5 top benefits of a Roth IRA.

- 1. Tax-free growth and withdrawals. Let’s start with the biggest advantages of a Roth IRA, the ones that will keep the government out of your pocket ...

- 2. Pass down your money tax-free to heirs.

- 3. Withdraw contributions penalty-free at any time.

- 4. No age limit for a Roth IRA.

- 5. Roth IRAs don’t have required distributions.

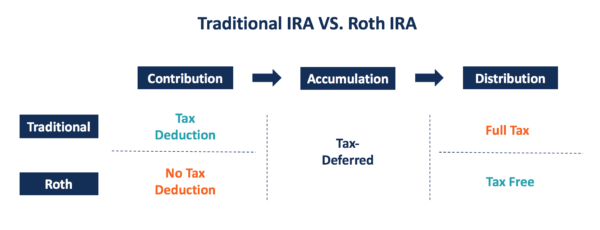

Is a Roth IRA better than a traditional IRA?

They are in a higher tax-bracket when they are working/contributing and drop to a lower tax-bracket in retirement. In this case, the traditional IRA is a better bet than the ROTH. That being said, people love ROTH IRAs! They love the idea of tax-free growth forever and leaving a tax-free inheritance to their kids.

What should you put in a Roth IRA?

Roth IRAs, for example, are funded with after-tax earnings and grow tax-free. Using tax-free municipal bonds to fund that account would thus be unnecessary. Bonds with high yields (interest rates) should instead be placed in a Roth IRA, where the interest income is tax-free.

What you can do for a Roth IRA?

There are three steps to starting a Roth IRA:

- Decide what type of investor you are Knowing how to open a Roth IRA starts with knowing your investing preferences. If you're a “do-it-yourself” investor, choose a brokerage. ...

- Choose a provider and open your Roth IRA The next step in how to open a Roth IRA is to find a home for your account. ...

- Select your investments

What is better a 401k or a Roth IRA?

- The investor is in the 22% tax bracket. He can invest $6,000 in Roth IRA or $7,690 pretax in 401k.

- 8% annual gain.

- The investor starts at 22, retires at 60, and lives until 86.

- The withdrawal rate is 7% at 60. I made the money run out at 86.

- After retirement, the investor will have a lower effective tax rate due to not having a job. ...

What are the pros and cons of a Roth IRA?

Roth IRA pros and consProsConsTax-free withdrawals No mandatory withdrawals No maximum age requirements for contributions Ways to get one even if you don't qualify Limited penalties on early distributionsContributions are taxed Limits based on income Low contribution limits Have to set it up yourselfMay 18, 2021

Is Roth IRA worth it?

The Bottom Line If you have earned income and meet the income limits, a Roth IRA can be an excellent tool for retirement savings. Once you put money into a Roth, you're done paying taxes on it, as long as you follow the withdrawal rules.

Is a Roth IRA better than a 401k?

In many cases, a Roth IRA can be a better choice than a 401(k) retirement plan, as it offers a flexible investment vehicle with greater tax benefits—especially if you think you'll be in a higher tax bracket later on.

What is the benefit of a Roth IRA vs traditional IRA?

With a Roth IRA, you contribute after-tax dollars, your money grows tax-free, and you can generally make tax- and penalty-free withdrawals after age 59½. With a Traditional IRA, you contribute pre- or after-tax dollars, your money grows tax-deferred, and withdrawals are taxed as current income after age 59½.

What is a good age to start a Roth IRA?

Starting at age 25 is better than starting at 30, and starting at age 30 is better than 35. It may be difficult to imagine now, but an extra five years of contributions at the start of your career can equal several hundred thousand dollars more in tax free retirement income.

At what age does a Roth IRA not make sense?

Unlike the traditional IRA, where contributions aren't allowed after age 70½, you're never too old to open a Roth IRA. As long as you're still drawing earned income and breath, the IRS is fine with you opening and funding a Roth.

How much should I put in my Roth IRA monthly?

