Do you pay taxes on workers comp benefits?

Workers’ compensation benefits and settlements are fully tax-exempt, which means you do not have to pay taxes. Whether you have received weekly payments or a lump sum, federal law does not allow it. When filing taxes, you do not need to add workers’ comp to your earned income.

Is Workers' Compensation considered income when filing taxes?

Workers' compensation is not taxable income. Although most income is taxed at different rates, it is generally taxable. Taxpayers who meet the requirement to file, based upon income and filing status, are usually taxed based upon the tax bracket into which their income falls. However, in certain circumstances, some categories of protected income are not taxed or are only partially taxed.

Does workers comp affect employee taxes?

Your employees may pay taxes on workers’ compensation benefits if they’re also receiving SSDI or SSI. For example, if one of your employees: Suffers a permanent injury on the job and receives both disability benefits and SSDI, their workers’ compensation payments may get taxed. Gets hurt on the job and has to take months off from work to recover.

How to calculate workers compensation benefits?

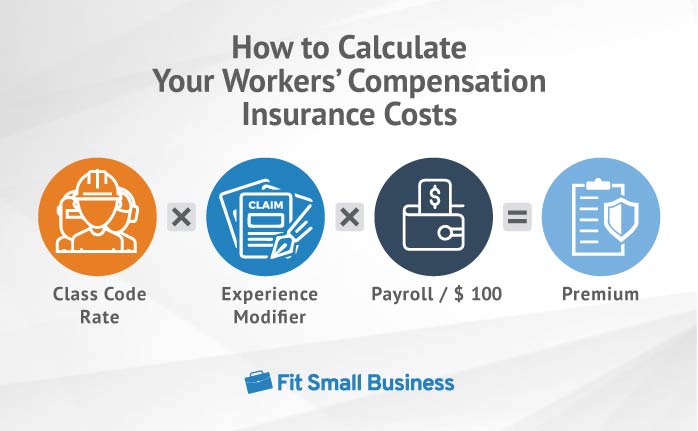

- Workers’ class codes

- Number of employees

- Payroll

- Claims history

How is workers comp reported to IRS?

If you return to work after qualifying for workers' compensation, payments you continue to receive while assigned to light duties are taxable. Report these payments as wages on Line 7 of Form 1040 or Form 1040A, or on Line 1 of Form 1040EZ.

Is workers compensation taxable IRS?

Do you claim workers comp on taxes as taxable income? Regarding your question: do you claim workers comp on taxes, the answer is no. You are not subject to claiming workers comp on taxes because you need not pay tax on income from a workers compensation act or statute for an occupational injury or sickness.

Are compensation benefits taxable?

For the most part, the answer is no. Worker's compensation benefits in California are considered non-taxable income. Workers' compensation is a public, federally funded benefit designed to help employees settle their bills as they recover from a work-related illness or injury.

Does compensation count as income?

A payment compensating the claimant for the loss of income is, itself, likely to be income. So a payment to compensate for the loss of trading receipts will be taxed as trading income. It does not matter that the compensation is received in a single lump sum.

How can I avoid paying taxes on a settlement?

How to Avoid Paying Taxes on a Lawsuit SettlementPhysical injury or sickness. ... Emotional distress may be taxable. ... Medical expenses. ... Punitive damages are taxable. ... Contingency fees may be taxable. ... Negotiate the amount of the 1099 income before you finalize the settlement. ... Allocate damages to reduce taxes.More items...•

What amount of income is not taxable?

In 2021, for example, the minimum for single filing status if under age 65 is $12,550. If your income is below that threshold, you generally do not need to file a federal tax return.

Which forms of compensation are taxable?

Employee Compensation In addition to wages, salaries, commissions, fees, and tips, this includes other forms of compensation such as fringe benefits and stock options. You should receive a Form W-2, Wage and Tax Statement, from your employer showing the pay you received for your services.

Are lump sum workers compensation payments taxable?

The short answer is no. Under the Income Tax Assessment Act 1997, the payment of a lump sum amount in relation to a motor vehicle accident, workers' compensation or slip & fall compensation claim is not assessed as income and does not need to be included in your tax return.

What is the taxable compensation income?

Federal and state payroll tax laws generally identify taxable compensation as being an employee's wages and broadly define "wages" to encompass virtually every payment to an employee for services rendered.

Do I have to declare compensation?

Compensation settlements paid directly to a claimant are seen as savings and must be declared if the total exceeds the threshold. Of course, unless you know how much personal injury compensation you will receive, it is impossible to answer exactly as to whether or not your benefits claim would be affected.

Are compensation payments tax deductible?

Payments of compensation may be deductible under Div8 (deductions) or s40-880 (capital expenditure) of the ITAA97, or under some provision having a more limited application,4 or they may form the cost base or part of the cost base of a CGT asset.

