The types of benefits payable are:

- Current spouse survivor annuity

- Former spouse annuity that is voluntarily elected or awarded by a court order in divorces granted on or after May 7, 1985

- A one-time lump sum benefit

How is the amount of my benefits as a surviving spouse determined?

The amount of the Allowance for the Survivor that you receive depends on your previous year’s income. Depending on your situation, you can find the exact amount you would receive each month.

How do you calculate survivor benefits?

Survivors aged 65 and older: CPP survivor benefit calculation = 60% of the deceased’s pension, if they are receiving no other CPP benefits Survivors aged under 65: CPP survivor benefit calculation = a flat rate portion PLUS 37.5% of the deceased’s pension, if they are receiving no other CPP benefits

How your spouse earns Social Security Survivors Benefits?

How your spouse earns Social Security Survivors Benefits Social Security work credits are based on your total yearly wages or self-employment income. You get one credit quarterly for every $1,470 dollars you earn in 2021, and you can earn up to four credits .

Can former spouses receive survivor benefits?

If your marriage to your current husband occurred after you reached age 60, Blankenship said you could be eligible for survivor benefits based on your first husband's record after he dies, assuming you were married to the first husband for at least 10 years.

How long does a spouse get survivors benefits?

Widows and widowers Generally, spouses and ex-spouses become eligible for survivor benefits at age 60 — 50 if they are disabled — provided they do not remarry before that age. These benefits are payable for life unless the spouse begins collecting a retirement benefit that is greater than the survivor benefit.

What is the difference between survivor benefits and spousal benefits?

Spousal benefits are based on a living spouse or ex-spouse's work history. Survivor benefits are based on a deceased spouse or ex-spouse's work history. The maximum spousal benefit is 50% of the worker's full retirement age (FRA) benefit.

How do spousal survivor benefits work?

As previously noted, if you have reached full retirement age, you get 100 percent of the benefit your spouse was (or would have been) collecting. If you claim survivor benefits between age 60 and your full retirement age, you will receive between 71.5 percent and 99 percent of the deceased's benefit.

When a husband dies does the wife get his Social Security?

Social Security is a key source of financial security to widowed spouses. About 7.8 million individuals aged 60 and older receive Social Security benefits based, at least in part, on a deceased spouse's work record. These surviving spouse beneficiaries are overwhelmingly women.

Who qualifies survivor benefits?

Who receives benefits?A widow or widower age 60 or older (age 50 or older if they have a disability).A surviving divorced spouse, under certain circumstances.A widow or widower at any age who is caring for the deceased's child who is under age 16 or has a disability and receiving child's benefits.More items...

What percent of a husband's Social Security does a widow get?

Widow or widower, full retirement age or older—100% of your benefit amount. Widow or widower, age 60 to full retirement age—71½ to 99% of your basic amount.

What percentage of a widow's benefit is a widow?

Widow or widower, full retirement age or older — 100 percent of the deceased worker's benefit amount. Widow or widower, age 60 — full retirement age — 71½ to 99 percent of the deceased worker's basic amount. A child under age 18 (19 if still in elementary or secondary school) or disabled — 75 percent.

How much can a family member receive per month?

The limit varies, but it is generally equal to between 150 and 180 percent of the basic benefit rate.

Can I apply for survivors benefits now?

You can apply for retirement or survivors benefits now and switch to the other (higher) benefit later. For those already receiving retirement benefits, you can only apply for benefits as a widow or widower if the retirement benefit you receive is less than the benefits you would receive as a survivor.

When can I switch to my own Social Security?

If you qualify for retirement benefits on your own record, you can switch to your own retirement benefit as early as age 62 .

Can a widow get a divorce if she dies?

If you are the divorced spouse of a worker who dies, you could get benefits the same as a widow or widower, provided that your marriage lasted 10 years or more. Benefits paid to you as a surviving divorced spouse won't affect the benefit amount for other survivors getting benefits on the worker's record.

Can a minor receive Social Security?

Minor Or Disabled Child. If you are the unmarried child under 18 (up to age 19 if attending elementary or secondary school full time) of a worker who dies, you can be eligible to receive Social Security survivors benefits. And you can get benefits at any age if you were disabled before age 22 and remain disabled.

Can a widow apply for disability online?

