Average Social Security Benefit by Age

| Age | Average Monthly Benefit |

| 66 | $1,745.14 |

| 67 | $1,719.23 |

| 68 | $1,739.24 |

| 69 | $1,736.43 |

What's the best age to begin Social Security benefits?

Key Points

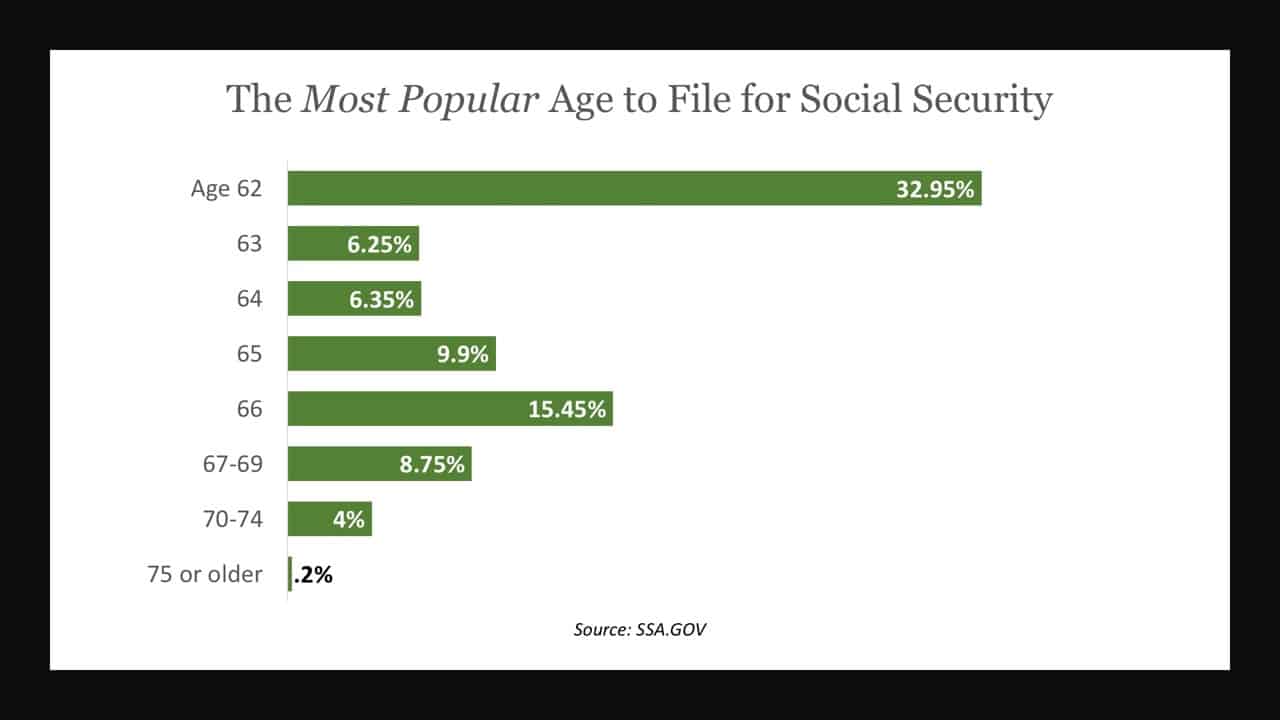

- Seniors can file for Social Security at a variety of ages.

- Age 62 is the earliest opportunity to sign up.

- Before you hurry to claim benefits at 62, consider the drawbacks of doing so.

Does working past age 70 affect your Social Security benefits?

While working past age 70 could mean higher Social Security benefits, it could also mean higher taxes and more.

How to maximize my Social Security benefits?

Simple strategies to maximize your benefits

- Work at Least the Full 35 Years. The Social Security Administration (SSA) calculates your benefit amount based on your lifetime earnings.

- Max Out Earnings Through Full Retirement Age. The SSA calculates your benefit amount based on your earnings, so the more you earn, the higher your benefit amount will be.

- Delay Benefits. ...

When should I start collecting Social Security benefits?

The rule of thumb for collecting ... will should they take early distributions. If the spouse is caring for a qualifying child, however, their spousal benefit is not reduced. The Social Security ...

Is it better to collect Social Security at 66 or 70?

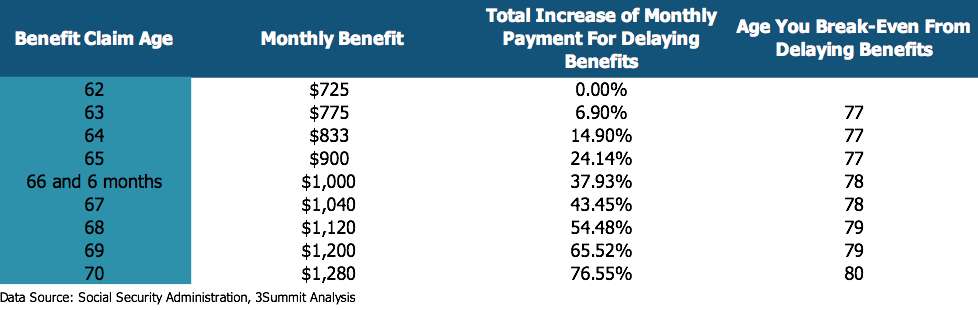

If you start receiving retirement benefits at age: 67, you'll get 108 percent of the monthly benefit because you delayed getting benefits for 12 months. 70, you'll get 132 percent of the monthly benefit because you delayed getting benefits for 48 months.

