Differences Between Defined Benefit and Defined Contribution Plans

| Defined contribution plan | Defined benefit plan | |

| Investment risk | Defined contribution plan Born by the em ... | Defined benefit plan Born by the employe ... |

| Contributions | Defined contribution plan Made by employ ... | Defined benefit plan Made by the employe ... |

| How is the benefit determined? | Defined contribution plan The employee’s ... | Defined benefit plan The employee’s bene ... |

| How do participants take their benefits? | Defined contribution plan Money can be w ... | Defined benefit plan Typically benefits ... |

What are the advantages of a defined benefit plan?

What Are the Advantages of a Defined Benefit Plan?

- Guaranteed Benefits. Unlike most other retirement schemes, a defined benefit plan allows you to determine exactly how much you’ll receive at retirement.

- Reduce Your Tax Liability. Introducing a defined benefit plan to your business can significantly reduce your tax liabilities. ...

- Spouses Can be Employees. ...

Why defined benefit plans are best?

- Product managers

- Systems administrators and IT managers

- IT administrators and operators

- IT engineers

- Cloud engineers

- Software developers

- Software architects

How to correct an overfunded defined benefit plan?

Overfunded Defined Benefit Plan: The #1 Solution [Illustration]

- Some background. Minimum and maximum contributions (as well as benefit limits) are established under the Internal Revenue Code.

- Possible Overfunding Solutions. When a plan is overfunded, there are many ways to get the plan back in line. ...

- Strategic Sale or Plan Merger. ...

- Example of a Strategic Sale. ...

- Final Thoughts. ...

How to calculate pension expense for a defined benefit plan?

The pensions accounting treatment for defined benefit plans requires:

- Determine the fair value of the assets and liabilities of the pension plan at the end of the year

- Determine the amount of pension expense for the year to be reported on the income statement

- Value the net asset or liability position of the pension plan on a fair value basis

Why is defined contribution plan better?

Easier to plan for retirement – defined benefit plans provide predictable income, making retirement planning much more straightforward. The predictability of these plans takes the guesswork out of how much income you will have at retirement.

What is a defined contribution benefit?

A defined benefit plan (APERS) specifies exactly how much retirement income employees will get once they retire. A defined contribution plan only specifies what each party – the employer and employee – contributes to an employee's retirement account.

What are the advantages of defined contribution pension plans for employees?

Defined Benefit Plan Advantages Employer tax benefits: Employers generally get a tax deduction for contributions to defined benefit plans. Improved retention: Defined benefit plans can keep employees with a company for a long period of time as they wait to vest and earn the most retirement benefits.

Why do employees prefer defined contribution plans?

Companies choose defined-contribution plans instead because they are less expensive and complex to manage than pension plans. The shift to defined-contribution plans has placed the burden of saving and investing for retirement on employees.

What happens to my defined contribution pension when I retire?

In a defined contribution pension plan, you know how much you will pay into the plan but not how much you will get when you retire. Usually you and your employer pay a defined amount into your pension plan each year. The money in your defined contribution pension is invested in one or more products on your behalf.

Do I need to save if I have a defined benefit pension?

In short, yes. You do need to save for retirement even if you have a pension. While having a pension definitely reduces the amount you need to save, it is still important to do so to full prepare you for retirement! A pension will typically provide you with 40-60% of your working salary in retirement.

Who benefits most from a defined contribution plan quizlet?

Who benefits more from a defined contribution plan? -Younger employees have longer for the money to grow. contributions may be deductible depending on income limits. -Contributions are not deductible, they are made with after tax dollars and may continue past 72 if still working.

Is defined benefit better than accumulation?

Accumulation 1 offers simple super that you can keep throughout your working life, even when you change jobs. It offers investment choice and flexible insurance cover. The Defined Benefit Division (DBD) aims to offer stable and reliable growth over your working life, as well as greater protection from market downturns.

What is one disadvantage to having a defined contribution plan?

The downside of defined contribution plans is that they require discipline and wise management. Life has a tendency to shape our financial priorities away from the horizon of retirement planning and savings. Also, most people don't have the expertise to understand how to invest.

Do defined contribution plans favor younger employees?

Employees using defined contribution plans may work longer and at a higher wage if they failed to save enough for retirement. Older workers may also bargain for higher employer contributions to their defined contribution plans versus a younger employee.

What's the difference between defined contribution and benefit plans?

As the names imply, a defined-benefit plan—also commonly known as a traditional pension plan—provides a specified payment amount in retirement. A defined-contribution plan allows employees and employers (if they choose) to contribute and invest in funds over time to save for retirement.

Why is a defined contribution plan called a defined contribution plan?

It’s called a defined contribution plan because the account is funded by contributions from the company and the employee —although in certain cases, only the company or the employee makes contributions to the plan. Defined contribution plans come with valuable tax benefits.