Because the maximum annual contribution amount for a Roth IRA is $6,000, following a dollar-cost-averaging approach means you would therefore contribute $500 a month to your IRA. If you're 50 or older, your $7,000 limit translates to $583 a month.

How does money grow in a Roth IRA?

A Roth IRA increases its value over time by compounding interest. Whenever investments earn interest or dividends, that amount gets added to the account balance. Account owners then earn interest on the additional interest and dividends, a process that continues over and over.

Can I have 2 Roth IRAs?

You can have multiple traditional and Roth IRAs, but your total cash contributions can't exceed the annual maximum, and your investment options may be limited by the IRS.

Should I open a Roth IRA at 30?

There is no age limit to open a Roth IRA, but there are income and contribution limits that investors should be aware of before funding one.

How much will an IRA grow in 10 years?

The actual rate of return is largely dependent on the types of investments you select. The Standard & Poor's 500® (S&P 500®) for the 10 years ending December 31st 2016, had an annual compounded rate of return of 6.6%, including reinvestment of dividends.

Do I have to report my Roth IRA on my tax return?

While you do not need to report Roth IRA contributions on your return, it is important to understand that the IRA custodian will be reporting these contributions to the IRS on Form 5498. You will get a copy of this form for your own information, but you do not need to file it with your federal income tax return.

What are the disadvantages of Roth IRA?

One key disadvantage: Roth IRA contributions are made with after-tax money, meaning that there's no tax deduction in the year of the contribution. Another drawback is that withdrawals of account earnings must not be made until at least five years have passed since the first contribution.

What happens to my Roth IRA if the market crashes?

After a stock market crash, the 401k or IRA's value is at a low point. Once again, the retirement plan owner can wait until the market recovers, which can take years, or they can take advantage of the bear market in a unique way.

How much money should I put in my Roth IRA?

Know your limits. The maximum amount you can contribute to a traditional IRA or Roth IRA (or combination of both) in 2022 is capped at $6,000 — the same as 2021. Viewed another way, that's $500 a month you can contribute throughout the year.

What is the 5 year rule for Roth IRA?

The Roth IRA five-year rule says you cannot withdraw earnings tax free until it's been at least five years since you first contributed to a Roth IRA account. 1 This rule applies to everyone who contributes to a Roth IRA, whether they're 59½ or 105 years old.

What are the benefits of Roth IRA?

Here are four that you should know about. Image source: Getty Images. 1. You'll gain access to potentially unlimited tax-free income in retirement.

Why is Roth IRA so popular?

1. You'll gain access to potentially unlimited tax- free income in retirement. The promise of tax-free income during retirement is attractive to many savers. It's one of the main reasons that the Roth IRA continues to grow in popularity. As long as your income falls below the limits -- and you've earned income during the year -- you can contribute ...

What happens to a Roth IRA when you pass away?

And once you pass away, your heirs will retain the ability to reap the benefits of your Roth IRA. An inherited Roth IRA is an incredible benefit that can lead to more tax-free income for beneficiaries.

How long can you withdraw from a Roth IRA?

Once you're eligible to make withdrawals from your Roth IRA tax- and penalty-free at 59 1/2 , you can enjoy the entire $1 million without worrying about a tax bill from the IRS -- as long as you've checked the box on the five-year rule . 2. You can always withdraw what you've contributed without tax or penalties.

Do you pay taxes on Roth IRA contributions?

Here's how it works. Whether you have your contributions taken directly out of your paycheck or you make them later, you will have already paid taxes on the money that goes into a Roth IRA. Those funds will grow tax-free, and in retirement, you will pay no taxes on the money you withdraw. Annual contributions, however, are capped.

Can you withdraw from a Roth IRA without penalty?

You can always withdraw what you've contributed without tax or penalties. A lesser-known feature of the Roth IRA is the ability to withdraw your contributions whenever you want.

Do Roth IRAs require RMDs?

You don't have to worry about required minimum distributions. When you're in your 70s, you may appreciate this benefit a bit more: Roth IRAs have no required minimum distributions (RMDs). RMDs are minimum mandated amounts that investors must withdraw from tax-deferred retirement plans after they turn 72.

