What's the best age for collecting Social Security benefits?

By now, you may have heard: 70 is the best age for claiming Social Security benefits. Here's why. Because you have already reached your full retirement age - age 66 or 67 for most - you'll receive 100% of the benefits you are entitled to.

When should you start claiming Social Security benefits?

You get flexibility when it comes to filing for Social Security. Whether you should file upon retirement ... age 65 but don't need your benefits right away to pay your bills, then it could make sense to hold off until FRA to claim then.

What is the maximum Social Security benefit at age 62?

You cannot collect your personal SS retirement benefit until you are at least 62 years old, but if you claim at that age ... your maximum benefit would be 24% more than it would be at your FRA. You have an 8 year window to claim your Social Security ...

Do Social Security benefits increase with age?

You can begin getting Social Security retirement benefits as early as age 62, but it will reduce your benefits by as much as 30% below what you would get if you waited to retire until your full retirement age. If you wait until your full retirement age (66 for most people), you will get your full benefit.

What are the advantages and disadvantages of taking your retirement benefits before your full retirement age?

What happens if you delay your retirement?

Is it better to collect your retirement benefits before retirement?

About this website

Is it better to take Social Security at 62 or 67?

The short answer is yes. Retirees who begin collecting Social Security at 62 instead of at the full retirement age (67 for those born in 1960 or later) can expect their monthly benefits to be 30% lower. So, delaying claiming until 67 will result in a larger monthly check.

What is the average Social Security benefit at age 62?

$2,364At age 62: $2,364. At age 65: $2,993. At age 66: $3,240. At age 70: $4,194.

Who qualifies for Social Security at age 62?

You can receive Social Security benefits based on your earnings record if you are age 62 or older, or disabled or blind and have enough work credits. Family members who qualify for benefits on your work record do not need work credits.

Can I retire at 55 and collect Social Security?

Can you retire at 55 to receive Social Security? Unfortunately, the answer is no. The earliest age you can begin receiving Social Security retirement benefits is 62.

Why retiring at 62 is a good idea?

Probably the biggest indicator that it's really ok to retire early is that your debts are paid off, or they're very close to it. Debt-free living, financial freedom, or whichever way you choose to refer it, means you've fulfilled all or most of your obligations, and you'll be under much less strain in the years ahead.

Can I draw Social Security at 62 and still work full time?

You can get Social Security retirement or survivors benefits and work at the same time. But, if you're younger than full retirement age, and earn more than certain amounts, your benefits will be reduced.

What is the lowest Social Security payment?

DEFINITION: The special minimum benefit is a special minimum primary insurance amount ( PIA ) enacted in 1972 to provide adequate benefits to long-term low earners. The first full special minimum PIA in 1973 was $170 per month. Beginning in 1979, its value has increased with price growth and is $886 per month in 2020.

Can I get Medicare at age 62?

What Are the Age Requirements for Medicare? Medicare is health insurance coverage for people age 65 and older. Most people will not qualify for Medicare at age 62. At age 62, you may meet the requirements for early retirement but have not met the requirements for Medicare coverage.

Is Social Security based on the last 5 years of work?

A: Your Social Security payment is based on your best 35 years of work. And, whether we like it or not, if you don't have 35 years of work, the Social Security Administration (SSA) still uses 35 years and posts zeros for the missing years, says Andy Landis, author of Social Security: The Inside Story, 2016 Edition.

What is the rule of 55?

The rule of 55 is an IRS provision that allows workers who leave their job for any reason to start taking penalty-free distributions from their current employer's retirement plan once they've reached age 55.

What is the best age to retire?

When asked when they plan to retire, most people say between 65 and 67. But according to a Gallup survey the average age that people actually retire is 61.

How much money do you need to retire comfortably at age 55?

Experts say to have at least seven times your salary saved at age 55. That means if you make $55,000 a year, you should have at least $385,000 saved for retirement. Keep in mind that life is unpredictable–economic factors, medical care, and how long you live will also impact your retirement expenses.