What is defined contribution plan?

A defined contribution plan is a type of employer-sponsored retirement plan funded by contributions from employers or employees—or both. Contributions earn employees and employers valuable tax breaks, and retirement income from a defined contribution plan depends entirely on the performance of the employee’s investment choices.

What are employer contributions?

Employer contributions can include profit sharing, safe harbor contributions or employee contribution matching. Employees can decide whether or not they want to participate in their employer’s defined contribution plan.

How many people participate in pension plans?

Today, only 21% of workers participate in a pension plan, and they’re largely state and local government workers. Twice as many workers (43%) participate in a defined contribution plan. Defined contribution plans are largely funded by employee contributions, and they offer no guaranteed return of income in retirement.

Do Roth contributions reduce taxable income?

These may include pretax contributions that reduce an employee’s taxable income—plus potential tax-write offs for the employer—or alternatively, post-tax Ro th contributions that give an employee tax-free income in retirement. Either way, contributions are sheltered from taxation while they remain in an employee’s account.

Is there a guaranteed payout on a defined contribution plan?

• No guaranteed income. Unlike a defined benefit pension, there is no guaranteed payout at the end of your defined contribution rainbow. Since contributions are invested in the market, they are subject to investment risks and market volatility.

What is defined contribution plan?

Defined contribution plans may be an option for employers who wish to control the costs of contributing to certain benefits. In a defined contribution strategy, the employer can designate a specific amount to contribute to a special account allocated for each qualified employee. These funds are tax-deferred, meaning that the employer has ...

What is a 401(k) tax deferred?

These funds are tax-deferred, meaning that the employer has the benefit of a tax shelter, while the employee pays tax once they are distributed. Examples include 401 (k) or 403 (b) plans, employee stock ownership plans, and profit-sharing plans. In short, the company sets aside a certain amount of money each year to benefit the employee.

What is defined contribution retirement plan?

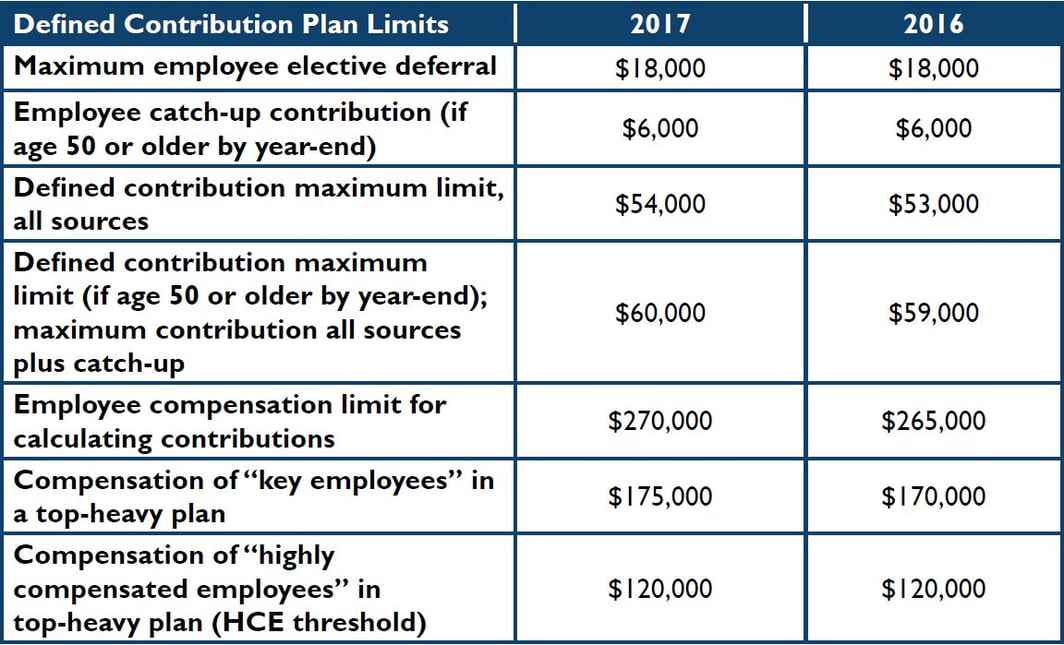

Defined contribution retirement plans are an important component of employer-sponsored benefit packages. These plans accumulate tax-deferred savings in individual employee accounts established by the employer. The government provides tax and savings incentives to both employers and employees by making it legal to set aside money on a tax-deferred, salary reduction basis for retirement expenses. Businesses have incentives for contributing money to these accounts as deferred salary because it reduces their income and payroll tax liabilities. The portion of deferred salary that workers contribute also may be exempt from income taxes, as well as investment income tax liabilities until the funds are withdrawn at retirement. Generally, there are no minimum amounts that an employer or employee may contribute to an account; there are, however, annual maximum limits that are set by the Internal Revenue Code.

