- Great rates offered The most important benefit that you are going to derive from the American Express credit card is basically great rates. ...

- Caters for small business For those with small businesses and are clueless in terms of getting the most suitable credit card that meets their business needs, then you ought ...

- No spending limit

- Travel protections. ...

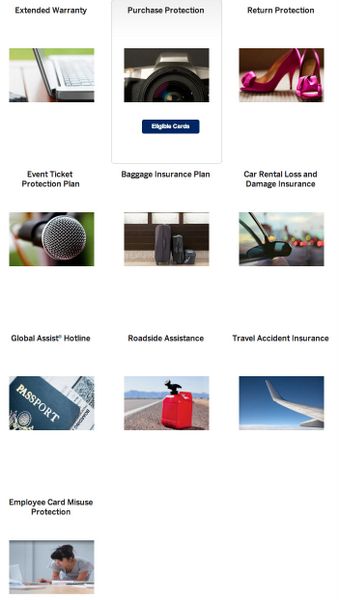

- Retail protections. ...

- Pre-sale ticket access. ...

- Complimentary hotel nights and property credits.

- Free ShopRunner membership. ...

- American Express Experiences hub. ...

- Limited-time retail offers.

What are the pros and cons of American Express?

Pros & Cons Details Pros. Long list of travel benefits, including airport lounge access and complimentary elite status with Hilton and Marriott (enrollment required) ... American Express has ...

What are the advantages of American Express?

American Express. "And they want more from their checking account, without giving up the benefits that are important to them. That’s why we built Amex Rewards Checking to deliver more value for ...

What are the advantages of American Express credit cards?

This card offers additional perks and benefits that you might find useful, including:

- 0 percent introductory APR on purchases for 15 months (13.99 percent to 23.99 percent variable APR thereafter)

- Amex Pay It Plan It

- Complimentary ShopRunner membership

- Car rental loss and damage insurance

- Purchase protection

What are the perks of American Express Platinum?

Which benefits apply to additional cardholders?

- Lounge access. The first key benefit that additional Platinum Card cardholders will enjoy is lounge access — without the primary cardholder.

- Global Entry/TSA PreCheck application-fee credit. ...

- Marriott and Hilton elite status. ...

- Access to the Fine Hotels & Resorts and Hotel Collection. ...

- Car rental elite status. ...

- Other benefits. ...

What is the benefit of having an American Express card?

Purchasing an American Express Credit Card enables you to cherish premium benefits such as curated dining experiences, amazing retail offers, travel offers, complimentary airport lounge access, and more. You can also explore customized deals using your American Express Credit Card with Amex Offers.

What's so special about American Express?

American Express is special because it is a luxury credit card brand, known for offering elite rewards and having exclusive approval requirements. American Express also is among the country's largest credit card issuers by purchase volume, and it is one of the four major payment networks.

Is getting an American Express card worth it?

The American Express® Gold Card is great for some, but a money-losing proposition for others. If you're a regular traveler who spends a lot on dining and at U.S. supermarkets, you can easily get more value out of this card than you pay in annual fees.

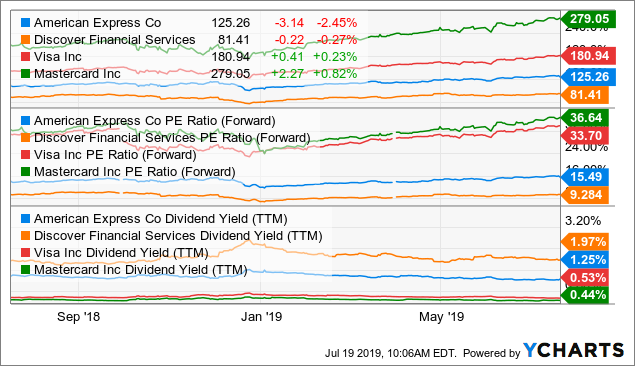

Is Visa or American Express better?

Winner: Visa American Express has long charged higher credit card processing fees than other payment networks. To avoid those more expensive fees, some merchants have opted not to accept American Express cards. It's accepted in over 170 countries; however, Visa is accepted in over 200 countries.

Why is Amex not widely accepted?

The different fees often make or break a deal for a merchant. This is why many merchants, especially small businesses, don't accept American Express. American Express' interchange fee is just too high. Providers like Visa and Mastercard charge between 1.5% and 2.5%, while Amex charges merchants between 2.5% and 3.5%.

How much do you need to spend to make Amex worth it?

This requires more work and even more spending — approximately $6,250 to $25,000 in purchases is required to offset the annual fee, depending on the categories you spend in. The quickest way to recoup the Amex Gold's annual fee is to spend a combined $6,250 at U.S. supermarkets and restaurants.

Do you have to pay your Amex in full every month?

WalletHub, Financial Company No, you don't have to pay off all American Express card every month. Most Amex credit cards allow you to carry a balance from month to month, requiring only a monthly minimum payment to keep your account in good standing.

What income do you need for Amex Gold?

American Express does not disclose a specific income requirement, but it will need to be enough to make payments on the card and to afford the $250 annual fee.

Why trust us?

Our editorial team and expert review board work together to provide informed, relevant content and an unbiased analysis of the products we feature. The editorial content on our site is independent of affiliate partnerships and represents our unique and impartial opinion. Learn more about our partners and how we make money .

Summary

American Express credit cards offer cardholders stand-out benefits in travel protection and retail protections. Plus, the issuer grants cardholders access to pre-sale tickets, unique experiences and valuable offers with partner merchants and services.

What benefits are available to American Express cardholders?

American Express continues to raise the bar when providing offers and services for cardholders. You very well may have an Amex card in your wallet, so here are some perks you can begin to enjoy today.