Are injury settlements taxable?

Compensation for Physical Injury is Not Taxable As a general rule, the proceeds received from most personal injury claims are not taxable under either federal or state law. It does not matter whether you settled the case before or after filing a personal injury lawsuit in court.

When Does The Workers' Compensation Offset Apply?

If you're receiving both workers' compensation and Social Security disability benefits, the combined amount of your benefits cannot exceed 80% of y...

Reducing Taxable Income Through Your Workers' Compensation Settlement

It's important that your attorney structure your workers' compensation settlement in a way that minimizes the workers' comp offset. This will also...

Other Tax Issues Involving Workers' Compensation

Although workers' comp benefits generally are not taxable, any retirement benefits you've collected based on your age, years of service, or prior c...

Contact A Disability Attorney

If you have the potential of receiving both Social Security and workers' compensation benefits, it's important to contact an experienced disability...

What is reverse offset for workers comp?

A minority of states have a "reverse offset," in which your workers' comp payments are reduced. Social Security will subtract legal fees, past and future medical costs, payments to dependents, and other expenses from the workers' comp amount prior to calculating the offset.

Is John on SSDI taxed?

John would be taxed on the $1,200 SSDI amount and $300 of the workers' comp benefit, because the SSDI was reduced by $300. John is treated for tax purposes as having received the full $1,500 in SSDI benefits, even though $300 of that amount was paid by workers' comp.

Is a $250 unemployment check taxable?

Thus, if SSA lowers your monthly SSDI check by $250 due to the workers' compensation offset, then $250 of your workers' comp is taxable. Most people who receive Social Security and workers' comp benefits don't have enough taxable income to owe federal taxes, so even if a portion of your benefits are taxable, it's not likely you'll owe taxes.

Is workers compensation taxable?

Workers' compensation benefits are not normally considered taxable income at the state or federal level. The lone exception arises when an individual also receives disability benefits through Social Security disability insurance (SSDI) or Supplemental Security Income (SSI). In some cases, the Social Security Administration (SSA) ...

Is workers comp taxable income?

Thus, while a portion of your workers' comp may considered taxable income, in practice the taxes paid on workers' comp are usually small or non-existent.

What happens if you get supplemental income on top of workers compensation?

If the injured worker receives supplemental security income on top of workers' compensation, he or she may have to end up paying taxes. Payments coming from Social Security would be reduced and the difference created by the payment of workers' compensation would be taxable.

What are the types of workers compensation?

Workers' compensation is in the same category of non-taxable income as the following: 1 Payments from public welfare fund; 2 Compensatory (but not punitive) damages for physical injury or sickness; 3 Disability benefits under a " no fault" car insurance policy for loss of income or earnings capacity as a result of injuries; 4 Compensation for permanent loss or loss of use of a part or function of your body, or for your permanent disfigurement.

What to do if your workers compensation claim is denied?

If your claim is denied or you fail to receive compensation, you may need skilled legal assistance . Contact a workers' compensation attorney for more information.

What is compensatory damages?

Compensatory (but not punitive) damages for physical injury or sickness; Disability benefits under a " no fault" car insurance policy for loss of income or earnings capacity as a result of injuries; Compensation for permanent loss or loss of use of a part or function of your body, or for your permanent disfigurement.

Can you receive disability and workers compensation at the same time?

This situation may arise if the health condition of a taxpayer who was injured in the workplace fails to improve; if the worker becomes disabled, he or she may receive disability insurance and workers' compensation payments at the same time. When this happens, the Social Security Administration will reduce its payments to a certain level and the difference created by the workers' compensation paycheck becomes taxable.

Is Social Security Disability taxable?

Specifically when you receive both Social Security Disability and Workers Compensation benefits the Social Security benefits are taxable to a certain extent. If part of your workers' compensation reduces your Social Security, that part is treated as Social Security income and could be taxable.

Is there any tax on workers compensation?

When it comes to how much tax is taken out of workers benefits, there’s a simple answer. “None,” said Tom Holder, a workers compensation attorney in Atlanta. At least that’s almost always the case. In fact, the lack of taxes is one of the enticements company lawyers often bring up when negotiating settlement claims with workers.

Is Workers Comp the same as Social Security?

In that sense, workers comp is in the same category as income from welfare, compensatory (but not punitive) damages from personal-injury lawsuits or disability benefits from no-fault car insurance settlements. The exception is when you also receive Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI).

Is workers comp taxable?

The IRS manual reads: “The following payments are not taxable …. Workers compensation for an occupational sickness or injury if paid under a workers compensation act or similar law.”. It doesn’t matter if your settlement is in a lump sum or structured to pay benefits over a period of time. In that sense, workers comp is in ...