A widow, widower, or surviving divorced spouse cannot apply online for survivors benefits. You should contact Social Security at 1-800-772-1213 to request an appointment. (If you are deaf or hard of hearing, call our TTY number at 1-800-325-0778 .) If you wish to apply for disability benefits as a survivor, you can speed up ...

What to do if you are not getting survivors benefits?

If you are not getting benefits. If you are not getting benefits, you should apply for survivors benefits promptly because, in some cases, benefits may not be retroactive.

Can you get survivors benefits if you die?

The Basics About Survivors Benefits. Your family members may receive survivors benefits if you die. If you are working and paying into Social Security, some of those taxes you pay are for survivors benefits. Your spouse, children, and parents could be eligible for benefits based on your earnings.

Why are Social Security spousal benefits and survivor benefits similar?

The two benefits are similar because they are both based solely on the spouse’s work history. Spousal benefits are based on a living spouse or ex-spouse’s work history.

When can a spouse claim a survivor benefit?

Survivor benefits would be based on the worker’s reduced benefit, not their FRA benefit if the deceased worker had applied for early benefits. Age 60 is the earliest a spouse can claim a survivor benefit.

What is the maximum survivor benefit?

The maximum survivor benefit is 100% of the deceased worker’s last Social Security benefit including any delayed retirement credits the worker may have accrued by waiting until age 70. Survivor benefits would be based on the worker’s reduced benefit, not their FRA benefit if the deceased worker had applied for early benefits.

How much can a widow claim on a survivor benefit?

The widow (er) could claim a survivor benefit equal to 71.5% of the deceased worker’s benefit stepping up to 100% if they filed at their FRA. They must be married for at least 9 months to qualify for the benefit.

How long do you have to be married to get Social Security?

They must be married for at least 12 months to qualify for the benefit. If divorced, you may still be able to apply for benefits based on your ex-spouse’s work if you were married at least 10 years and are currently unmarried. Survivor Benefits. The maximum survivor benefit is 100% of the deceased worker’s last Social Security benefit ...

What Are Social Security Survivor Benefits?

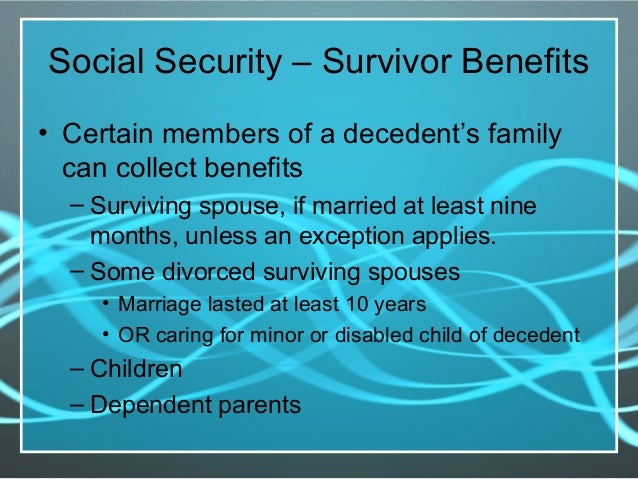

Social Security survivor benefits are paid to a surviving dependent of a Social Security benefit recipient. A surviving dependent may be a spouse, child, grandchild, parent, or even an ex-spouse.

Who Is Eligible For Social Security Survivor Benefits?

A dependent of the deceased may be eligible to receive survivor benefits. When you hear the word dependent, you often think of a child. However, when it comes to these benefits, a dependent might include many different people. Here are the different types of dependents who can be eligible to receive these benefits.

Applying For Social Security Survivor Benefits

Applying for survivor benefits is not difficult, and in a few cases, an application is not even necessary. First, the Social Security Administration will need to be notified of the death. Most of the time, the local authorities or funeral home will handle the notification to the SSA.

How Are Social Security Survivor Benefits Calculated?

There are a few different factors that are used to calculate survivor benefits. The biggest factor is the deceased’s benefit amount. This amount is calculated based on the AIME, or average indexed monthly earnings, over the course of the deceased’s lifetime.

How Much Survivor Benefits Can You Receive?

The amount of benefits that a survivor can receive varies based on the specifics of their situation. A current spouse can receive up to 100% of the deceased’s benefits as long as they have already reached full retirement age. They might also be eligible for a death payment of $255 upon the death of their spouse.