At what age do you get maximum Social Security?

You receive the highest benefit payable on your own record if you start collecting Social Security at age 70. Once you reach your full retirement age, or FRA, you can claim 100 percent of the benefit calculated from your lifetime earnings.

Do you get more Social Security at age 72?

If you wait until age 70 to start your benefits, your benefit amount will be higher because you will receive delayed retirement credits for each month you delay filing for benefits. There is no additional benefit increase after you reach age 70, even if you continue to delay starting benefits.

Does Social Security max out at age 70?

The maximum benefit depends on the age you retire. For example, if you retire at full retirement age in 2022, your maximum benefit would be $3,345. However, if you retire at age 62 in 2022, your maximum benefit would be $2,364. If you retire at age 70 in 2022, your maximum benefit would be $4,194.

How much Social Security will I get if I make 60000 a year?

That adds up to $2,096.48 as a monthly benefit if you retire at full retirement age. Put another way, Social Security will replace about 42% of your past $60,000 salary. That's a lot better than the roughly 26% figure for those making $120,000 per year.

Is it better to take Social Security at 62 or 67?

The short answer is yes. Retirees who begin collecting Social Security at 62 instead of at the full retirement age (67 for those born in 1960 or later) can expect their monthly benefits to be 30% lower. So, delaying claiming until 67 will result in a larger monthly check.

Is Social Security based on the last 5 years of work?

A: Your Social Security payment is based on your best 35 years of work. And, whether we like it or not, if you don't have 35 years of work, the Social Security Administration (SSA) still uses 35 years and posts zeros for the missing years, says Andy Landis, author of Social Security: The Inside Story, 2016 Edition.

Do you have to pay income tax after age 70?

There's no set age at which the IRS says you no longer have to file income tax returns or pay income taxes, and it's not as though you reach an age that absolves you of your tax bill.

How much will I get from Social Security if I make $30000?

1:252:31How much your Social Security benefits will be if you make $30,000 ...YouTubeStart of suggested clipEnd of suggested clipYou get 32 percent of your earnings between 996. Dollars and six thousand and two dollars whichMoreYou get 32 percent of your earnings between 996. Dollars and six thousand and two dollars which comes out to just under 500 bucks.

How much Social Security will I get if I make $100000 a year?

Based on our calculation of a $2,790 Social Security benefit, this means that someone who averages a $100,000 salary throughout their career can expect Social Security to provide $33,480 in annual income if they claim at full retirement age.

How much Social Security will I get if I make $120000 a year?

If you make $120,000, here's your calculated monthly benefit According to the Social Security benefit formula in the previous section, this would produce an initial monthly benefit of $2,920 at full retirement age.

How much Social Security will I get if I make $75000 a year?

about $28,300 annuallyIf you earn $75,000 per year, you can expect to receive $2,358 per month -- or about $28,300 annually -- from Social Security.

What are the advantages and disadvantages of taking your retirement benefits before your full retirement age?

The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person's situation is different.

What happens if you delay your retirement?

If you delay your benefits until after full retirement age, you will be eligible for delayed retirement credits that would increase your monthly benefit. That there are other things to consider when making the decision about when to begin receiving your retirement benefits.

Is it better to collect your retirement benefits before retirement?

There are advantages and disadvantages to taking your benefit before your full retirement age. The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person's situation is different.

How much will Social Security decrease at age 62?

Opting to receive benefits at age 62 will reduce their monthly benefit by 28.4% to $716 to account for the longer time they could receive benefits, according to the Social Security Administration. That decrease is usually permanent. 7 . If that same individual waits to get benefits until age 70, the monthly benefit increases to $1,266.

What is the maximum Social Security benefit for 2021?

The maximum monthly Social Security benefit that an individual can receive per month in 2021 is $3,895 for someone who files at age 70. For someone at full retirement age, the maximum amount is $3,113, and for someone aged 62, the maximum amount is $2,324.

How much will Social Security pay in 2021?

According to the Social Security Administration (SSA), the maximum monthly Social Security benefit that an individual who files a claim for Social Security retirement benefits in 2021 can receive per month is as follows: $3,895 for someone who files at age 70. $3,113 for someone who files at full retirement age (FRA)

How are Social Security benefits calculated?

Social Security benefits are calculated by combining your 35 highest-paid years (if you worked for more than 35 years). First, all wages are indexed to account for inflation. Wages from previous years are multiplied by a factor based on the years in which each salary was earned and the year in which the claimant reaches age 60. 5 .

How do Social Security benefits depend on earnings?

Social Security benefits depend on earnings. The amount of a person's retirement benefit depends primarily on his or her lifetime earnings. We index such earnings (that is, convert past earnings to approximately their equivalent values near the time of the person's retirement) using the national average wage index.

What is the retirement age for a person born in 1943?

c Retirement at age 66 is assumed to be at exact age 66 and 0 months. Age 66 is the normal retirement age for people born in 1943-54. People who retired at age 66 and who were born before 1943 received delayed retirement credits ; those born after 1954 will have their benefits reduced for early retirement.

What does it mean to delay retirement benefits?

If you are the higher earner, delaying starting your retirement benefit means higher monthly benefits for the rest of your life and higher survivor protection for your spouse, if you die first.

Is it important to decide when to start receiving Social Security?

Choosing when to start receiving your Social Security retirement benefits is an important decision that affects your monthly benefit amount for the rest of your life. Your monthly retirement benefit will be higher if you delay claiming it.