1. Tax-free growth

The money you invest in a Roth grows tax-free, so you don’t have to worry about reporting investment earnings—the money your money makes—when you file your taxes. For comparison, if you invest in a nonretirement account, your earnings are subject to federal, state, and local taxes each year.

2. Tax-free withdrawals in retirement

If you’re age 59½ or older and have owned your account for at least 5 years,* you can withdraw money—contributions plus earnings—from your Roth IRA without paying any penalties or taxes. So even if you take a lump-sum withdrawal in retirement, your income won’t be affected.

3. You decide when, if, and how to take withdrawals

Leave it in You don’t have to take money out of your Roth IRA unless you want to. Unlike a traditional IRA, a Roth IRA has no lifetime required minimum distribution (RMD).

What are the tax benefits of a Roth IRA?

Tax benefits of Roth IRAs. The most immediate tax benefit of a Roth IRA is the tax-free growth of your contributions. Although Roth IRAs have contribution limits, you can receive an unlimited amount of dividends, interest, and realized capital gains without increasing your tax liability for the current year.

Why are Roth IRAs good for young adults?

There are three main reasons why. First, having a relatively low income maximizes the tax advantages of a Roth IRA.

How long can you hold a Roth IRA?

You can even hold a Roth IRA long enough to bequeath it to your heirs. Withdrawals by the new beneficiaries would be tax-free provided that the Roth IRA has been open for at least five years. The beneficiaries would only need to withdraw all the funds from their inherited Roth IRA within 10 years of your death.

What is Roth IRA?

The Roth individual retirement account, or IRA, is a versatile retirement plan that confers multiple benefits. You can use your Roth IRA to fund a home down payment and higher-education expenses, for example. But the plan's tax benefits are, to many investors, its most compelling feature. Contributing to a Roth IRA enables ...

What age can a child take over a Roth IRA?

And the standard income limits do still apply. For beneficiaries younger than age 18 or 21, depending on the state where you live, custodians are required to supervise their accounts. The child assumes legal ownership of the Roth IRA upon reaching the age specified by your state.

When do you have to take RMDs from Roth IRA?

For retirement accounts with taxable distributions, the IRS requires RMDs after you turn age 72 (or 70 1/2 if you reached that age before Jan. 1, 2020).

Is Roth IRA tax deferred?

These earnings are tax-deferred, meaning any tax that may be assessed is deferred until you make a withdrawal. Not having to withdraw money annually to pay taxes on capital gains earned by the securities in the account enables the value of the Roth IRA to increase more rapidly. Even better, when you reach retirement age, ...

What can I invest in with a Roth IRA?

In a traditional or Roth IRA account, you can invest in all sorts of traditional financial assets such as stocks, bonds, exchange-traded funds (ETFs), and mutual funds. You can invest in a wider range of investments through a self-directed IRA (one in which you the investor, not a custodian, makes all the investment decisions)—commodities, ...

What is a traditional IRA?

Traditional and Roth IRAs: An Overview. Two widely popular types of individual retirement accounts (IRAs) are the traditional IRA and the Roth IRA. They have many advantages and a few drawbacks for retirement savers. The IRA was created decades ago as defined-benefit pension plans were declining.

How much penalty do you pay for IRA withdrawals?

With the traditional IRA, you face a 10% penalty on top of the taxes owed for any withdrawals before age 59½. With the Roth IRA, you can withdraw a sum equal to your contributions penalty and tax-free at any time. 2. However, you can only withdraw earnings without getting dinged with the 10% penalty if you’ve held the account for five years ...

How much can I contribute to an IRA in 2021?

To contribute to an IRA, you or your spouse need earned income. For 2020 and 2021, the maximum contribution amount per person is $6,000, or $7,000 if you’re age 50 or older.

When do you have to withdraw from an IRA?

