How much tax do you pay on unemployment benefits?

- Taxable social security benefits (Instructions for Form 1040 or 1040-SR, Social Security Benefits Worksheet)

- IRA deduction (Instructions for Form 1040 or 1040-SR, IRA Deduction Worksheet)

- Student loan interest deduction (Instructions for Form 1040 or 1040-SR, Student Loan Interest Deduction Worksheet)

Are taxes taken from unemployment?

Yes. State unemployment agencies allow you to have federal and state taxes taken out of your unemployment checks, and the IRS recommends you do this to avoid surprise tax bills. You can set this up when you first apply for unemployment, or at any point while you are receiving it, by filing Form W-4V.

How does collecting unemployment affect your taxes?

Unemployment compensation is not subject to FICA taxes, the flat-percentage Social Security and Medicare taxes that would normally be withheld from your paycheck if you were working. You'll still pay significantly less in FICA taxes than you would have if you'd been working if you collected unemployment through a significant part of the year.

Do you have to pay taxes on unemployment income?

You have to pay federal income taxes on your unemployment benefits, as well as any applicable local and state income taxes.

Are unemployment benefits taxable IRS?

In general, all unemployment compensation is taxable in the tax year it is received. You should receive a Form 1099-G showing in box 1 the total unemployment compensation paid to you. See How to File for options, including IRS Free File and free tax return preparation programs.

Is the unemployment stimulus taxable?

Unlike stimulus checks, which you don't have to pay taxes on, unemployment payments are considered taxable income and will need to be accounted for on your 2021 return.

How much of the 600 will be taxed?

The second stimulus check from the $900 billion relief package is not taxable. The $600 stimulus payment is also considered an advance of a tax credit for the 2020 tax year and is not considered part of your taxable income.

Do you have to pay taxes on 600 stimulus?

The good news is that you don't have to pay income tax on the stimulus checks, also known as economic impact payments. The federal government issued two rounds of payments in 2020 — the first starting in early April and the second in late December.

When will the IRS refund unemployment?

The IRS announced o n March 31, 2021 that the money will be automatically refunded by the IRS during the spring and summer of 2021 to taxpayers who filed their tax return reporting unemployment compensation on or before March 15, 2021.

When will unemployment be refunded?

The IRS announced o n March 31, 2021 that the money will be automatically refunded by the IRS during the spring and summer ...

How long will unemployment be extended in 2021?

Monitor here to see how your state (s) will handle the unemployment compensation exclusion in response to the ARPA. 2020 Unemployment benefit payments were extended from September 6, 2020 to March 14, 2021, and then again until September 6, 2021, thus states will now provide 53 weeks of benefits, up from 23 weeks in 2020.

How long does unemployment last?

In most states, unemployment benefits are paid weekly for 26 weeks after the unemployment application and approval process. Some states offer different maximum weeks for unemployment compensation, such as Montana at 28 weeks or Florida at 12 weeks (see table below).

When will the IRS start issuing tax refunds in 2021?

The IRS has begun issuing these refunds as of May 10, 2021. There is no tracking nor lookup tool, but taxpayers may be able to see a scheduled transaction in their IRS account - see how to create an IRS account. Here, navigate to the View Tax Records on the homepage and click the Get Transcript button.

Does unemployment change with stimulus 3?

If you filed on eFile.com, see how your unemployment income may have been affected . As a result of Stimulus 3 and the American Rescue Plan Act (ARPA), the taxation of unemployment income, benefits changed in reference to 2020 Federal returns.

Is severance pay taxable?

Remember that any severance pay or unemployment compensation you receive is taxable, in addition to any payouts received for accumulated vacation or sick time. Be sure that enough tax is withheld from these payments. Make sure you receive your final W-2 from your former employer to use for your tax return. Companies are not required to send out W-2s right away, but must provide them to all employees (even former ones) by January 31 of the following year. If you have left the company, this would be the year after you leave.

How are unemployment benefits taxable?

How Unemployment Benefits Are Usually Taxed. Unemployment benefits are usually taxable as income – and are still subject to federal income taxes above the exclusion, or if you earned more than $150,000 in 2020. Depending on the maximum benefit size in your state and the amount of time you were receiving unemployment benefits, ...

Do you have to file an amended tax return if you already filed your state income tax return?

