How much money should I save each year for retirement?

The amount you should save for retirement should be based upon factors including:

- your income

- your planned retirement age

- the kind of lifestyle you want to have in retirement

How much should I have saved by age 50?

The quick answer to how much you should have saved by age 50 = 10X your annual expenses or more. In other words, if you spend $50,000 a year, you should have about $500,000 in savings. Your ultimate savings by 50 goal is to achieve a 20X expense coverage ratio in order to retire comfortably. Let’s look at the methodology!

Can I get SSI benefits if I get retirement?

You can get both SSI and Social Security retirement benefits at the same time, but there are a few requirements for SSI benefits, including: Having countable income below $783 per month for...

How much money should you have saved for your age?

Fidelity's rule of thumb: Save 10x your income by age 67. Fidelity's rule of thumb: Aim to save at least 1x your salary by 30, 3x by 40, 6x by 50, 8x by 60, and 10x by 67. Factors that will impact your personal savings goal include the age you plan to retire and the lifestyle you hope to have in retirement. If you're behind, don't fret.

Can I retire at 55 and collect Social Security?

Can you retire at 55 to receive Social Security? Unfortunately, the answer is no. The earliest age you can begin receiving Social Security retirement benefits is 62.

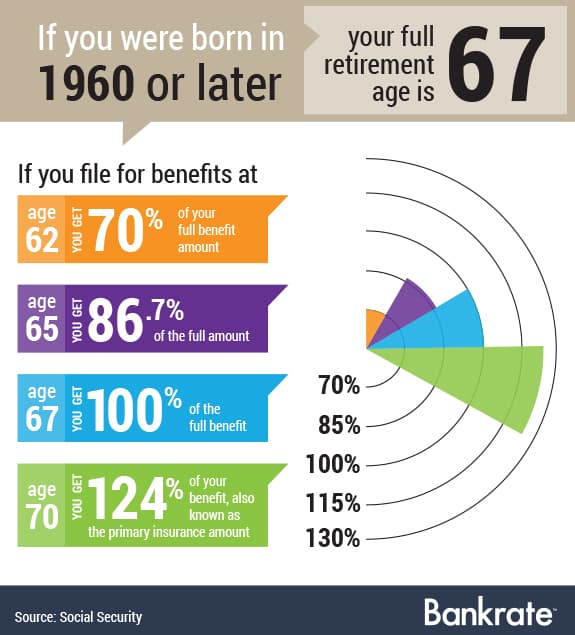

What is my eligible retirement age?

The law raised the full retirement age beginning with people born in 1938 or later. The retirement age gradually increases by a few months for every birth year, until it reaches 67 for people born in 1960 and later.

Can you collect Social Security at 62 and still work?

Can You Collect Social Security at 62 and Still Work? You can collect Social Security retirement benefits at age 62 and still work. If you earn over a certain amount, however, your benefits will be temporarily reduced until you reach full retirement age.

What is full retirement age for a 60 year old?

The full retirement age for those who turn age 62 in 2022, born in 1960, is 67. The full retirement age will remain age 67 for everyone born in 1960 or later.

Can I retire at 60 and get Social Security?

You can start receiving your Social Security retirement benefits as early as age 62. However, you are entitled to full benefits when you reach your full retirement age.

Is it better to take Social Security at 62 or 67?

The short answer is yes. Retirees who begin collecting Social Security at 62 instead of at the full retirement age (67 for those born in 1960 or later) can expect their monthly benefits to be 30% lower. So, delaying claiming until 67 will result in a larger monthly check.

What is the average Social Security check at age 62?

$2,364At age 62: $2,364. At age 65: $2,993. At age 66: $3,240. At age 70: $4,194.

What is the maximum Social Security benefit at age 62?

$2,364The maximum benefit depends on the age you retire. For example, if you retire at full retirement age in 2022, your maximum benefit would be $3,345. However, if you retire at age 62 in 2022, your maximum benefit would be $2,364.

Can I retire at 57 and collect Social Security?

