The Benefits of Medicare Supplement Insurance Plans

| Medicare Supplement Benefits | K 2 | L 3 |

| Part A coinsurance and hospital coverage | ||

| Part B coinsurance or copayment | 50% | 75% |

| Part A hospice care coinsurance or copay ... | 50% | 75% |

| First 3 pints of blood | 50% | 75% |

What are the basic benefits in a Medicare supplement plan?

Medicare Supplement insurance Plan A covers 100% of four things:

- Medicare Part A coinsurance payments for inpatient hospital care up to an additional 365 days after Medicare benefits are used up

- Medicare Part B copayment or coinsurance expenses

- The first 3 pints of blood used in a medical procedure

- Part A hospice care coinsurance expense or copayment

What are the top 5 Medicare supplement plans?

- Plan G

- Plan N

- Plan A

- Plan F

- High Deductible Plan F

Which is the best Medicare supplement?

Medicare Supplement Plan G is identical to Plan F except you pay the Part B deductible once per year on Plan G. It’s definitely one of the best Medicare supplement Plans. Whereas Plan F pays that amount for you (with the extra money you give them in the higher monthly premium for Plan F).

What is the best supplemental insurance to have with Medicare?

- You must have Medicare Part A and Part B.

- A Medigap policy is different from a Medicare Advantage Plan. ...

- You pay the private insurance company a monthly premium The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. ...

- A Medigap policy only covers one person. ...

What is the difference between Medicare Advantage and Medicare Supplement?

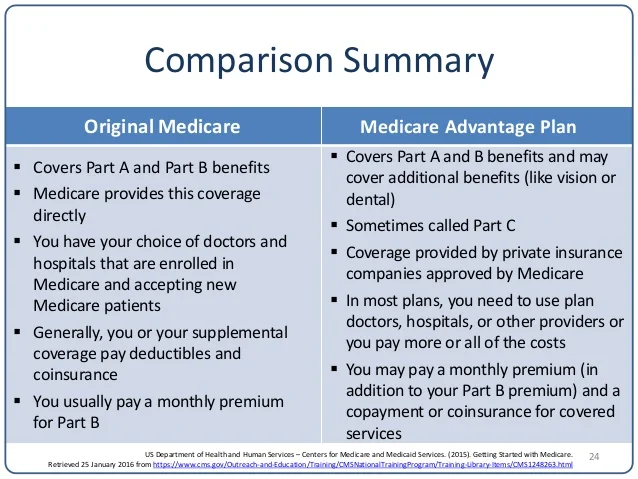

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.

What are some supplemental benefits?

Some of the most common supplemental benefits are visits to the optometrist, hearing aids, dental care, and reimbursement for fitness costs (such as a gym membership).

What is the best supplemental insurance with Medicare?

Best Medicare Supplement Insurance Companies of 2022Best Overall: Mutual of Omaha.Best User Experience: Humana.Best Set Pricing: AARP.Best Medigap Coverage Information: Aetna.Best Discounts for Multiple Policyholders: Cigna.

What are mandatory supplemental benefits?

Mandatory supplemental benefits are paid for either in full, directly by, or on behalf of, MA enrollees by premiums and cost sharing, or through application of rebate dollars. An MA MSA plan may not provide mandatory supplemental benefits. in that they are non-drug benefits that are not covered by original Medicare.

How do supplemental benefits work?

Overview. Supplemental benefits products are insurance policies that provide financial protection against expenses associated with accidents or illnesses not covered by major medical insurance.

Who benefits supplemental insurance?

These policies may provide a lump-sum cash benefit to help you pay for additional costs that are related to your illness but not covered by your regular health plan or disability coverage. The money can then be used to pay for various expenses, including: Deductibles. Out-of-network specialists.

What are the top 3 most popular Medicare Supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

How do I choose a Medicare Supplement plan?

Here are some tips for choosing the best Medicare Supplement Insurance (Medigap) plan for your needs.Understand your coverage needs and budget.Sign up during the Medigap Open Enrollment Period.Explore any potential discounts.Know when you may have guaranteed-issue rights.

What was the purpose of offering Medicare Advantage to Medicare beneficiaries?

While original Medicare has plenty to offer, a market for high-performing, quality private health plans has emerged, giving insurers an incentive to provide optimal, reasonably priced coverage in the form of Medicare Advantage (MA) plans.

What is Medicare Ssbci?

The CHRONIC Care Act of 2018 gave Medicare Advantage plans new flexibility to offer Special Supplemental Benefits for the Chronically Ill (SSBCI) that are intended to help enrollees with specific chronic conditions. In 2019, MA plans offered a wider array of primarily health-related benefits.