Required Withdrawals. There are mandatory withdrawals for your traditional IRA called required minimum distributions (RMDs), starting when you reach age 72. The amount of the withdrawal is calculated based on your life expectancy, and it will be added to that year's taxable income.

When is the IRA contribution deadline for 2021?

As well, given the winter storms that hit Texas, Oklahoma, and Louisiana in February 2021, the IRS had delayed the 2020 federal individual and business tax filing deadline for those states to June 15 , 2021. The IRA contribution deadline for those affected by these storms is extended to June 15, 2021. 14 15 16.

Can you withdraw money from a Roth IRA?

A popular benefit of the Roth IRA is that there is no required withdrawal date. You can actually leave your money in the Roth IRA to let it grow and compound tax-free as long as you live. What's more, any money you do choose to withdraw is tax-free. 20 .

What is Roth IRA withdrawal?

Roth IRA Withdrawal Rules. The Bottom Line. A Roth IRA is a retirement savings account that holds investments that you choose using after-tax money. 1 Roth IRAs offer many benefits, and the greatest of them is the fact that your retirement money and its earnings will never be taxed again. But they're not the right choice for every investor.

How much can I contribute to a Roth IRA in 2021?

Roth and traditional IRAs are both excellent ways to stash money away for retirement. They share the same contribution limits. For 2021, that's $6,000 , or $7,000 if you're age 50 or older. 2

What is a backdoor Roth IRA?

The Backdoor Roth IRA. There's a tricky but perfectly legal way for high income-earners to contribute to a Roth IRA even if their income exceeds the limits. This is called a backdoor Roth IRA and it entails contributing to a traditional IRA and then immediately rolling over the money into a Roth account.

How long can you withdraw from a Roth IRA?

With a Roth, you can withdraw your contributions at any time, for any reason, without tax or penalty. And qualified withdrawals in retirement are also tax-free and penalty-free. Those happen when you're at least 59½ years old and it's been at least five years since you first contributed to a Roth IRA—also known as the five-year rule. 8

How long do you have to wait to start a Roth?

The five-year rule can be a disadvantage if you start a Roth later in life. For example, if you first contributed to a Roth at age 58, you have to wait until you're 63 years old to make tax-free withdrawals. 10 .

Can I contribute to a Roth IRA if my MAGI is too high?

You can make a partial contribution if your MAGI is in the "phase-out" range. And if your MAGI is too high, you can't contribute at all. Below is a rundown of the Roth IRA income and contribution limits for 2021. 2 .

Can you avoid the penalty for using a Roth IRA?

You may be able to avoid the penalty ( but not the taxes) if you use the money for a first-time home purchase or for certain other exemptions. Age 59½ and over: Withdrawals are subject to taxes but not penalties. The five-year rule can be a disadvantage if you start a Roth later in life.

Tax-Free Growth

- The money you invest in a Roth grows tax-free, so you don’t have to worry about reporting investment earnings—the money your money makes—when you file your taxes. For comparison, if you invest in a nonretirement account, your earnings are subject to federal, state, and local taxes each year.

Tax-Free Withdrawals in Retirement

- If you’re age 59½ or older and have owned your account for at least 5 years,* you can withdraw money—contributions plus earnings—from your Roth IRA without paying any penalties or taxes. So even if you take a lump-sum withdrawal in retirement, your income won’t be affected. This is a valuable benefit because your income impacts how much you pay in taxes—including the taxatio…

You Decide When, If, and How to Take Withdrawals

- Unlike a traditional IRA, a Roth IRA has no lifetime required minimum distribution. However, you can take out what you contribute at any time, free and clear. It's smart to contribute to your Roth IRA and let compounding—when your contributions generate returns—work its magic until you need to take a withdrawal. But if you need to take distributions from your Roth IRA, that's okay to…

What’s Next?

- Roth IRA owners Save as much as you can, and keep your contributions invested for as long as you can. Even if you need to tap into them, you’re still saving for retirement. Don't have a Roth IRA yet? Learn more about Roth IRAs.Then open an account to see for yourself why so many investors love them.