The Bottom Line

Survivor benefits play a crucial role for many couples and families across America. These benefits provide payments to surviving family members of Social Security benefit recipients. These benefits may extend to surviving spouses, children, grandchildren, and even parents and ex-spouses.

What is the difference between spousal benefits and survivor benefits?

Spousal benefits are received while both spouses are still alive. This often happens when one spouse is the primary earner and the other does not have a significant earnings history. In that case, you can receive spousal benefits based on your spouse’s earnings record. The maximum benefit is 50% of the primary insurance amount.

What is the survivor benefit amount?

Survivor benefit amounts include any delayed retirement credits accumulated up until the passing of the earner. 1 Spousal benefits do not carry this inclusion of delayed retirement credits. When you delay retirement, you can earn credits, which will result in a benefit increase of 5.5% to 8% per year. 2 .

How long do you have to be married to claim spousal benefits?

If they have already filed for benefits there is no two-year requirement for claiming on an ex-spouse’s record. 10 years: must have been married to claim a spousal benefit on an ex-spouse’s record 9 .

How long do you have to be married to receive Social Security?

The rules surrounding the length of time you need to be married to claim different types of benefits vary. Below is a summary of the requirements: 9 months: to be eligible for a social security survivor benefit on your spouse’s record 7 . 1 year: to be eligible for a spousal benefit on a current spouse's work record 8 .

What happens if you wait until 70 to collect Social Security?

When you wait until the full retirement age of 70 to begin collecting your Social Security benefits not only does your benefit amount go up , but the survivor benefit paid out to a surviving spouse also goes up. Survivor benefit amounts include any delayed retirement credits accumulated up until the passing ...

Can a widow file for survivor benefits?

As a widow/widower, you can begin benefits based on your own earnings record and later switch to survivor’s benefits, or begin survivor’s benefits and later switch to benefits based on your own record. Using either of these strategies entails filing a restricted application, which means you are restricting your application to either your own benefit amount or a survivor benefit amount. 5

Is it important to bone up on Social Security?

It is important to bone up on the various benefits that come with Social Security. Benefit formulas and length of marriage rules vary depending on the type of Social Security benefits being sought.

Can you increase your spousal benefits if you delay retirement?

Delaying retirement benefits will not increase spousal benefits, but survivor benefits will increase. Unless you were born before 1954, you cannot switch between your own benefits and your spousal benefits, but you can switch between your own benefits and survivor benefits. The length of time you've been married may affect your eligibility ...

What is the maximum survivor benefit?

If you retire under the Civil Service Retirement System (CSRS), the maximum survivor benefit payable is 55 percent of your unreduced annual benefit. If you retire under the Federal Employees Retirement System (FERS), the maximum survivor benefit payable is 50 percent of your unreduced annual benefit .

When is a survivor annuity payable?

For both CSRS and FERS, a survivor annuity may still be payable if the employee's death occurred before 9 months if the death was accidental or there was a child born of your marriage to the employee. If a former spouse was awarded part of the total survivor CSRS or FERS annuity, you'll receive the remainder.

What are the types of benefits payable?

The types of benefits payable are: Current spouse survivor annuity. Former spouse annuity that is voluntarily elected or awarded by a court order in divorces granted on or after May 7, 1985. A one-time lump sum benefit.

What is a partial annuity?

A full or partial annuity for a spouse. A full or partial annuity for a former spouse. A combination of a full or partial annuity for a spouse and for a former spouse. Here are things you should consider when making an election: Your spouse's future retirement benefits based on his or her own employment. Other sources of income.

How long after annuity can you increase your spouse's health insurance?

Your spouse's need for continued coverage under the Federal Employees Health Benefit program. There's an opportunity to increase survivor benefits within 18 months after the annuity begins. However, this election may be more expensive than the one you make at retirement.

How much is the reduction for insurable interest?

Here's how the reduction to provide an insurable interest benefit is calculated: If the person named is older, the same age, or less than 5 years younger than the retiree, the reduction is 10 percent. If the person named is 5 but less than 10 years younger than the retiree, the reduction is 15 percent.

Can you name an insurable interest for your ex spouse?

You can elect to provide an insurable interest benefit and the maximum survivor benefit for a current spouse or an ex-spouse (your annuity would be reduced for both benefits). Spousal consent is not required to name an insurable interest if you've elected a maximum survivor annuity for your current spouse.