What does Ssbci mean?

Special Supplemental Benefits for the Chronically IllSpecial Supplemental Benefits for the Chronically Ill (SSBCI) and New Primarily Health Related Benefits.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

Does Medicare cover prescription drugs?

Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage. If you want prescription drug coverage, you can join a Medicare Prescription Drug Plan (Part D). If you buy Medigap and a Medicare drug plan from the same company, you may need to make 2 separate premium payments. Contact the company to find out how to pay your premiums.

Does Medigap cover everything?

Medigap policies don't cover everything. Medigap policies generally don't cover. long-term care. Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (also called Medigap) can help cover the costs of deductibles, copayments, coinsurance and other fees associated with Original Medicare (Part A and Part B). Compare the basic benefits of the 10 standardized Medigap plans listed below to find the right plan for your needs.

What is Medicare Part A?

Medicare Part A (hospital insurance) and Medicare Part B (medical insurance) offer benefits that help cover services such as hospital stays, doctor visits and preventive care — but they often come at a price. Medicare Part A Costs.

How much is Medicare Part A deductible in 2021?

The Medicare Part A deductible is $1,484 per benefit period in 2021, and you may have to pay coinsurance fees for hospital stays that last longer than 60 days. Medicare Part B Costs. Medicare Part B has an annual deductible that is $203 in 2021.

What is Medicare Part B deductible?

Medicare Part B deductible. Medicare Part B excess charge. Foreign travel emergency. Each of the nine Medigap health insurance plans cover the first four basic benefits listed above. Plans may cover some, all or none of the five additional benefits — partially or in full.

How much does Plan N pay for Part B?

4 Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to $50 copayment for emergency room visits that don’t result in an inpatient admission .

What is Medicare Advantage?

Medicare Advantage is designed to be a comprehensive, all-in-one healthcare plan that gives you access to everything you might need to stay healthy and well, including hospital stays, doctor care, prescription drugs, and an array of non-medical healthcare services like vision, dental and hearing. These supplemental benefits can be highly attractive but also surprisingly affordable, depending on your plan.

Does Medicare Advantage cover eye exams?

Vision: Most Medicare Advantage plans offer vision care such as eye exams, as well as sometimes an allowance towards glasses/contact lenses.

Is Medicare Advantage declining?

