Advantages of a checking account

- Accessibility. First, it’s easy to withdraw funds in-person or at an ATM using your debit card. Or, you can access your...

- Peace of mind. When you have a checking account, there’s no need to carry around all your cash or keep it in a shoebox...

- Convenience of direct deposit. With a checking account, you can set up direct deposit of your...

- There are many advantages of having a checking account. Safety. No need to carry cash. ...

- Your bank can provide proof of payment. Build your credit. A checking account can help you establish and build your credit score. ...

- Convenience. Access your funds without carrying cash.

What are the advantages and disadvantages of checking account?

Checking Accounts: Advantages & Disadvantages

- Advantages of Checking Accounts. If you're considering opening a bank account, there are lots of advantages of having a checking account.

- Disadvantages of Checking Accounts. While checking accounts are full of benefits, they have a few shortcomings to be aware of, too. ...

- Different Types of Checking Accounts. ...

What are some benefits of having a personal checking account?

Premium checking account

- Typically earns or offers perks, such as a no fee safe deposit account, no fee personal checks, no fee official checks, no fee money orders and waived out-of-network ATM fees

- Some banks offer additional perks, such as lower mortgage interest rates and financial guidance

- Most require a higher minimum balance

What are reasons for having a checking account?

- It may be easier to keep your finances organized.

- You could earn hundreds of dollars in new checking account bonuses.

- It’s easier to manage FDIC coverage limits.

- Separate accounts can keep business and personal finances from being commingled.

- Having individual and joint checking accounts could make sense if you’re married.

What is the best bank to have a checking account?

Summary of our top online checking accounts

- Ally Bank: Best online checking overall.

- Chime: Best online checking for beginners.

- Charles Schwab: Best online checking for travel.

- Navy Federal Credit Union: Best online checking for teens.

- LendingClub Bank: Best online checking for cash back.

- Discover Bank: Best checking/savings combo.

What is an advantage of using a checking account?

Check Cashing, Access and Security The main advantages of a checking account are to save fees charged by storefronts that provide check cashing services, and the ability to access funds by writing checks, instead of carrying cash with you.

What are the pros and cons of a checking account?

The Pros of Checking AccountsThere is always a record of your spending. ... Many checking accounts generate interest on the balance. ... Maintenance costs are often low or non-existent. ... There is no need to carry cash around with you. ... Financial institutions can block access to your cash.More items...•

What is downside of a checking account?

Checking Account Disadvantages Fees include monthly or maintenance fees, ATM withdrawal fees from third-party machines, in-bank transactions fees and over-the-phone transaction fees for using customer service. Some banks also require minimum balances and charge a fee if the account balance is lower than the minimum.

What is one benefit to using a checking account that is not a benefit of using a savings account?

another purchase.] What is one benefit to using a checking account that is not a benefit of using a savings account? proof of payment. You just studied 28 terms!

Why do we need a checking account?

Your checking account can help you budget your money, make on-time bill payments and save for big purchases. These actions play a big role in improving your future financial outlook.

What are the advantages of joint checking account?

One of the most significant checking account advantages is its ability to teach young adults about money management and building financial literacy. Open a joint checking account, and your child can learn to write checks, pay bills, balance the checkbook, and plan for future expenses. As you offer guidance and prevent major money mistakes, ...

How to build credit score?

2. Establish Credit. To build or improve your credit score, maintain your checking account. Keep your account balance above zero, avoid bounced checks and pay your bills on time. These actions demonstrate to lenders and credit reporting agencies that you’re responsible with money. 3.

Why do you need multiple points of access?

Multiple points of access allow you to conveniently and quickly deposit or withdraw money when you need it. Perhaps this is one of the best checking account advantages because it enables you to save time while gaining peace of mind. 9.

Can you grow interest on a high yield checking account?

Open a high-yield checking account, and your money will grow interest. The minimum balance for an interest-earning account can be very high. However, the interest and other perks of an interest-bearing checking account offer numerous advantages including the ability to grow your account balance with minimal effort. 5.

Can I open a free checking account?

You can also open a free checking account. With this account, you maintain access to all the money in your account since you won’t owe a monthly fee or per-check fee. To ensure you save money on your checking account services, read the Terms and Conditions page of the contract.

Is checking account insured?

The majority of checking accounts are insured by the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Association (NCUA) With this insurance, up to $250,000 in your checking account is protected which means your money is safer in your checking account than under your mattress.

Why is a checking account important?

One of the benefits of a checking account that often gets overlooked is the aspect of safety. Since the bank is holding your money, you won’t need to about the cash getting lost or stolen. In addition, debit cards allow you to access your money or pay for items. If something were to happen to your debit card, call the bank immediately to cancel ...

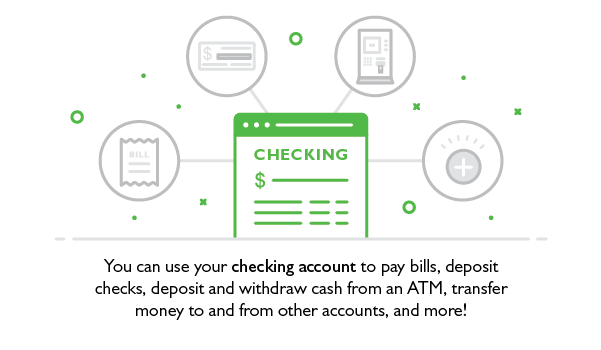

What is a checking account?