Are Workers Comp Benefits Taxable?

The short answer is no, they are not taxable. The longer answer gets more complicated, but most will not have to worry about it.

SSDI and SSI

If the injured worker in question is receiving supplemental security income at the same time, that is where taxes come into question.

1. The Rate of Taxation

Calculating how much of your workers’ comp and Social Security benefits may face taxation is simple. Follow these markers for determining general taxation.

2. From Workers Injury to Disability

The most common time that an injured worker may be taking workers’ comp benefits and social security at the same time is through serious injury.

Getting the Help You Need and the Benefits You Deserve

Are workers comp benefits taxable? While the answer has a lot of what if statements and social security dilemmas, we hope this guide through the details puts you in a better situation if the time comes.

Do you pay taxes on retirement?

Retirement Benefits. Depending on your location, you may face federal or state taxes on some or all of your retirement benefits. You may receive a pension, an annuity, a 401 (k), social security disability, or regular social security benefits and may be subject to state or federal taxes. You would need to consult with your tax professional ...

Do you get taxed if you have workman's comp?

When you return to work, even if you still have medical bills paid by workman’s comp, you will still be taxed on any income you receive from your employer. In the event you are unable to return to work, you could also receive a lump sum workers’ comp settlement or continued weekly benefits. Those awards typically would not be subject ...

Is a lump sum worker's compensation taxable?

Neither the weekly payments nor any lump sum workers’ compensation awards are considered taxable income by federal or state governments or most local governments. If you receive any SSI or SSD benefits, any unemployment insurance, or any compensation from your employer (back pay, vacation pay, etc.) you should receive a federal tax form on it ...

Does Kentucky tax Social Security?

Kentucky does not tax regular social security payments as income. If you are injured and unable to work, you are still treated under workers’ compensation as an injured employee. If you have other questions or concerns, contact the Bryant Law Center for a thorough review of your workers’ comp case.

Is unemployment tax exempt from workers compensation?

The only exceptions to worker’s compensation’s tax exempt status are if you are receiving additional income such as social security or unemployment insurance or pay for any other part time work or other regularly taxable income. The IRS and states do not tax worker’s compensation benefits.

Is workers compensation taxable in Kentucky?

Survivors benefits from workers’ compensation would not be taxable in Kentucky.nor at the local level for any city or county occupational taxes.

Is workers comp taxable?

The short answer is no, workers’ comp payments are not reportable as income on a federal or state tax return. This should not be confused with other benefits you may receive, such as unemployment benefits, which are fully taxable, or Social Security disability, which may be taxable. This is one of the questions we often hear from injured workers ...

When is nonqualified compensation included in gross income?

In most cases, any compensation deferred under a nonqualified deferred compensation plan of a nonqualified entity is included in gross income when there is no substantial risk of forfeiture of the rights to such compensation. For this purpose, a nonqualified entity is one of the following.

How much can you exclude from your income?

However, the amount you can exclude is limited to your employer's cost and can’t be more than $1,600 ($400 for awards that aren’t qualified plan awards) for all such awards you receive during the year. Your employer can tell you whether your award is a qualified plan award. Your employer must make the award as part of a meaningful presentation, under conditions and circumstances that don’t create a significant likelihood of it being disguised pay.

What is included in gross income?

In most cases, you must include in gross income everything you receive in payment for personal services. In addition to wages, salaries, commissions, fees, and tips, this includes other forms of compensation such as fringe benefits and stock options.

What is income received by an agent for you?

Income received by an agent for you is income you constructively received in the year the agent received it. If you agree by contract that a third party is to receive income for you, you must include the amount in your income when the third party receives it.

Is emergency financial aid included in gross income?

The amounts of these are not included in the gross income of the eligible self-employed individual. Emergency financial aid grants. Certain emergency financial aid grants under the CARES Act are excluded from the income of college and university students, effective for grants made after 3/26/2020.

Completing your tax return

On line 14400, enter the amount from box 10 of your T5007 slip. Claim a deduction on line 25000 for the benefits you entered on line 14400.

Forms and publications

Login error when trying to access an account (e.g. My Service Canada Account)

Exception to Tax-Exempt Status

Social Security and Workers' Compensation Benefits

- Specifically when you receive both Social Security Disability and Workers Compensation benefits the Social Security benefits are taxable to a certain extent. If part of your workers' compensation reduces your Social Security, that part is treated as Social Security income and could be taxable. You can use the normal formula for Social Security bene...

Learn More About Workers' Comp Benefits from An Attorney

- The workers' compensation system provides a method to receive compensation for work-related injuries. However, things can still get pretty complicated, especially if your injuries are severe. If your claim is denied or you fail to receive compensation, you may need skilled legal assistance. Contact a workers' compensation attorneyfor more information.