If you are Widowed - Key Points to Remember

- You may start a survivor benefit at age 60, and/or a worker benefit at age 62, but may not draw both at the same time.

- One strategy is to draw the larger of the survivor benefit or the worker benefit when the individual files.

- A second strategy is to draw your worker benefit at age 62 and switch to a survivor benefit at Full Retirement Age.

How do you calculate survivor benefits?

Survivors aged 65 and older: CPP survivor benefit calculation = 60% of the deceased’s pension, if they are receiving no other CPP benefits Survivors aged under 65: CPP survivor benefit calculation = a flat rate portion PLUS 37.5% of the deceased’s pension, if they are receiving no other CPP benefits

How do you calculate survivor Social Security benefits?

There are three basic steps:

- Adjust historical earnings for inflation.

- Get monthly average from the highest 35 years

- Apply monthly average to benefits formula

How much is Social Security survivor benefits?

Social Security survivor benefits are one of the most ... an important income source for seniors Survivor benefits often provide much more income for seniors if their partner was the higher ...

What is the maximum Social Security benefit for a widow?

You will need to meet one of the following criteria to collect Social Security survivor benefits:

- A widow or widower who is at least 60 years old (50 years old if disabled)

- A widow or widower who is caring for the deceased’s child (under 16 years of age or receiving disability benefits)

- An unmarried child of the deceased who is either: 18 years of age or younger Disabled, with the disability occurring before the age of 22

How much survivor benefits will I get at 60?

71.5 percentFull Retirement Age for Survivors Born Between 1945 And 1956: 66 (En español) The earliest a widow or widower can start receiving Social Security survivors benefits based on age is age 60. 60, you will get 71.5 percent of the monthly benefit because you will be getting benefits for an additional 72 months.

How much Social Security does a widow receive at age 60?

Survivors Benefit Amount Widow or widower, full retirement age or older — 100% of the deceased worker's benefit amount. Widow or widower, age 60 — full retirement age — 71½ to 99% of the deceased worker's basic amount. Widow or widower with a disability aged 50 through 59 — 71½%.

At what age do survivor benefits stop?

Generally, benefits for surviving children stop when a child turns 18. Benefits can continue until as late as age 19 and 2 months if the child is a full-time student in elementary or secondary education or with no age limit if the child became disabled before age 22.

Can I collect widows benefits at age 60?

Widows or widowers benefits based on age can start any time between age 60 and full retirement age as a survivor. If the benefits start at an earlier age, they are reduced a fraction of a percent for each month before full retirement age.

How do I maximize Social Security survivor benefits?

Notify Social Security as soon as your spouse dies. Benefits generally start from the time you apply, not the time your spouse died. If you're currently collecting spousal benefits on a retired worker's account and they're low, you'll probably be switched to the higher benefit automatically.

What is the difference between spousal benefits and survivor benefits?

Spousal benefits are based on a living spouse or ex-spouse's work history. Survivor benefits are based on a deceased spouse or ex-spouse's work history. The maximum spousal benefit is 50% of the worker's full retirement age (FRA) benefit.

Can I collect my Social Security and survivor benefits at the same time?

Social Security allows you to claim both a retirement and a survivor benefit at the same time, but the two won't be added together to produce a bigger payment; you will receive the higher of the two amounts. You would be, in effect, simply claiming the bigger benefit.

Are survivor benefits considered income?

The IRS requires Social Security beneficiaries to report their survivors benefit income. The agency does not discriminate based on the type of benefit -- retirement, disability, survivors or spouse benefits are all considered taxable income.

Can I collect survivor benefits and still work?

You can get Social Security retirement or survivors benefits and work at the same time. But, if you're younger than full retirement age, and earn more than certain amounts, your benefits will be reduced. The amount that your benefits are reduced, however, isn't truly lost.

How long are you considered a widow?

two yearsRead on to learn more about the qualified widow or widower filing status. Qualifying Widow (or Qualifying Widower) is a filing status that allows you to retain the benefits of the Married Filing Jointly status for two years after the year of your spouse's death.

What percent of a husband's Social Security does a widow get?

Widow or widower, full retirement age or older—100% of your benefit amount. Widow or widower, age 60 to full retirement age—71½ to 99% of your basic amount.

What happens if a survivor takes her own benefit at 60?

If she takes her survivor benefit at 60, but then forgets to switch over to her own benefit at 70, she could be giving up additional benefits. Now, at some point SSA would probably notify her that she could increase her benefit by switching over to her own retirement benefit.

How much is the survivor benefit reduced?

If she starts the survivor benefit at age 60 (50 if disabled), the benefit will be reduced to 71.5% of the full amount. To get the full amount, she must apply for it at her full retirement age. If she applies between the ages of 60 and FRA, the reduction will be prorated.

What happens when a widow switches to survivor benefit?

When she switches to the survivor benefit, her own benefit will stop. Planning revolves around the loss of this income and maintaining the widow’s standard of living through life insurance or some other instrument (such as using a reverse mortgage if there is equity in the home, assuming there is one).

