Some of the typical examples of fringe benefits are:

- Health Insurance

- Retirement Plans

- Family and medical leave

- Paid leave

- Mean Subsidization

- Commuter Benefits

What are fringe benefits and why are they important?

Why Fringe Benefits Are Important.Providing fringe benefits plays a significant role in attracting and making employees stay. From medical insurance to sick pay and meal allowances, these fringe benefits are often one of the top things considered by employees after taking the amount of salary into account.

What you should know about fringe benefits?

Some examples of tax-free fringe benefits are:

- Accident insurance

- Disability insurance

- Achievement awards

- Health savings accounts

- Dependent care assistance

- Group-term life insurance up to $50,000

Which fringe benefits are taxable and nontaxable?

- Employee discounts

- Employee stock options

- Group-term life insurance

- Retirement planning services

- Job-related education assistance reimbursements

What is considered a fringe benefit?

A fringe benefit is something that your employer offers you that is above and beyond your annual salary or other wages. These are perks that employers offer in order to attract and retain the best talent.

What are the 7 fringe benefits?

These include health insurance, life insurance, tuition assistance, childcare reimbursement, cafeteria subsidies, below-market loans, employee discounts, employee stock options, and personal use of a company-owned vehicle.

What does fringe benefits mean with examples?

fringe benefit, any nonwage payment or benefit (e.g., pension plans, profit-sharing programs, vacation pay, and company-paid life, health, and unemployment insurance programs) granted to employees by employers. It may be required by law, granted unilaterally by employers, or obtained through collective bargaining.

What means fringe benefit?

fringe benefit. noun [ C, usually plural ] HR. an extra thing that is given to you by your employer in addition to your pay but is not in the form of money: Fringe benefits include a company car and free health insurance.

What are three examples of excluded fringe benefits?

2. Fringe Benefit Exclusion RulesAccident and health benefits.Achievement awards.Adoption assistance.Athletic facilities.De minimis (minimal) benefits.Dependent care assistance.Educational assistance.Employee discounts.More items...•

Is 401k a fringe benefit?

Typical forms of fringe benefits include: Medical and dental insurance. Year-end and performance bonuses. 401k, IRA or other employer-sponsored retirement plan, including employee matching contribution plans.

Is a car allowance a fringe benefit?

Therefore, a car expense payment benefit paid on a cents per kilometre basis that is exempt from fringe benefits tax under the FBT Act is not subject to payroll tax.

What is another word for fringe benefit?

In this page you can discover 14 synonyms, antonyms, idiomatic expressions, and related words for fringe-benefit, like: gravy, allowances, benefits, bonus, compensation package, employee-benefit, lagniappe, perk, perks, perquisite and perquisites.

What fringe benefits are not taxable?

Nontaxable fringe benefits can include adoption assistance, on-premises meals and athletic facilities, disability insurance, health insurance, and educational assistance.

Is Social Security a fringe benefit?

Such payments required to fund Social Security, unemployment compensation and workers' compensation programs, as required by law, do not count as fringe benefits.

Is cell phone reimbursement a fringe benefit?

When it comes to reimbursing employees or providing a monthly stipend for the use of their personal cellphones for business purposes, yes, this a non-taxable fringe benefit - provided that your reimbursement is reasonably calculated to actually reimburse the employees for the actual costs of maintaining the phone.

Is salary packaging a fringe benefit?

Salary packaging reduces your taxable income and is then represented on your PAYG payment summary as Reportable Fringe Benefits. Your Reportable Fringe Benefits amount can affect other entitlements. Salary packaging enables you to reduce your taxable salary, and as a result, pay less income tax.

What is a fringe benefit?

A fringe benefit is a benefit that an employee receives in addition to their regular salary. It can include anything from health insurance to subsidized meals or a company phone. While some fringe benefits are required, employers can also offer them to employees to reward them or to entice future candidates.