2022 Social Security Changes - COLA Fact Sheet

Fact Sheet SOCIAL SECURITY . Social Security National Press Office Baltimore, MD . 2022 SOCIAL SECURITY CHANGES . Cost-of-Living Adjustment (COLA):

Benefits Planner: Retirement | Retirement Age Calculator | SSA

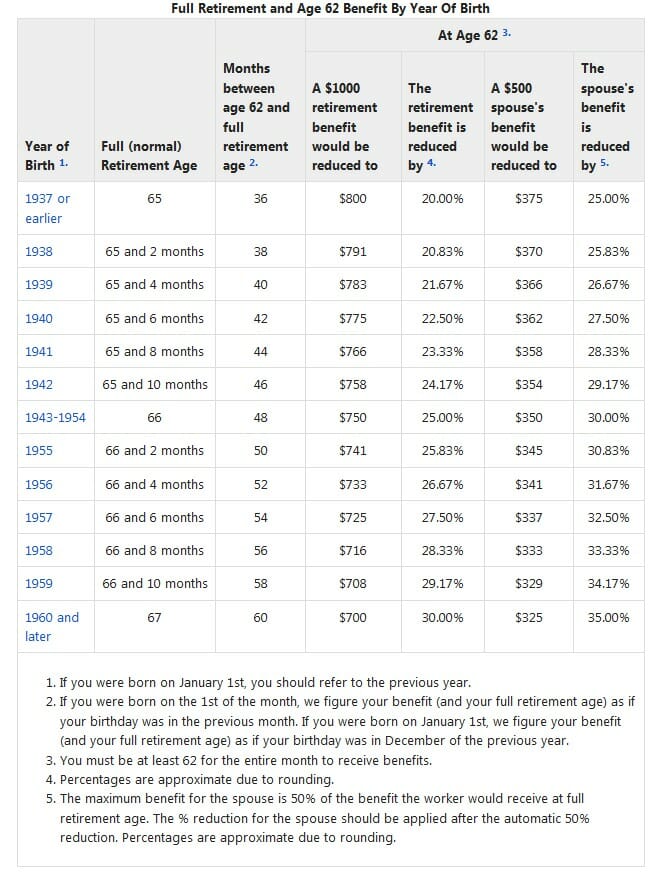

Why Did the Full Retirement Age Change? Full retirement age, also called "normal retirement age," was 65 for many years. In 1983, Congress passed a law to gradually raise the age because people are living longer and are generally healthier in older age.

Social Security COLA 2022: How Much Will Benefits Increase?

How the COLA is calculated. The actual COLA will depend on the increase in the Consumer Price Index for Urban Wage Earners and Clerical Workers, or the CPI-W, an official measure of the monthly price change in a market basket of goods and services, including food, energy and medical care. The Bureau of Labor Statistics tracks both the CPI-W and its better-known cousin, the CPI-U — the ...

Social Security Calculator (2022 Update) - SmartAsset

Annual Income: We assume that your income in the future increases by the rate if inflation and your income in the past is discounted by the same inflation rate Indexed Earnings: We use the Social Security Administrations National Average Wage Index to index wages for the social security benefit calculation Working Years: We assume that you have worked and paid Social Security taxes for 35 ...

Retirement Calculator

Retirement Calculator. Our Retirement Calculator can help a person plan the financial aspects of retirement. Each calculation can be used individually for quick and simple calculations, or in chronological order as a more comprehensive walkthrough of retirement planning.

What is the earliest age you can collect Social Security?

Earliest Normal Social Security Eligibility Age: 62. Even though you can begin receiving benefits as early as 62, that doesn't mean you should start taking them at that age. This is primarily because you will receive reduced benefits. 4 If you want a larger amount of guaranteed income later in retirement, then waiting to begin benefits ...

What is the full retirement age?

Full Retirement Age: Age 65–67 Depending on Date of Birth. Your full retirement age is determined by your day and year of birth, and it is the age in which you get your full amount of Social Security benefits. For every year you delay taking your benefits from full retirement age up until you turn 70, your benefit amount will increase by almost 8% ...