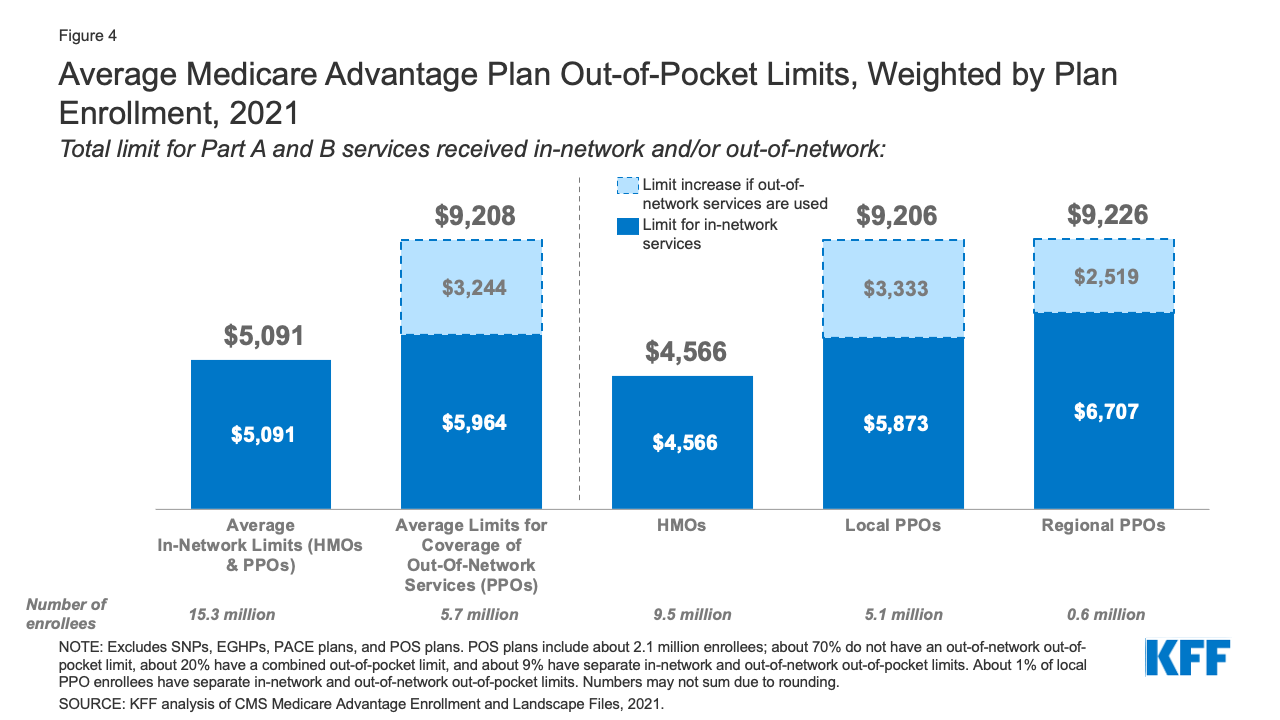

At the same time, premiums for Medicare Advantage are declining and out-of-pocket payments are being limited, making Medicare Advantage more widely accessible. In fact, almost two thirds of Medicare Advantage enrollees paid no additional premium (other than the premium for Part B that everyone pays) in 2021.

Is Medicare Advantage supplemental benefit a beneficiary?

The Medicare Advantage supplemental benefits are definitely beneficiary to have, if available to you. While each Medicare Advantage plan is different and offers varying benefits and coverage, this option is becoming more and more affordable to choose.

Is Medicare Advantage more affordable than Original?

For many, original Medicare is enough coverage to suit their needs. But others might enjoy the added coverage and benefits of a Medicare Advantage plan. After all, Medicare Advantage plans can offer many more benefits and services than original Medicare and the premiums for Medicare Advantage have been declining over the years, making it even more affordable.

Does Medicare cover dental insurance?

Dental: S ome plans offer dental coverage, which can be used at any licensed dentist that accepts Medicare. You can use your allowance towards both preventive and comprehensive dental treatments, such as cleanings, fillings, extractions, root canals, x-rays, and more.

Is Medicare Advantage a good supplement?

It can help you get access to medical and non-medical health services that can offer important both preventive and comprehensive treatment. Medicare Advantage is becoming more accessible and affordable so that everyone can benefit from comprehensive healthcare coverage.

What is Medicare Advantage Supplemental Benefits?

By Charlene Arsenault | Updated on October 6, 2020. Medicare Advantage insurers are adding more supplemental benefits to their plans in 2021. Medicare Advantage, also called Part C, is an alternative to Original Medicare and is offered by private insurance companies.

What is Medicare Advantage?

Medicare Advantage combines coverage that people with Original Medicare get in Parts A and B (hospitals and physician services) and usually combines it with prescription drug coverage and other benefits.

Why is Medicare Advantage so popular?

One reason for its increased popularity is Medicare Advantage’s supplemental benefits. The plans often offer dental, vision and prescription drug coverage. In recent years, Medicare Advantage insurers have expanded benefits further to include services that go beyond a person's medical care.

What are the benefits of Medicare Advantage 2021?

More Medicare Advantage supplemental benefits in 2021. Medicare Advantage can now offer expanded services, such as meal delivery, home safety, rides to doctor appointments and preventative care. Here are some of the expanded supplemental benefits in 2021: More than 94% of Medicare Advantage plans will have telehealth benefits.

How many hours of personal care for Medicare?

The insurer provides up to 124 hours of an in-home personal care aide to help with daily activities, such as dressing, grooming and bathing. Transportation Services via Uber and Lyft: Some Medicare Advantage insurers offer free "on-demand" transportation to doctor appointments using Uber and Lyft.

What is the largest Medicare Advantage insurance?

House Calls: UnitedHealthcare, which is the largest Medicare Advantage insurer, has a program called HouseCalls. The program offers people an annual health and wellness visit from the comfort of home, helping make it easier to get needed care, tests and treatment.

How many Medicare Advantage plans are there?

A new program will increase access to pallative care and integrated hospital care. Fifty-three Medicare Advantage plans will offer the program.

What is Medicare Advantage?

Medicare Advantage, sometimes called Medicare Part C, is an "all in one" alternative to Original Medicare, according to the U.S. Centers for Medicare & Medicaid Services.

What is the purpose of Medicare gym membership?

One of the primary goals of the expanded supplemental benefits offered through Medicare Advantage plans is to support the overall physical and mental health of enrollees in order to reduce the amount of emergency health care needed , according to The Commonwealth Fund.

What is a special needs plan?

According to the Centers for Medicare and Medicaid Services, a Special Needs Plan (SNP) is a type of Medicare Advantage plan that offers benefits and services to those with qualifiying diseases, certain health care requirements, or limited incomes.

Does Medicare offer transportation to appointments?