A checking account is a type of account offered through a bank or other financial institution that allows the checking account holder to make deposits and withdrawals. Checking accounts are better for everyday transactions such as purchases, bill payments, and ATM withdrawals.

How much is a checking account insured by?

Another reason checking accounts are great is that practically every bank in the United States is insured by Federal Deposit Insurance Corporation ( FDIC) up to $250,000. Credit unions are insured by the National Credit Union Administration (NCUA).

What are the disadvantages of checking accounts?

Low interest rates. One of the main disadvantages of checking accounts is that they pay a low or no interest rate on the balance in the account. It’s not like savings accounts, CDs, or money market accounts are that generous, but their annual percentage yields (APYs) are usually higher.

What is online banking?

Online banking allows you to manage your finances and access your banking information, such as your account balance, from anywhere without going to an ATM or physical location. Some checking accounts are online-only and typically pay higher interest rates, lower fees, and better mobile banking services.

What should I check when shopping for a checking account?

The first thing you should check for when shopping for a checking account is what fees they charge . Some checking accounts charge substantial fees, such as monthly maintenance fees, which means you will have to pay money to use your money. Fortunately, there are free checking accounts and checking accounts that allow you to waive fees.

What does it mean to have proof of payment?

Proof of payment means that when you pay bills or an invoice, your bank can prove that you’ve paid it as long as you paid it out of your checking account. This can be beneficial if you’re trying to build or rebuild your credit, as proof of consistent payments is the most important factor when building credit.

What are the benefits of opening a checking account?

From online transactions to direct deposits, a checking account gives you the ability to take control of your money in many important ways: 1. Get Your Money Faster with Direct Deposit.

How to get money faster with a checking account?

1. Get Your Money Faster with Direct Deposit. One of the main benefits of a checking account is the ability to receive direct deposits. Rather than waiting on paper checks from your employer, benefits provider, or pension provider, a checking account with direct deposit allows you to access your funds much faster.

How to keep money safe?

Keep Your Money Secure. Rather than stashing cash under a mattress or in a shoebox, putting your hard-earned money in a checking account will safeguard it from the unexpected. Loose cash can be lost, stolen, or damaged, and there is no way of getting back paper currency once it is gone.

Why do you need an interest bearing checking account?

By meeting minimum account balance requirements and receiving monthly direct deposits , an interest-bearing checking account will earn you passive income to help you plan for the future.

Do you have to write checks with a checking account?

With a checking account, you do not have to write physical checks to do things like pay your rent or utility bills—and that is all thanks to secure online and mobile banking tools. If you are connected to a mobile service provider’s network or the internet, you can use a smartphone or computer to: Check balances.

Checking account basics

Essentially, a checking account is used for day-to-day transactions. Checking accounts are held through a financial institution, like a traditional bank, online bank or credit union. With a regular checking account, you can deposit and withdraw money (either through the bank or an ATM), write checks, pay bills and make purchases using a debit card.

Advantages of a checking account

There are a number of advantages to having a checking account, so here are some to consider.

Disadvantages of a checking account

While it’s a good idea to have a checking account to store your funds, there are some potential downsides.

Why should I have a checking account?

After considering the advantages and disadvantages of a checking account, if you choose to apply for a new checking account, you’d be on your way to have your money tracked and spent however you need. A checking account may play an important role when it comes to managing your finances.

Why do people have a savings account and a checking account?

There is value to having both checking and savings accounts, especially if you are trying to accumulate wealth or save money for specific financial goals. However, if you are only going to have one type of account, a checking account is usually the smart go-to option. One of the big reasons is that there are no transaction limits on checking accounts. With a savings account, you can typically only make a few withdrawals or write a few checks from that account per month. With a checking account, you aren’t limited in terms of withdrawals, debit card payments, checks, or money transfers—giving you more financial freedom across the board.

What is a checking account?

What is a checking account, exactly? Essentially, it is an account designed to give you easy access to your money. So, while a savings account is intended as a place to keep your money for a long period, a checking account offers a way to keep your money secure while also keeping it accessible. You can make deposits or withdrawals regularly if you prefer to continue dealing mostly in cash. Alternatively, you can use your checking account to expand your payment options. Checking accounts enable you to write checks, pay with a debit card, or initiate digital transfers.

What are the benefits of online banking?

Beyond online bill pay, the other benefit of a checking account’s online banking features is easy money management. Instead of having to count cash or think about how much money you have in various hiding places, you can enjoy a single view of your financial situation by just typing in a password. You can even link your account with budgeting software (such as Mint) to streamline the money management process further. This benefit is especially useful for teenagers, who can use a checking account to learn about budgeting and managing money for the first time.

Why is it important to keep cash safe?

Even if you have a secure place to put it, such as a safe, large cash reserves in the home attract robberies and can be destroyed by fires, floods, or other disasters.

What happens if you don't have a bank account?

If you don’t have a bank account, your options for accessing cash are limited by your proximity to wherever that cash is stored. 10. Member-specific benefits: Many banks or credit unions have benefits or perks that they only offer to their customers or members.

Can I get cash from an ATM?

If you do need cash, you can just go to an ATM and make a withdrawal.

Do people feel they don't have enough money?

Some people feel as if they don’t have enough money to justify using a bank. Others prefer to deal with cash rather than worrying about checks or debit cards. Some—especially among the millennial age range—developed a mistrust of banks following the 2008 financial crisis. Still, the fact is that virtually everyone from teenagers ...