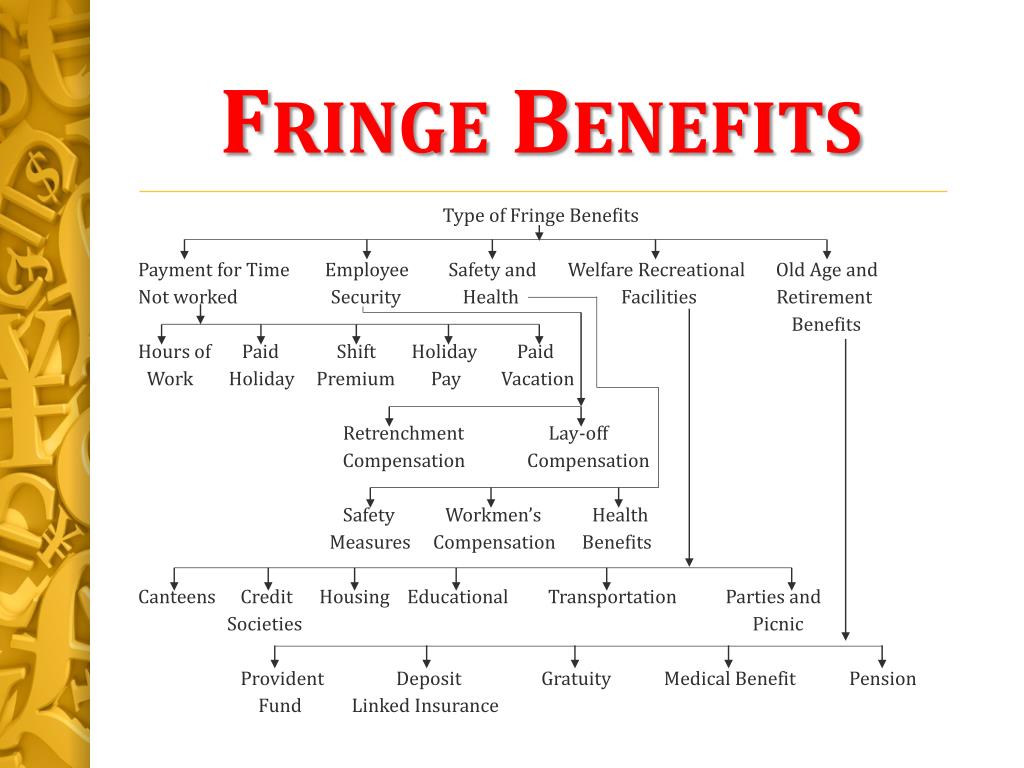

Types of fringe benefits

Here are some examples of fringe benefits you might encounter with your current or future employer:

Faqs about fringe benefits

Here are some answers to frequently asked questions you might have about fringe benefits:

What are fringe benefits? What are some examples?

Examples of optional fringe benefits include free breakfast and lunch, gym membership, employee stock options, transportation benefits, retirement planning services, childcare, education assistance, etc. One of the advantages of fringe benefits is that they are tax-exempt for the employer, provided that the set conditions are met.

What is fringe benefit?

Fringe benefits are the additional benefits offered to an employee, above the stated salary for the performance of a specific service. Some fringe benefits such as social security. Social Security Social Security is a US federal government program that provides social insurance and benefits to people with inadequate or no income.

How does fringe benefit work?

The various fringe benefits that are provided to employees vary from one company to another, since the employer can choose the benefits that will be provided to employees during a certain period. Employees are given the chance to select the fringe benefits that they are interested in during recruitment.

Why do employers provide fringe benefits?

Although the goal of providing fringe benefits to employees is to ensure their comfort at the workplace, it also helps the company stand out for potential employees. In highly competitive markets, employers may find it challenging to retain top employees on salary alone.

How to increase employee satisfaction?

One way to increase employee satisfaction is by providing additional benefits like paid holidays, health care insurance, employer-provided car, stock options, etc.

Is fringe benefit taxable?

Fringe benefits not required by law. The following benefits are provided at the employer’s discretion. On the side of the employer, most of these benefits are taxable, but with certain exceptions. Examples of these fringe benefits include: Stock options.

Do fringe benefits include fair value?

On the contrary, the recipients of fringe benefits are required to include the fair value. Fair Value Fair value refers to the actual value of an asset - a product, stock, or security - that is agreed upon by both the seller and the buyer. Fair value is applicable to a product that is sold or traded in the market where it belongs or ...

Fringe Benefits Definition

Federal law states that you must pay all your full-time employees certain benefits on top of their standard pay. This includes Medicare and social security, unemployment insurance, workers’ compensation insurance, and Family and Medical Leave Act (FMLA) protections (although workers’ compensation rates vary according to local or state laws).

Fringe Benefits Examples

Generally speaking, salary and fringe benefits fall into three categories: legally required benefits, taxable benefits, and non-taxable benefits.

Is Holiday Pay a Fringe Benefit?

One question that people often have is whether or not holiday pay is classed as a fringe benefit.

How to Calculate Fringe Benefits

Whichever fringe benefits you offer your employees, you need to make sure you take them into consideration when you calculate payroll each month. This includes withholding the right percentage of payroll tax. It also involves including salary and fringe benefits as supplemental income on an employee’s W-2.