Other states may have to take specific action to allow the exclusion.". Taxpayers who already filed their state income-tax return and qualify for the exclusion may need to file an amended return, he says. Check with your tax professional or your state's department of revenue as guidance becomes available.

Will unemployment be taxed in 2020?

Some states that usually tax unemployment benefits are likely to follow the federal exclusion for 2020. "Some states start their state tax return preparation with the federal adjusted gross income figure," says Luscombe. "In those states the exclusion would automatically be taken into account also for state income tax purposes.

Do you have to pay taxes on unemployment in 2020?

Millions of people received unemployment benefits in 2020, and many are in tax limbo now. The federal government usually taxes unemployment benefits as ordinary income (like wages), although you don't have to pay Social Security and Medicare taxes on this income.

Can you file a W-4V with unemployment?

You can ask to have taxes withheld from your payments when you apply for benefits, or you can file IRS Form W-4V, Voluntary Withholding with your state unemployment office . You can only request that 10% of each payment be withheld from your unemployment benefits for federal income taxes.

Is the stimulus payment taxable?

Those payments were considered a refundable income tax credit and were never taxable. The stimulus payments were technically an advanced payment of a special 2020 tax credit, based on your 2018 or 2019 income (your most recent tax return on file when they calculated the stimulus payments).

Does the $10,200 unemployment tax apply to 2020?

The $10,200 exclusion only applies to unemployment benefits paid in 2020, but the rules could change. "It does appear to be the type of provision that Congress may include in the next round of tax legislation later this year for 2021," says Luscombe. [.

Are unemployment benefits taxable?

Your unemployment qualifies as taxable income subject to federal and state taxes, depending on where you live. In some states like Florida, Alaska, Nevada, South Dakota, Wyoming, Texas and Washington, residents do not have state income taxes.

COVID-19 stimulus and taxes

For the 2020 tax season, the American Rescue Plan helped reduce Americans’ tax liability by making the $10,200 received from unemployment benefits federal tax-free for those with an adjusted income of $150,000 or less. If you made more than $150,000, you do not qualify for any exclusions under the plan.

Does taxable income vary by state?

While federal income taxes are easier to understand, state taxes are another story.

Paperwork you need to file for taxes if you received unemployment

In January, you will receive Form 1099-G for unemployment benefits. It contains information like wages, federal taxes withheld (box 4) and state taxes paid (box 11). States can send this through the mail. You can also access it online, especially if that is how you file for benefits.

How to have taxes withheld from unemployment benefits

It is tempting to forgo paying taxes on unemployment benefits until it comes time to file. However, doing this could leave you with a serious tax liability. States allow you to have taxes withheld for federal and state (if applicable) when you receive approval for benefits.

What happens if I filed my taxes before the rescue plan went into effect?

Keep in mind, the goal of the American Rescue Plan was to reduce the tax liability of those on unemployment, not eliminate it. If you did not have taxes withheld on a federal level, that exclusion would apply to only the first $10,200 received. Any amount exceeding this will require you to owe taxes.