Can I Take Social Security at 57? The short answer is no, you're not eligible to receive Social Security retirement benefits at age 57. The earliest you can begin taking Social Security for retirement is age 62. So if you plan to retire at 57 you'll be waiting at least five years before you can claim those benefits.

Why retiring at 62 is a good idea?

Probably the biggest indicator that it's really ok to retire early is that your debts are paid off, or they're very close to it. Debt-free living, financial freedom, or whichever way you choose to refer it, means you've fulfilled all or most of your obligations, and you'll be under much less strain in the years ahead.

How much is Social Security at 60?

Full Retirement Age for Survivors Born Between 1945 And 1956: 66 (En español) The earliest a widow or widower can start receiving Social Security survivors benefits based on age is age 60. 60, you will get 71.5 percent of the monthly benefit because you will be getting benefits for an additional 72 months.

Can I retire at 60 and claim State Pension?

Although you can retire at any age, you can only claim your State Pension when you reach State Pension age. For workplace or personal pensions, you need to check with each scheme provider the earliest age you can claim pension benefits.

Retirement Age Calculator

Find out your full retirement age, which is when you become eligible for unreduced Social Security retirement benefits. The year and month you reach full retirement age depends on the year you were born.

Why Did the Full Retirement Age Change?

Full retirement age, also called "normal retirement age," was 65 for many years. In 1983, Congress passed a law to gradually raise the age because people are living longer and are generally healthier in older age.

What does it mean to delay retirement benefits?

If you are the higher earner, delaying starting your retirement benefit means higher monthly benefits for the rest of your life and higher survivor protection for your spouse, if you die first.

Is it important to decide when to start receiving Social Security?

Choosing when to start receiving your Social Security retirement benefits is an important decision that affects your monthly benefit amount for the rest of your life. Your monthly retirement benefit will be higher if you delay claiming it.

What is the full retirement age?

Full Retirement Age: Age 65–67 Depending on Date of Birth. Your full retirement age is determined by your day and year of birth, and it is the age in which you get your full amount of Social Security benefits. For every year you delay taking your benefits from full retirement age up until you turn 70, your benefit amount will increase by almost 8% ...

What is the earliest age you can collect Social Security?

Earliest Normal Social Security Eligibility Age: 62. Even though you can begin receiving benefits as early as 62, that doesn't mean you should start taking them at that age. This is primarily because you will receive reduced benefits. 4 If you want a larger amount of guaranteed income later in retirement, then waiting to begin benefits ...

What happens if you don't reach full retirement age?

If you have not reached your full retirement age, and you are still working and earn more than the earnings limit, your benefits will be reduced. 3 Once you reach full retirement age, no more reductions will apply, regardless of how much you work and earn. Those working will want to consider waiting until their full retirement age ...

How much does a delayed retirement credit increase?

For every year you delay taking your benefits from full retirement age up until you turn 70, your benefit amount will increase by almost 8% a year. 5 It is referred to as a delayed retirement credit. This increase can result in more lifetime income for you and your spouse.

What is the full retirement age for a baby boomer?

The Social Security Full Retirement Age Is 66 for Most Baby Boomers. People born between 1943 and 1954 qualify for their full Social Security benefit at age 66. The Social Security full retirement age gradually increases from 66 and two months to 66 and 10 months for those born between 1955 and 1959. For example, the full retirement age is 66 and ...

What age do you have to be to get Social Security?

Age 67 Is the Social Security Full Retirement Age for Younger Generations. The Social Security full retirement age is 67 for workers born in 1960 or later. Millennials and younger generations need to wait until age 67 to qualify for their full Social Security benefit.

What age do you have to take 401(k)s?

Those over age 72 are typically required to take annual withdrawals from 401 (k)s and traditional IRAs and pay the resulting income tax bill. The penalty for missing a required minimum distribution is a stiff 50% of the amount that should have been taken out.

What is the maximum 401(k) contribution for 2021?

Saving in a retirement account can additionally qualify you for tax breaks and employer contributions. The 401 (k) contribution limit is $19,500 in 2021.