Keep Track of Employee Benefits and Compensation

As you can see, keeping track of employee benefits and compensation is never straightforward. You need to make sure you calculate all your benefits correctly and withhold the right rate of tax where applicable. A payslip template can help with this, but you still need to ensure the right rate of tax is calculated.

What is fringe benefit?

Fringe benefits are additions to compensation that companies give their employees. Some fringe benefits are given universally to all employees of a company while others may be offered only to those at executive levels. Some benefits are awarded to compensate employees for costs related to their work while others are geared to general job ...

Why do employers use fringe benefits?

In any case, employers use fringe benefits to help them recruit, motivate, and keep high-quality people. 1:41.

What are the benefits of Alphabet?

Alphabet, the parent company of Google, is known for its benefits that include free commuter bus service and a free gourmet cafeteria. Microsoft gives 20 weeks of paid time off to new birth mothers and 12 weeks for other new parents.

Is fringe benefit taxable?

By default, fringe benefits are taxable unless they are specifically exempted. Recipients of taxable fringe benefits are required to include the fair market value of the benefit in their taxable income for the year.

What are the advantages of fringe benefits?

Advantages. Employee motivation and satisfaction. The employer gets tax benefits on most of the fringe benefit expenses. Increased productivity of employees. The employer gets the deal in bulk, so the insurance costs are less costly compared to individual policies. Increases goodwill of organization in the market;

When an employer provides an interest free loan to its employees, what is considered the value of the fringe benefit?

When the employer provides an interest-free loan to its employees, the national interest which the employee would have paid had he taken that loan from an outside lender, is considered the value of the fringe benefit.

What are the disadvantages of a 401(k) plan?

Disadvantages. Increases the cost per employee for an organization; Difficult to keep all employees happy instead of best efforts by the employer. Statutory obligation regarding fringe benefits and time-consuming and costly; Maintenance of records needs personnel.

Is personal usage fringe benefit?

In a few cases, the equipment is used for both personal and professional usage, then the value or cost of personal usage is considered a Fringe benefit. Many companies provide free meals to their employees during office hours. This is calculated based on the cost charges by Vendor per meal per person.

Is a meal discount fringe benefit?

If the meals are provided at a discounted value, the discount amount borne by the employer forms part of fringe benefit. Sometimes when the employer reimburses the travel expenses or any other expenses. Other Expenses Other expenses comprise all the non-operating costs incurred for the supporting business operations.

What is fringe benefit?

Fringe benefits are benefits which are provided by the employer to an employee over and above the normal salary and wages, which may be in the form of cash-support or assistance in daily needs of life or financial support for retirement age or any other form with the objective to retain the high-quality people within the organization.

Why is fringe benefit important?

Thus, fringe benefits in the form of personal health care helps the employees to stay fit & active during the working hours.

What is the effect of providing additional benefits over and above the salary?

Employers who provide additional benefits over and above the salary are always concentrated with a huge number of employees. Once the organization is known for its good approach with the employees, the reputation of the employer in the market increases.

Why is uniqueness important?

At one side, it given happiness and a feeling of satisfaction to the employees; on the other side it gives confidence of retention to the employer at a minimal cost. Uniqueness is always appreciated. The same is the case with the benefits. Employees like to continue with those employers who offer unique benefits.

What are the three categories of benefits?

IRS specifies three categories of benefits viz., non-taxable benefits, partially taxable benefits & tax deferred benefits. For paying tax, we need to know the value of benefit multiplied by the tax rate. Tax rate is specified by the IRS but the real task lies in valuing the benefits.

What are the benefits of the federal government?

Such benefits are medical support, financial support, retirement benefits, an insurance benefit, unemployment insurance, etc. The basic intent behind such benefits is that these are life-saving & life-supporting benefits.

Who chooses fringe benefits?

Employees are at the discretion to choose the fringe benefits. Employees choose those options at which they are at maximum benefit. Employees with retail businesses (such as traders of electronic items) are given benefits in the form of discounts, sale at cost benefit, rewards for increasing the customers, etc.

How Fringe Benefits Work

Types of Benefits

- Fringe benefits can be categorized into two categories. Some benefits are required by law and others are provided at the employer’s discretion.

Why Employers Offer Fringe Benefits

- The following are some of the reasons why employers invest in fringe benefit programs: Public perception Companies that offer additional benefits above the salary often stand out from their competitors, and it makes the company attractive to different stakeholders. For example, customers are likely to buy from companies that are recognized in the p...

Additional Resources

- Thank you for reading CFI’s guide to Fringe Benefits. To keep advancing your career, the additional resources below will be useful: 1. Commission 2. Employee Morale 3. Stock-based Compensation 4. FMVA Compensation Guide