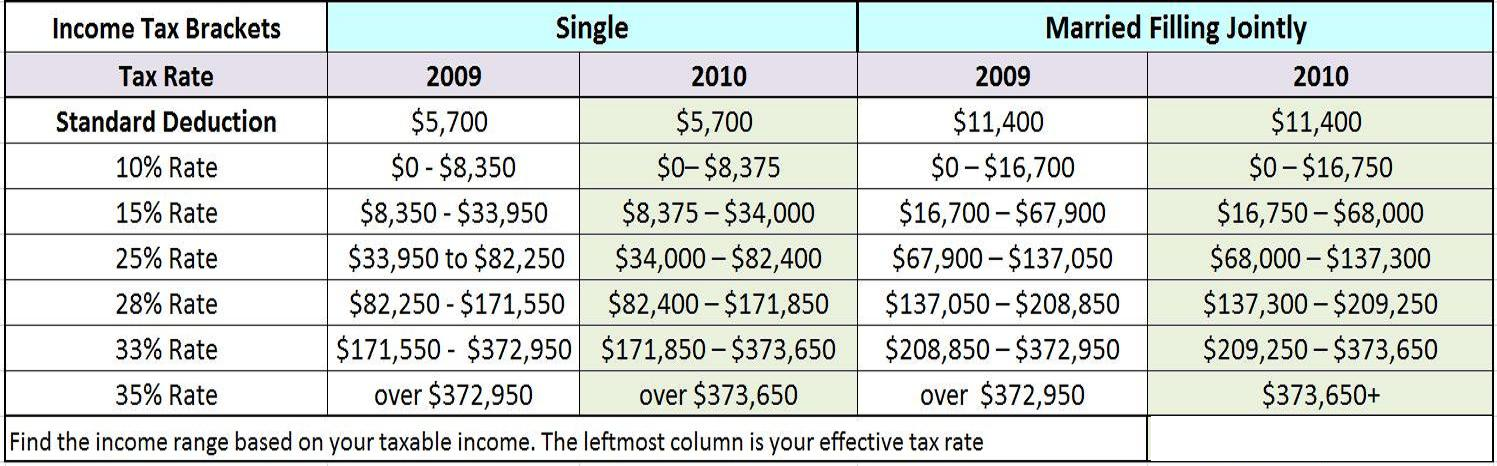

What is the tax rate for unemployment in 2020?

So if you make less than $85,525 in 2020, it’s a safe bet to stash away between 12% and 24% of your unemployment checks to prepare for tax time.

Do you pay taxes on unemployment?

The amount you will have to pay varies widely depending on your tax bracket and which state you live in. Everyone will owe federal income tax on unemployment, but six states exempt the benefit from what’s considered taxable income. Another handful don’ t have income tax at all.

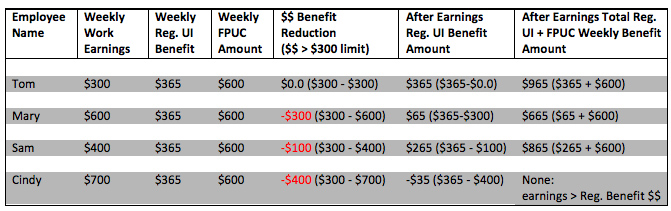

Is the 300 unemployment tax taxable?

The extra $300 unemployment benefit will be considered taxable income in April. Here’s how to pad your savings account in preparation. Updated Mon, Mar 15 2021. Megan DeMatteo.

Can you ask for unemployment to withhold taxes?

The National Foundation for Credit Counseling (NFCC) points out that you can sometimes ask your state unemployment office to withhold taxes, the same way an employer would . But because many states are scrambling to complete applications and rush checks out, you may want to take matters into your own hands.

Will the federal government send additional money to unemployment?

If you are currently receiving unemployment benefits, the federal government could be sending you additional funds soon. And although local governments themselves are cash-strapped, some states will also be contributing an additional $100.

Is unemployment taxable in 2021?

It’s important for the people tapping this assistance to remember that, come April 2021, your unemployment benefits will be considered taxable income. While you won’t have to pay payroll taxes on unemployment, such as Social Security and Medicare withholdings, you will get taxed according to your income level for 2020.

The Answer Might Surprise You

More than 7.9 million Americans were unemployed at the end of 2015, according to the Bureau of Labor Statistics, and many of those received unemployment compensation. As tax time approaches, one thing that many unemployed workers don’t realize is that they might have to pay taxes on the money they receive in unemployment benefits.

Are Unemployment Benefits Taxable

Your unemployment qualifies as taxable income subject to federal and state taxes, depending on where you live. In some states like Florida, Alaska, Nevada, South Dakota, Wyoming, Texas and Washington, residents do not have state income taxes.

Paying Unemployment Taxes At The State And Local Level

At the local and state level, the options to pay for your state and local taxes may differ depending on where you live. Contact your state, county, or local unemployment office to learn about the different options to pay your taxes. These options may include:

Repayment Of Employment Benefits

For the 2020 tax year, if you received EI payments and your net income was greater than $67,750, the Canada Revenue Agency requires you to repay 30 percent of your net income over the threshold.

How To Have Taxes Withheld From Unemployment Benefits

It is tempting to forgo paying taxes on unemployment benefits until it comes time to file. However, doing this could leave you with a serious tax liability. States allow you to have taxes withheld for federal and state when you receive approval for benefits.

How To Pay Taxes On Unemployment

The three most common ways to pay those taxes include: paying them when you file your tax return, making estimated payments during the year, or having them automatically withheld which experts say is often the best option.

Unemployment Benefits Are Taxable

The United States has a pay-as-you-go tax system, which means you must pay income tax as you earn income during the year. And while it may feel like unemployment benefits are not considered earned income, they actually are.