When were defined contribution retirement plans a fairly new concept in the workplace?

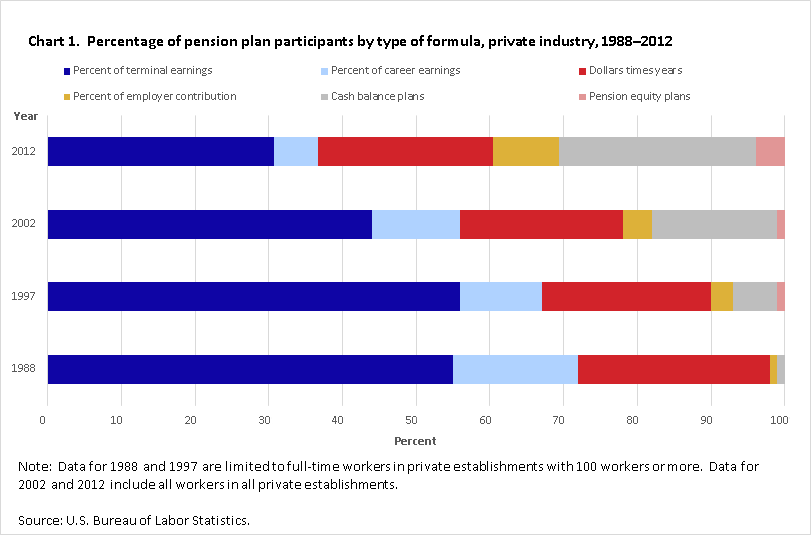

In 1988 , when defined contribution retirement plans were a fairly new concept in the workplace, Bureau of Labor Statistics (BLS) Commissioner, Janet L. Norwood wrote, “It is unclear whether the more rapid growth in defined contribution plans compared to defined benefit plans is a movement towards variable rather than fixed payments.

What is savings and thrift plan?

A savings and thrift plan requires an employee to contribute a predetermined amount of earnings into an individual account, all or part of which may be matched by the employer. Usually the employer matches a portion of the employee’s contribution up to a specified percent of the employee’s earnings.

What is defined contribution plan?

Defined Contribution Plans Benefit both the Employer and the Employee. If you’re behind on your own retirement savings, you can benefit yourself and your employees by starting a defined contribution plan.

What are the advantages of a defined benefit plan?

A defined benefit plan has its advantages, especially if you are ‘older’ and haven’t saved for retirement yet. Your tax liability will decrease and your retirement savings will increase at much faster levels than any other retirement account allows. They allow for large tax deductible contributions.

Why do defined benefit plans encourage harder work?

If you set your defined benefit plan up to coincide with your profit sharing , employees may be encouraged to work harder. When they can see the fruits of their labor, other than their standard paycheck, they feel more invested in the company and want to work harder to make it succeed. Your company’s success directly affects the employees’’ retirement balance, which may encourage harder workers.

How much catch up allowance do you get with a defined contribution plan?

With defined contribution plans, you have much lower contribution limits, unless you are over 50-years old, at which point you get an additional $6,000 catch-up allowance. With a defined benefit plan, the limits are as much as 4 xs higher and the limits increase as you age.

Can I have a defined benefit plan and an IRA?

You can Have a Defined Benefit Plan and IRA. If you want to further your retirement benefits, you can contribute to an IRA (both employees and employers). Whether you qualify for the tax deduction for contributing to an IRA may differ, though. It depends on your income level at the time.

Do pension plans have guaranteed payouts?

Defined benefit plans have guaranteed payouts. You don’t have to worry about how the market performs – your retirement funds are guaranteed, which means you’ll know beyond a doubt what you’ll receive in retirement, allowing you to start budgeting early.

Do pension contributions go on taxes?

Employers that make pension contributions may write the contributions off on their taxes. This helps reduce an employer’s taxable income while providing a benefit to its employees and the tax break is often much larger than any other retirement fund for employers.

What Is A Defined Contribution (DC) Plan?

- Another advantage of putting money into this type of retirement plan is that it is portable. This means that you can easily take the money with you when you move to another company or become self-employed. For example, if you have money in a 401k with your employer, you can si…

Understanding Defined Contribution (DC) Plans

Advantages of Participating in A Defined Contribution (DC) Plan

Limitations of Defined Contribution Plans

Defined Contribution (DC) Plan Examples

- There is no way to know how much a DC plan will ultimately give the employee upon retiring, as contribution levels can change, and the returnson the investments may go up and down over the years. DC plans accounted for $11 trillion of the $39.4 trillion in total retirement plan assets held in the United States as of Dec. 31, 2021, according to the Investment Company Institute. The DC …