Transportation. Transportation to and from medical appointments is a supplemental benefit you can expect from certain Medicare Advantage plans, according to the U.S. Centers for Medicare & Medicaid Services. The Commonwealth Fund reports that rides to medical appointments have been offered since before 2018, with some plans offering expanded ...

What is Medicare Supplement?

Medicare supplement insurance policies help fill in the gaps left by Original Medicare health care insurance. For many people, Medicare Supplement, also known as Medigap, insurance helps them economically by paying some of the out-of-pocket costs associated with Original Medicare.

What percentage of Medicare supplement is paid?

After this is paid, your supplement policy pays your portion of the remaining cost. This is generally 20 percent. Some policies pay your deductibles The deductible is a set amount which you must pay before Medicare begins covering your health care costs.

How many people does Medicare Supplement cover?

Keep in mind that, just like Medicare, Medicare Supplement plans are individual insurance policies. They only cover one person per plan. If you want coverage for your spouse, you must purchase a separate plan.

How long does it take to get a Medigap plan?

When you turn 65 and enroll in Part B, you will have a 6-month Initial Enrollment Period to purchase any Medigap plan sold in your state. During this time, you have a “guaranteed issue right” to buy any plan available. They are required to accept you and cannot charge you more due to any pre-existing conditions.

How long does Medicare cover travel?

Each plan varies in what it covers, but all plans pay for Medicare Part A (hospital insurance) coinsurances for up to 365 days beyond the coverage that Medicare offers. Some of the plans cover a percentage of the cost for emergency health care while traveling abroad.

How old do you have to be to qualify for medicare?

To be eligible for Medicare, you must be at least 65 years old, a citizen of the United States or permanent legal resident for at least five consecutive years. Also, you, or your spouse, must have worked and paid federal taxes for at least ten years (or 40 quarters).

Does Medicare cover long term care?

Most plans do not cover long-term care, vision, dental, hearing care, or private nursing care. All Medicare Supplement insurance coverage comes with a monthly premium which you pay directly to your provider. How much you pay depends on which plan you have.

What is supplement benefit?

Supplemental benefits may help plans improve health outcomes and address unmet patient needs. However, to offer these benefits, plans must decide the best way to allocate resources among different types of services, some of which may require significant investment and infrastructure.

Why are Supplemental Benefits important?

Supplemental benefits may be particularly helpful for plans as they develop strategies to better manage the care of high-cost, high-need beneficiaries, including those with chronic diseases . Plans now have the flexibility to offer a combination of primarily health-related supplemental benefits and SSBCI to certain enrollees (for example, transportation to medical appointments as well as transportation to grocery stores). However, a relatively small number of plans offered SSBCI in the first year these services were permitted (Exhibit 6).

What are the benefits of Medicare Advantage?

Medicare Advantage plans can offer additional benefits not covered by Medicare Parts A, B, or D, such as dental and vision coverage. These benefits, called supplemental benefits, include medical-related benefits, such as dental care, and nonmedical benefits, including those that address social and environmental factors, such as pest control.

What is MA in Medicare?

Medicare Advantage (MA) plans are seeing increasing numbers of enrollees who have social risk factors and complex medical needs. 3 Recently, both Congress and the Centers for Medicare and Medicaid Services (CMS) have granted these plans new flexibilities in designing benefits, with the goal of improving outcomes and lowering costs, particularly for enrollees with chronic conditions (Exhibit 1). In 2017, CMS began allowing MA plans participating in the Value-Based Insurance Design (VBID) model — a Center for Medicare and Medicaid Innovation demonstration program — the ability to offer benefit designs tailored to specific diseases, such as reduced cost sharing and deductibles for certain specialist visits or prescription drugs. Then, in 2019, CMS extended to all MA plans the ability to offer disease-tailored benefit designs.

How many MA plans offer SSBCI in 2020?

Key Findings: Adoption of SSBCI was relatively limited in the first year: only 6 percent of MA plans offered these benefits in 2020. However, plans offering additional, primarily health-related supplemental benefits increased substantially between 2018 and 2020, including meal provision (20% of plans to 46% of plans), transportation (19% to 35%), in-home support services (8% to 16%), and acupuncture (11% to 20%).

What is SSBCI in MA?

As of 2020, plans can also offer Special Supplemental Benefits for the Chronically Ill (SSBCI) — nonmedical services such as pest control. Goals: To assess the availability of and enrollment in MA plans offering new types of supplemental benefits in 2019 and 2020.

Why is there a small percentage of SSBCI in 2020?

Conclusion: The relatively small percentage of plans offering SSBCI in 2020 may be due in part to operational and logistic challenges. But based on initial insight into 2021 plan benefit offerings, the trend toward more benefits that address social determinants of health will continue.