Getting the most out of Amex card benefits

The first step to reaping all the American Express credit card benefits is to download the American Express mobile app, where a dashboard will outline your benefits. Travel protections and retail protection benchmarks can be easily accessed from your membership page.

Bottom line

No matter which card you carry, odds are your American Express credit card is packed with valuable benefits – including travel protection, retail protection and surprising perks and unexpected services.

Enroll to enjoy

With Hilton Honors Gold status, you can enjoy benefits at hotels and resorts within the Hilton Portfolio and earn reward stays faster with Hilton Honors Bonus Points. Terms apply.

Enroll to enjoy

Upgrade to Gold Status. With Marriott Bonvoy Gold Elite Status, you can receive upgrades to enhanced rooms upon check-in when available.*

Enroll to enjoy

Treat yourself and discover new shows, audiobooks, music, news and recipes from Peacock, Audible, SiriusXM, and The New York Times. Get up to $20 in statement credits each month when you pay for a subscription to one or more of these providers with your Platinum Card ® .

Enroll to enjoy

Get a $25 statement credit each month at Equinox. Simply use your Platinum Card ® to pay for monthly Equinox All Access, Destination, or E by Equinox membership fees, or for Equinox+.

Enroll to enjoy

Get up to $100 in statement credits annually for purchases at Saks Fifth Avenue or saks.com on your Platinum Card.

Car Rental Privileges

Enjoy complimentary premium status for a number of car rental programs. Once enrolled in a program, receive upgrades when available, discounts, and priority service for your next car rental at participating locations. 19

Departures Magazine

Your Platinum Card ® Membership includes a subscription to Departures ™ , a lifestyle resource. You can access Departures content at departures.com.

How much is the American Express service fee?

There’s a $39 servicing fee per ticket.

What is the premium roadside assistance?

The Premium Roadside Assistance benefit offers help when you have an emergency on the road. You can call the number on the back of your card at any time of day. Eligible services include towing up to 10 miles, changing a flat or jump-starting a battery, and American Express pays for these services up to four times a year. Exclusions and terms apply.

How much credit does Equinox give?

Up to $300 Equinox credit. You'll get $25 per month in credit when you use the card to pay for eligible Equinox fitness club memberships. Eligible memberships include Equinox All Access, Destination or E by Equinox memberships. Or it can be applied to Equinox+, an on-demand fitness app.

Does American Express offer medical assistance?

If you’re traveling farther than 100 miles from home, American Express offers around-the-clock medical, legal, financial or other select emergency and assistance services. This benefit may also provide emergency medical transportation assistance. You may be responsible for any costs charged by third-party service providers.

How long is a credit card protected?

Your eligible purchases could be protected for up to 90 days from accidental damage or theft or sometimes loss for certain Eligible Card Products. Up to $1,000 per occurrence ($10,000 for certain Cards) and $50,000 per calendar year. Terms & Conditions Apply.

Can you create a pay over time plan with American Express?

You will not be able to create plans if your Pay Over Time feature is suspended or your Account is canceled. You will also not be able to create plans if one or more of your American Express Accounts is enrolled in a payment program, has a payment that is returned unpaid, or is past due.

Does American Express have a plan it?

Plan It is available on Card Accounts issued by a U.S. banking subsidiary of American Express, excluding Accounts that do not have either a Credit Limit or the Pay Over Time feature. Only the Basic Card Member or Authorized Account Managers on the Account can create a plan.

Does American Express take your preferences?

American Express reserves the right to note your preferences (which may include, for example, flower preferences or tee times) for servicing and marketing purposes, but is not responsible for notifying a restaurant of any food allergies or any other dietary restrictions or preferences when making dining reservations.

Points: Spending rewards

New cardholders are eligible for a welcome bonus, which American Express describes this way: “Earn 45,000 Membership Rewards® points after you spend $2,000 on purchases on your new Card in your first 6 months. Terms Apply. ”

Perks: Benefits for travelers

You'll get up to $100 per year in statement credit when you use your American Express® Green Card to purchase airport lounge passes via LoungeBuddy. Terms apply. Single-use lounge passes are available at hundreds of airports and start at $25.

Payment options and protections

Get up to $1,000 in coverage for up to 90 days (up to $50,000 per calendar year), plus an extra year added to the original manufacturer’s warranty, when you use your American Express® Green Card. Terms apply.

Exclusive perks for cardholders

Access to ticket presales means you can beat the rush for popular shows, concerts, sporting events and more. Terms apply.

What is Amex card?

American Express, often called "AmEx", is different from most credit card issuers in that it is it's own bank as well. With other cards such as Visa or MasterCard, there is a bank backing the card.

How much cash back is on American Express?

One of the most rewarding benefits are the cash back rewards offered on many American Express cards. Cash back is often up to five percent on regular purchases; more than competitor Visa or MasterCard usually offers. Advertisement.

Do American Express credit cards require payment?

When American Express first started offering credit cards they were true credit cards, meaning the balance had to be paid in full each month. At this time not all of American Express' cards require payment in full each month but many of them still do ; be sure to understand your terms of use. Advertisement.

Is there a pre-determine spending limit on Amex?

Advertisement. Unlike many other credit cards, there are usually no pre-determine spending limits on an American Express. A good credit report, history with AmEx, and time as a customer will enable you to have more freedom with your card. Lastly, American Express customer service is known to be excellent quality.

Is American Express a bad credit card?

With any good, there is always the bad. Drawbacks of American Express include the notorious annual fees. Although an annual fee is almost expected, the actual fee itself varies. In some instances, the annual fee is waived for the first year, or sometimes two years, for simply signing up or agreeing to spend a certain amount each year, according to 100 Best Credit Card Reports.