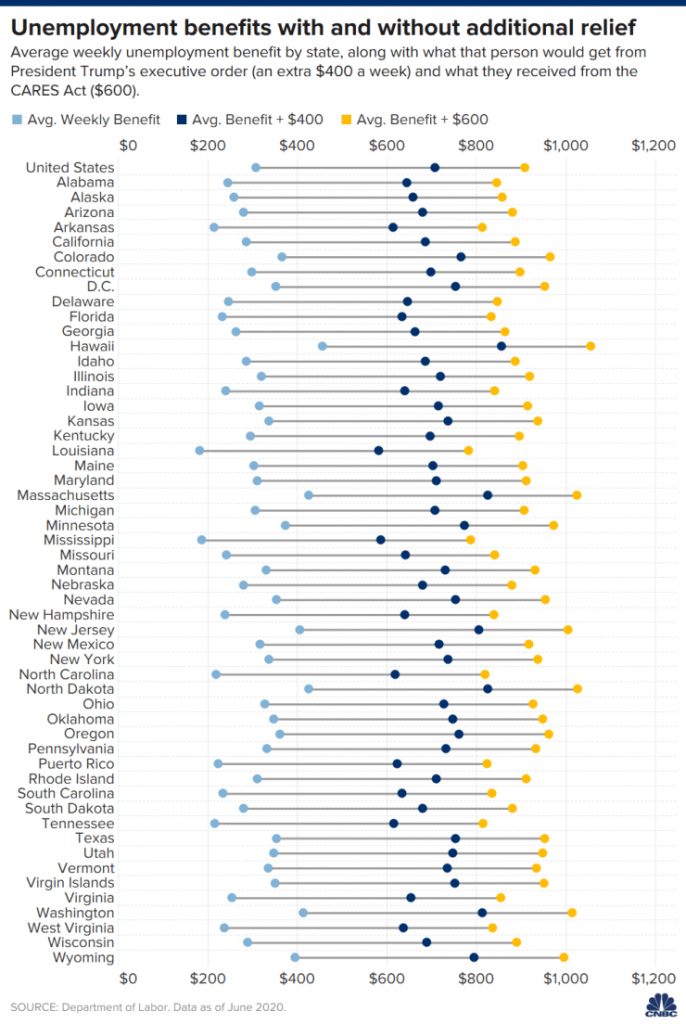

The extra $600/week benefit expired on July 31, 2020 (though Congress is working on potentially expanding this to a later date).

When will the 600 unemployment stop?

That means that even if you are self-employed or an independent contractor, you can still get unemployment after July 31, 2020.

Does the Executive Order expand unemployment?

As of August 12, 2020, this Executive Order expands unemployment in name only, and does not actually assist workers.

Is unemployment a public charge?

Uncertainty About Unemployment Benefits and Public Charge at the Department of State. As a side note, while DHS and USCIS have clearly stated that they do not consider receiving unemployment as a public charge risk, the Department of State (DOS)'s opinion for purposes of people applying via consular processing is less clear .

What are the requirements for a public charge?

Immigration officials will now require information and supporting documents to assess your financial prospects and whether you may become a public charge in the future, including your: 1 Age: Being under 18 years old, the minimum age for full-time employment or older than 61, the minimum retirement age for Social Security, or close to retirement age are considered negatives. 2 Health: Immigration officials will look for medical conditions that could affect your ability to work. 3 Family status: Officials will consider the number of children or other dependents you support. 4 Assets, resources and financial status: Officials will assess household income, assets and liabilities, requiring information including a U.S. credit report or proof of no credit history, your credit score and whether the household has private health insurance or enough resources to cover future medical costs. 5 Education and skills: Officials will look at your education, skills and proficiency in English as an indication you can obtain or maintain employment. 6 Visa: Officials are looking at your prospective immigration status and expected period of admission. 7 Form I-864, Affidavit of Support: Officials are looking to see whether or not you have a joint sponsor and how close your relationship is.

Is unemployment insurance considered public charge?

This is because receiving unemployment benefits, getting tested for coronavirus and seeking emergency medical treatment (even if it’s covered by Medicaid) are all exempt from consideration as government benefits under the new public charge rule.

How long do you have to work to get unemployment in Ohio?

An individual earns unemployment benefits. For instance, in Ohio, an individual must work a minimum of 20 weeks full or part-time during the base period before becoming eligible for unemployment benefits.

When did the public charge rule go into effect?

by Nikki Lyons. The Trump Administration’s “public charge” rule went into effect on February 24, 2020. Shortly after, there were two events that have caused concern among my clients and their ability to obtain immigration benefits.

How long is a public charge?

The final rule defines public charge as an alien who receives one or more public benefits (as defined in the final rule) for more than 12 months, in total , within any 36-month period (such that, for instance, receipt of two benefits in one month counts as two months).

What is the determination of an alien's likelihood of becoming a public charge at any time in the future?

The determination of an alien’s likelihood of becoming a public charge at any time in the future is a prospective determination that is based on the totality of the alien’s circumstances and by weighing all of the factors that are relevant to the alien’s case.

Does DHS consider public benefits?

DHS will only consider public benefits as listed in the rule, including: Supplemental Security Income; Temporary Assistance for Needy Families; Any federal, state, local, or tribal cash benefit programs for income maintenance (often called general assistance in the state context, but which may exist under other names);