What happens to Social Security when you reach full retirement age?

Keep these ages in mind to boost your retirement benefits and avoid penalties. Once you reach your full retirement age, your Social Security benefit will be recalculated to give you credit for the benefit withholding and your continued earnings.

How long does it take to enroll in Medicare?

You can first enroll in Medicare during a seven-month period that begins three months before the month you turn 65. Take care to sign up on time, because your Medicare Part B premiums will increase by 10% for each 12-month period you were eligible for benefits but did not enroll.

When are federal taxes due for the year after 72?

Your first distribution must be taken by April 1 of the year after you turn 72. After that, annual withdrawals are due by Dec. 31 each year. Those who delay the first withdrawal until April will need to take two distributions in the same year, which could result in a big tax bill that year.

How long can a 65 year old woman live in retirement?

How long will you live in retirement? Based on current estimates, a 65 year old man can expect to live approximately 18 years in retirement, and a 65 year old woman can expect to live about 20 years , but many people live longer. Planning to live well into your 90s can help you avoid outliving your income.

How long do people live after retirement?

Show Description of Infographic. In the United States, people live an average of 20 years after retirement. The three most common options to save for retirement are: Retirement Plans offered by an employer. Savings and Investments. Social Security.

How much of your pre-retirement income should you replace with retirement?

Current savings. The worksheet assumes that you’ll need to replace about 80 percent of your pre-retirement income. Social Security retirement benefits should replace about 40 percent of an average wage earner’s income after retiring. This leaves approximately 40 percent to be replaced by retirement savings.

What does Social Security provide?

Social Security provides you with a source of income when you retire or if you can’t work due to a disability. It can also support your legal dependents (spouse, children, or parents) with benefits in the event of your death.

How much does Social Security pay?

Social Security pays benefits that are generally equal to about 40 percent of your pre-retirement earnings. The Social Security Administration helps you estimate your benefits. Learn from Investor.gov how you can boost your retirement savings. If you have a financial advisor, talk to them about your plans.

What percentage of your salary should you save for 401(k)?

If, for example, you are in a 401 (k) plan in which you contribute 4 percent of your salary and your employer also contributes 4 percent, your saving rate would be 8 percent of your salary. By using the worksheet, you’ve figured out your target savings rate. It gives you a rough idea –a savings goal.

How to save for retirement?

Use automatic deductions from your payroll or your checking account. Make saving for retirement a habit. Be realistic about investment returns. If you change jobs, keep your savings in the plan or roll them over to another retirement account. Don’t dip into retirement savings early.

What age can you collect a $1000 survivor benefit?

Generally, if the person who died was receiving reduced benefits, we base the survivors benefit on that amount. Year of Birth 1. Full (survivors) Retirement Age 2. At age 62 a $1000 survivors benefit would be reduced to 3. Months between age 60 and full retirement age.

What are the pros and cons of taking survivors benefits before retirement age?

Pros And Cons. There are disadvantages and advantages to taking survivors benefits before full retirement age. The advantage is that the survivor collects benefits for a longer period of time. The disadvantage is that the survivors benefit may be reduced.

How much is the 62 survivors benefit?

It includes examples of the age 62 survivors benefit based on an estimated monthly benefit of $1000 at full retirement age . If the worker started receiving retirement benefits before their full retirement age, we cannot pay the full retirement age benefit amount on their record. Generally, if the person who died was receiving reduced benefits, ...

When can a widow receive Social Security?

The earliest a widow or widower can start receiving Social Security survivors benefits based on age will remain at age 60. Widows or widowers benefits based on age can start any time between age 60 and full retirement age as a survivor. If the benefits start at an earlier age, they are reduced a fraction of a percent for each month ...

Can you use the retirement estimate to determine the amount of a spouse's retirement benefits?

You cannot use the Retirement Estimator to determine benefit amounts for a surviving spouse. However, if you know what the worker's yearly lifetime earnings were, you can use our Online Calculator to get a rough estimate of what the benefits would be for the surviving spouse at full retirement age.