What happens if you don't reach full retirement age?

If you have not reached your full retirement age, and you are still working and earn more than the earnings limit, your benefits will be reduced. 3 Once you reach full retirement age, no more reductions will apply, regardless of how much you work and earn. Those working will want to consider waiting until their full retirement age ...

How much does a delayed retirement credit increase?

For every year you delay taking your benefits from full retirement age up until you turn 70, your benefit amount will increase by almost 8% a year. 5 It is referred to as a delayed retirement credit. This increase can result in more lifetime income for you and your spouse.

What does it mean to delay retirement benefits?

If you are the higher earner, delaying starting your retirement benefit means higher monthly benefits for the rest of your life and higher survivor protection for your spouse, if you die first.

Is it important to decide when to start receiving Social Security?

Choosing when to start receiving your Social Security retirement benefits is an important decision that affects your monthly benefit amount for the rest of your life. Your monthly retirement benefit will be higher if you delay claiming it.

Retirement Age Calculator

Find out your full retirement age, which is when you become eligible for unreduced Social Security retirement benefits. The year and month you reach full retirement age depends on the year you were born.

Why Did the Full Retirement Age Change?

Full retirement age, also called "normal retirement age," was 65 for many years. In 1983, Congress passed a law to gradually raise the age because people are living longer and are generally healthier in older age.

When can I receive Social Security?

Retired workers and their spouses can receive benefits as early as age 62. Widows and widowers can receive survivor benefits as early as age 60, though if they're also disabled they can begin receiving benefits ...

When can disabled workers receive disability benefits?

Disabled workers can receive benefits at any age. Dependent children also can begin receiving benefits at any age if they qualify. Parents who were financially dependant on a son or daughter who dies can collect survivor benefits from age 62.

How much is a month of benefits at 62?

If, for example, you’d get $1,500 a month starting at age 62 or $2,000 a month starting at age 66, you will have received roughly the same amount in total benefits by age 77 or so. At that point the higher monthly benefits you’d get as a result of waiting will begin to pay off.

How long do you have to wait to get Medicare if you are 65?

The Social Security Administration (SSA) also cautions that even if you delay receiving Social Security benefits until after age 65, you might still need to apply for Medicare benefits within three months of turning 65 to avoid paying higher premiums for life for Medicare Part B and Part D.

How much tax do you pay if you are married filing jointly?

If you’re married filing a joint return, and your combined income is $32,000 to $44,000, you may have to pay income tax on up to 50% of your benefits. If your combined income is more than $44,000, you may have to pay tax on up to 85% of your benefits. 11 .

How much extra insurance do you get at 70?

If you wait until you’re 70 to start claiming benefits, you’ll get an extra 8% per year , or, in total, 132% of your primary insurance amount ($2,640 per month in the example above) for the rest of your life.

How much is my unemployment check at 62?

In other words, you’ll get 25% less per month, and your check will be $1,500. 1 .

Can a spouse get Social Security if they don't work?

Spouses who don’t qualify for their own Social Security. Spouses who didn’t work at a paid job or didn’t earn enough credits to qualify for Social Security on their own are eligible to receive benefits starting at age 62 based on their spouse’s record.

Do marginal tax rates affect Social Security?

At today’s marginal tax rates, they may not have much of an impact on most people. Still, tax rates and income thresholds can change, so it’s worth remembering that you will lose less of your Social Security to taxes if you are in a lower marginal tax bracket when you begin to collect.

What are the advantages and disadvantages of taking your retirement benefits before your full retirement age?

The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person's situation is different.

What happens if you delay your retirement?

If you delay your benefits until after full retirement age, you will be eligible for delayed retirement credits that would increase your monthly benefit. That there are other things to consider when making the decision about when to begin receiving your retirement benefits.

Is it better to collect your retirement benefits before retirement?

There are advantages and disadvantages to taking your benefit before your full retirement age. The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person's situation is different.