What is survivor benefit?

The survivor benefit will be the amount the husband is receiving at his death. (If he is receiving less than 82.5% of his PIA, the survivor benefit will be increased to that amount.)

How old is Teresa from Social Security?

Teresa is a 60-year-old widow who was married to a high earner who died before starting benefits. According to his latest Social Security statement, his PIA was $2,600.

When can a widow receive survivor benefits?

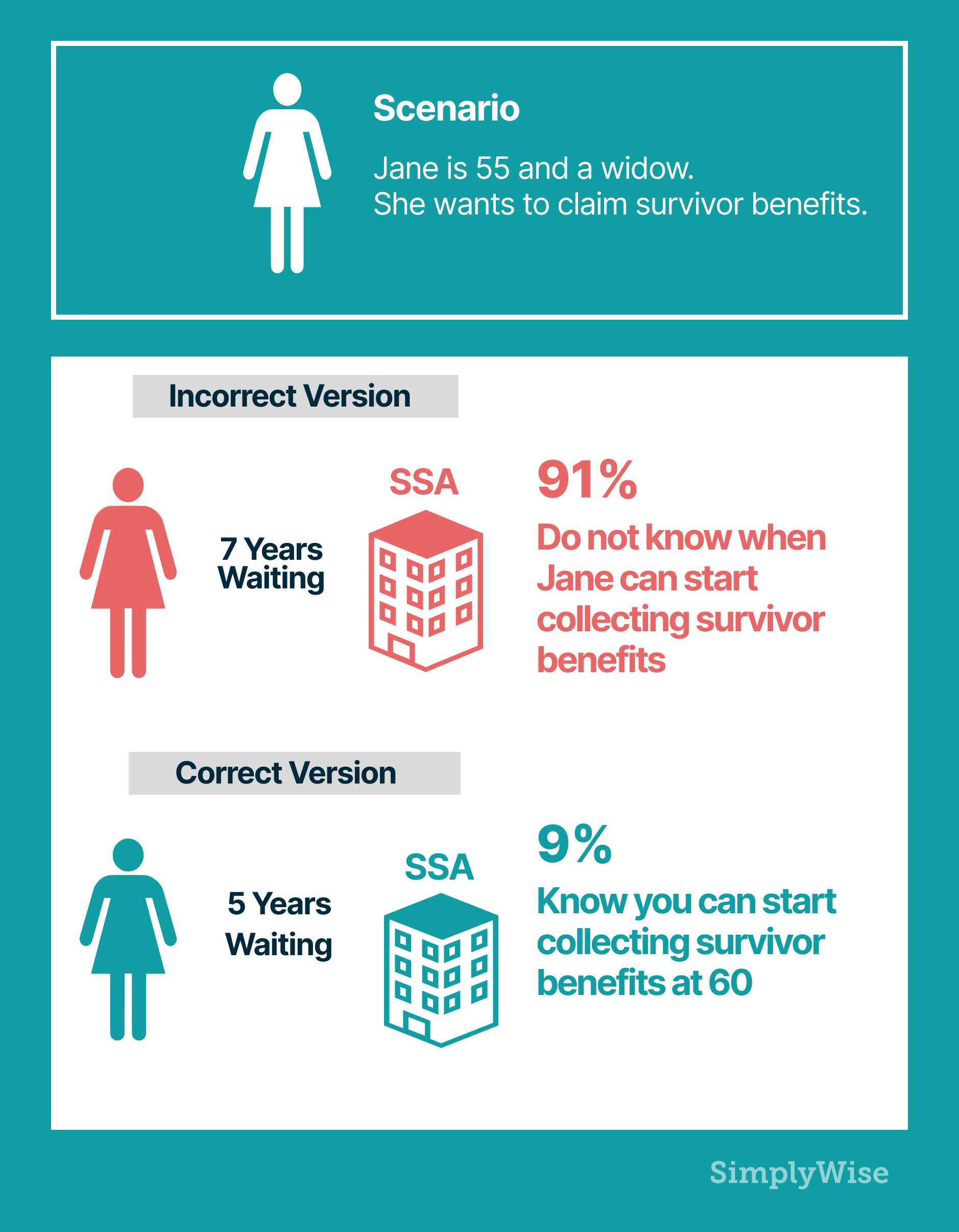

Survivor Benefits for Widows or Widowers who are 60 to 70. One of the trickiest — and most critical — Social Security planning strategies applies to widows who are between the ages of 60 and 70. Once a widow becomes eligible for survivor benefits — as early as age 60 (50 if disabled) — she will be looking for guidance on how ...

Does a widow receive the most after her spouse dies?

Once the spouse has died and the survivor benefit is set, the amount the widow will actually receive is based on the age SHE is when she applies for it; the deceased spouse’s age is not relevant. She will receive the most if she applies for it at her FRA. It does not build delayed credits after FRA.